Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Definition and Calculation

Net Asset Value (NAV) represents the underlying value of an ETF's assets per share. For ETFs like the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV is calculated daily by subtracting the fund's liabilities from the total market value of its assets and dividing by the number of outstanding shares. In simpler terms, it's the net worth of the fund divided by the number of shares.

- Market Price vs. NAV: The market price of an ETF, what you see on the exchange, fluctuates throughout the trading day based on supply and demand. The NAV, however, reflects the actual value of the underlying assets. While generally close, discrepancies can occur.

- Simplified Example: Imagine an ETF with assets worth $10 million and liabilities of $100,000, with 1 million shares outstanding. The NAV would be ($10,000,000 - $100,000) / 1,000,000 = $9.90 per share.

- Factors Influencing Daily NAV Fluctuations: The daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is influenced by fluctuations in the market values of the underlying securities it holds (global stocks in this case), currency exchange rates (since it's USD Acc), and any changes in the fund's liabilities.

NAV and the Amundi MSCI All Country World UCITS ETF USD Acc

How to Find the Daily NAV

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. You can typically find this information on:

-

Amundi Website: Check the official Amundi website's dedicated ETF page for this specific fund. They usually provide daily NAV updates.

-

Financial News Sources: Major financial news websites and data providers often publish ETF NAV data.

-

Brokerage Platforms: If you hold this ETF through a brokerage account, the NAV will usually be displayed alongside other fund details on your account statement and portfolio page.

-

Typical Update Time: The NAV is typically updated at the close of the relevant market(s) on which the underlying assets trade, reflecting the end-of-day values. However, there might be slight delays.

-

Potential Delays: While rare, there might be occasional delays in NAV reporting due to factors such as market closures or data processing issues.

Interpreting NAV Changes and Their Impact on Investment Strategy

Analyzing NAV Trends

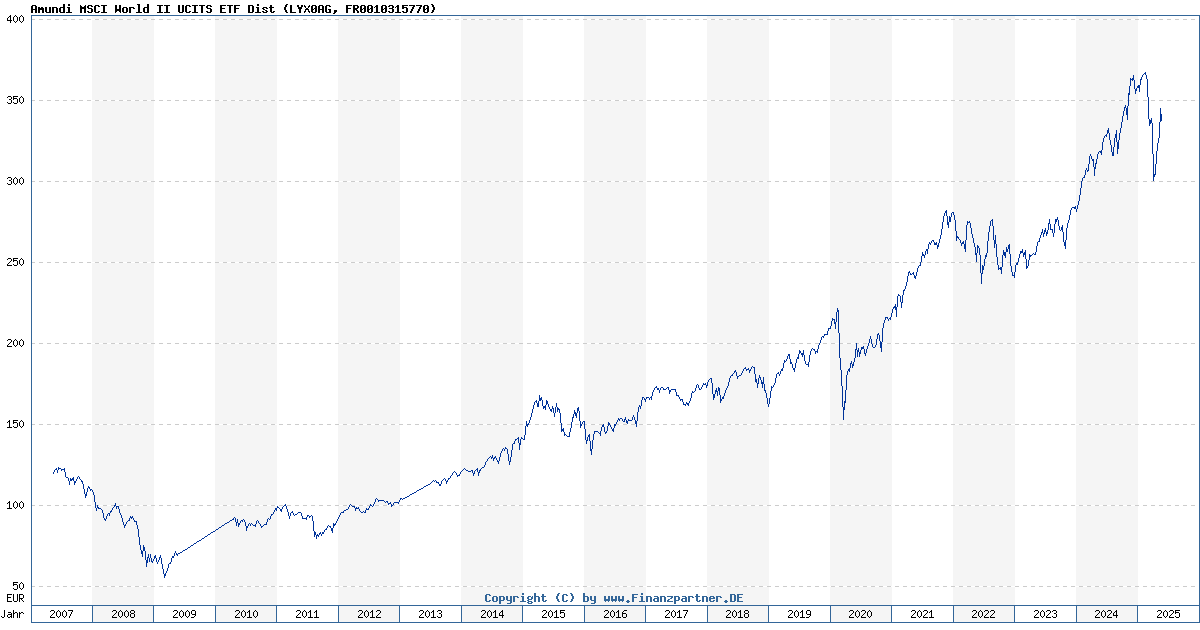

Monitoring the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc over time provides valuable insights into your investment's performance. By tracking daily, weekly, or monthly changes, you can gain a clearer picture of growth or losses.

- NAV and ETF Share Price Relationship: While not always identical, the NAV and the market price of the ETF should generally be quite close. Significant divergences might indicate trading inefficiencies.

- Long-Term NAV Trends and Market Performance: Long-term NAV trends usually reflect the overall performance of the global equity markets, as the fund tracks the MSCI All Country World Index.

- Beyond NAV: It's crucial to remember that the NAV is only one factor. You should also consider the ETF's expense ratio, trading volume (liquidity), and broader market conditions before making investment decisions.

NAV and Other Key Metrics for ETF Evaluation

Comprehensive Investment Analysis

While NAV is essential, it's just one piece of the investment puzzle when evaluating the Amundi MSCI All Country World UCITS ETF USD Acc or any ETF. A holistic assessment requires considering other factors:

- Expense Ratio: The annual fee charged by the fund to manage the assets. A lower expense ratio is generally preferable.

- Trading Volume and Liquidity: High trading volume indicates easy buying and selling, minimizing slippage.

- Historical Performance Data: Past performance isn't a guarantee of future results, but it provides valuable context.

- Fund's Investment Strategy and Holdings: Understanding the ETF's investment strategy (in this case, global diversification) and the specific assets it holds provides further insight into potential risks and returns.

Conclusion

Understanding the Net Asset Value (NAV) is crucial for effectively monitoring the performance of your Amundi MSCI All Country World UCITS ETF USD Acc investment. Regularly checking the NAV, readily available from various sources, allows you to track your portfolio's growth. Remember, however, that NAV is just one factor among several key metrics, including expense ratio, trading volume, and historical performance data, that should be considered for a comprehensive assessment. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc's Net Asset Value (NAV) for optimal investment management. Learn more about managing your Amundi MSCI All Country World UCITS ETF USD Acc investments by understanding their NAV and other key performance indicators.

Featured Posts

-

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025 -

Joy Crookes New Single Carmen Is Here

May 24, 2025

Joy Crookes New Single Carmen Is Here

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025 -

Atfaq Washntn Wbkyn Aljmrky Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Aljmrky Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025

Latest Posts

-

Tathyr Atfaqyt Altjart Alamrykyt Alsynyt Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaqyt Altjart Alamrykyt Alsynyt Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025 -

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 24, 2025

Artfae Daks Alalmany Mwshr Ela Teafy Alaqtsad Alawrwby

May 24, 2025 -

Mwshr Daks Ytjawz 24 Alf Nqtt Bfdl Atfaq Jmrky Amryky Syny

May 24, 2025

Mwshr Daks Ytjawz 24 Alf Nqtt Bfdl Atfaq Jmrky Amryky Syny

May 24, 2025 -

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025