Analyzing CoreWeave (CRWV): Jim Cramer's Assessment Of Its Prowess

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): A Deep Dive

Unfortunately, publicly available information regarding Jim Cramer's specific and direct comments on CoreWeave (CRWV) is currently limited. A thorough search of his various media appearances (Mad Money, Squawk Box, etc.) and online articles hasn't revealed any explicit statements about CRWV. However, we can indirectly assess his likely perspective by considering his general views on the cloud computing sector and similar companies. Cramer is typically bullish on companies demonstrating strong growth potential and disruptive technologies.

- Specific quotes from Jim Cramer about CRWV: (None found publicly at this time. This section will be updated if relevant information becomes available).

- Contextual background: Given Cramer's generally positive outlook on technology and the increasing demand for cloud infrastructure, especially in areas like AI and machine learning, it's plausible he would view CoreWeave favorably if he were to comment.

- Overall sentiment expressed: Based on indirect inference, a cautiously optimistic sentiment is possible, pending further details on CRWV's financial performance and market position.

CoreWeave's (CRWV) Business Model and Competitive Advantages

CoreWeave offers Infrastructure-as-a-Service (IaaS) focusing on GPU-accelerated cloud computing. This is a crucial differentiator in today's market, especially given the rising demand for powerful computing resources to support AI, machine learning, and high-performance computing (HPC) applications. Their target market consists of businesses needing significant computational power for data-intensive tasks.

- Key features: CoreWeave's cloud infrastructure boasts high-performance GPUs, optimized networking, and scalable resources, allowing for efficient and cost-effective processing of vast datasets.

- Unique technologies: They leverage advanced technologies to optimize performance and minimize latency, making their services attractive to demanding applications.

- Market share and growth potential: While precise market share figures may be difficult to obtain publicly, the explosive growth of the GPU computing market suggests considerable growth potential for CoreWeave.

- Customer base and key partnerships: Identifying CoreWeave's key clients and strategic partnerships is essential for understanding their market penetration and future trajectory.

Financial Performance and Future Growth Prospects of CRWV

Analyzing CoreWeave's financial performance requires reviewing publicly available financial statements, including revenue, expenses, and profitability metrics. These figures will help determine the company's financial health and its capacity for future growth. (Note: This section requires access to CRWV's financial reports, which are assumed to be publicly available. Specific numbers would need to be inserted here based on those reports.)

- Key financial metrics: Revenue growth, gross margin, operating expenses, net income, and cash flow are vital metrics to analyze.

- Growth forecasts: Analysts' projections regarding CoreWeave's future revenue growth and profitability will provide additional insight.

- Potential risks and challenges: Factors such as competition, technological disruption, and economic conditions will pose risks to CoreWeave’s future growth.

- Valuation and investment considerations: A thorough valuation of CRWV stock is necessary to assess whether its current market price reflects its inherent value and potential growth.

Risks and Considerations When Investing in CoreWeave (CRWV)

Investing in CoreWeave, like any stock, carries inherent risks. The highly competitive cloud computing market presents significant challenges.

- Competition: Major players like AWS, Azure, and Google Cloud pose intense competition. CoreWeave needs to differentiate itself effectively.

- Technological dependence: Reliance on specific GPU technologies could create vulnerabilities if those technologies become obsolete or less competitive.

- Economic downturns: Economic instability can significantly impact cloud spending, potentially affecting CoreWeave’s revenue.

- Regulatory hurdles: Compliance with data privacy regulations and other legal requirements is crucial and could present obstacles.

Conclusion: Investing in CoreWeave (CRWV): A Final Verdict

While Jim Cramer’s direct assessment of CoreWeave (CRWV) remains unavailable, an analysis of its business model, market position, and financial performance paints a mixed picture. CoreWeave holds significant potential within the rapidly expanding GPU-accelerated cloud computing market. However, the intense competition and inherent risks associated with technology investments require a cautious approach. A balanced assessment highlights both the substantial growth opportunities and the considerable challenges.

Before making any investment decisions regarding CoreWeave (CRWV) or any other stock, it’s crucial to conduct thorough due diligence. Consult a financial advisor and carefully examine the company's financial statements, market position, and competitive landscape. Remember that investing involves risk, and understanding the company’s financials and market position is paramount before making investment decisions related to CoreWeave (CRWV) stock.

Featured Posts

-

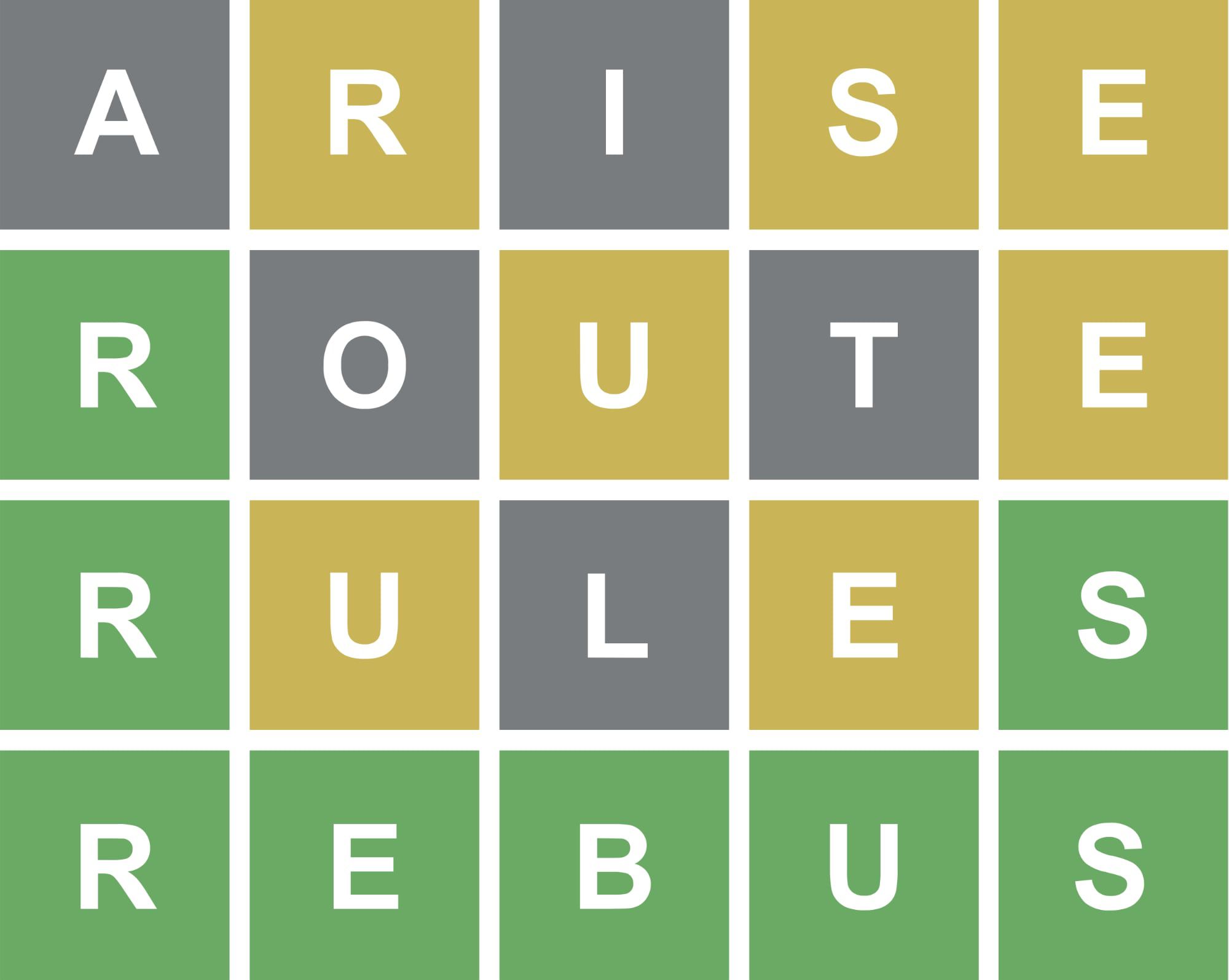

Solve Wordle Puzzle 1407 April 26 2025 Clues And Answer

May 22, 2025

Solve Wordle Puzzle 1407 April 26 2025 Clues And Answer

May 22, 2025 -

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025 -

Thang 6 Nay Cau Ma Da Noi Dong Nai Va Binh Phuoc Chinh Thuc Khoi Cong

May 22, 2025

Thang 6 Nay Cau Ma Da Noi Dong Nai Va Binh Phuoc Chinh Thuc Khoi Cong

May 22, 2025 -

Peppa Pig Theme Park Texas What To Expect On Your Visit

May 22, 2025

Peppa Pig Theme Park Texas What To Expect On Your Visit

May 22, 2025 -

Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025