Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Importance

Table of Contents

A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of investment fund regulated under EU law, offering investors a diversified portfolio. The Amundi MSCI World II UCITS ETF Dist specifically tracks the MSCI World Index, providing broad global market exposure across developed countries. This article aims to explain the importance of understanding the daily NAV of this popular ETF.

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. Simply put, it's the total value of all the stocks, bonds, or other assets held by the ETF, minus any liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, the daily NAV calculation involves determining the market value of each holding in the MSCI World Index. This is then adjusted for expenses such as management fees and any accrued dividends before being divided by the total number of outstanding shares.

- NAV reflects the intrinsic value of the ETF's holdings.

- Daily NAV fluctuations show market performance.

- Understanding NAV helps in investment decision-making.

The Significance of Daily NAV for Amundi MSCI World II UCITS ETF Dist Investors

Monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist allows investors to track its performance over time. By comparing the NAV on different dates, you can easily see the ETF's growth or decline. For instance, if the NAV increases from one day to the next, it indicates a positive market performance for the ETF's underlying assets. Conversely, a decrease signals a negative performance.

This NAV data is crucial for making informed buy and sell decisions. A rising NAV might suggest a good time to sell, while a dip could present a buying opportunity, depending on your investment strategy and risk tolerance. However, it's important to consider other market factors before making any rash decisions.

- Identify trends and potential investment opportunities.

- Compare performance against benchmarks (like the MSCI World Index itself).

- Assess the impact of market events (e.g., interest rate changes, geopolitical events) on the ETF.

Where to Find the Daily NAV of Amundi MSCI World II UCITS ETF Dist

Reliable sources for accessing the daily NAV of the Amundi MSCI World II UCITS ETF Dist include:

- Amundi's official website: The fund manager usually provides this data directly.

- Major financial data providers: Platforms like Bloomberg, Refinitiv, and Yahoo Finance often list ETF NAVs.

- Your brokerage account: Most brokerage platforms display the current NAV of your holdings.

Interpreting NAV data involves looking for significant changes or trends. A consistently rising NAV generally indicates positive performance, while a prolonged decline warrants closer examination of market conditions and your investment strategy. Sudden, sharp changes could signal specific events impacting the market or the ETF's underlying assets.

Using Daily NAV for Investment Strategies with Amundi MSCI World II UCITS ETF Dist

The daily NAV information is valuable for several investment strategies:

-

Dollar-Cost Averaging (DCA): By investing a fixed amount at regular intervals regardless of the NAV, you mitigate the risk of investing a large sum at a market peak. The daily NAV helps you track your average purchase price over time.

-

Value Investing: While not directly a value investing metric on its own, significant drops in the NAV, when coupled with a strong fundamental outlook for the underlying assets, may signal potential undervaluation offering attractive buying opportunities.

-

Risk Management: Monitoring the NAV allows you to assess the volatility of your investment and adjust your portfolio accordingly. Combining the Amundi MSCI World II UCITS ETF Dist with other asset classes can further diversify your holdings and manage risk.

-

DCA helps mitigate risk by averaging purchase price.

-

Identify undervalued assets (potentially) based on NAV movements and fundamental analysis.

-

Diversify your portfolio using the ETF in conjunction with other assets (bonds, real estate, etc.).

Conclusion: Daily NAV and Your Amundi MSCI World II UCITS ETF Dist Investment

Regularly monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist is essential for making well-informed investment decisions. Understanding NAV fluctuations allows you to track performance, identify potential opportunities, and manage risk effectively. By utilizing the information provided in this article, you can better understand your investment and optimize your strategy. Stay informed about your Amundi MSCI World II UCITS ETF Dist: Daily NAV monitoring is key to successful investing! Start utilizing daily NAV data to optimize your Amundi MSCI World II UCITS ETF Dist investment strategy today!

Featured Posts

-

Porsche Elektromobiliu Ikrovimo Tinklo Pletra Europoje

May 24, 2025

Porsche Elektromobiliu Ikrovimo Tinklo Pletra Europoje

May 24, 2025 -

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Escape To The Country A Step By Step Relocation Plan

May 24, 2025 -

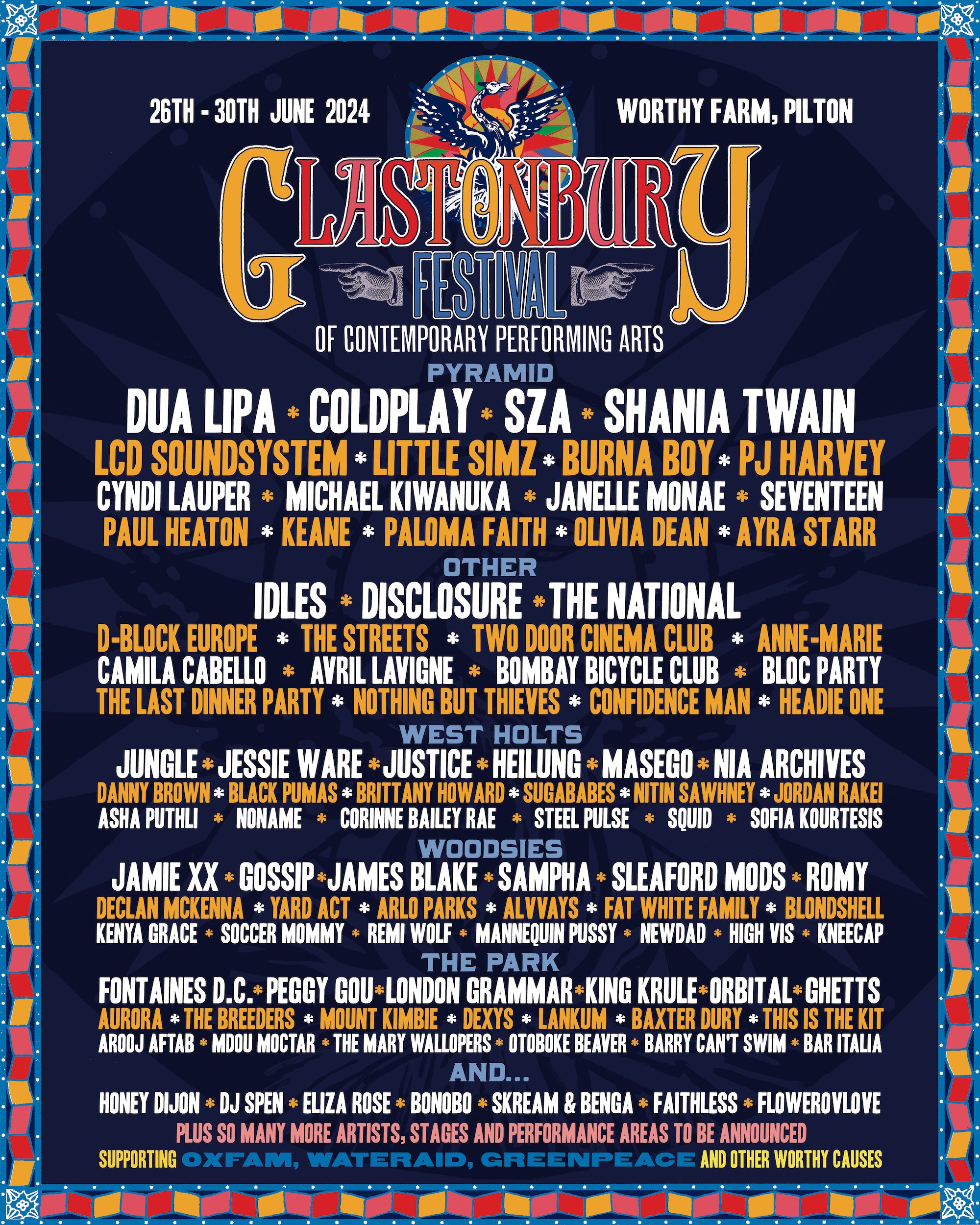

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Latest Posts

-

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 24, 2025

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 24, 2025 -

Proposed French Law Banning Hijabs For Under 15s In Public Areas

May 24, 2025

Proposed French Law Banning Hijabs For Under 15s In Public Areas

May 24, 2025 -

French Presidents Party Seeks Public Hijab Ban For Minors

May 24, 2025

French Presidents Party Seeks Public Hijab Ban For Minors

May 24, 2025 -

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025 -

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025