Analysis Of The Oil Market On May 16: Price Movements And Factors

Table of Contents

Crude Oil Price Movements on May 16

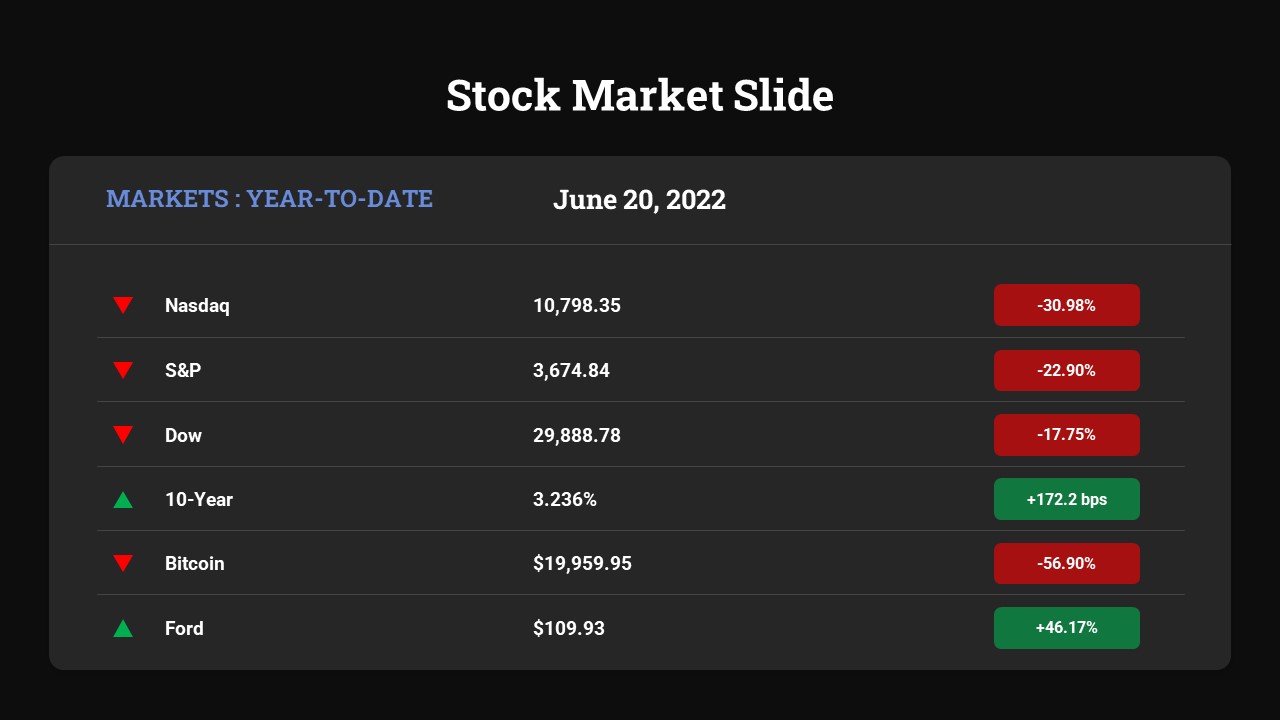

May 16 witnessed significant shifts in crude oil prices, impacting both the West Texas Intermediate (WTI) and Brent crude benchmarks. Analyzing these price movements requires examining the daily highs, lows, opening, and closing prices, as well as the percentage change compared to the previous day's close. A visual representation, such as a chart or graph, further enhances this analysis.

-

WTI Crude: The WTI crude oil price opened at $X, reached a high of $Y, experienced a low of $Z, and closed at $A. This represents a percentage change of B% compared to the previous day's closing price. (Note: Replace X, Y, Z, A, and B with actual data for May 16th). A significant dip was observed around [Time], potentially triggered by [Event].

-

Brent Crude: Similarly, Brent crude opened at $X, reached a high of $Y, experienced a low of $Z, and closed at $A. This resulted in a percentage change of B% compared to the previous day's close. (Note: Replace X, Y, Z, A, and B with actual data for May 16th). A notable price spike occurred around [Time], possibly attributed to [Event].

[Insert a chart or graph here visually representing the price movements of WTI and Brent crude oil on May 16.]

Geopolitical Factors Influencing Oil Prices

Geopolitical events significantly influence oil prices by impacting oil supply and overall market sentiment. On May 16, several factors likely played a role. Analyzing these events helps us understand the price fluctuations observed.

-

Ongoing Conflicts: Any ongoing conflicts in major oil-producing regions or areas of significant oil transit (e.g., the Middle East, Eastern Europe) can disrupt oil supply and create uncertainty, leading to price increases. For example, [mention specific conflict and its impact].

-

Political Instability: Political instability in key oil-producing nations can also lead to supply disruptions and price volatility. Concerns regarding [mention specific political situation and its influence on oil prices] might have contributed to the price movements on May 16.

-

OPEC+ Decisions: The actions and announcements of OPEC+ (Organization of the Petroleum Exporting Countries and its allies) are major drivers of oil prices. Any decisions regarding production quotas or strategies made around May 16 would have had a substantial impact on the market. [Mention any relevant OPEC+ news or announcements].

Economic Factors Affecting Oil Prices on May 16

Economic factors play a crucial role in determining oil demand and, consequently, prices. Macroeconomic indicators such as inflation rates, interest rates, and global economic growth influence investment decisions and consumer spending, impacting oil demand.

-

Global Economic Growth: Strong global economic growth typically boosts oil demand, pushing prices higher. Conversely, weaker economic growth can lead to reduced demand and lower prices. On May 16, [mention relevant economic growth figures and their impact].

-

Inflation and Interest Rates: High inflation and rising interest rates can curb economic activity and reduce oil demand, potentially leading to lower prices. [Discuss the impact of inflation and interest rate changes on May 16’s oil prices].

-

Recessionary Fears: Concerns about a potential global recession can significantly impact oil prices, as reduced economic activity lowers oil demand. [Discuss the influence of recessionary fears on May 16’s oil market].

Supply and Demand Dynamics in the Oil Market (May 16)

The interplay of supply and demand is fundamental to understanding oil price movements. On May 16, several factors contributed to the observed dynamics.

-

Oil Production Levels: Production levels from major oil-producing countries, both within OPEC+ and outside, directly impact global oil supply. Any changes in production quotas or unforeseen disruptions would have affected the market. [Discuss production levels from key countries on May 16].

-

Global Oil Demand: Changes in global oil demand, driven by factors like economic growth and seasonal changes, directly influence prices. [Discuss global oil demand trends leading up to and on May 16].

-

Oil Inventories: Strategic Petroleum Reserve (SPR) releases or changes in commercial oil inventories influence the perceived supply availability and impact prices. [Analyze inventory levels and their impact on May 16’s oil market].

Conclusion

The oil market analysis for May 16 reveals that price movements were shaped by a complex interaction of geopolitical factors, economic indicators, and supply and demand dynamics. Geopolitical tensions, economic growth concerns, OPEC+ decisions, and fluctuations in oil production and demand all played a significant role. Understanding these interwoven factors is critical for forecasting future oil price trends. Continuous monitoring of the oil market, including regular oil market analysis, is crucial for navigating this dynamic landscape. To stay informed about future price movements and influencing factors, regularly check for updated analyses and consider subscribing to a reliable news source or newsletter for ongoing oil market analysis.

Featured Posts

-

Rossiya Ukreplyaet Pozitsii V Uzbekistane Rost Inostrannykh Investitsiy

May 17, 2025

Rossiya Ukreplyaet Pozitsii V Uzbekistane Rost Inostrannykh Investitsiy

May 17, 2025 -

Canadian Online Casino 7 Bit Casino Expert Review And Player Guide

May 17, 2025

Canadian Online Casino 7 Bit Casino Expert Review And Player Guide

May 17, 2025 -

Everton Vina Vs Coquimbo Unido 0 0 Resumen Goles Y Resultado

May 17, 2025

Everton Vina Vs Coquimbo Unido 0 0 Resumen Goles Y Resultado

May 17, 2025 -

University Of Utah To Build New Hospital And Medical Campus In West Valley City

May 17, 2025

University Of Utah To Build New Hospital And Medical Campus In West Valley City

May 17, 2025 -

Black Americans Reaction To Trumps Student Loan Executive Order

May 17, 2025

Black Americans Reaction To Trumps Student Loan Executive Order

May 17, 2025