Analyzing Buffett's Apple Investment: Lessons For Long-Term Investors

Table of Contents

Buffett's Investment Strategy and Apple's Attributes

H3: Identifying Undervalued Companies with Strong Fundamentals:

Warren Buffett is renowned for his value investing principles, focusing on identifying undervalued companies with strong fundamentals. Apple, at the time of significant investment, fit this criteria perfectly. Buffett recognized Apple's exceptional brand strength, fiercely loyal customer base, and consistent profitability, all key indicators of a long-term winner.

- Strong Financials: At the time of increased investment, Apple boasted:

- High revenue growth year-over-year.

- Robust free cash flow generation.

- Increasing profit margins.

- A strong balance sheet with minimal debt.

- Key Financial Ratios: Favorable P/E ratios (Price-to-Earnings), high Return on Equity (ROE), and other key metrics signaled a potentially undervalued asset with significant growth prospects.

- Competitive Advantage (Moat): Apple's strong brand recognition, ecosystem lock-in through its services (iCloud, App Store), and consistent innovation created a significant competitive advantage, protecting its market share and ensuring long-term profitability. This "moat" is a crucial element in Buffett's investment philosophy.

H3: The Importance of Long-Term Vision:

Buffett's patient and long-term approach is central to his success. Unlike short-term traders focused on quick profits, Buffett views investments as partnerships with exceptional companies, holding them for years, even decades. His Apple investment exemplifies this.

- Long-Term Growth: Buffett's investment in Apple wasn't a quick flip. The substantial increase in value occurred over a considerable period, showcasing the power of long-term growth.

- Avoiding Market Fluctuations: Buffett famously ignores short-term market volatility. This disciplined approach avoids impulsive reactions driven by fear or greed, allowing him to capitalize on long-term growth potential.

- Intrinsic Value: Buffett's philosophy centers on identifying companies trading below their "intrinsic value" – their true worth based on long-term earning potential. He patiently waits for the market to recognize this value, allowing for significant returns.

Lessons for Long-Term Investors

H3: Due Diligence and Fundamental Analysis:

Before investing, thorough research is paramount. Analyzing Buffett's Apple investment underscores the importance of due diligence and fundamental analysis.

- Key Areas to Investigate: Before investing, carefully examine:

- Company financials (revenue, profit margins, cash flow).

- Management team quality and experience.

- Competitive landscape and market share.

- Industry trends and growth potential.

- Actionable Tips for Fundamental Analysis: Learn to interpret financial statements, analyze industry reports, and understand a company's business model. Consider using resources like SEC filings (for US-listed companies) and financial news sources.

- Understanding the Business Model: Deeply understand how a company generates revenue and profits. This knowledge is crucial for assessing its long-term sustainability.

H3: Patience and Discipline:

Long-term investing demands patience and emotional discipline. Market volatility can trigger impulsive decisions, potentially leading to losses.

- Managing Emotional Reactions: Develop strategies to manage fear and greed during market fluctuations. A well-defined investment plan and a long-term perspective are vital.

- Diversified Portfolio: Diversification reduces risk. Don't put all your eggs in one basket. A diverse portfolio mitigates losses from individual stock underperformance.

H3: Focusing on Quality Over Quantity:

Buffett's success stems from focusing on high-quality companies, even if it means a smaller portfolio.

- Examples Beyond Apple: Coca-Cola and American Express are other examples of high-quality companies Buffett has held for decades, demonstrating the long-term benefits of this approach.

- Avoiding Speculative Investments: Resist the temptation to chase high-growth, speculative investments with uncertain futures.

- Long-Term Growth Potential: Prioritize companies with demonstrable long-term growth potential, based on their business model, competitive advantage, and management team.

Conclusion

Analyzing Buffett's Apple investment reveals several key lessons for long-term investors. Value investing, thorough fundamental analysis, a long-term vision, unwavering patience, emotional discipline, and a focus on high-quality companies are crucial for success. By applying the principles gleaned from analyzing Buffett's Apple investment, you can improve your own long-term investment approach and make informed decisions. Start your journey toward successful long-term investing today by conducting thorough due diligence and focusing on identifying undervalued, high-quality companies. Remember, successful investing is about more than just picking the next big winner; it’s about building a portfolio of durable companies that will stand the test of time. Mastering Buffett's investment in Apple offers a valuable roadmap for long-term financial success.

Featured Posts

-

Celtic Fcs Latest Advert Brendan Rodgers And Martin Compston

May 06, 2025

Celtic Fcs Latest Advert Brendan Rodgers And Martin Compston

May 06, 2025 -

Game Time And Broadcast Details Celtics Vs Suns April 4th

May 06, 2025

Game Time And Broadcast Details Celtics Vs Suns April 4th

May 06, 2025 -

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 06, 2025

Stiven King Vernulsya V X I Oskorbil Ilona Maska

May 06, 2025 -

Family Dynamics And Narcissism Miley Cyrus Story

May 06, 2025

Family Dynamics And Narcissism Miley Cyrus Story

May 06, 2025 -

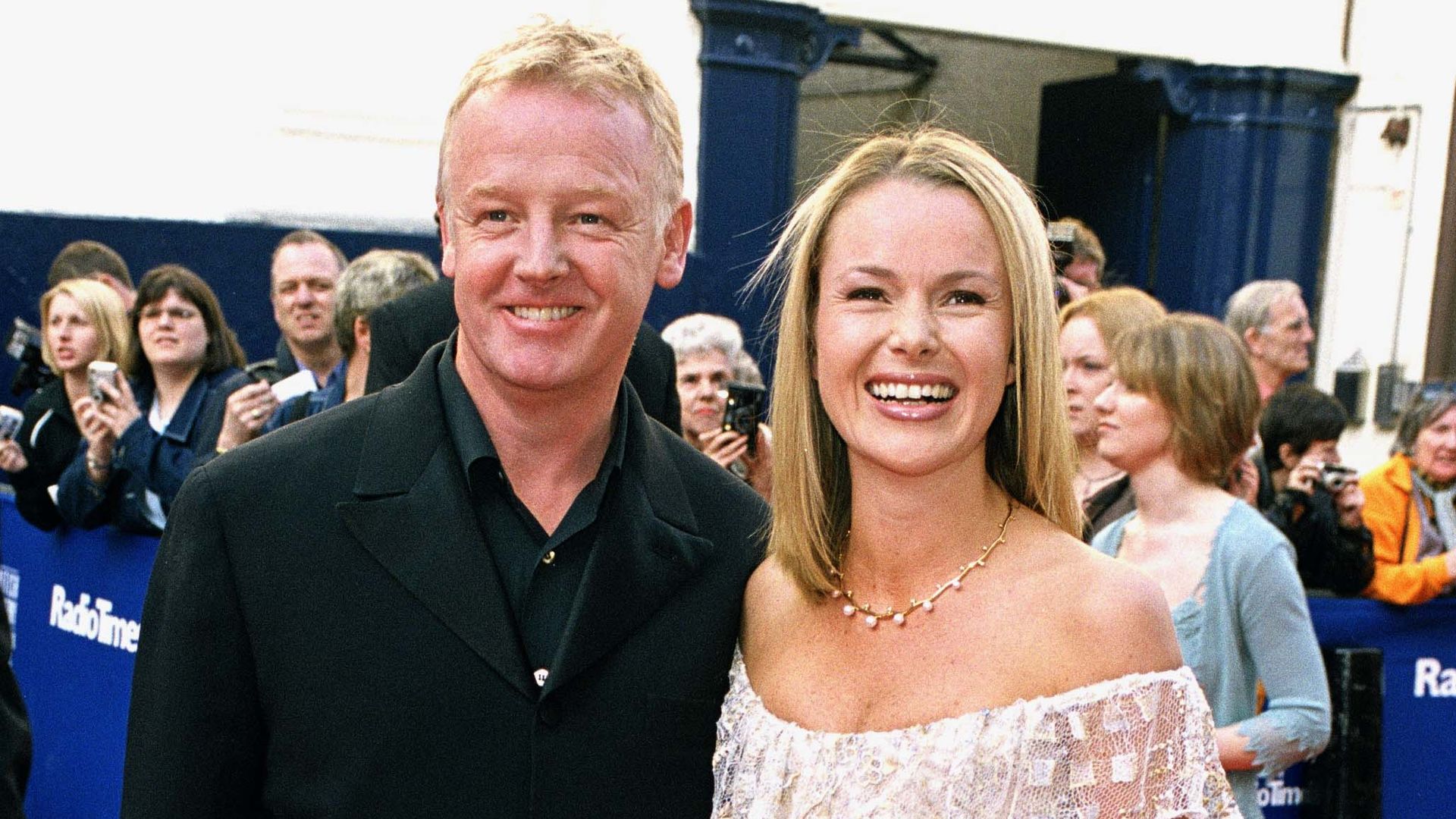

Holden Speaks Out Addressing Rumors After Les Dennis Separation

May 06, 2025

Holden Speaks Out Addressing Rumors After Les Dennis Separation

May 06, 2025