Analyzing BigBear.ai Stock: Is It Worth The Investment?

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai's core business revolves around providing advanced AI-driven solutions to address complex challenges across various sectors. Understanding its financial performance is crucial for any BigBear.ai investment decision.

Revenue Streams and Growth Prospects

BigBear.ai generates revenue primarily through government contracts and commercial clients. Government contracts often involve large-scale projects focused on national security, defense, and intelligence. Commercial clients utilize BigBear.ai's AI solutions for diverse applications, including data analytics, cybersecurity, and predictive modeling. The company's growth trajectory depends heavily on securing new contracts and expanding its commercial client base. While precise future projections are inherently uncertain, analysts often cite growth potential based on market trends and the company’s strategic initiatives. To get a complete picture, refer to their official financial reports and SEC filings.

- Key Contracts: BigBear.ai has secured significant contracts with various government agencies, which form a substantial portion of its current revenue. Specific contract details are usually disclosed in their financial reports.

- Market Share: Precise market share data for BigBear.ai within the broad AI market is challenging to obtain, as the market is fragmented and data is often proprietary. However, tracking their growth relative to competitors provides a valuable indicator.

- Projected Revenue Growth: Analysts provide estimates for BigBear.ai's revenue growth, but these should be viewed with caution as they are subject to considerable uncertainty. Always conduct your own research and consult multiple sources.

Profitability and Financial Health

Assessing BigBear.ai's profitability and financial health requires a thorough examination of several key metrics. Profitability is gauged through metrics such as gross profit margin, operating margin, and net profit margin. Financial stability is assessed by analyzing its debt levels, cash flow, and liquidity ratios.

- Debt-to-Equity Ratio: This ratio indicates the proportion of BigBear.ai's financing that comes from debt versus equity. A high ratio suggests higher financial risk.

- Current Ratio: This liquidity ratio assesses BigBear.ai's ability to meet its short-term obligations. A healthy current ratio indicates strong short-term financial health.

- Operating Margin: This metric shows the profitability of BigBear.ai's operations, after accounting for direct costs. A higher operating margin generally indicates greater efficiency and profitability.

Competitive Landscape and Market Positioning

BigBear.ai operates in a fiercely competitive AI market. Understanding its competitive landscape and market positioning is crucial for a comprehensive BigBear.ai analysis.

Key Competitors and Market Share

BigBear.ai faces competition from established tech giants and numerous smaller AI companies. Identifying its main competitors and analyzing their market share provides context for evaluating BigBear.ai's potential for growth. Direct comparisons in market share are difficult due to data limitations and the diverse applications within the AI sector.

- List of Key Competitors: The list of competitors includes both large multinational corporations and specialized AI firms, each with its own strengths and weaknesses.

- BigBear.ai's Market Share: Precise market share data is difficult to ascertain publicly, but tracking their progress and growth relative to their competitors gives a good indication.

- Competitive Advantages: BigBear.ai's competitive advantages may lie in its specialized expertise in government contracts, its proprietary AI algorithms, or its strong client relationships.

Market Trends and Growth Potential

The AI market is experiencing rapid growth, driven by increased adoption across various sectors. BigBear.ai aims to benefit from this expansion by focusing on areas with high growth potential. However, potential challenges and threats to its market position should also be considered.

- Market Size Projections: Industry reports provide projections for the overall AI market size, offering a general context for BigBear.ai's growth potential.

- Growth Drivers: Factors driving growth in the AI market include increasing data volumes, advancements in AI technology, and greater demand for AI-powered solutions across multiple industries.

- Potential Risks: Potential risks include intense competition, changes in government regulations, and the possibility of technological disruption.

Valuation and Investment Risks

Evaluating BigBear.ai's stock valuation and understanding the inherent investment risks is essential before making any investment decisions.

Stock Valuation Metrics

Several metrics can be used to assess BigBear.ai's stock valuation, including the Price-to-Earnings (P/E) ratio and the Price-to-Sales (P/S) ratio. Comparing these metrics to those of its competitors helps determine whether BigBear.ai is overvalued or undervalued. These ratios are dynamic and change constantly, requiring up-to-date information.

- P/E Ratio: This ratio compares the stock price to earnings per share. A high P/E ratio might suggest that the stock is overvalued.

- Price-to-Sales Ratio: This ratio compares the stock price to revenue per share. It's often used for companies that are not yet profitable.

- Market Capitalization: This represents the total market value of all outstanding shares of BigBear.ai stock.

Investment Risks and Potential Downsides

Investing in BigBear.ai stock involves several potential risks. These include market volatility, intense competition, the risk of underperforming financial results, and potential regulatory changes affecting the AI industry.

- Key Risks to Consider: Besides those already mentioned, consider the risks associated with reliance on government contracts, the competitive landscape, and the potential for technological obsolescence.

- Potential Impact on Stock Price: These risks can significantly impact the BigBear.ai share price, leading to potential losses for investors.

Conclusion: Is BigBear.ai Stock a Smart Investment?

Our BigBear.ai stock analysis reveals a company operating in a high-growth market with significant potential. However, it also faces considerable competition and inherent risks associated with the AI sector and its reliance on government contracts. BigBear.ai's financial health and future performance will largely depend on its ability to secure new contracts, expand its commercial client base, and maintain its competitive edge. Based on the current information, a thorough assessment of the risks and potential rewards is crucial. Whether it's a "buy," "hold," or "sell" depends heavily on individual investment strategies and risk tolerance.

Therefore, it is crucial to conduct your own thorough due diligence before making any investment decisions regarding BigBear.ai stock. Consult financial news sources, review SEC filings (available on the SEC's EDGAR database), and consider seeking advice from a qualified financial advisor to make an informed decision. Remember, a comprehensive BigBear.ai stock analysis is key to successful investing.

Featured Posts

-

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Reintoarcerea In Romania

May 21, 2025

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Reintoarcerea In Romania

May 21, 2025 -

Ancelotti Den Klopp A Real Madrid In Gelecegi Icin Bir Degerlendirme

May 21, 2025

Ancelotti Den Klopp A Real Madrid In Gelecegi Icin Bir Degerlendirme

May 21, 2025 -

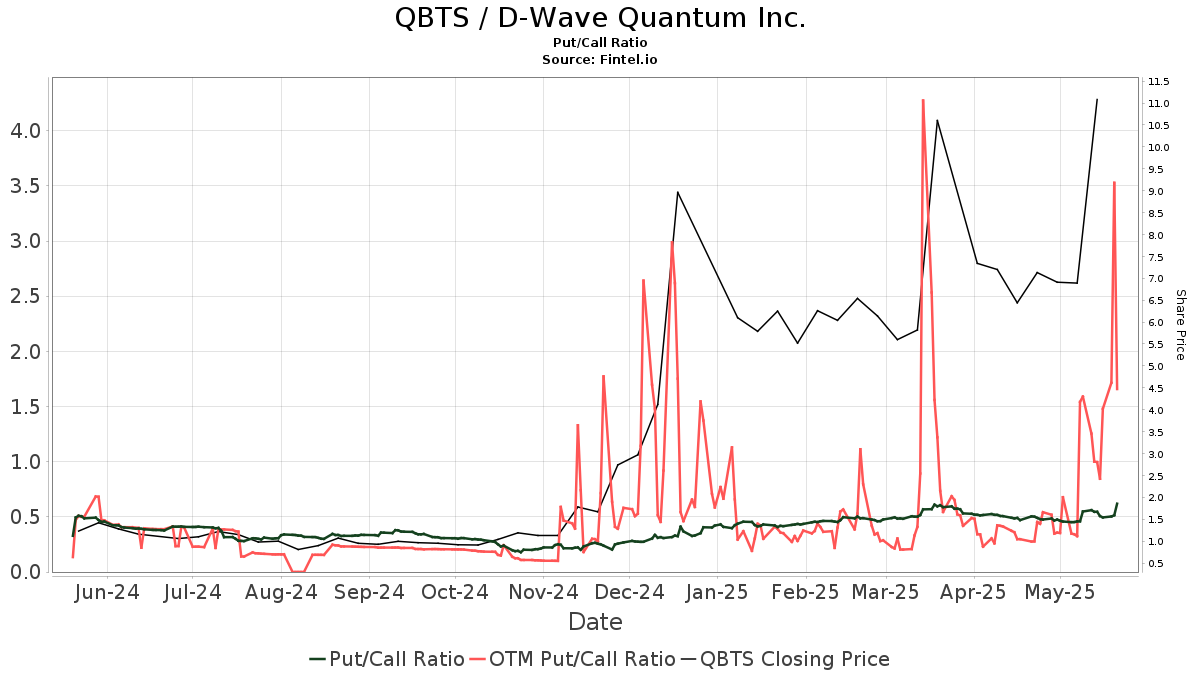

Analysis Factors Contributing To D Wave Quantum Qbts Stocks Surge

May 21, 2025

Analysis Factors Contributing To D Wave Quantum Qbts Stocks Surge

May 21, 2025 -

Complete Sandylands U Tv Listings Shows Times And Channels

May 21, 2025

Complete Sandylands U Tv Listings Shows Times And Channels

May 21, 2025 -

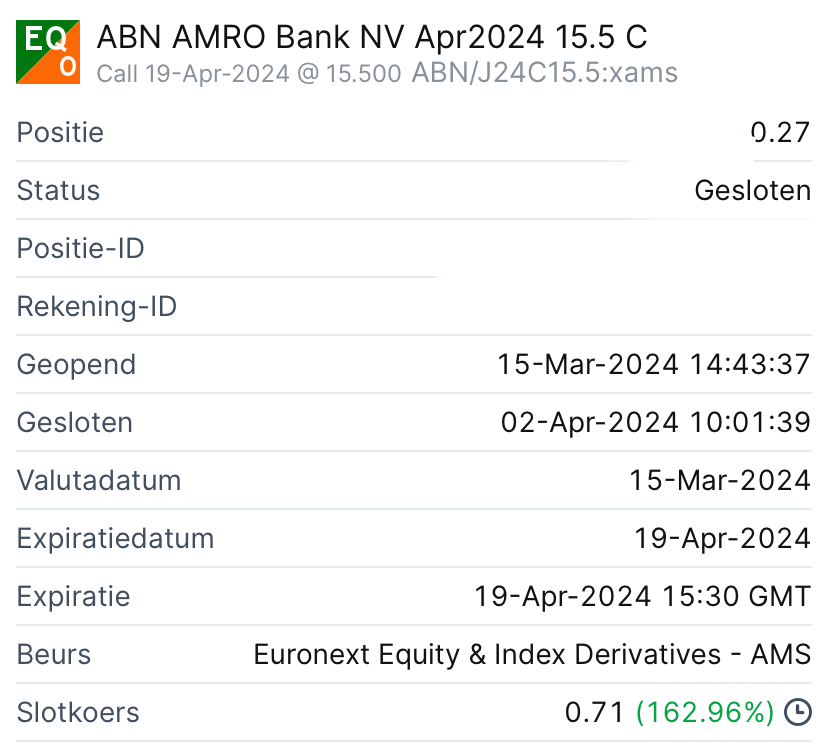

Uw Gids Voor Het Abn Amro Kamerbrief Certificaten Verkoopprogramma

May 21, 2025

Uw Gids Voor Het Abn Amro Kamerbrief Certificaten Verkoopprogramma

May 21, 2025