Analyzing Economic Trends During The Trump Administration

Table of Contents

Tax Cuts and Their Impact

The cornerstone of the Trump administration's economic policy was the 2017 Tax Cuts and Jobs Act (TCJA). Analyzing the effects of this legislation is crucial to understanding the economic trends of the era.

The 2017 Tax Cuts and Jobs Act

The TCJA significantly altered the US tax code. Key provisions included:

- Lower Corporate Tax Rates: The corporate tax rate was slashed from 35% to 21%, a substantial reduction aimed at boosting investment and competitiveness.

- Changes to Individual Income Tax Brackets: Individual income tax rates were also adjusted, with some brackets reduced.

- Standard Deduction Increases: The standard deduction was increased, benefiting many taxpayers.

While proponents argued these cuts stimulated investment and economic growth, critics pointed to increased income inequality and a ballooning national debt as negative consequences. The impact on economic growth is a subject of ongoing debate.

Economic Growth and Revenue Projections

Following the tax cuts, the US economy experienced a period of moderate growth. However, the relationship between the tax cuts and this growth remains a subject of intense debate among economists. While proponents pointed to increased GDP as evidence of success, critics questioned whether the growth outweighed the increased national debt. Comparing projected revenue increases based on supply-side economic theory with actual revenue figures reveals a complex picture, highlighting the difficulties in predicting the long-term consequences of such sweeping tax reforms. Analyzing these discrepancies requires further investigation and consideration of various economic indicators.

Deregulation and its Effects

The Trump administration pursued a significant deregulation agenda, affecting various sectors. Analyzing the consequences of these policy changes is vital to assessing the overall impact on the economy.

Impact on Specific Sectors

Deregulation efforts spanned numerous sectors:

- Finance: Relaxed regulations on banks and financial institutions.

- Energy: Easing environmental regulations impacting fossil fuel production.

- Environmental Protection: Rollbacks of environmental regulations, impacting air and water quality.

The consequences varied significantly across these sectors. While some argued deregulation boosted economic efficiency and job creation, others raised concerns about environmental damage and increased risks in the financial sector. Analyzing the long-term consequences requires careful consideration of both immediate economic impacts and potential future liabilities.

Regulatory Rollbacks and Economic Growth

The claimed link between deregulation and economic growth is a central point of contention. Proponents argued that reduced regulatory burdens fostered investment and innovation, leading to higher GDP and employment. However, critics argued that the long-term costs of environmental damage and financial instability could outweigh any short-term gains. The debate highlights the complexity of analyzing the interplay between regulations and economic performance. Legal challenges to some deregulatory actions further complicate the assessment of their long-term impact on economic trends.

Trade Policies and International Relations

The Trump administration's trade policies were highly controversial, marked by trade wars and renegotiated agreements. Analyzing these policies is crucial to understanding their impact on the US economy.

Trade Wars and Their Consequences

The administration initiated trade wars, notably with China, imposing tariffs on various goods. These actions led to retaliatory measures and disruptions in global trade. The effects on specific industries were varied, with some sectors benefiting from protectionist measures while others suffered from increased costs and reduced exports. The overall impact on the US economy is a subject of ongoing debate, with economists offering differing assessments of the net effect on GDP and employment.

Renegotiation of Trade Agreements

The renegotiation of NAFTA, resulting in the USMCA (United States-Mexico-Canada Agreement), represents another significant aspect of the Trump administration's trade policy. While proponents framed the changes as beneficial to the US economy, critics raised concerns about potential negative impacts on trade relationships and the broader global economy. Analyzing the specific changes to the agreement and their subsequent impacts necessitates examining trade flows and economic activity within the participating countries.

Job Growth and Unemployment Rates

Analyzing job growth and unemployment rates provides a crucial indicator of the Trump administration's economic performance.

Changes in Employment Figures

During the Trump administration, the US saw a period of sustained job growth, with unemployment rates reaching historic lows. However, analyzing these figures requires examining trends within different sectors and demographic groups. The distribution of job creation and its impact on various segments of the population are critical factors in assessing the overall effectiveness of economic policies. Comparing these figures to previous administrations offers a broader context for understanding the unique characteristics of this period.

Impact on Wages and Income Inequality

While job growth was positive, the impact on wages and income inequality is a complex issue. While some sectors experienced wage increases, the gains were not evenly distributed across all income levels. Analyzing the distribution of income gains and losses is vital for a complete understanding of the economic effects of the policies implemented during this period. Further research is needed to fully assess the long-term effects on different socioeconomic groups.

Conclusion

Analyzing economic trends during the Trump administration reveals a complex picture. The tax cuts stimulated some economic growth but also contributed to a rise in the national debt and potentially exacerbated income inequality. Deregulation yielded mixed results, with some sectors experiencing increased efficiency while others faced heightened risks. Trade policies, including trade wars and renegotiated agreements, significantly impacted various industries and international relations. While job growth was positive, the effects on wages and income inequality require further investigation. Further analysis of these economic trends during the Trump administration is crucial for understanding the complexities of modern economic policy and informing future strategies. Continue your research to form your own informed opinion on the impact of the Trump administration's economic policies.

Featured Posts

-

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025

High Winds Fuel Power Outages Across Lehigh Valley

Apr 23, 2025 -

New Survey Trump Era Dashes Canadian Hopes Of Us Relocation

Apr 23, 2025

New Survey Trump Era Dashes Canadian Hopes Of Us Relocation

Apr 23, 2025 -

English Language Leaders Debate 5 Crucial Economic Insights

Apr 23, 2025

English Language Leaders Debate 5 Crucial Economic Insights

Apr 23, 2025 -

Pascal Boulanger President De La Fpi Enjeux Et Defis De L Immobilier

Apr 23, 2025

Pascal Boulanger President De La Fpi Enjeux Et Defis De L Immobilier

Apr 23, 2025 -

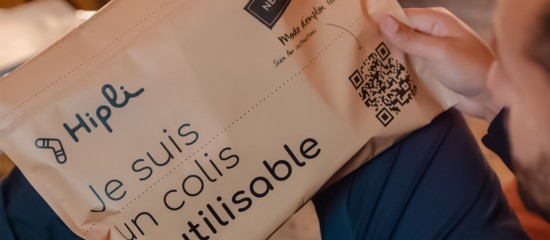

Le Pitch Hipli Emballages Reutilisables Pour Un E Commerce Responsable

Apr 23, 2025

Le Pitch Hipli Emballages Reutilisables Pour Un E Commerce Responsable

Apr 23, 2025