Analysis: Japan's Steep Bond Yield Curve And Its Economic Impact

Table of Contents

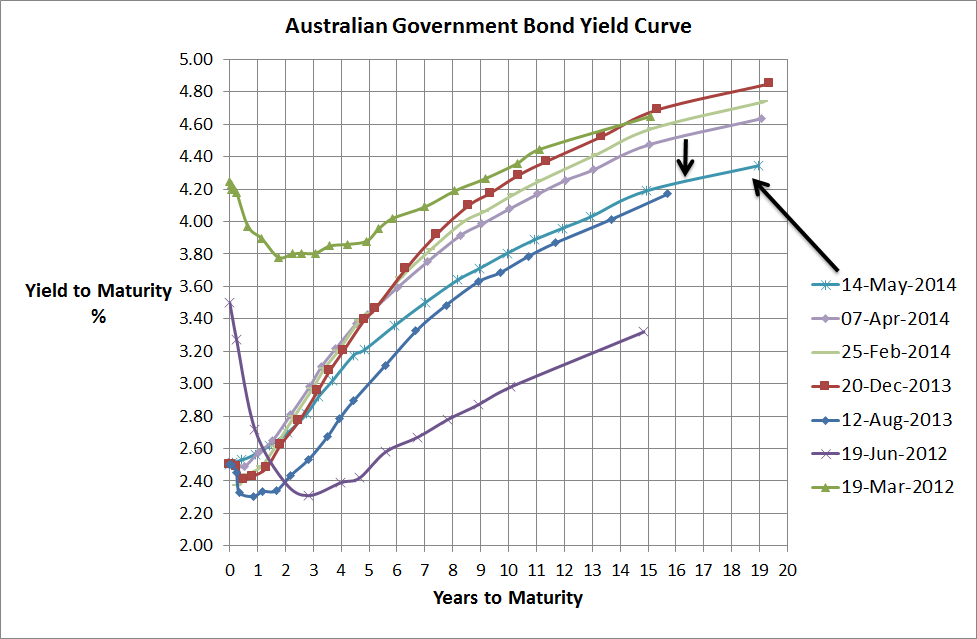

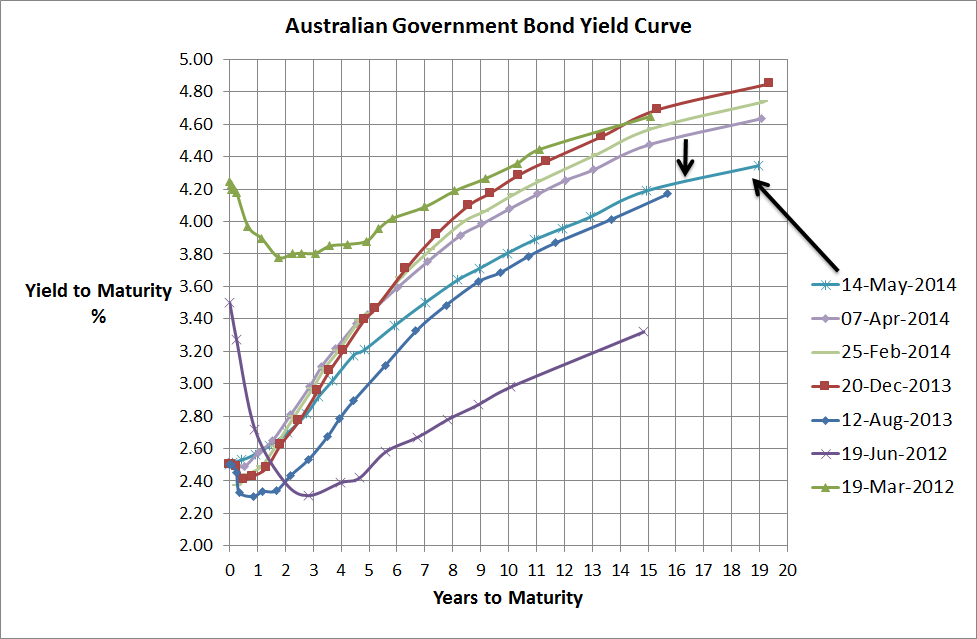

Understanding Japan's Bond Yield Curve

The bond yield curve illustrates the relationship between the yields (returns) of government bonds with different maturities. A "normal" curve slopes upward, reflecting higher yields for longer-term bonds due to higher perceived risk. An "inverted" curve, where short-term yields exceed long-term yields, often signals anticipated economic slowdown. A flat curve indicates uncertainty.

Historically, Japan's yield curve has been predominantly flat or even inverted, a direct result of the Bank of Japan's (BOJ) aggressive monetary easing policies aimed at combating deflation. The BOJ's interventions, designed to keep interest rates low, effectively suppressed yields across the maturity spectrum.

- Japanese Government Bonds (JGBs): JGBs are issued by the Japanese government and are considered among the safest investments globally, driving substantial demand.

- Yield Curve Control (YCC): The BOJ's YCC policy targeted specific yield levels for certain JGBs, aiming to maintain low borrowing costs. This significantly influenced the shape of the yield curve.

- Recent Shift: The recent steepening represents a dramatic departure from this long-standing pattern, signaling a potential shift in market expectations.

Factors Contributing to the Steepening Yield Curve

Several interconnected factors have contributed to the steepening of Japan's bond yield curve:

-

Increased Inflation Expectations: While still relatively low by global standards, inflation in Japan has edged higher, prompting speculation about a potential shift in the BOJ's monetary stance and causing investors to demand higher yields to compensate for inflation risk. Data from the Japanese government on CPI (Consumer Price Index) supports this trend.

-

Changes in Global Interest Rate Environments: The aggressive interest rate hikes implemented by central banks globally, particularly the US Federal Reserve, have increased global interest rates, making Japanese bonds relatively less attractive compared to higher-yielding alternatives. This outflow of funds has contributed to higher yields on JGBs.

-

Potential Shifts in BOJ Monetary Policy: While the BOJ has maintained its commitment to YCC, market participants anticipate a potential future adjustment or abandonment of the policy, leading to speculation about rising interest rates. Statements by BOJ officials and analysts have fueled this speculation.

-

Increased Foreign Investor Demand (or Lack Thereof): The interplay of global interest rate changes and inflation expectations has led to a shift in foreign investor appetite for JGBs. Some analysts suggest decreased foreign demand has contributed to the upward pressure on yields.

Economic Implications of a Steepening Yield Curve for Japan

A steeper yield curve in Japan presents a complex interplay of potential positive and negative economic consequences:

Potential Positive Impacts:

-

Increased Borrowing Costs: Higher borrowing costs for businesses may curb excessive investment and potentially lead to more sustainable economic growth, reducing the risk of asset bubbles.

-

Impact on the Japanese Yen: A steeper curve could strengthen the Japanese yen, as higher interest rates attract foreign investment.

-

Effect on Consumer Spending: Increased borrowing costs could temper consumer spending, potentially mitigating inflationary pressures. However, the impact is nuanced and dependent on various other economic factors.

-

Potential Consequences for the Housing Market: Higher interest rates could cool down the housing market, potentially preventing overheating.

Potential Negative Impacts:

-

Increased Government Borrowing Costs: The government will face higher costs for financing its debt, potentially impacting fiscal policy and straining public finances.

-

Risk of Further Yen Depreciation: The interplay of global and domestic factors influencing the Yen's value remains complex. While higher yields could strengthen it, other factors might counteract this effect.

-

Potential for Economic Slowdown: Increased borrowing costs for businesses can stifle investment and hinder economic growth.

Global Market Implications of Changes in Japan's Bond Market

Changes in Japan's bond yield curve have significant repercussions for global financial markets:

-

Ripple Effect on Other Asian Economies: Japan's economic performance and monetary policy heavily influence its neighbors. A slowdown in Japan could trigger a regional slowdown.

-

Global Interest Rates and Currency Values: The shift in Japanese bond yields can affect global investor sentiment, influencing interest rates and currency values worldwide. The interconnectedness of global markets means any significant changes in Japan resonate elsewhere.

-

Specific Examples: For instance, increased Japanese interest rates could attract capital away from other emerging markets, affecting their currency values and economic growth.

Conclusion

The recent steepening of Japan's bond yield curve signifies a pivotal moment in the country's economic trajectory and carries significant international implications. Understanding the factors contributing to this shift – inflation, global interest rate adjustments, potential BOJ policy changes, and fluctuating foreign investment – is crucial for analyzing the potential consequences. While some aspects could have positive effects (e.g., curbing over-investment), others might negatively impact economic growth (e.g., higher borrowing costs for the government). The ripple effect on global markets is undeniable, impacting everything from currency values to global interest rate expectations. To fully grasp the ongoing evolution of the Japanese economy and its impact on the world stage, it’s vital to monitor Japan's bond yield curve closely and remain informed about related developments. Stay updated on analysis of Japan's bond yield curve by regularly checking reputable financial news sources and further researching topics like BOJ monetary policy and Japanese economic forecasts.

Featured Posts

-

Backwards Music In Fortnite Players Express Discontent

May 17, 2025

Backwards Music In Fortnite Players Express Discontent

May 17, 2025 -

Thu Thiem Phoi Canh Cong Vien Dien Anh Duoc De Xuat

May 17, 2025

Thu Thiem Phoi Canh Cong Vien Dien Anh Duoc De Xuat

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

Twm Krwz Wana Dy Armas Tfasyl Alelaqt Alghamdt Bynhma

May 17, 2025

Twm Krwz Wana Dy Armas Tfasyl Alelaqt Alghamdt Bynhma

May 17, 2025 -

Mariners Vs Tigers Series Injury Report And Game Preview March 31 April 2

May 17, 2025

Mariners Vs Tigers Series Injury Report And Game Preview March 31 April 2

May 17, 2025