Amundi MSCI World II UCITS ETF USD Hedged Dist: Daily NAV Updates And Insights

Table of Contents

Understanding Daily NAV Fluctuations for the Amundi MSCI World II UCITS ETF USD Hedged Dist

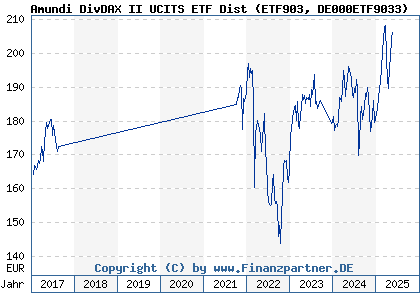

The daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist reflects the value of its underlying assets. Understanding its fluctuations is key to informed investment decisions. Several factors influence this daily NAV:

-

Market Movements of Underlying Assets: The primary driver of NAV changes is the performance of the stocks within the MSCI World Index, which comprises large and mid-cap equities across developed markets globally. Positive market movements generally lead to NAV increases, and vice versa. This is influenced by factors such as economic data releases, company earnings reports, and overall investor sentiment.

-

Currency Exchange Rates: Since this is a USD-hedged ETF, fluctuations in the exchange rate between the underlying currencies and the US dollar are partially mitigated. The hedging strategy aims to reduce the impact of currency risk on the NAV, although minor fluctuations might still occur. However, for international investors whose base currency isn't the USD, understanding the effect of currency fluctuations on their returns is important.

-

Impact of Market Volatility: Periods of high market volatility, such as those caused by geopolitical events or economic uncertainty, can lead to significant daily NAV swings in either direction. Understanding this volatility is essential for risk management.

Let's consider an example: If the MSCI World Index rises by 1% on a particular day and the USD strengthens slightly against the Euro, the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist will likely increase, though perhaps by less than 1% due to the hedging mechanism. Conversely, a negative day in the global market might lead to a decrease in NAV, but again, the impact will be partially cushioned by the hedging.

Accessing Reliable Daily NAV Updates for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Reliable and accurate NAV data is crucial for effective investment monitoring. Here are several sources:

-

Amundi's Official Website: This is the most reliable source for official NAV information. The website typically provides historical NAV data and may offer real-time or near real-time updates.

-

Major Financial News Websites: Reputable financial news outlets such as Bloomberg, Reuters, and Yahoo Finance often provide ETF data, including NAVs. However, always verify information from multiple sources.

-

Dedicated ETF Data Providers: Several companies specialize in providing comprehensive ETF data, including daily NAVs. These providers often offer advanced charting and analysis tools.

It is crucial to prioritize official sources. Utilizing unofficial or unreliable sources can lead to inaccurate information and potentially flawed investment decisions. NAV data is usually presented in tables, charts, or graphs, allowing for easy comparison over time. Some platforms also provide real-time NAV updates through dedicated APIs or data feeds.

Interpreting Daily NAV Updates and Their Implications for Your Investment Strategy

Daily NAV changes shouldn't be viewed in isolation. Interpret them within the context of broader market trends and your long-term investment goals.

-

Long-Term Performance vs. Short-Term Fluctuations: Daily fluctuations are normal and often insignificant in the long run. Focus on the long-term performance and consistency of the Amundi MSCI World II UCITS ETF USD Hedged Dist rather than reacting to every minor daily change.

-

Investment Goals and Risk Tolerance: Your investment strategy should align with your personal goals and risk tolerance. A conservative investor might be less inclined to react to short-term NAV fluctuations, while a more aggressive investor might consider adjusting their portfolio based on more frequent analysis.

-

Portfolio Management Strategies: Daily NAV information can be used to inform rebalancing decisions. Regular portfolio rebalancing helps maintain your desired asset allocation, ensuring your investment strategy remains aligned with your objectives. For example, if a sector within the MSCI World Index outperforms significantly, you might consider rebalancing to return to your target allocation.

Amundi MSCI World II UCITS ETF USD Hedged Dist: A Diversified Global Equity Investment

The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, offering broad diversification across global markets.

-

Global Diversification: The ETF provides exposure to a wide range of companies across developed markets, mitigating the risk associated with concentrating investments in a single country or sector.

-

Market Capitalization: The MSCI World Index includes both large and mid-cap companies, providing a balanced representation of the global equity market.

-

Asset Allocation: This ETF can be a valuable component in various asset allocation strategies, serving as a core holding for global equity exposure.

Conclusion

Monitoring the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for making informed investment decisions. By utilizing reliable data sources and understanding the factors influencing NAV fluctuations, investors can gain insights into market trends and adapt their strategies accordingly. Remember to focus on long-term performance, aligning your investment approach with your goals and risk tolerance. For further detailed information on the Amundi MSCI World II UCITS ETF USD Hedged Dist and its performance, we encourage you to visit Amundi's official website or consult with a financial advisor. Stay informed about daily NAV updates and utilize this knowledge to optimize your investment strategy with the Amundi MSCI World II UCITS ETF USD Hedged Dist and similar global equity ETFs.

Featured Posts

-

End Of Ryujinx Nintendo Contact Leads To Emulator Closure

May 25, 2025

End Of Ryujinx Nintendo Contact Leads To Emulator Closure

May 25, 2025 -

Plan Your Memorial Day Trip 2025 Flight Date Guide

May 25, 2025

Plan Your Memorial Day Trip 2025 Flight Date Guide

May 25, 2025 -

The Untapped Potential Of Middle Managers Driving Performance And Engagement

May 25, 2025

The Untapped Potential Of Middle Managers Driving Performance And Engagement

May 25, 2025 -

Marylands Aubrey Wurst Shines In 11 1 Softball Win Against Delaware

May 25, 2025

Marylands Aubrey Wurst Shines In 11 1 Softball Win Against Delaware

May 25, 2025 -

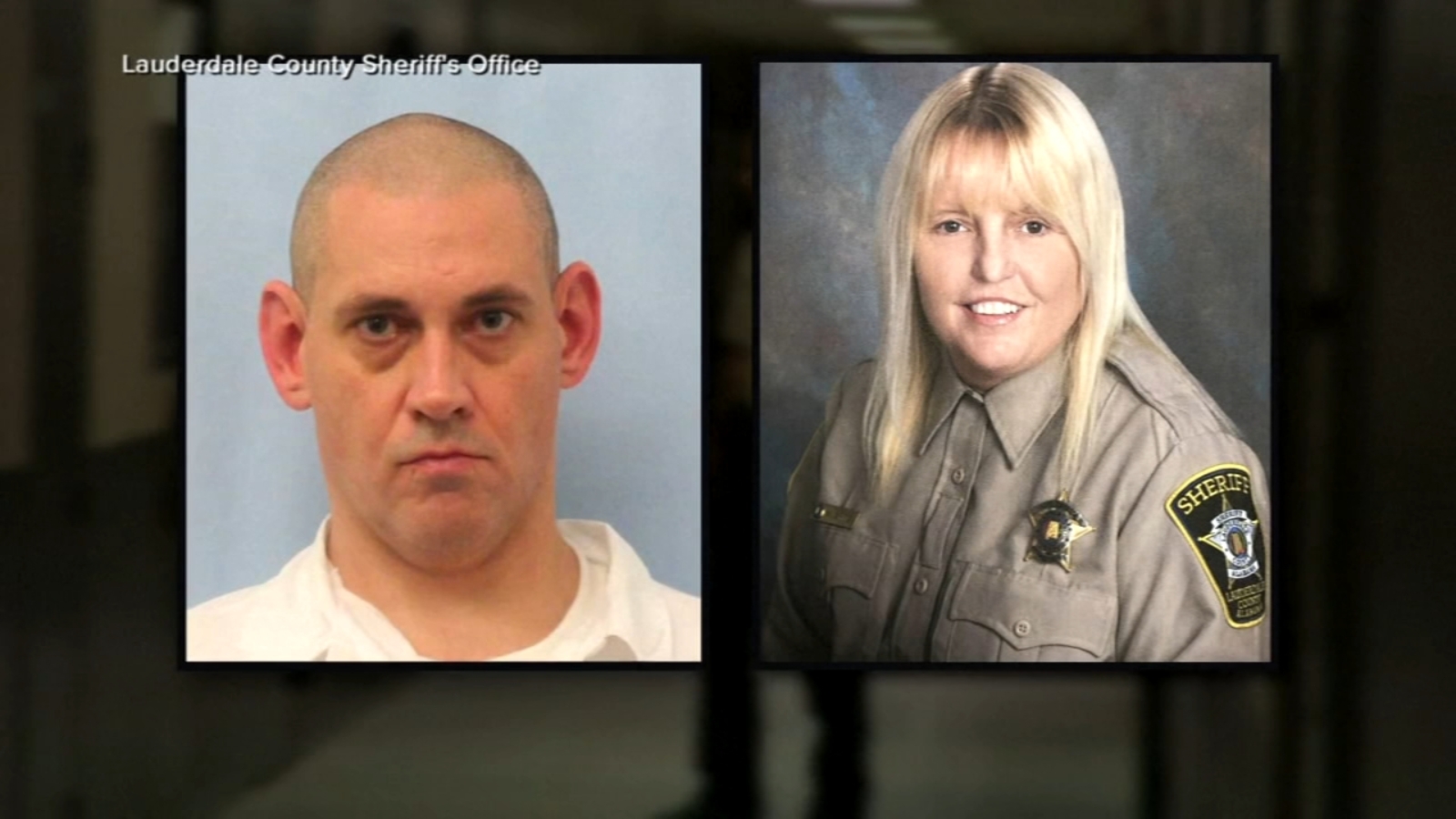

10 New Orleans Inmates Escape A Detailed Account Of The Jailbreak

May 25, 2025

10 New Orleans Inmates Escape A Detailed Account Of The Jailbreak

May 25, 2025