Analysis Of Treasury Market Movements On The Night Of April 8th

Table of Contents

Pre-Market Conditions and Leading Indicators

Analyzing the economic landscape leading up to April 8th is crucial to understanding the subsequent Treasury market movements. Several factors likely contributed to the market's volatility. Let's examine some key pre-market indicators:

-

Review of the Consumer Price Index (CPI) release: The CPI release preceding April 8th likely played a significant role. High inflation figures could signal increased expectations for Federal Reserve intervention, impacting Treasury yields. Conversely, unexpectedly low inflation could have eased concerns about aggressive rate hikes. Analyzing the specific numbers and market reaction to those numbers is critical.

-

Impact of potential Federal Reserve announcements or hints: Any statements or hints from the Federal Reserve regarding future monetary policy decisions would significantly influence investor expectations. Market participants closely scrutinize Fed communications for clues on interest rate adjustments, which directly affect Treasury yields. Did any comments or leaks from the Fed precede the April 8th activity?

-

Analysis of any significant international economic news: Geopolitical events and international economic news can significantly impact investor sentiment and consequently, Treasury yields. For example, news about international conflicts, trade disputes, or economic slowdowns in major economies could trigger risk aversion, leading to increased demand for safe-haven assets like US Treasuries. Identifying any such news is vital to a complete picture.

These indicators collectively influenced investor expectations, setting the stage for the dramatic Treasury market movements observed on April 8th. The interplay between inflation expectations, monetary policy outlook, and global economic events created a volatile environment.

The Night's Events: A Timeline of Treasury Market Activity

The night of April 8th saw a period of intense Treasury market movements. To understand the dynamics, let's examine the timeline:

-

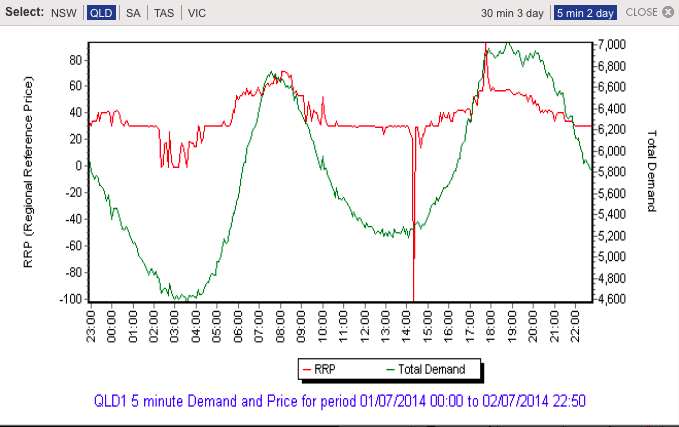

Specific times and yield changes for key Treasury securities (e.g., 10-year, 30-year): A precise record of yield changes for benchmark Treasury securities like the 10-year and 30-year notes is essential. For instance, we might have seen a sharp increase in the 10-year yield between 8 PM and 10 PM, followed by a period of relative calm. This detailed account, ideally presented graphically, is key to understanding the sequence of events.

-

Mention of any unusual trading volume or volatility spikes: Did trading volume spike significantly during specific periods? Were there notable increases in volatility, perhaps indicating panic selling or aggressive buying? High trading volumes during specific moments could signal shifts in investor sentiment.

-

Highlight any significant auction results if applicable: If any Treasury auctions occurred around this time, their results would significantly influence market dynamics. A poorly received auction could increase yields while a successful auction might lead to lower yields.

[Insert Chart/Graph here visually representing the Treasury yield movements throughout the night of April 8th] This visual representation will dramatically improve understanding of the described Treasury market movements.

Identifying the Primary Drivers of the Treasury Market Movements

Several factors likely contributed to the observed Treasury market movements on April 8th. Let's analyze the key drivers:

-

Assessment of the impact of changing inflation expectations: Shifts in inflation expectations are a major driver of Treasury yields. Higher-than-expected inflation typically pushes yields upward as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, lower inflation expectations may lead to lower yields.

-

Discussion of any shifts in investor risk appetite: Investor risk appetite plays a crucial role. Periods of increased risk aversion might lead to a "flight to safety," pushing demand for US Treasuries higher and causing yields to fall. Conversely, an increase in risk appetite might lead to selling pressure, causing yields to rise.

-

Role of algorithmic trading and high-frequency transactions: Algorithmic trading and high-frequency trading can amplify volatility and contribute to rapid Treasury market movements. These automated trading strategies react quickly to changes in market data, sometimes exacerbating price swings.

-

Potential influence of major financial institutions' actions: The actions of large financial institutions, including central banks and commercial banks, can have a significant impact on Treasury markets. Their trading decisions and portfolio adjustments can influence market sentiment and price movements.

The correlation between movements in the Treasury market and other financial markets (stocks, commodities) also needs consideration. For instance, a decline in the stock market might trigger a "flight to safety" into Treasuries, causing yields to fall.

Impact on Interest Rates and the Broader Economy

The Treasury market movements on April 8th had a ripple effect across the broader economy:

-

Analysis of the potential impact on borrowing costs for businesses and consumers: Changes in Treasury yields directly affect borrowing costs for businesses and consumers. Higher Treasury yields generally lead to higher interest rates on loans, mortgages, and other forms of credit.

-

Discussion on the effects on mortgage rates and real estate markets: Shifts in Treasury yields impact mortgage rates, influencing the affordability of housing and affecting the real estate market's overall performance.

-

Consideration of implications for monetary policy decisions: The observed Treasury market movements likely informed the Federal Reserve's subsequent monetary policy decisions. Understanding these market signals is crucial for the central bank in setting interest rates and managing the economy.

Conclusion

The analysis of Treasury market movements on April 8th highlights the complex interplay of economic indicators, investor sentiment, and algorithmic trading. Changes in inflation expectations, shifts in risk appetite, and the actions of major financial institutions were all key drivers of the observed volatility. These Treasury market movements have significant implications for interest rates, borrowing costs, and the broader economy. Understanding these dynamics is critical for investors, policymakers, and anyone seeking to navigate the intricacies of the global financial landscape. To stay informed about future Treasury market movements and refine your understanding of these complex interactions, subscribe to our regular market analysis updates and utilize our resources to make informed decisions. Gain a deeper understanding of Treasury market movements and position yourself for success.

Featured Posts

-

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 29, 2025

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 29, 2025 -

Brain Drain The Global Scramble For Us Researchers Following Trump Era Funding Reductions

Apr 29, 2025

Brain Drain The Global Scramble For Us Researchers Following Trump Era Funding Reductions

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025 -

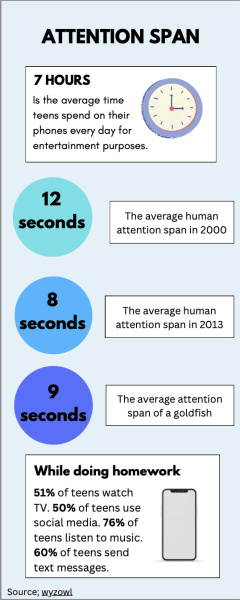

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025 -

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025