Analyst Predicts $254 For Apple Stock: Is Now The Time To Buy?

Table of Contents

Apple's Current Financial Health and Future Outlook

Apple's recent financial reports paint a mixed picture. While the company continues to dominate the smartphone market with its iPhone sales, there are nuances to consider within the larger Apple stock forecast. Examining key performance indicators (KPIs) reveals both strengths and weaknesses influencing the potential for a $254 Apple share price.

-

Positive Aspects:

- Strong Growth in Services Revenue: Apple's services segment, including Apple Music, iCloud, and the App Store, demonstrates robust growth, showcasing a diverse revenue stream less reliant on single product sales. This diversification is a crucial factor in any Apple stock price prediction.

- Potential for Increased Market Share in Wearables: Apple Watch and AirPods continue to gain popularity, suggesting further growth potential in this lucrative market segment. This contributes positively to the overall Apple stock outlook.

-

Negative Aspects:

- Concerns about Slowing iPhone Sales: While still a major revenue driver, iPhone sales growth has plateaued in recent quarters, raising concerns among investors analyzing the Apple stock forecast.

- Increased Competition: Intense competition in the smartphone and tech sectors poses a challenge to maintaining market share and growth, affecting any Apple stock price prediction.

Keywords: Apple financials, Apple revenue, Apple earnings, Apple sales growth, Apple services revenue

Market Analysis and Predictions

The current market conditions significantly influence the viability of the $254 Apple stock price prediction. While the overall market shows signs of [insert current market condition - e.g., moderate growth, cautious optimism], the tech sector faces specific challenges. The analyst's $254 prediction likely stems from [explain analyst's methodology and reasoning - e.g., a projected increase in services revenue, anticipation of new product launches, a bullish outlook on the overall market]. It's crucial to note that this is just one perspective. Other analysts hold differing views, with some predicting a lower Apple share price and others more optimistic. This divergence emphasizes the importance of independent research and understanding various Apple stock forecasts before making any investment decisions.

Keywords: Stock market prediction, tech stock forecast, market analysis, Apple stock outlook, market trends

Risks and Considerations Before Investing in Apple Stock

Before jumping into buying Apple stock, a thorough risk assessment is vital. Investing always involves potential losses, and Apple stock is no exception.

- Competition: Fierce competition from companies like Samsung, Google, and other tech giants poses a significant threat to Apple's market share and profitability.

- Economic Downturn: A global economic recession could significantly impact consumer spending, decreasing demand for Apple products and affecting the Apple stock price.

- Supply Chain Issues: Global supply chain disruptions can hamper production and negatively affect Apple's ability to meet market demand.

- Valuation: Analyzing whether Apple stock is currently overvalued or undervalued is crucial. Various valuation metrics need consideration before investing.

- Diversification: Never put all your eggs in one basket! Diversification across multiple asset classes is essential for mitigating risk.

Keywords: Apple stock risk, investment risk, stock market risk, diversification, investment strategy

Alternative Investment Options

Exploring alternative investment options within the tech sector or broader market provides a balanced perspective. Researching other tech companies with strong growth potential or considering index funds that diversify your portfolio can complement your investment strategy.

Keywords: Tech investments, stock market investments, investment portfolio

Conclusion: Should You Buy Apple Stock at the Predicted $254?

The $254 Apple stock price prediction presents a tempting opportunity, but it's essential to weigh the potential rewards against significant risks. Apple's financial health displays both strengths and weaknesses, while market conditions and competition add layers of complexity. Remember to conduct thorough due diligence before investing in Apple stock or any other stock. The prediction, while compelling, should only be one factor informing your decision. Consider your individual risk tolerance and carefully research the Apple stock forecast before committing to any investment. While the $254 Apple stock price prediction is intriguing, responsible investing requires a balanced approach. Consider your personal circumstances and consult with a financial advisor before making any decisions regarding buying Apple stock.

Featured Posts

-

The I O Io Showdown Analyzing Google And Open Ais Strategies

May 25, 2025

The I O Io Showdown Analyzing Google And Open Ais Strategies

May 25, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 25, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 25, 2025 -

Inside The Hells Angels A Comprehensive Overview

May 25, 2025

Inside The Hells Angels A Comprehensive Overview

May 25, 2025 -

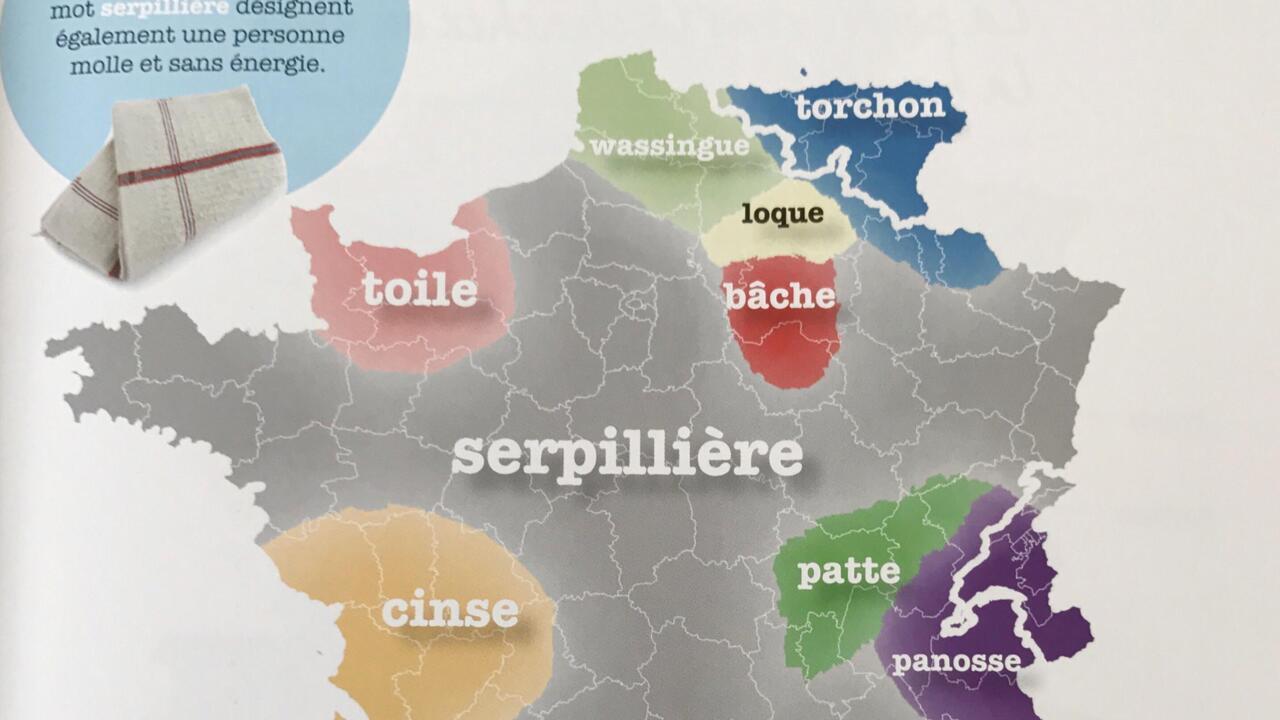

L Impact De Mathieu Avanzi Sur L Enseignement Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur L Enseignement Du Francais

May 25, 2025 -

Stocks Rise 8 On Euronext After Trump Pauses Us Tariffs

May 25, 2025

Stocks Rise 8 On Euronext After Trump Pauses Us Tariffs

May 25, 2025