Analysis: Copper Market's Response To China-US Trade Prospects

Table of Contents

China's Role in Copper Demand and Price Volatility

China's insatiable appetite for copper makes it the world's largest consumer. Its massive infrastructure projects, from high-speed rail lines to sprawling urban developments, fuel an enormous demand for this essential metal. Consequently, any shift in Chinese economic policy directly impacts global copper prices. Stimulus packages, for example, often lead to increased infrastructure spending and a surge in copper demand, driving prices upward. Conversely, periods of slower economic growth or tightened environmental regulations can curb demand and exert downward pressure on prices.

- Impact of Chinese construction boom on copper consumption: The ongoing urbanization and modernization in China necessitate vast quantities of copper for wiring, plumbing, and construction materials, significantly influencing global copper prices.

- Effect of environmental policies on copper mining and refining in China: Stringent environmental regulations aimed at reducing pollution from copper mining and smelting operations can impact production and availability, thus affecting global supply and prices.

- Influence of Chinese government initiatives on copper import/export: Government policies impacting copper imports and exports, including tariffs and quotas, directly influence global market dynamics and price fluctuations.

US Trade Policies and Their Ripple Effects on the Copper Market

US trade policies, particularly tariffs and trade restrictions, significantly influence the copper market. Imposing tariffs on copper imports from China, for instance, can disrupt supply chains, increase prices for US consumers, and potentially trigger retaliatory measures from China, further destabilizing the market. Trade wars and sanctions imposed by the US on other copper-producing nations create ripple effects, impacting global supply and demand. Furthermore, domestic economic policies in the US, such as infrastructure spending or industrial growth initiatives, influence copper demand within the country and subsequently affect global prices.

- Analysis of specific US tariffs and their impact on copper prices: The imposition of tariffs on copper imports from specific countries has historically led to price increases in the US market and global price volatility.

- The role of US sanctions on copper trade with specific countries: Sanctions imposed on certain countries can restrict copper supply, influencing global prices and potentially leading to market instability.

- Impact of US-China trade agreements on copper market stability: Trade agreements between the US and China can create greater stability and predictability in the copper market, reducing price volatility.

Analyzing the Correlation Between Trade Tensions and Copper Futures Prices

A strong correlation exists between escalating China-US trade tensions and copper futures prices. Data analysis reveals that periods of heightened trade disputes often correspond with significant price fluctuations in the copper market. This is partly due to investor sentiment – uncertainty about future trade relations can lead to increased speculation and volatility. Furthermore, disruptions to supply chains caused by trade wars directly impact copper availability and prices. Analyzing trade indicators, such as the volume of copper imports and exports between China and the US, can provide valuable insights into potential future market movements.

- Correlation analysis of trade data and copper futures prices: Statistical analysis can reveal the strength of the relationship between specific trade events and copper price fluctuations.

- Examples of significant price fluctuations linked to trade events: Historical examples of how specific trade events (tariffs, sanctions, trade agreements) have impacted copper prices can illustrate the correlation.

- Discussion of hedging strategies used by copper market players: Copper market participants utilize hedging strategies to mitigate risks associated with trade-related price volatility.

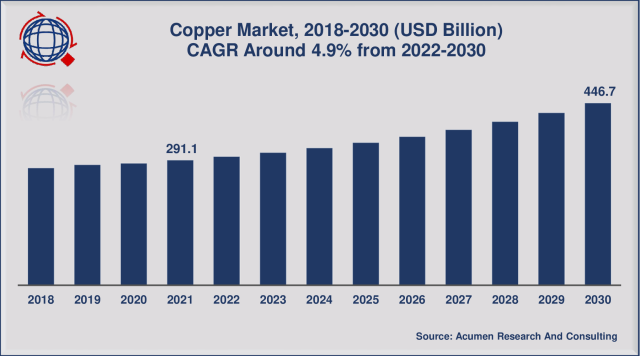

Future Outlook: Predicting Copper Market Behavior Based on Trade Prospects

Predicting the future of the copper market requires careful consideration of various scenarios regarding China-US trade relations. A continuation of trade tensions could lead to increased price volatility and potential supply chain disruptions. Conversely, a resolution of trade disputes and increased cooperation between the two nations could lead to greater market stability and predictable price movements. Technological advancements, such as the increasing use of copper in renewable energy technologies and electric vehicles, will also shape future copper demand. Sustainable mining practices and responsible sourcing will become increasingly important, influencing both supply and pricing.

- Projected copper demand based on various trade scenarios: Different trade scenarios (e.g., continued conflict, trade agreement) can be modeled to forecast future copper demand.

- Potential shifts in global copper production and supply: Changes in mining production, refining capacity, and geopolitical factors will influence global copper supply.

- The emergence of new technologies impacting copper usage: The adoption of new technologies may significantly alter copper demand, affecting its price and market dynamics.

Conclusion: Understanding and Capitalizing on the Copper Market's Response to China-US Trade Prospects

The intricate relationship between China-US trade relations and the copper market is undeniable. Both nations exert significant influence over global copper prices and supply chains. Monitoring trade developments and understanding their impact on the Copper Market's Response to China-US Trade Prospects is crucial for informed investment decisions and strategic business planning. Continued analysis of this dynamic market interplay is essential for navigating the complexities and opportunities within this vital sector. Stay informed about the latest developments in China-US trade to effectively manage your involvement in the copper market and capitalize on emerging opportunities. Further research and analysis are encouraged to deepen our understanding of this crucial market dynamic.

Featured Posts

-

Podcast Production Reimagined Ais Impact On Scatological Document Analysis

May 06, 2025

Podcast Production Reimagined Ais Impact On Scatological Document Analysis

May 06, 2025 -

Mastering Sabrina Carpenter In Fortnite A Comprehensive Guide

May 06, 2025

Mastering Sabrina Carpenter In Fortnite A Comprehensive Guide

May 06, 2025 -

Colman Domingo 10 Ideal Mcu Roles Beyond Kang The Conqueror

May 06, 2025

Colman Domingo 10 Ideal Mcu Roles Beyond Kang The Conqueror

May 06, 2025 -

Susunan Pemain Timnas U20 Indonesia Vs Yaman Analisis Dan Perkiraan

May 06, 2025

Susunan Pemain Timnas U20 Indonesia Vs Yaman Analisis Dan Perkiraan

May 06, 2025 -

Stock Market Today Dow S And P 500 Live Updates For May 5

May 06, 2025

Stock Market Today Dow S And P 500 Live Updates For May 5

May 06, 2025