Amundi MSCI World Catholic Principles UCITS ETF Acc: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc is a unique investment vehicle designed to track the performance of a global equity index while adhering to specific ethical guidelines rooted in Catholic social teachings. Its investment strategy focuses on companies that align with these principles, excluding those involved in activities considered morally objectionable.

The ETF uses the MSCI World Index as its benchmark, but it applies a rigorous screening process to exclude companies involved in activities such as:

- Weapons manufacturing: Companies producing conventional weapons, nuclear weapons, or weapons of mass destruction are excluded.

- Alcohol production: Companies significantly involved in the production and distribution of alcoholic beverages are generally excluded.

- Gambling: Companies primarily engaged in gambling activities are typically excluded.

- Adult entertainment: Businesses involved in the adult entertainment industry are not included.

This rigorous screening process results in a portfolio geographically diversified across various sectors and geographies, providing investors with exposure to a broad range of companies that meet both financial and ethical criteria. The ETF's expense ratio is relatively low (check the official Amundi website for the most up-to-date information), making it a potentially cost-effective option for ethical investors.

Key Characteristics:

- Accumulation Class: Reinvesting dividends for growth.

- UCITS Compliant: Meeting the standards of the Undertakings for Collective Investment in Transferable Securities directive, ensuring regulatory compliance across Europe.

The typical investor profile includes those seeking socially responsible investments (SRI) and faith-based investors looking for alignment between their values and their investments.

Daily NAV Updates and Their Importance

The daily Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc is a critical indicator of its performance. It reflects the market value of the ETF's underlying assets at the close of each trading day. Fluctuations in the daily NAV are influenced by various factors, including:

- Overall market performance: Positive market trends generally lead to increased NAV, while negative trends can lead to decreases.

- Investor sentiment: Changes in investor confidence and demand for the ETF will affect its price and consequently the NAV.

- Global events: Significant geopolitical events or economic news can cause considerable short-term fluctuations in the NAV.

Reliable daily NAV data can be found on the official Amundi website and reputable financial news sources. Monitoring these updates helps investors:

- Track performance: Assessing daily changes provides a clear picture of the ETF's short-term performance.

- Make informed trading decisions: Understanding NAV trends can help investors time their buy and sell orders strategically.

- Calculate returns: By tracking the NAV over time, investors can precisely calculate their returns on investment.

Analyzing the Amundi MSCI World Catholic Principles UCITS ETF Acc Performance

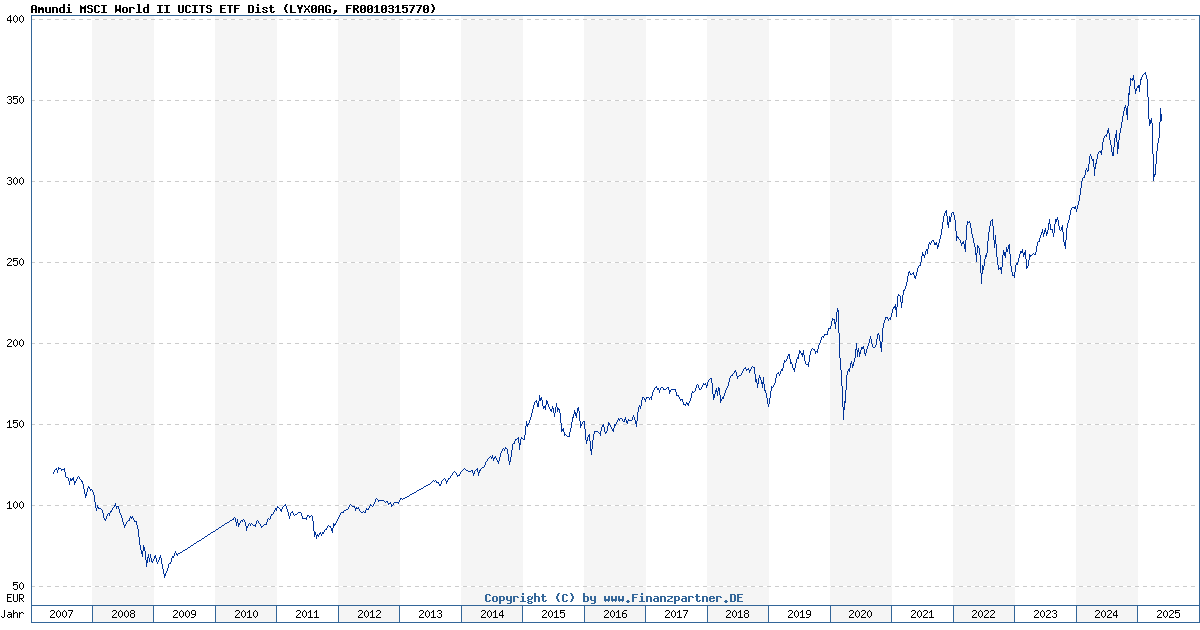

Analyzing the historical performance of the Amundi MSCI World Catholic Principles UCITS ETF Acc requires examining key performance indicators (KPIs). This includes:

- Total return: The overall return on investment over a specified period.

- Volatility: A measure of price fluctuations, indicating risk.

- Sharpe ratio: A risk-adjusted performance metric.

Comparing its performance to benchmark indices like the MSCI World Index will illustrate how effectively it tracks the market while applying its ethical filters. While past performance is not indicative of future results, it provides valuable context for evaluating potential investment decisions. Long-term performance analysis will provide a more robust view of the ETF’s ability to deliver sustainable returns. A thorough risk assessment is crucial, considering both market risks and the potential impact of ethical considerations on long-term performance.

Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc

Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc is generally a straightforward process. It's typically traded through various brokerage platforms, allowing investors to buy and sell shares.

Investment Considerations:

- Minimum investment: Check the specific requirements of your brokerage account.

- Investment strategy: Consider whether a lump-sum investment or regular contributions best suit your financial goals.

- Portfolio diversification: Integrating this ETF into a well-diversified investment portfolio is crucial for managing risk.

Remember to seek professional financial advice before making any investment decisions.

Conclusion

The Amundi MSCI World Catholic Principles UCITS ETF Acc presents a compelling opportunity for investors seeking to combine financial returns with ethical considerations aligned with Catholic social teachings. Regular monitoring of its daily NAV, alongside analysis of its performance and market conditions, is key to making informed investment decisions. By understanding the ETF's investment strategy, risk profile, and performance history, investors can assess whether it fits their individual investment objectives. Stay informed about the daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc and make informed investment choices. Start your journey towards responsible investing with the Amundi MSCI World Catholic Principles UCITS ETF Acc. Visit the official Amundi website for the latest information and resources.

Featured Posts

-

Navigating The Chinese Market The Experiences Of Bmw Porsche And Competitors

May 25, 2025

Navigating The Chinese Market The Experiences Of Bmw Porsche And Competitors

May 25, 2025 -

Explore The 2025 Porsche Cayenne Interior And Exterior Design Gallery

May 25, 2025

Explore The 2025 Porsche Cayenne Interior And Exterior Design Gallery

May 25, 2025 -

Alex De Minaur Out Of Madrid Open After Straight Sets Loss To Opponents Name

May 25, 2025

Alex De Minaur Out Of Madrid Open After Straight Sets Loss To Opponents Name

May 25, 2025 -

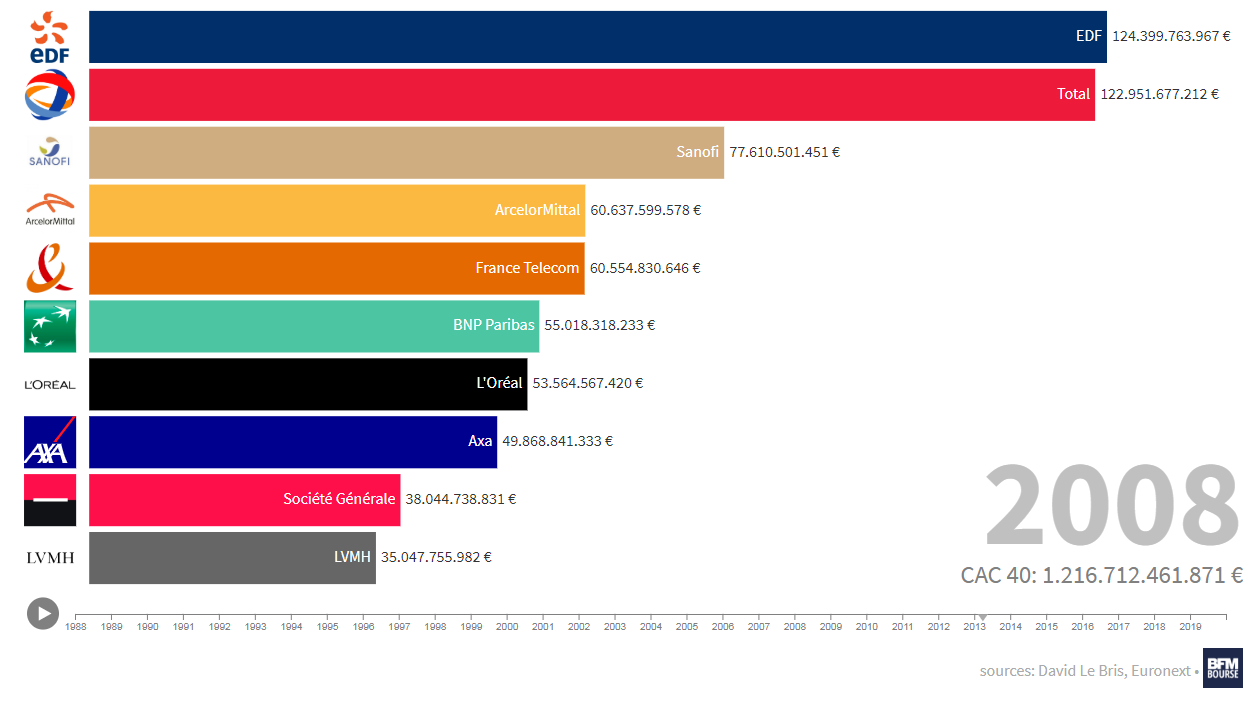

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 25, 2025

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 25, 2025 -

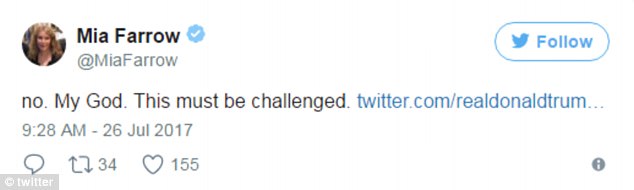

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025