Analyzing Bitcoin's Rebound: Opportunities And Risks For Investors

Table of Contents

Understanding the Drivers of Bitcoin's Rebound

Bitcoin's price movements are rarely simple. Several interconnected factors contribute to its rebound, creating both potential for profit and significant risk. Understanding these drivers is key to making informed investment decisions.

Macroeconomic Factors

Global macroeconomic conditions heavily influence Bitcoin's price. Its performance is often viewed as a hedge against inflation and economic uncertainty.

- Weakening Dollar: A declining US dollar often strengthens Bitcoin's value, as investors seek alternative stores of value. This is because Bitcoin, unlike fiat currencies, has a limited supply, making it potentially less susceptible to inflation.

- Quantitative Easing and Monetary Policy: Central banks' monetary policies, like quantitative easing, can impact Bitcoin's price. Increased money supply can lead to inflation, potentially driving investors towards Bitcoin as a hedge.

- Correlation with Traditional Markets: While not always perfectly correlated, Bitcoin's price can sometimes mirror or diverge from traditional market trends. Understanding this dynamic is crucial for assessing overall market sentiment and potential spillover effects.

Regulatory Developments

Government regulations significantly impact Bitcoin adoption and, consequently, its price. Positive developments can fuel price increases, while negative ones can trigger downturns.

- Positive Regulatory News: Clearer regulatory frameworks, institutional adoption by banks and financial firms, and the approval of Bitcoin-related ETFs can boost investor confidence and drive up prices.

- Negative Regulatory Impact: Stricter regulations, outright bans, or inconsistent regulatory approaches across different jurisdictions can dampen investor enthusiasm and lead to price drops.

- Jurisdictional Variations: It's crucial to monitor regulatory changes globally, as differing approaches in different countries can influence Bitcoin's overall market dynamics.

Technological Advancements

Underlying technological improvements within the Bitcoin network and ecosystem also play a role in its price action. These advancements enhance Bitcoin's functionality and appeal.

- Lightning Network: The Lightning Network significantly increases transaction speed and scalability, addressing some of Bitcoin's limitations. This improvement can lead to greater adoption and potentially increased value.

- Protocol Upgrades: Significant protocol upgrades and improvements to the Bitcoin network enhance security, efficiency, and overall functionality, potentially boosting investor confidence.

- Ecosystem Innovation: Ongoing development and innovation within the Bitcoin ecosystem, including new applications and services built on the Bitcoin blockchain, can further enhance its value proposition and attract new users.

Assessing the Risks Associated with Bitcoin Investment

While Bitcoin's rebound offers exciting opportunities, it's crucial to acknowledge the inherent risks involved. These risks demand a cautious approach and a thorough understanding of the market.

Volatility and Price Fluctuations

Bitcoin is known for its extreme price volatility. Sharp price swings are common, presenting both potential for profit and the risk of significant losses.

- Historical Volatility: Examining Bitcoin's historical price charts reveals dramatic fluctuations, highlighting the inherent risk associated with this asset class.

- Risk Tolerance: Only investors with a high-risk tolerance and the ability to withstand significant price drops should consider investing in Bitcoin.

- Buy the Dip Strategy: The "buy the dip" strategy, while potentially lucrative, carries significant risk. Incorrect timing can result in substantial losses. Diversification is crucial.

Security Risks and Scams

The decentralized nature of Bitcoin makes it vulnerable to security breaches and scams. Protecting your investment requires vigilance and careful security practices.

- Secure Wallets and Exchanges: Using reputable, secure wallets and exchanges is paramount to safeguarding your Bitcoin holdings.

- Phishing and Fraud: Be aware of phishing scams and other fraudulent activities designed to steal Bitcoin.

- Due Diligence: Always conduct thorough due diligence before investing in any Bitcoin-related product or service.

Regulatory Uncertainty

The evolving regulatory landscape poses ongoing risks to Bitcoin investors. Changes in regulations can significantly impact Bitcoin's price and overall market stability.

- Future Regulations: The potential for future regulations to negatively impact Bitcoin's value remains a significant concern.

- Staying Informed: Staying updated on regulatory changes worldwide is crucial for managing risk and making informed investment decisions.

- Geographical Differences: Regulatory approaches vary greatly across different jurisdictions, adding another layer of complexity and risk.

Identifying Opportunities in Bitcoin's Rebound

Despite the risks, Bitcoin's rebound presents several investment opportunities for those who understand and manage the inherent volatility.

Long-Term Investment Potential

Many believe Bitcoin has long-term growth potential as a store of value and a decentralized alternative to traditional currencies.

- Limited Supply: Bitcoin's limited supply of 21 million coins creates a potential for scarcity and increased value over time.

- Institutional Adoption: Growing adoption by institutional investors signals increasing acceptance and legitimacy.

- Mainstream Asset Potential: Bitcoin's potential to become a mainstream asset class could further drive its price appreciation.

Short-Term Trading Strategies (Disclaimer: This section does not constitute financial advice.)

Short-term trading in Bitcoin can offer opportunities for profit, but carries substantial risk.

- Technical Analysis: Some traders use technical analysis and chart patterns to identify short-term trading opportunities.

- Risk Management: Employing robust risk management strategies, including stop-loss orders, is crucial for mitigating losses.

- Market Trends: Understanding current market trends and sentiment is vital for successful short-term trading.

Diversification and Portfolio Management

Integrating Bitcoin into a well-diversified investment portfolio can help manage risk and potentially enhance returns.

- Asset Allocation: Carefully allocate a portion of your portfolio to Bitcoin, considering your risk tolerance and investment goals.

- Financial Advisor: Consult with a qualified financial advisor to discuss Bitcoin's role in your overall investment strategy.

- Beyond Bitcoin: Diversify beyond Bitcoin into other cryptocurrencies or traditional assets to further reduce risk.

Conclusion

Analyzing Bitcoin's rebound reveals a complex interplay of opportunities and risks. While the potential for significant gains exists, investors must carefully weigh the inherent volatility and security concerns. Understanding the macroeconomic factors, regulatory landscape, and technological advancements is crucial for making informed investment decisions. By carefully assessing the risks and opportunities, and diversifying your portfolio accordingly, you can navigate the exciting world of Bitcoin investment. Remember to conduct thorough research and consider seeking professional financial advice before investing in Bitcoin or any other cryptocurrency. Don't miss out on the potential of Bitcoin's rebound – but always invest responsibly and within your risk tolerance.

Featured Posts

-

Play Station Podcast 512 True Blue Deep Dive

May 08, 2025

Play Station Podcast 512 True Blue Deep Dive

May 08, 2025 -

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025 -

Exclusive U S Steps Up Intelligence Gathering In Greenland

May 08, 2025

Exclusive U S Steps Up Intelligence Gathering In Greenland

May 08, 2025 -

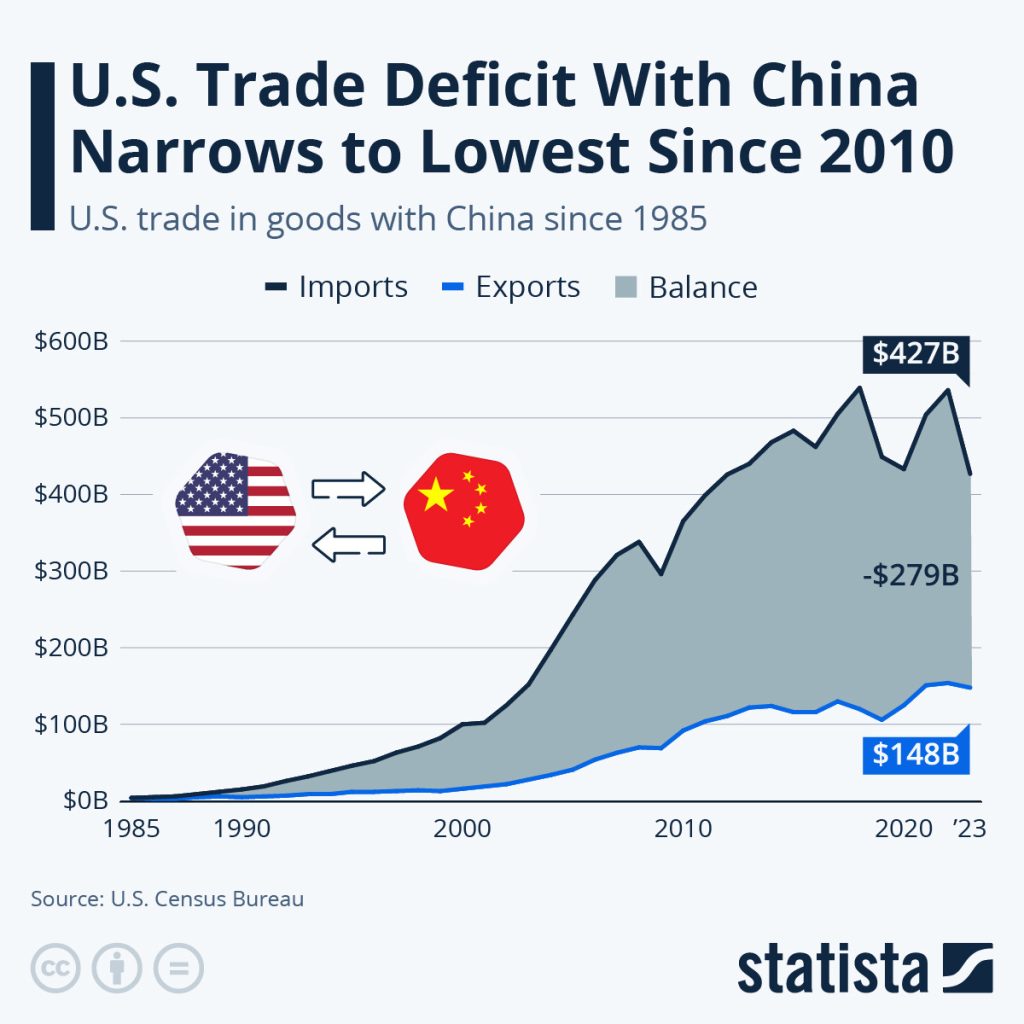

New Tariffs Impact Canadas Trade Deficit A 506 Million Reduction

May 08, 2025

New Tariffs Impact Canadas Trade Deficit A 506 Million Reduction

May 08, 2025 -

The European Digital Identity Wallet A Closer Look

May 08, 2025

The European Digital Identity Wallet A Closer Look

May 08, 2025