Amundi MSCI World Catholic Principles UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of an investment fund, such as the Amundi MSCI World Catholic Principles UCITS ETF Acc. Simply put, it's the value of all the fund's assets minus its liabilities, divided by the number of outstanding shares. This provides a per-share valuation of the fund. For ETFs like the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV calculation involves these key components:

-

Total Market Value of Assets: This is the sum of the current market value of all the securities (stocks, bonds, etc.) held within the ETF portfolio. The Amundi MSCI World Catholic Principles UCITS ETF Acc, being an ethically-focused fund, holds assets that meet specific Catholic Principles criteria. This influences the underlying asset selection and, thus, the overall market value.

-

Liabilities: These include any expenses, fees, and other obligations associated with running the ETF. This could include management fees, administrative costs, and any accrued expenses payable.

-

Number of Outstanding Shares: This represents the total number of shares of the Amundi MSCI World Catholic Principles UCITS ETF Acc currently held by investors.

Understanding the NAV is crucial for investors because it provides a snapshot of the fund's intrinsic worth. Changes in the NAV reflect the underlying performance of the ETF's investments.

How Does NAV Relate to the Amundi MSCI World Catholic Principles UCITS ETF Acc?

The Amundi MSCI World Catholic Principles UCITS ETF Acc's investment strategy, based on Catholic Principles, directly influences its NAV. This ethical screening process means the ETF only invests in companies adhering to specific social and environmental criteria, potentially excluding certain sectors or companies. This selective approach can impact the overall value of the assets held within the fund, thereby affecting its NAV. Several factors influence the NAV of this ethically-focused ETF:

-

Market Performance of Underlying Assets: Like any ETF, the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV is directly tied to the performance of the companies it invests in. Positive market movements generally lead to an increase in NAV, while negative movements result in a decrease.

-

Changes in the Composition of the ETF's Holdings: The ETF's managers regularly review the portfolio based on the Catholic Principles screening criteria. Companies failing to meet these criteria may be removed, resulting in changes to the portfolio composition and consequently, the NAV.

-

Currency Fluctuations: As a globally diversified ETF, the Amundi MSCI World Catholic Principles UCITS ETF Acc holds assets denominated in various currencies. Changes in exchange rates can impact the value of these assets, thus affecting the overall NAV.

It's important to note that the NAV might not always perfectly align with the ETF's market price. This difference can be due to market supply and demand.

Accessing and Interpreting the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

The daily NAV for the Amundi MSCI World Catholic Principles UCITS ETF Acc is typically available on the fund provider's website (Amundi's website), major financial news sources, and through brokerage platforms. Interpreting this data is straightforward: A higher NAV indicates an increase in the fund's value, while a lower NAV indicates a decrease. Tracking NAV changes over time allows investors to assess the long-term performance of their investment. Compare the NAV to previous periods to gauge performance. You can also use the NAV to calculate your returns.

NAV vs. Market Price: Understanding the Difference

While the NAV represents the fund's intrinsic value, the market price reflects the price at which the ETF is currently trading on the exchange. The difference between the two stems from the bid-ask spread – the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). Market fluctuations and trading volume also influence this discrepancy. This difference is usually small, but understanding the potential for divergence is key to making informed investment decisions.

Conclusion: Mastering the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Understanding the Net Asset Value (NAV) is fundamental to effectively managing your investment in the Amundi MSCI World Catholic Principles UCITS ETF Acc. Regularly monitoring the NAV provides crucial insights into the fund's performance, allowing you to make informed decisions regarding your investment strategy. By understanding the factors influencing the NAV and the relationship between NAV and market price, you can better assess the value and risk associated with your investment in this ethically-focused ETF. Learn more about understanding your Amundi MSCI World Catholic Principles UCITS ETF Acc NAV and monitoring your Amundi MSCI World Catholic Principles UCITS ETF Acc NAV effectively by visiting [link to relevant resource].

Featured Posts

-

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025 -

2024 Porsche Macan Buyers Guide Find The Perfect Model For You

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Model For You

May 24, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025 -

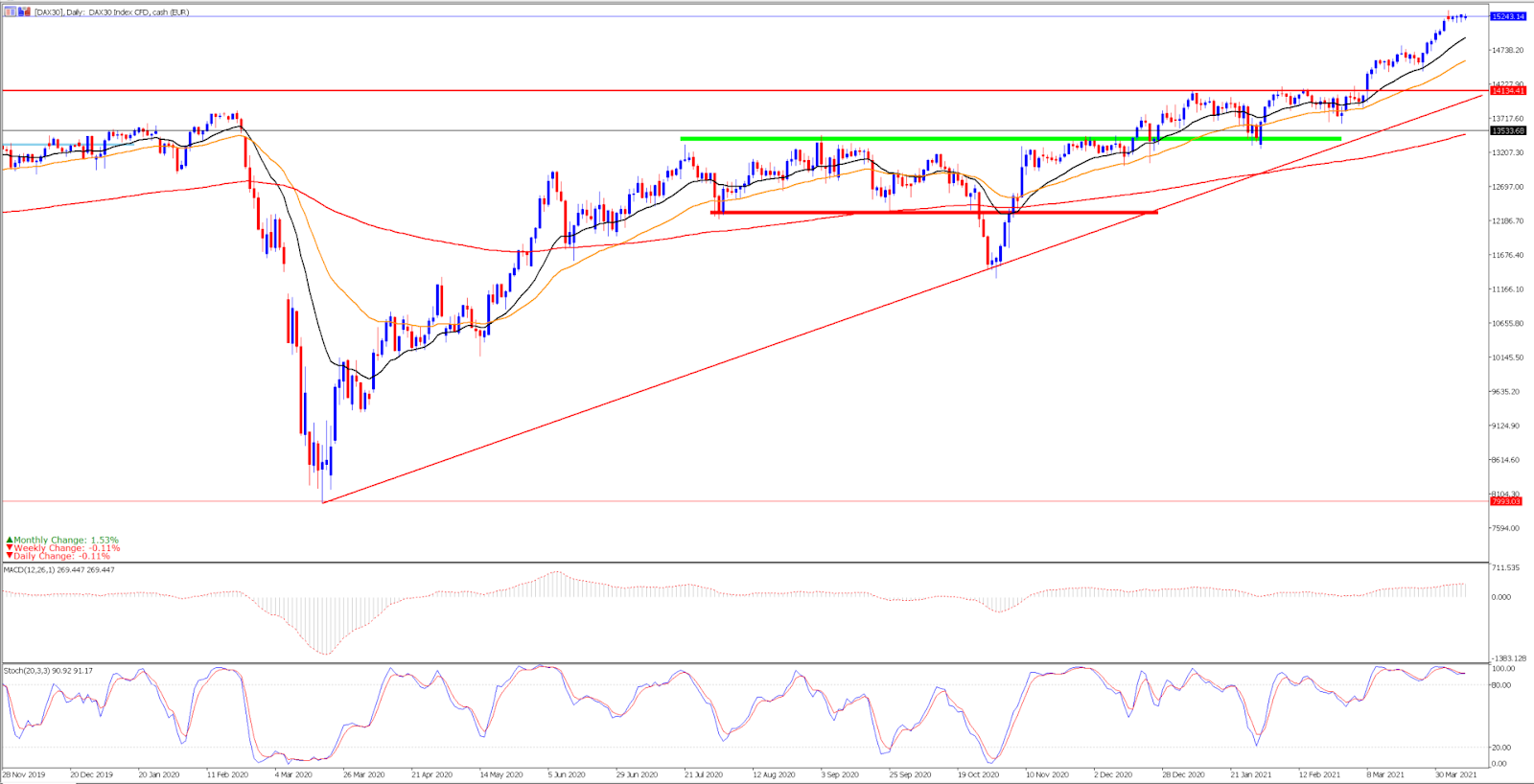

Hl Ystmr Sewd Daks 30 Thlyl Ladae Almwshr Alalmany

May 24, 2025

Hl Ystmr Sewd Daks 30 Thlyl Ladae Almwshr Alalmany

May 24, 2025 -

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025

Latest Posts

-

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025 -

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025 -

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025