Analysis: Reliance Earnings And Their Effect On India's Large-Cap Stocks

Table of Contents

Reliance Industries' Q[Quarter] Earnings Performance

Reliance Industries, a behemoth in the Indian economy, reported its Q[Quarter] earnings recently, revealing [positive/negative] growth across various sectors. The results painted a picture of [positive/negative] momentum, impacting investor confidence and market sentiment. Let's examine the key highlights:

- Revenue Growth: [Percentage]%, showing [growth/decline] compared to the previous quarter and [growth/decline] compared to the same period last year. This reflects [explain the reasons for the growth/decline, referencing specific business segments].

- Net Profit: [Amount], indicating [growth/decline] compared to the previous quarter and [growth/decline] compared to the same period last year. This is attributed to [explain the reasons, mentioning factors like cost-cutting measures, increased sales, etc.].

- EBITDA: [Amount], showcasing [growth/decline] demonstrating [explain the significance of EBITDA change and its implications for the company's profitability].

- Debt Reduction: [Amount], signifying [explain the impact of debt reduction on Reliance’s financial health and future prospects]. This positive development likely contributed to the overall positive/negative investor sentiment.

Impact on Nifty 50 and Other Large-Cap Indices

The market reacted swiftly to Reliance's earnings announcement. The Nifty 50, a benchmark index for India's large-cap stocks, experienced a [percentage]% change immediately following the release. This movement reflects the significant weight Reliance carries within the index. The correlation between Reliance's stock price fluctuations and the overall market performance is undeniable, highlighting the company's pivotal role in India's financial ecosystem. A visual representation of this correlation, using a chart displaying Reliance's stock price against the Nifty 50 performance, would provide a clearer picture. [Insert chart here]. Other large-cap indices, such as the [mention other relevant indices], also demonstrated a [positive/negative] correlation, showcasing the widespread impact.

Sectoral Influence and Spillover Effects

Reliance's diverse business interests, spanning telecom (Jio), retail (Reliance Retail), and energy, create significant spillover effects across various sectors. The company's performance influences other large-cap players within these segments. For instance, [explain the impact on the telecom sector, mentioning competitors and related companies]. Similarly, the retail sector witnessed [explain the ripple effect in the retail sector]. Analyzing these sectoral correlations helps understand the broader economic implications of Reliance's earnings. The observed "market contagion" or "spillover effects" underscore the interconnected nature of India’s large-cap market.

Investor Sentiment and Market Volatility

Investor sentiment shifted considerably following the earnings report. [Positive/Negative] investor confidence is reflected in the [increase/decrease] in trading volume and the [increase/decrease] in market volatility. Analyst ratings also experienced changes, with [mention specific examples of rating changes and their justifications]. The shift in investor sentiment directly impacted the overall market's trajectory, further highlighting Reliance's influence on investor confidence in the Indian large-cap market. The interplay between Reliance's performance and overall market volatility underlines the importance of understanding its earnings announcements.

Long-Term Implications for Investors

Reliance's performance has profound long-term implications for investors. This analysis suggests that [state conclusions about the long-term implications based on the previous analysis]. Investors should consider [mention specific investment strategies, such as diversification, risk assessment, and long-term vs. short-term investment approaches] based on the current trends. Future scenarios might include [mention potential future scenarios, including positive and negative projections based on the company's performance].

Conclusion: Understanding the Reliance Earnings Effect on India's Large-Cap Stocks

Reliance Industries' earnings significantly impact India's large-cap market, influencing major indices, related sectors, and overall investor sentiment. Its performance acts as a key indicator of broader economic health and market stability. Understanding the interplay between Reliance's earnings and the performance of other large-cap stocks is crucial for effective investment strategies. Stay informed about future Reliance earnings announcements and their impact on your investment portfolio by subscribing to our newsletter [link to newsletter signup]. For more in-depth analysis of Reliance Industries and its effect on the Indian stock market, continue reading our other articles [link to other relevant articles].

Featured Posts

-

Driving With Adhd A Comprehensive Guide To Vehicle Safety

Apr 29, 2025

Driving With Adhd A Comprehensive Guide To Vehicle Safety

Apr 29, 2025 -

Bundesliga Abstiegskampf Investor Von Klagenfurt Will Trainer Austauschen Jancker Betroffen

Apr 29, 2025

Bundesliga Abstiegskampf Investor Von Klagenfurt Will Trainer Austauschen Jancker Betroffen

Apr 29, 2025 -

Open Ai Facing Ftc Investigation Examining The Potential Consequences For Chat Gpt And Ai Development

Apr 29, 2025

Open Ai Facing Ftc Investigation Examining The Potential Consequences For Chat Gpt And Ai Development

Apr 29, 2025 -

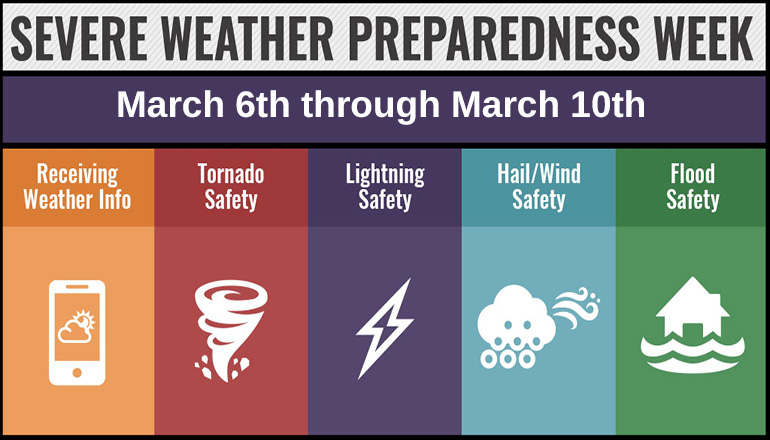

Kentucky Severe Weather Awareness Week Nws Preparedness Efforts

Apr 29, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness Efforts

Apr 29, 2025 -

Reliance Industries Stock Jumps After Positive Earnings Report

Apr 29, 2025

Reliance Industries Stock Jumps After Positive Earnings Report

Apr 29, 2025