Analyzing Palantir Stock: Should You Invest Before May 5th?

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's financial health is crucial for any investment decision. Let's delve into the key financial metrics:

-

Review of Recent Quarterly Earnings Reports: Palantir's recent earnings reports should be carefully examined. Look for trends in revenue, earnings per share (EPS), and operating margins. Significant increases or decreases in these metrics can be strong indicators of the company's overall performance and future potential. For example, a consistent upward trend in revenue, coupled with improving margins, would signal positive growth.

-

Analysis of Palantir's Revenue Growth Trajectory: Sustained revenue growth is a key indicator of a healthy company. Analyzing the rate of growth and its consistency over several quarters is vital. Is the growth organic, or is it driven by acquisitions? Understanding the sources of revenue growth provides a clearer picture of Palantir's long-term prospects.

-

Palantir's Profitability (or Lack Thereof): Palantir's path to profitability is a critical factor to consider. While some companies prioritize growth over immediate profitability, investors should assess whether Palantir's spending is sustainable and if a clear path to profitability is evident. Analyze its operating expenses and identify areas for potential cost optimization.

-

Evaluation of Palantir's Debt Levels: High debt levels can hinder a company's growth and flexibility. Analyzing Palantir's debt-to-equity ratio and its ability to service its debt is essential. High debt coupled with slowing revenue growth can be a red flag.

-

Comparison to Competitors: Benchmarking Palantir against its competitors in the data analytics and government contracting sectors is crucial. How does Palantir's revenue growth, profitability, and market share compare to its rivals? This comparison provides valuable context for evaluating Palantir's performance and competitive position.

Factors Influencing Palantir's Stock Price Before May 5th

Several factors can significantly impact Palantir's stock price before May 5th:

-

Upcoming News and Events: Keep an eye out for any news or events that might significantly influence the PLTR stock price. This includes earnings reports, new product launches, major contract wins or losses, and geopolitical events that could affect government spending on data analytics.

-

Market Sentiment Towards Palantir and the Tech Sector: The overall market sentiment towards technology companies, and Palantir specifically, plays a significant role in its stock price. Positive sentiment, driven by strong earnings or technological advancements, can push the price up, while negative sentiment can lead to a decline. Monitoring news articles, analyst reports, and social media sentiment can provide insights into prevailing market opinions.

-

Potential Risks: Several risks could negatively affect Palantir's stock price. Increased competition from other data analytics companies, regulatory changes impacting government contracts, and a broader economic downturn are all potential concerns that should be considered.

-

Interest Rate Hikes and Inflation: Rising interest rates and inflation can significantly impact the valuation of growth stocks like Palantir. Higher interest rates generally make investing in growth stocks less attractive, potentially leading to a decrease in stock prices.

Long-Term Growth Potential of Palantir

Despite short-term market fluctuations, Palantir's long-term growth potential is a key consideration for investors:

-

Innovative Technologies and Market Opportunities: Palantir's innovative technologies, particularly in artificial intelligence (AI) and machine learning, present significant long-term growth opportunities. The expanding use of AI across various industries provides a vast market for Palantir's data analytics solutions.

-

Strategic Initiatives: Palantir's strategic initiatives, including its focus on expanding into new markets and developing new products, will significantly impact future revenue growth. Tracking these initiatives and assessing their success is crucial for evaluating long-term growth potential.

-

Competitive Advantages: Palantir's ability to maintain a strong market position depends on its competitive advantages. Does it possess proprietary technology, strong customer relationships, or a unique business model that sets it apart from its competitors?

-

Leveraging AI and Machine Learning: Palantir's ability to leverage AI and machine learning to enhance its products and services is a key driver of future growth. The potential for automation, improved data analysis, and new product development based on AI is a major factor to consider.

Should You Invest in Palantir Before May 5th? – A Risk Assessment

Deciding whether to invest in Palantir before May 5th requires a careful assessment of the risks and rewards:

-

Weighing Potential Rewards Against Risks: Consider the potential for significant returns against the inherent volatility of the stock market and the specific risks associated with Palantir. A balanced approach is essential.

-

Investment Strategies (Long-Term vs. Short-Term): Long-term investors may be more tolerant of short-term fluctuations, focusing on Palantir's long-term growth potential. Short-term investors might be more sensitive to market sentiment and news events.

-

Recommendation: Based on the analysis above, conducting your own thorough due diligence is paramount. This includes researching Palantir's financials, competition, and future plans. Remember, this is not financial advice; any decision to buy, sell, or hold PLTR stock should be based on your own research and risk tolerance.

Conclusion

Analyzing Palantir stock requires considering its recent performance, influencing factors, long-term potential, and inherent risks. While Palantir shows promise in its innovative technology and growing market opportunities, potential investors should carefully weigh these against market volatility and the company's path to profitability. Conduct thorough due diligence before making any investment decisions. Remember to consider your personal risk tolerance and financial goals when evaluating a Palantir stock investment. Should you invest in Palantir before May 5th? The decision ultimately rests on your own assessment of the risks and rewards, after conducting comprehensive research on Palantir stock and the broader market conditions. Carefully consider all factors before making a decision about investing in Palantir stock.

Featured Posts

-

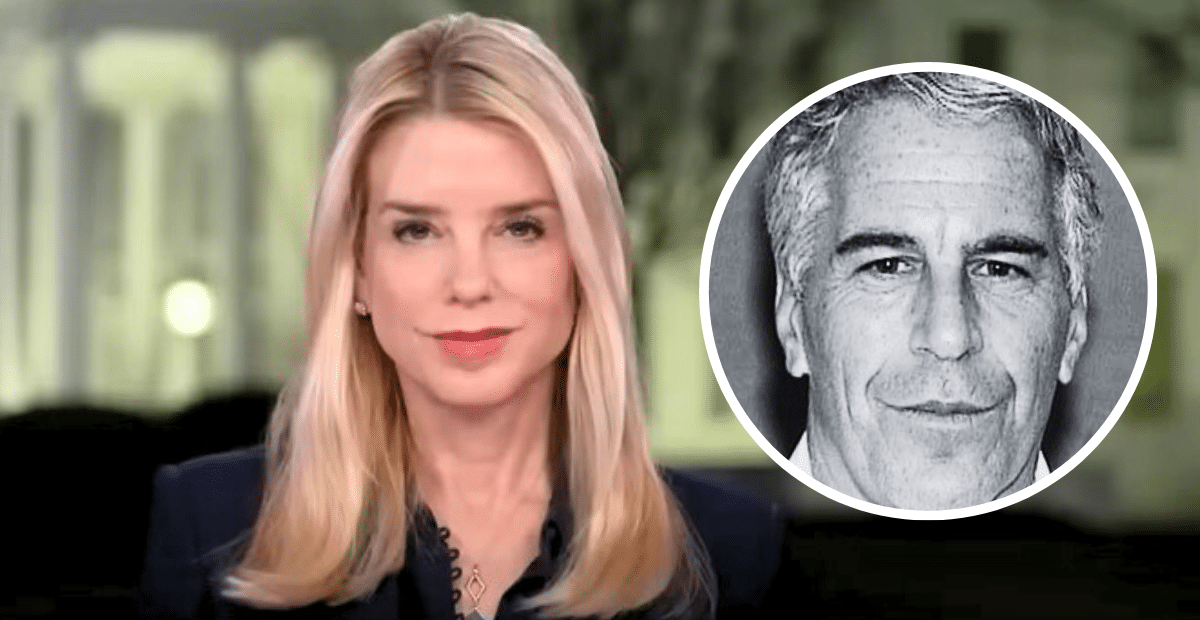

Epstein Files Pam Bondis Announcement And What It Means

May 09, 2025

Epstein Files Pam Bondis Announcement And What It Means

May 09, 2025 -

10 Agensi Dan Ngo Pas Selangor Salurkan Bantuan Mangsa Tragedi Putra Heights

May 09, 2025

10 Agensi Dan Ngo Pas Selangor Salurkan Bantuan Mangsa Tragedi Putra Heights

May 09, 2025 -

Tomas Hertls Dominant Performance Leads Golden Knights Past Red Wings

May 09, 2025

Tomas Hertls Dominant Performance Leads Golden Knights Past Red Wings

May 09, 2025 -

Exec Office365 Breach Millions Made By Hacker Feds Say

May 09, 2025

Exec Office365 Breach Millions Made By Hacker Feds Say

May 09, 2025 -

The Irony Of Davids Casting In High Potential Episode 13

May 09, 2025

The Irony Of Davids Casting In High Potential Episode 13

May 09, 2025