Analysis Of Trump's Call For Jerome Powell's Termination From The Federal Reserve

Table of Contents

Trump's Rationale for Seeking Powell's Removal

Trump's public pressure campaign to remove Jerome Powell stemmed from a combination of economic policy disagreements and potential political motivations. Understanding the "Trump Powell Federal Reserve Termination" narrative requires examining both aspects.

Economic Policy Disagreements

Trump consistently criticized Powell's monetary policy, particularly the interest rate hikes implemented in 2018 and 2019. He argued these hikes stifled economic growth and negatively impacted the stock market.

- Specific Instances of Criticism: Trump frequently used Twitter and public statements to denounce Powell's actions, calling them "crazy" and "terrible." He directly blamed Powell for slowing economic growth and hindering his reelection prospects.

- Preference for Lower Rates: Trump repeatedly advocated for lower interest rates, believing they would stimulate economic activity and boost the stock market. He often compared the US's monetary policy unfavorably to those of other countries.

- Expert Opinions: Many economists disagreed with Trump's assessment, arguing that Powell's actions were necessary to curb inflation and maintain long-term economic stability. They pointed to the potential dangers of excessively loose monetary policy.

Political Motivations

Beyond economic policy, political calculations likely fueled Trump's attacks on Powell.

- Reelection Strategy: As the 2020 election approached, Trump sought to portray a positive economic outlook. Blaming Powell for any economic slowdown served as a convenient scapegoat.

- Public Opinion and Media: Trump's rhetoric was amplified by sympathetic media outlets, creating a narrative that resonated with segments of the population critical of the Federal Reserve.

- Deflecting Blame: By targeting Powell, Trump attempted to shift responsibility for any economic downturn away from his own administration's policies.

Legal and Constitutional Implications of Removing Powell

The "Trump Powell Federal Reserve Termination" debate highlights the crucial issue of the Federal Reserve's independence and the limits of presidential power.

The Federal Reserve's Independence

The Federal Reserve Act of 1913 established the Fed's independence to ensure its decisions are based on economic considerations, not political pressure.

- Implications of Trump's Actions: Trump's attempts to influence the Fed directly threatened this independence, raising concerns about the integrity of monetary policy.

- Undermining Public Trust: Openly pressuring the Fed can erode public trust in its ability to manage the economy effectively and impartially.

- Legal Precedents: While presidents have historically clashed with Fed chairs, Trump's overt attempts to remove Powell were unprecedented and raised serious questions about the boundaries of executive authority.

The President's Power Over the Federal Reserve

While the President appoints the Federal Reserve Chair, their influence is limited by law.

- Appointment Process and Terms: The Chair serves a four-year term, and while the President nominates, Senate confirmation is required. Removing a sitting chair is significantly more difficult.

- Historical Context: Presidents have occasionally voiced concerns about Fed policy, but direct attempts to dismiss a chair for disagreeing on policy have been rare.

- Congressional Oversight: Congress also plays a crucial role in overseeing the Federal Reserve, providing another check on executive power.

Economic and Market Impacts of Trump's Actions

Trump's repeated calls for Powell's removal had significant economic and market consequences. Understanding the implications of "Trump Powell Federal Reserve Termination" requires analyzing these impacts.

Market Volatility and Uncertainty

Trump's pronouncements regarding Powell introduced significant uncertainty into the markets.

- Investor Confidence: The unpredictable nature of Trump's actions shook investor confidence, leading to increased market volatility.

- Capital Flows: Uncertainty about the future direction of monetary policy could potentially impact capital flows and investment decisions.

- Market Fluctuations: Data clearly showed increased market volatility during periods when Trump's attacks on Powell were most intense.

- Long-Term Consequences: The long-term impact on investor sentiment and economic growth remains a subject of ongoing debate among economists.

Global Economic Implications

Trump's actions also had international repercussions, impacting global economic stability.

- Global Financial Stability: Attempts to politicize the Fed can undermine confidence in the US dollar and global financial markets.

- US-Global Relationships: Trump's actions raised concerns among international partners about the reliability and predictability of US economic policy.

- International Commentary: Economists and financial analysts worldwide expressed concerns about the implications of Trump's actions for global economic stability.

Conclusion

Donald Trump's efforts to remove Jerome Powell from the Federal Reserve, encapsulated by the phrase "Trump Powell Federal Reserve Termination," represent a significant challenge to the independence of the central bank. His rationale, a mix of economic policy disagreements and political calculations, demonstrably impacted market stability and global confidence. The legal and constitutional implications are profound, highlighting the delicate balance between executive power and the need for an independent central bank. The economic and market consequences included heightened volatility and uncertainty, and raised concerns about broader global economic stability. Further research into the topic of "Trump Powell Federal Reserve Termination" is crucial to understanding the delicate balance of power and the ongoing impact of political interference on economic policy. Understanding the implications of such actions is paramount for safeguarding the stability of the global economy.

Featured Posts

-

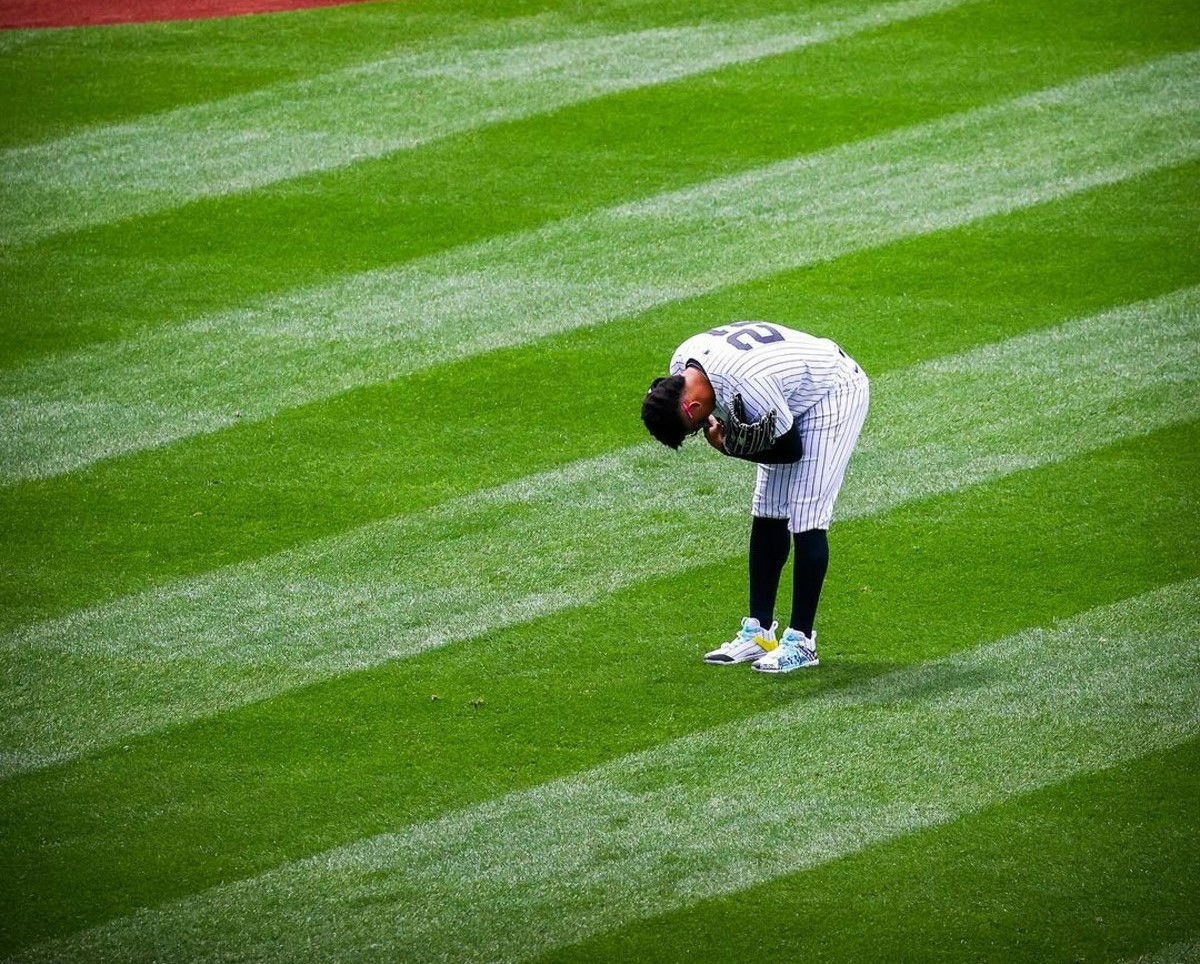

Yankees Offensive Explosion 9 Home Runs In Single Game

Apr 23, 2025

Yankees Offensive Explosion 9 Home Runs In Single Game

Apr 23, 2025 -

Wildlife Conservation In The Age Of Ai Opportunities And Risks

Apr 23, 2025

Wildlife Conservation In The Age Of Ai Opportunities And Risks

Apr 23, 2025 -

Examining The Anti Trump Protests Sweeping The Us

Apr 23, 2025

Examining The Anti Trump Protests Sweeping The Us

Apr 23, 2025 -

T Mobile Data Breaches Result In 16 Million Fine

Apr 23, 2025

T Mobile Data Breaches Result In 16 Million Fine

Apr 23, 2025 -

Michael Lorenzens Contract And Future In Baseball

Apr 23, 2025

Michael Lorenzens Contract And Future In Baseball

Apr 23, 2025