Analyzing Cryptocurrency Performance During Trade Conflicts

Table of Contents

Safe Haven Asset or Risky Investment? Cryptocurrency's Dual Nature During Trade Wars

The narrative surrounding cryptocurrencies during trade conflicts is multifaceted. Some argue that cryptocurrencies act as a safe haven asset, offering diversification benefits due to their decentralized nature and independence from traditional financial systems. This argument suggests that during times of geopolitical instability, investors might flock to cryptocurrencies as a hedge against potential losses in traditional markets. The decentralized and borderless nature of cryptocurrencies makes them less susceptible to the direct impact of national trade policies.

Conversely, others view cryptocurrencies as inherently risky investments, particularly during trade wars. Their high volatility, coupled with the regulatory uncertainty surrounding cryptocurrencies in many jurisdictions, makes them a less-than-ideal safe haven. The lack of inherent value backing many cryptocurrencies further exacerbates this risk. Sudden price drops, fueled by fear and uncertainty, are commonplace.

Examples from past trade conflicts illustrate this dual nature. During the height of the US-China trade war in 2018-2019, Bitcoin, often considered a benchmark cryptocurrency, experienced significant price fluctuations, reflecting the overall market uncertainty. While some investors saw it as a safe haven, others opted to sell off their holdings. Similarly, altcoins, generally considered riskier than Bitcoin, experienced even more dramatic price swings.

- Increased demand for stablecoins: During periods of trade uncertainty, investors often seek stablecoins, pegged to fiat currencies, to minimize risk.

- Flight to safety towards established cryptocurrencies: Investors might shift their holdings toward established, more reputable cryptocurrencies like Bitcoin, perceiving them as relatively safer options during times of market turmoil.

- Increased risk aversion leading to sell-offs in altcoins: The heightened risk aversion often leads to a significant sell-off in altcoins, contributing to their price volatility.

Geopolitical Factors and Cryptocurrency Price Fluctuations

A clear correlation exists between specific trade conflicts and cryptocurrency price movements. Geopolitical events, such as the imposition of tariffs, sanctions, and trade embargoes, directly influence investor sentiment and market dynamics. For instance, heightened US-China trade tensions have historically led to significant price swings in Bitcoin and other cryptocurrencies. Sanctions imposed on specific countries can impact cryptocurrency adoption and trading volumes within those regions, creating localized market disruptions.

News sentiment and media coverage play a critical role in shaping investor behavior. Negative news reports about escalating trade conflicts can trigger sell-offs, while positive developments may lead to price increases. This highlights the importance of critically evaluating news sources and avoiding emotional reactions based on potentially biased reporting.

- Impact of US-China trade tensions on Bitcoin's price: Periods of escalated tensions have historically resulted in both significant increases and decreases in Bitcoin's price, depending on the prevailing market sentiment.

- Influence of sanctions on specific countries on cryptocurrency adoption and trading volumes: Sanctions can restrict access to cryptocurrency exchanges or limit trading activity, thereby impacting market liquidity and price discovery.

- Role of social media in spreading FUD (Fear, Uncertainty, and Doubt): Social media platforms can amplify negative narratives surrounding trade conflicts, exacerbating market volatility and potentially leading to panic selling.

Regulatory Responses and Their Effect on Cryptocurrency Trading

Governments' responses to trade conflicts can significantly impact cryptocurrency regulation. Increased geopolitical risk may lead to heightened regulatory scrutiny, with governments potentially implementing stricter KYC/AML (Know Your Customer/Anti-Money Laundering) requirements to prevent illicit activities. Conversely, some governments might adopt a more relaxed approach to crypto regulation during trade conflicts, viewing it as a means of fostering economic resilience and innovation.

These regulatory changes have a direct effect on cryptocurrency exchanges and trading activity. Increased compliance requirements can increase operational costs for exchanges, potentially leading to higher trading fees or stricter user verification processes. The imposition of capital controls, often implemented during trade wars, can further restrict cryptocurrency trading by limiting the flow of funds.

- Increased KYC/AML compliance requirements: This can lead to a more stringent vetting process for users, potentially reducing the accessibility of cryptocurrency trading for some.

- Potential for capital controls impacting cryptocurrency trading: Capital controls can make it more difficult for investors to transfer funds into and out of cryptocurrency exchanges, hampering market liquidity.

- Impact of regulatory uncertainty on investor confidence: Uncertainty surrounding crypto regulations during trade conflicts can erode investor confidence and lead to increased price volatility.

Market Sentiment and Investor Behavior During Trade Conflicts

Investor sentiment shifts dramatically during trade disputes. Fear and uncertainty are dominant emotions, leading to increased volatility and market swings. Risk appetite decreases, and investors often shift their strategies from higher-risk assets, such as altcoins, to lower-risk assets, including stablecoins or even traditional safe havens like gold. Herd behavior, where investors mimic the actions of others, can amplify these effects, leading to significant price fluctuations.

Retail investors, often driven by emotion, are particularly susceptible to these shifts in sentiment. Institutional investors, while generally more sophisticated, are not immune to the impacts of geopolitical uncertainty and may adjust their strategies to mitigate potential risks.

- Increased volatility and market swings fueled by fear and uncertainty: Trade conflicts often create unpredictable market conditions, increasing the frequency and magnitude of price swings.

- Shift in investment strategies from high-risk to low-risk assets: Investors often move away from high-risk cryptocurrencies towards safer alternatives during times of heightened uncertainty.

- Impact of herd behavior on cryptocurrency price movements: The tendency of investors to copy the actions of others can exacerbate price fluctuations, creating self-fulfilling prophecies.

Conclusion: Navigating Cryptocurrency Investments Amidst Trade Conflicts

Analyzing cryptocurrency performance during trade conflicts reveals a complex interplay of geopolitical factors, regulatory responses, and investor behavior. Cryptocurrencies exhibit a dual nature, serving as both a potential safe haven and a risky investment, depending on various circumstances. Understanding the impact of geopolitical events, market sentiment, and regulatory changes is crucial for navigating the volatile crypto market during times of international trade tension. Careful risk management, including diversification of your portfolio and thorough due diligence, is essential.

To make informed investment decisions, continue learning about analyzing cryptocurrency performance during trade conflicts. Stay updated on geopolitical events, monitor market sentiment, and understand the potential impact of regulatory changes. For in-depth analysis, explore resources such as reputable financial news outlets, research publications, and cryptocurrency market analysis platforms. By proactively addressing these factors, you can improve your ability to navigate the complex world of cryptocurrency investment, even amidst the uncertainties of global trade disputes.

Featured Posts

-

Former Boris Becker Judge Heads Nottingham Attacks Investigation

May 09, 2025

Former Boris Becker Judge Heads Nottingham Attacks Investigation

May 09, 2025 -

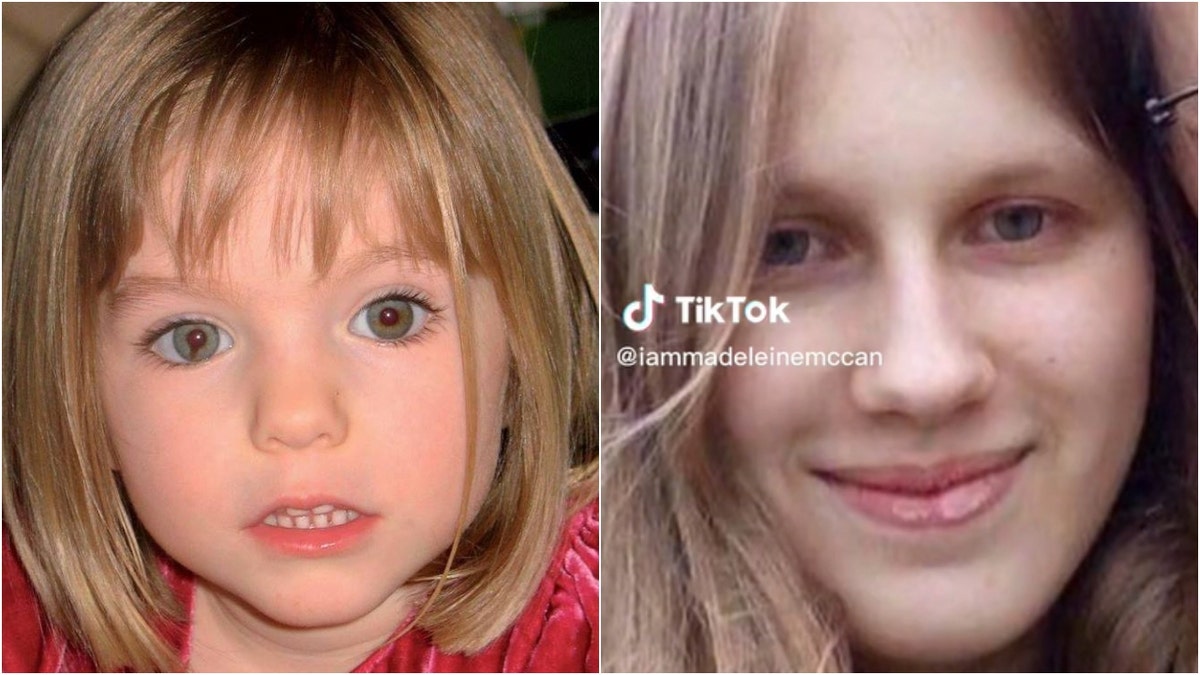

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim

May 09, 2025

New Dna Test Results In Madeleine Mc Cann Case A 23 Year Olds Claim

May 09, 2025 -

F1 News Alpine Team Principals Strong Statement To Doohan

May 09, 2025

F1 News Alpine Team Principals Strong Statement To Doohan

May 09, 2025 -

Should Investors Buy Palantir Stock Before May 5th A Wall Street Analysis

May 09, 2025

Should Investors Buy Palantir Stock Before May 5th A Wall Street Analysis

May 09, 2025 -

Le Modem Et Renaissance Vers Une Fusion Selon Elisabeth Borne

May 09, 2025

Le Modem Et Renaissance Vers Une Fusion Selon Elisabeth Borne

May 09, 2025