Analyzing Palantir Stock Before Its May 5th Earnings Release

Table of Contents

Palantir's Recent Performance and Key Metrics

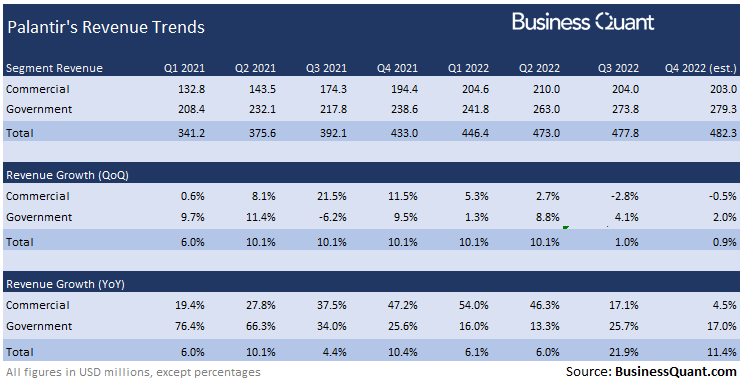

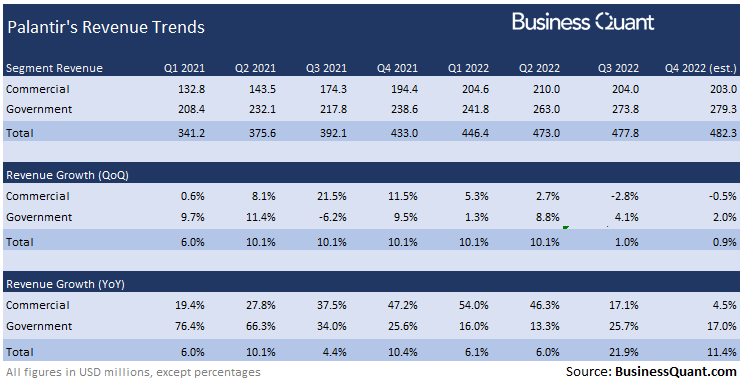

H3: Revenue Growth and Projections: Palantir's revenue growth is a key indicator of its overall health. Analyzing recent quarters reveals crucial trends. While precise Q1 2024 figures await the May 5th release, examining year-over-year (YoY) revenue growth and comparing it to analyst consensus estimates will be vital.

- YoY Revenue Growth: Tracking the percentage increase in revenue compared to the same period last year provides a clear picture of Palantir's expansion.

- Q1 2024 Revenue: The upcoming announcement will unveil the actual Q1 2024 revenue. Analysts' predictions will be rigorously scrutinized to determine whether Palantir exceeded, met, or fell short of expectations.

- Consensus Estimates: Understanding the average prediction from multiple analysts provides a benchmark against which Palantir's performance can be measured.

- Potential for Exceeding Expectations: Factors like successful new contract wins or strong performance in key sectors could indicate a positive surprise.

H3: Key Business Segments and Performance: Palantir operates in two main segments: Government and Commercial. Analyzing the performance of each is crucial for a complete picture.

- Government Contracts: The government sector is a significant revenue driver for Palantir. Analyzing the volume and value of new contracts secured will be critical.

- Commercial Partnerships: Growth in the commercial sector reflects Palantir's ability to expand beyond government clients. Looking at the number of new commercial partnerships and their contributions to revenue is essential.

- Growth in Each Segment: Identifying which segment contributed most significantly to revenue growth and the reasons behind it provides valuable insight into Palantir's strategic direction.

- Sector-Specific Challenges and Opportunities: Understanding sector-specific challenges and opportunities within each business segment can predict future performance. For example, increased geopolitical instability might affect government contracts, while economic slowdowns could impact the commercial sector.

H3: Profitability and Margins: Assessing Palantir's profitability is crucial for long-term investors. Focus on operating margins and net income trends reveals much about its financial health.

- Operating Margins: Analyzing operating margins indicates the efficiency of Palantir's operations and its ability to control costs.

- Net Income: Net income, the bottom line, demonstrates the company's overall profitability after all expenses.

- Profitability Trends: Tracking profitability trends over multiple quarters helps establish a pattern and understand the direction of Palantir's financial health.

- Path to Profitability: Investors will be closely watching Palantir’s progress towards sustained profitability, examining cost-cutting measures and strategic initiatives implemented to achieve this goal.

Analyzing Key Factors Affecting Palantir Stock Price

H3: Geopolitical Factors and Market Sentiment: Global events and overall market sentiment significantly influence Palantir's stock price.

- Impact of Global Instability: Geopolitical tensions and uncertainty often impact investor confidence and lead to market volatility, directly impacting Palantir's stock.

- Investor Confidence: Positive news and strong financial performance generally boost investor confidence, leading to increased demand and potentially higher stock prices. Negative news has the opposite effect.

- Market Volatility: Broader market trends and volatility can influence Palantir's stock price independently of its own performance.

- Macroeconomic Factors: Economic indicators like inflation, interest rates, and economic growth affect investor sentiment and investment decisions.

H3: Competition and Industry Landscape: Understanding Palantir's competitive landscape is essential.

- Key Competitors: Identifying Palantir's main competitors (e.g., other data analytics companies) helps assess its market position and competitive advantages.

- Competitive Advantages: Palantir's proprietary technology, strong government relationships, and expanding commercial partnerships provide key advantages. Analyzing these is vital.

- Market Share: Examining Palantir's market share reveals its dominance or vulnerability within the industry.

- Technological Innovation: Palantir's ability to innovate and adapt to changing technologies significantly influences its competitiveness.

H3: Recent News and Developments: Recent announcements can significantly impact Palantir's stock price.

- New Contracts: Securing significant new contracts, especially large government contracts, boosts investor confidence.

- Partnerships: Strategic partnerships can expand Palantir's market reach and technological capabilities.

- Product Launches: New product releases and upgrades can demonstrate Palantir's innovation and enhance its competitiveness.

- Regulatory Changes: Regulatory changes impacting the data analytics industry can create opportunities or challenges for Palantir.

- Leadership Changes: Changes in leadership can impact investor sentiment depending on the perceived expertise and strategic vision of the new leadership.

Potential Scenarios and Investment Strategies

H3: Bullish Case: A positive outlook for Palantir stock after the earnings release hinges on several factors.

- Exceeding Expectations: Surpassing analyst revenue and earnings projections would likely lead to a significant stock price increase.

- Positive Guidance: Strong guidance for future quarters signifies continued growth and reinforces investor confidence.

- Strategic Partnerships: Announcing significant strategic partnerships would indicate expansion opportunities and increased market reach.

- Technological Breakthroughs: Announcing significant technological advancements could enhance Palantir's competitive advantage and attract new customers.

H3: Bearish Case: Negative scenarios could negatively impact Palantir's stock price.

- Missing Earnings Expectations: Failing to meet or significantly underperforming analyst expectations would likely trigger a stock price decline.

- Negative Guidance: Weak guidance for future quarters indicates slowing growth and could undermine investor confidence.

- Increased Competition: Increased competition from rivals could erode Palantir's market share and profitability.

- Macroeconomic Headwinds: Adverse macroeconomic conditions could reduce demand for Palantir's services.

H3: Trading Strategies: Various trading strategies can be employed depending on the predicted scenarios.

- Buy, Hold, Sell Recommendations: This classic approach involves buying if the outlook is positive, holding if neutral, and selling if negative.

- Options Strategies: Using options trading allows investors to manage risk and potentially profit from price movements.

- Risk Management: Implementing appropriate risk management techniques is crucial regardless of the chosen strategy. Diversification and stop-loss orders are essential elements.

Conclusion: Making Informed Decisions on Palantir Stock (May 5th and Beyond)

This analysis highlights the multifaceted factors influencing Palantir stock. Understanding both the bullish and bearish scenarios is critical before making any investment decisions. While this pre-earnings analysis provides valuable insights, remember to conduct your own thorough research, considering your personal risk tolerance and investment goals. Stay informed about Palantir's May 5th earnings release and continue analyzing Palantir stock to make informed investment decisions. Remember that this is not financial advice, and all investment decisions should be made after careful consideration of your personal circumstances.

Featured Posts

-

February And March Elizabeth Line Strikes Full Route And Date Information

May 10, 2025

February And March Elizabeth Line Strikes Full Route And Date Information

May 10, 2025 -

Dakota Johnsons Materialist Premiere Family In Attendance

May 10, 2025

Dakota Johnsons Materialist Premiere Family In Attendance

May 10, 2025 -

The Kilmar Abrego Garcia Case Examining The Complexities Of Immigration And Politics In The Us

May 10, 2025

The Kilmar Abrego Garcia Case Examining The Complexities Of Immigration And Politics In The Us

May 10, 2025 -

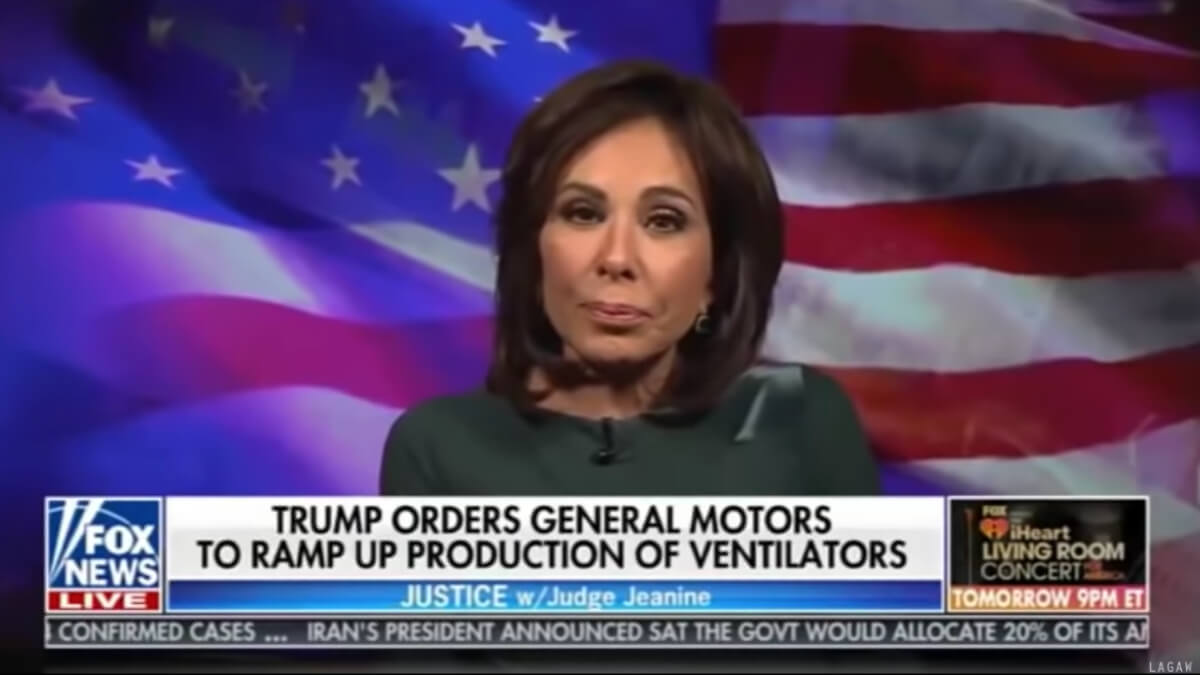

Former Fox News Host Jeanine Pirro To Lead Trumps Dc Prosecution Team

May 10, 2025

Former Fox News Host Jeanine Pirro To Lead Trumps Dc Prosecution Team

May 10, 2025 -

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Forthcoming Release

May 10, 2025

Documents On Epstein Diddy Jfk And Mlk Pam Bondi Announces Forthcoming Release

May 10, 2025