Analyzing Bitcoin's Potential: A $100,000 BTC Price After Trump's Speech?

Table of Contents

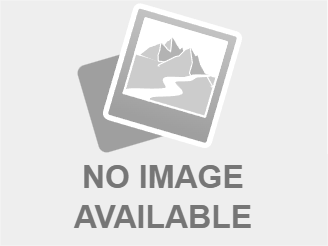

Trump's Statements and Their Impact on Bitcoin

H3: Analyzing Trump's Recent Rhetoric on Cryptocurrencies and the Economy

While Trump hasn't explicitly commented on Bitcoin reaching $100,000, his pronouncements on the economy and financial regulation inevitably cast a shadow over the crypto market. His past statements regarding cryptocurrency have been mixed, sometimes expressing skepticism, other times hinting at potential. Analyzing these statements for their potential impact on Bitcoin's price requires careful consideration.

- Example 1: (Insert a specific example of a Trump statement related to crypto or the economy, if available, and analyze its potential impact on Bitcoin’s price. Did it boost or dampen investor sentiment?)

- Example 2: (Insert another specific example and its analysis).

- Example 3: (Insert another specific example and its analysis).

The overall sentiment surrounding Trump's economic policies can significantly influence investor risk appetite. Positive pronouncements might lead to increased investment in riskier assets, including Bitcoin, potentially driving its price upwards. Conversely, negative statements could trigger a sell-off. Keywords: Trump Bitcoin, Trump cryptocurrency, Bitcoin regulation.

H3: The Psychological Effect of Trump's Influence on Market Sentiment

Trump's pronouncements, regardless of their direct relevance to Bitcoin, wield immense psychological power over the markets. His statements can dramatically shift investor confidence, creating ripple effects across various asset classes, including cryptocurrencies.

- Market psychology often dictates short-term price fluctuations. A positive tweet can trigger a buying frenzy, while a critical remark can spark a sell-off.

- Fear, Uncertainty, and Doubt (FUD) are powerful factors in the crypto market, and Trump's unpredictable nature can exacerbate these sentiments.

- The "Trump effect" isn't solely about his words; it's also about the anticipation and speculation they generate. The mere expectation of a statement can cause significant price swings. Keywords: market sentiment, investor confidence, Bitcoin price volatility.

Bitcoin's Underlying Fundamentals and Long-Term Potential

H3: Adoption Rate and Institutional Investment

Beyond the short-term noise of political pronouncements, Bitcoin's intrinsic value depends on its underlying fundamentals. Increasing adoption by businesses and institutional investors is a crucial driver of price appreciation.

- The number of companies accepting Bitcoin as payment is steadily increasing, broadening its use cases and creating further demand.

- Major financial institutions are increasingly exploring Bitcoin as an asset class, leading to significant investments. This institutional interest brings legitimacy and stability to the market.

- Growing adoption strengthens Bitcoin's network effect, making it more resilient and valuable. Keywords: Bitcoin adoption, institutional investment, Bitcoin demand.

H3: Technological Advancements and Scalability Improvements

Ongoing development and upgrades to Bitcoin's underlying technology contribute to its long-term viability. Improvements in scalability and transaction speed address some of the initial criticisms leveled against Bitcoin.

- The Lightning Network, for instance, aims to significantly increase transaction speed and reduce fees, making Bitcoin more user-friendly for everyday transactions.

- Ongoing research and development continue to refine Bitcoin's security and efficiency, enhancing its position as a store of value and a medium of exchange.

- These technological advancements are crucial for Bitcoin's continued growth and mass adoption. Keywords: Bitcoin scalability, Bitcoin technology, Lightning Network.

Factors that Could Prevent Bitcoin from Reaching $100,000

H3: Regulatory Uncertainty and Government Intervention

Regulatory uncertainty remains a significant obstacle to Bitcoin's price appreciation. Government intervention, whether through outright bans or stringent regulations, could dampen investor enthusiasm and limit price growth.

- Different countries have adopted varying approaches to cryptocurrency regulation, creating a fragmented and uncertain landscape.

- Stringent regulations can stifle innovation and limit the accessibility of Bitcoin.

- The risk of government crackdowns or unforeseen regulatory changes continues to pose a considerable challenge. Keywords: Bitcoin regulation, cryptocurrency regulation, government intervention.

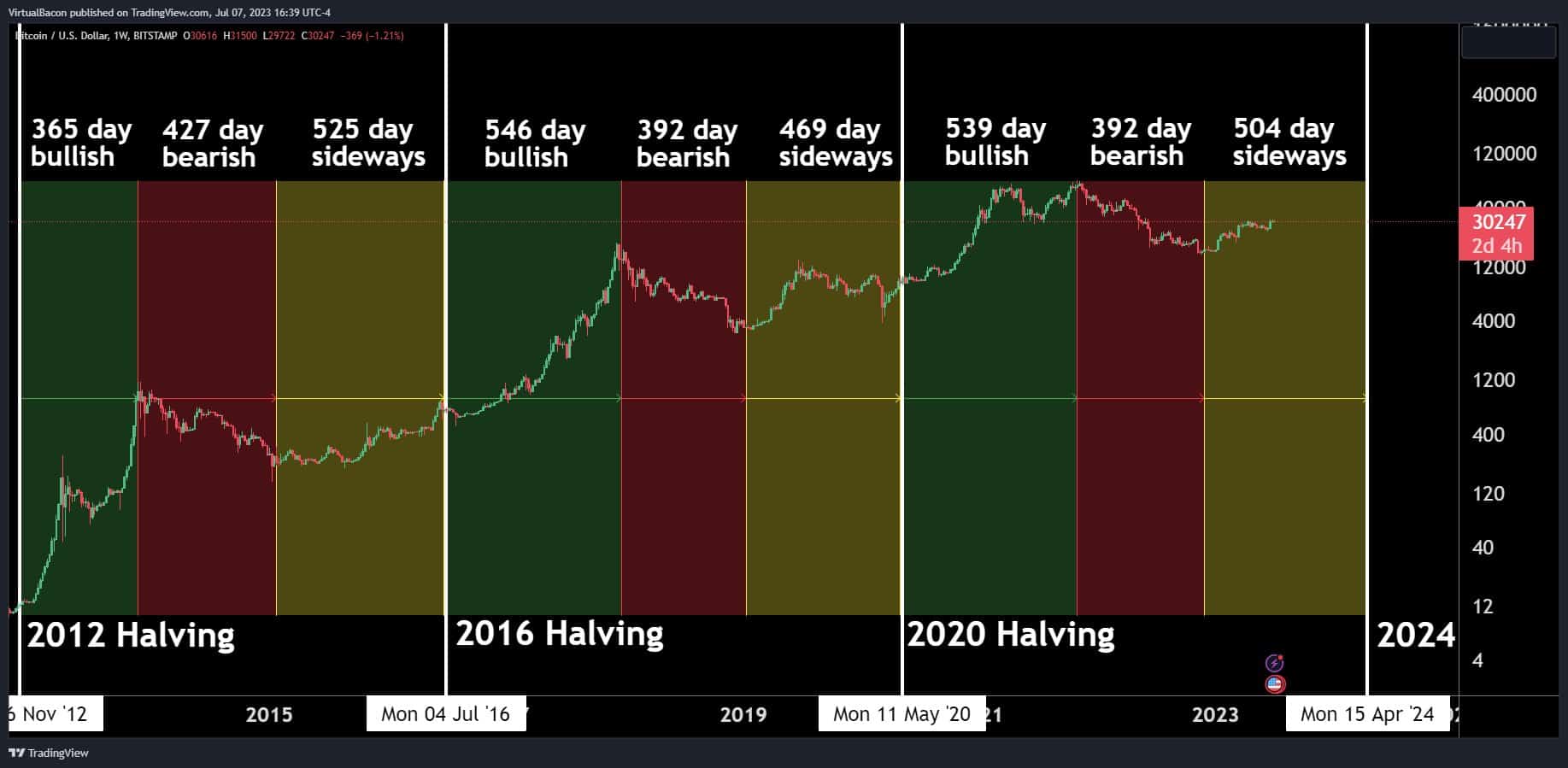

H3: Market Volatility and Speculative Bubbles

The cryptocurrency market, including Bitcoin, is inherently volatile. The risk of speculative bubbles and sudden price crashes is ever-present.

- Bitcoin's price is highly susceptible to market sentiment and speculative trading, making it prone to sharp price swings.

- History has shown that cryptocurrency markets can be subject to extreme volatility and rapid corrections.

- The potential for speculative bubbles to burst poses a significant risk to investors aiming for a $100,000 Bitcoin. Keywords: Bitcoin volatility, crypto market, speculative bubble.

Conclusion: Bitcoin's Future and the $100,000 Question

Whether Bitcoin will reach a $100,000 price is a complex question with no easy answer. While Trump's pronouncements and the broader economic climate can certainly influence short-term price movements, Bitcoin's long-term potential is ultimately tied to its underlying fundamentals: adoption rate, technological advancements, and regulatory clarity. While the possibility of a $100,000 Bitcoin is certainly captivating, it's crucial to maintain a balanced perspective, acknowledging both the potential upside and the significant risks involved. Analyze Bitcoin's potential carefully, research Bitcoin's future, and understand Bitcoin's price drivers before making any investment decisions. Continue to follow Bitcoin's journey to $100,000 (or beyond)!

Featured Posts

-

Formacioni Ideal I Gjysmefinaleve Te Liges Se Kampioneve Analiza E Dominimit Te Psg

May 09, 2025

Formacioni Ideal I Gjysmefinaleve Te Liges Se Kampioneve Analiza E Dominimit Te Psg

May 09, 2025 -

Nl Federal Election 2024 Candidate Information And Comparisons

May 09, 2025

Nl Federal Election 2024 Candidate Information And Comparisons

May 09, 2025 -

Ocasio Cortez Vs Fox News A Clash Over Trumps Legacy

May 09, 2025

Ocasio Cortez Vs Fox News A Clash Over Trumps Legacy

May 09, 2025 -

Psg 11 Lojtaret Kyc Te Suksesit

May 09, 2025

Psg 11 Lojtaret Kyc Te Suksesit

May 09, 2025 -

Bekam Nepobiten Na Dobar Na Site Vreminja

May 09, 2025

Bekam Nepobiten Na Dobar Na Site Vreminja

May 09, 2025