Analyzing Elon Musk's Financial Empire: Strategies And Investments

Table of Contents

SpaceX: A Gateway to Astronomical Returns

SpaceX, Musk's aerospace manufacturer and space transportation services company, represents a significant pillar of his financial empire. Its success story is a testament to his long-term vision and strategic approach to securing diverse revenue streams.

Government Contracts and Commercial Launches

SpaceX's revenue streams are multifaceted and growing rapidly. The company has secured lucrative contracts with NASA for cargo resupply missions to the International Space Station, a significant source of funding and validation for its technology. Furthermore, the burgeoning commercial space launch market provides another lucrative avenue. SpaceX's reusable Falcon 9 rocket has significantly lowered the cost of space access, attracting a wider range of clients. Finally, the Starlink satellite internet constellation promises to revolutionize global connectivity, generating substantial revenue through subscription fees.

- NASA Contracts: These contracts provide a stable, albeit competitive, revenue stream, ensuring ongoing cash flow for research and development.

- Commercial Launches: The reusability of Falcon 9 rockets has made SpaceX highly competitive, capturing a significant market share in the commercial space launch market. Projections indicate continued growth in this sector.

- Starlink Satellite Internet: The global rollout of Starlink promises to become a massive revenue generator, with projections estimating billions in annual revenue within the next few years, establishing SpaceX as a major player in the rapidly expanding satellite internet market.

Long-Term Vision and Investment Strategy

SpaceX's long-term vision—the colonization of Mars—is not merely a fanciful aspiration; it's a driving force shaping its investment strategy. This ambitious goal necessitates significant investment in research and development, requiring a high-risk, high-reward approach to securing funding.

- Long-Term Investment: Mars colonization requires decades of consistent investment, reflecting a long-term perspective uncommon in many business ventures.

- High-Risk, High-Reward: The inherent risks associated with space exploration are undeniable, but the potential rewards – a new frontier for human settlement and resource extraction – are equally immense.

- Funding Model: SpaceX balances private funding rounds with government contracts, strategically mitigating risk and ensuring financial stability.

Tesla's Electrifying Financial Success

Tesla, the world's leading electric vehicle (EV) manufacturer, is arguably the most recognizable component of Elon Musk's Financial Empire. Its remarkable growth and profitability have solidified its position as a dominant force in the automotive industry and a major player in the renewable energy sector.

Dominating the Electric Vehicle Market

Tesla’s market share in the electric vehicle market is substantial, largely due to its innovative technology, strong brand recognition, and the relentless drive of its CEO. Sales figures consistently exceed expectations, and Tesla's profitability is steadily increasing, signifying a financially sound and scalable business model.

- Electric Vehicle Market Share: Tesla holds a significant lead in the premium EV segment and is rapidly expanding its presence in the mass market.

- Tesla Stock Performance: Tesla's stock price reflects investor confidence in its future growth potential, making it one of the most valuable companies globally.

- Innovative Technology & Branding: Tesla's focus on cutting-edge technology and a carefully cultivated brand image have been key factors in its success.

Diversification Beyond Cars

Tesla’s strategic diversification beyond electric vehicles demonstrates a commitment to long-term sustainability and growth, moving beyond cars into renewable energy solutions. The Powerwall and Powerpack energy storage systems cater to the residential and commercial sectors, respectively, while Solar Roof aims to integrate solar energy directly into homes. Tesla's AI investments further signal expansion into autonomous driving technology and related artificial intelligence fields.

- Renewable Energy Investment: Tesla's expansion into solar energy and energy storage positions it as a leader in the transition to renewable energy sources.

- Energy Storage Solutions: The Powerwall and Powerpack address the growing need for reliable and efficient energy storage, complementing Tesla's electric vehicle offerings.

- AI Investment Opportunities: Tesla's investments in AI are crucial for the development of autonomous driving technology, a potentially transformative element of the automotive industry.

The Neuralink and The Boring Company: High-Risk, High-Reward Ventures

Beyond SpaceX and Tesla, Musk's portfolio includes more speculative, yet potentially revolutionary, ventures. These high-risk, high-reward endeavors represent a different facet of his investment philosophy.

Neuralink's Ambitious Brain-Computer Interface

Neuralink, focused on developing advanced brain-computer interfaces, is a high-risk, high-reward venture with the potential to revolutionize medicine and human-computer interaction. While still in its early stages, the technology's potential applications are immense, ranging from treating neurological disorders to enhancing human cognitive abilities.

- Biotechnology Investment: Neuralink represents a significant investment in the rapidly developing field of biotechnology.

- Brain-Computer Interface: The development of a successful brain-computer interface could have profound implications for medicine and technology.

- High-Risk Startups: The inherent uncertainties involved in developing this groundbreaking technology underscore the high-risk nature of the investment.

The Boring Company's Infrastructure Innovations

The Boring Company aims to revolutionize urban transportation through the development of advanced tunneling technology. While the technology itself is less inherently risky than Neuralink, the challenges of securing regulatory approvals and building cost-effective infrastructure pose significant obstacles. However, the potential for substantial government contracts and private sector investment make it a high-reward venture.

- Infrastructure Investment: The Boring Company tackles the crucial issue of improving urban transportation infrastructure.

- Tunneling Technology: The company's innovative tunneling technology promises to reduce the cost and time required for constructing underground transportation systems.

- Innovative Construction: The Boring Company’s approach to construction offers a potentially disruptive solution to urban infrastructure challenges.

Musk's Investment Philosophy and Risk Management

Elon Musk's investment strategy is characterized by a long-term vision, a high tolerance for risk, and a masterful understanding of leveraging public image.

Long-Term Vision vs. Short-Term Gains

Musk consistently prioritizes long-term goals over short-term gains. His investments are guided by a clear vision for the future, even if it requires navigating significant challenges and setbacks along the way.

- Long-Term Investment Strategy: Musk's investments are often characterized by a long time horizon, frequently spanning decades rather than years.

- Risk Management in Finance: While accepting high risk, Musk carefully manages it through diversification and strategic partnerships.

- Entrepreneurial Investment: Musk's investment approach reflects the spirit of entrepreneurialism, prioritizing innovation and disruption above all else.

Leveraging Public Image and Brand Power

Musk's highly visible public persona significantly impacts investor confidence and funding acquisition. While this approach presents both advantages and disadvantages, it's undeniably a key component of his success.

- Brand Building: Musk has cultivated a powerful personal brand, which is closely associated with his companies and their products.

- Public Image: His public image, while sometimes controversial, generates significant media attention and attracts potential investors.

- Investor Confidence: Musk's public pronouncements, despite their occasional volatility, often boost investor confidence in his ventures.

3. Conclusion:

Elon Musk's Financial Empire is a complex and fascinating tapestry woven from diverse investments, a long-term vision, and a willingness to embrace high-risk ventures. His success is not solely attributable to financial acumen, but also to a unique combination of technological innovation, strategic planning, and a remarkable ability to capture public attention and investor confidence. From the groundbreaking advancements in space exploration at SpaceX to the revolutionary electric vehicles of Tesla, and the ambitious projects of Neuralink and The Boring Company, Musk's portfolio showcases an unparalleled diversity of high-impact investments. To gain a deeper understanding of the complexities and intricacies within Elon Musk's Financial Empire, further research into each of his individual ventures is strongly recommended. Explore the financial models, technological innovations, and market dynamics that drive the success of each company to fully appreciate the scope and ambition of this remarkable financial landscape.

Featured Posts

-

Melanie Griffith And Dakota Johnsons Matching Spring Outfits

May 09, 2025

Melanie Griffith And Dakota Johnsons Matching Spring Outfits

May 09, 2025 -

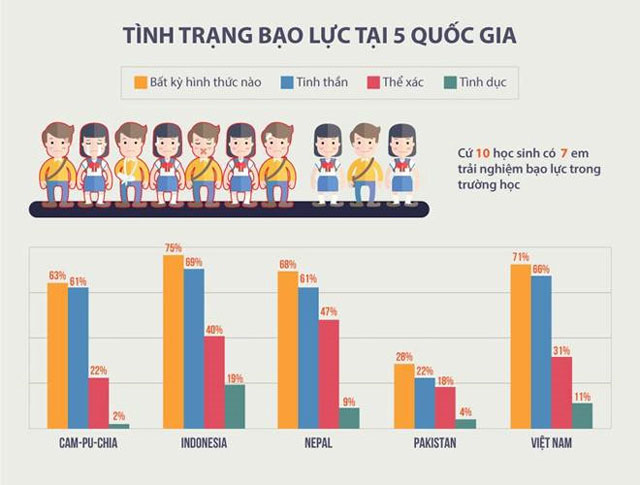

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em Tai Co So Giu Tre Tu Nhan

May 09, 2025 -

Go Compare And Wynne Evans Part Ways The Aftermath Of The Strictly Controversy

May 09, 2025

Go Compare And Wynne Evans Part Ways The Aftermath Of The Strictly Controversy

May 09, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 09, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 09, 2025 -

Tracking The Billions Elon Musk Jeff Bezos And Mark Zuckerbergs Post Inauguration Losses

May 09, 2025

Tracking The Billions Elon Musk Jeff Bezos And Mark Zuckerbergs Post Inauguration Losses

May 09, 2025