Amundi MSCI World II UCITS ETF Dist: How To Interpret Net Asset Value (NAV) Data

Table of Contents

Where to Find Amundi MSCI World II UCITS ETF Dist NAV Data

Accessing reliable NAV data for your Amundi MSCI World II UCITS ETF Dist investment is crucial. Several reputable sources provide this information, each offering its own advantages:

- Amundi's Website: The official source, offering real-time and historical NAV data directly from the fund manager. Look for dedicated sections on ETF details and fund factsheets.

- Major Financial News Sources: Reputable financial news websites and portals (like Bloomberg, Yahoo Finance, Google Finance) often display real-time and historical ETF NAV data.

- Brokerage Platforms: Your brokerage account will usually display the NAV of your holdings, offering convenient access to your specific investment's performance.

The data presentation varies across sources:

- Tables: A straightforward tabular format, showing the NAV for specific dates.

- Charts: Visual representations of NAV changes over time, ideal for identifying trends and performance patterns.

Remember that reporting times can differ due to time zone variations and market closures. Always check the timestamp associated with the NAV data to ensure accuracy.

Understanding Daily NAV Fluctuations of the Amundi MSCI World II UCITS ETF Dist

Daily NAV changes in the Amundi MSCI World II UCITS ETF Dist are influenced by several dynamic factors:

- Market Movements: The underlying assets within the ETF (global equities) fluctuate based on various economic indicators, investor sentiment, and geopolitical events. A positive market day typically leads to a higher NAV, and vice versa.

- Currency Fluctuations: As a globally diversified ETF, the Amundi MSCI World II UCITS ETF Dist is exposed to currency risk. Changes in exchange rates between the currencies of the underlying assets and the reporting currency (usually EUR) will directly impact the NAV.

- Dividend Distributions: When underlying companies pay dividends, the NAV will typically decrease by the amount distributed, reflecting the payout to ETF shareholders.

Examples:

- Positive Market Day: Strong economic data leads to a rise in global equity markets, boosting the value of the underlying assets and resulting in a higher NAV for the Amundi MSCI World II UCITS ETF Dist.

- Geopolitical Uncertainty: A major global event can cause market volatility and significant NAV fluctuations, either positive or negative, depending on investor reaction.

It's vital to remember the difference between NAV and market price. While they are usually very close, slight discrepancies can arise due to trading volume and the timing of transactions.

Using NAV Data to Make Informed Investment Decisions with the Amundi MSCI World II UCITS ETF Dist

NAV data is a powerful tool for informed investment decisions:

- Monitoring NAV Trends: Tracking the long-term NAV trend allows you to assess the ETF's performance over time, identifying periods of growth and potential challenges.

- Return Calculation: Comparing historical NAV data enables accurate calculation of returns on your investment, helping you gauge the effectiveness of your strategy.

- Benchmark Comparison: Compare the Amundi MSCI World II UCITS ETF Dist's NAV performance against relevant benchmarks (like the MSCI World Index) to evaluate its relative success.

- Investment Strategies: NAV data can inform investment strategies such as dollar-cost averaging (investing a fixed amount regularly) and buy-and-hold (long-term investment without frequent trading).

Limitations: While NAV is crucial, it shouldn't be the sole factor in investment decisions. Consider the ETF's overall investment objective, expense ratio, and broader market conditions.

Potential Pitfalls and Considerations When Interpreting Amundi MSCI World II UCITS ETF Dist NAV

While NAV provides valuable insights, be aware of potential issues:

- Data Discrepancies: Slight variations in reported NAV might exist across different sources due to reporting lags or data processing differences. Always prioritize official sources.

- Currency Considerations: Understand the currency in which the NAV is reported. Currency conversions can impact your perception of performance if your portfolio is managed in a different currency.

- Short-Term Fluctuations: Avoid impulsive decisions based solely on short-term NAV fluctuations. Focus on the long-term trend and your overall investment goals.

- Investment Strategy Alignment: Ensure your use of NAV data aligns with the Amundi MSCI World II UCITS ETF Dist's investment strategy and objective.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Analysis

Mastering Amundi MSCI World II UCITS ETF Dist NAV analysis is key to successful investing. By accessing NAV data from reliable sources, understanding the factors that influence daily fluctuations, and incorporating this data into your investment strategy alongside other crucial factors, you can make informed decisions about your portfolio. Actively monitor the NAV of your Amundi MSCI World II UCITS ETF Dist holdings and continue learning about effective investment strategies using Amundi MSCI World II UCITS ETF Dist NAV data. Remember, a holistic approach, combining NAV analysis with broader market understanding and your personal investment objectives, is crucial for long-term success.

Featured Posts

-

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 24, 2025 -

Escape To The Country Making The Move To Rural Life

May 24, 2025

Escape To The Country Making The Move To Rural Life

May 24, 2025 -

2025 Porsche Cayenne A Comprehensive Interior And Exterior Photo Gallery

May 24, 2025

2025 Porsche Cayenne A Comprehensive Interior And Exterior Photo Gallery

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

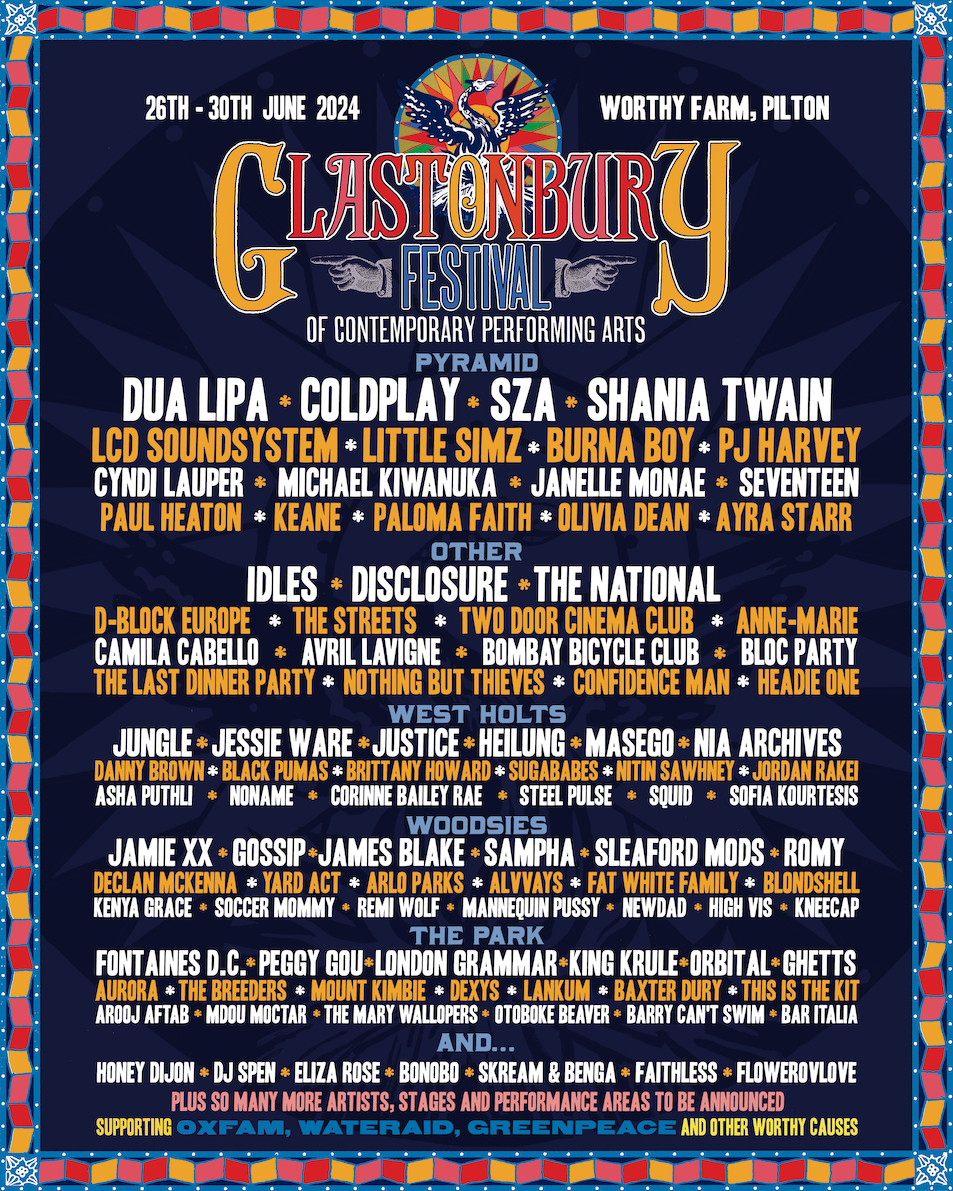

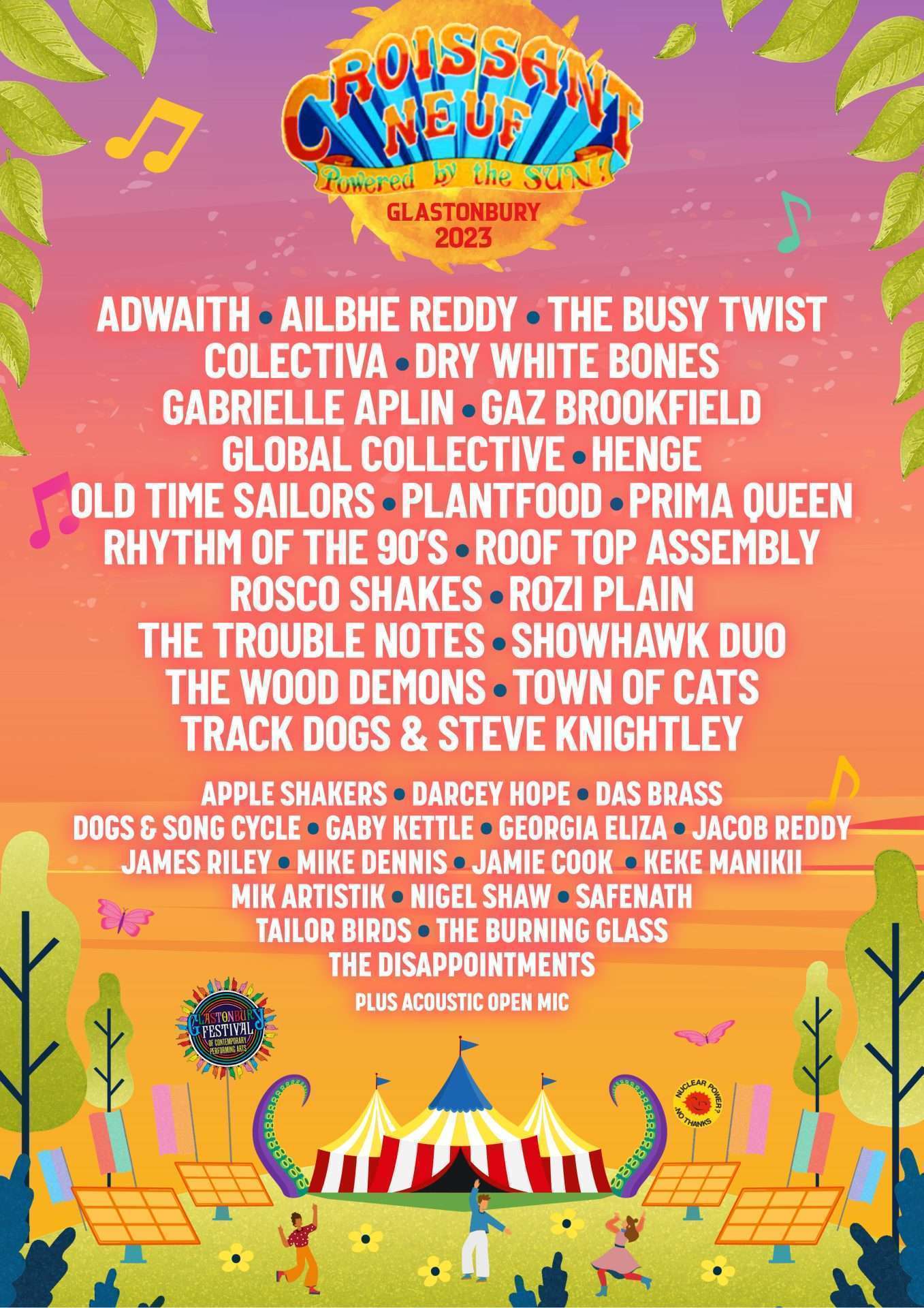

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Ignites Debate

May 24, 2025

Latest Posts

-

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Glastonbury 2025 Lineup Update New Additions Include Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Lineup Update New Additions Include Olivia Rodrigo And The 1975

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Headline Full Lineup Speculation

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Headline Full Lineup Speculation

May 24, 2025