Analyzing Palantir's Stock Performance

Table of Contents

Main Points: Deconstructing Palantir's Stock Performance

2.1 Financial Performance Analysis of Palantir's Stock

H3: Revenue Growth and Profitability

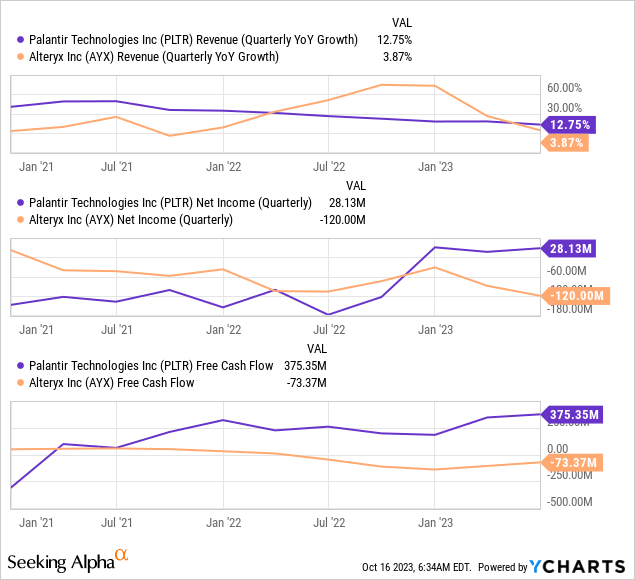

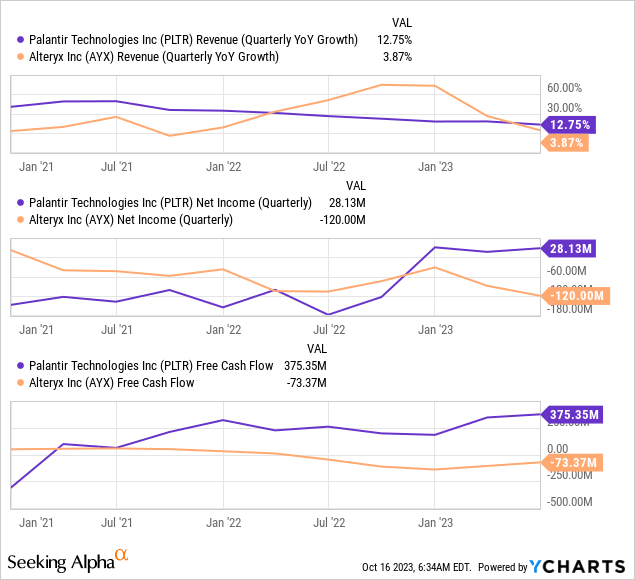

Palantir's revenue streams are divided between government contracts and commercial clients. Examining year-over-year growth and quarterly earnings reports reveals the dynamics of this split. Key Performance Indicators (KPIs) like revenue growth rate, operating margin, and net income margin provide crucial insights into Palantir's profitability.

- Year-over-Year Growth: Analyzing past years' revenue growth helps establish trends and predict future performance. A consistent upward trend signals strong growth, while fluctuations may indicate market challenges or changes in government spending.

- Quarterly Earnings Reports: Scrutinizing Palantir's quarterly earnings reports provides a granular view of its financial performance, highlighting successes and potential weaknesses. Comparing these reports year-over-year provides valuable context.

- KPIs: Monitoring KPIs like revenue growth, operating margin (a measure of profitability after deducting operating expenses), and net income margin (profitability after all expenses) are essential for assessing Palantir's financial health and long-term prospects. The relationship between Palantir revenue and profitability is key to understanding its financial performance.

H3: Valuation Metrics

Assessing Palantir's valuation involves comparing its Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and market capitalization to industry averages and competitors.

- P/E Ratio: A high P/E ratio suggests investors expect high future growth, while a low ratio might indicate undervaluation or concerns about future profitability.

- P/S Ratio: This metric compares the company's market capitalization to its revenue, offering another perspective on valuation, especially useful for companies with negative earnings like Palantir has historically had.

- Market Capitalization: This reflects the total market value of Palantir's outstanding shares and is a significant indicator of investor confidence. Analyzing Palantir's market capitalization alongside its competitors reveals its relative standing within the market. Changes in Palantir's market capitalization can signal shifts in investor sentiment and expectations. Understanding Palantir valuation requires careful consideration of all these metrics in relation to the broader market context.

H3: Cash Flow and Debt

Analyzing Palantir's cash flow from operations, free cash flow (FCF), and debt levels provides insight into its financial health and sustainability.

- Cash Flow from Operations: This indicates Palantir's ability to generate cash from its core business operations. Strong positive cash flow suggests a healthy and sustainable business model.

- Free Cash Flow (FCF): FCF represents the cash available after accounting for capital expenditures. High FCF implies the company can invest in growth, pay down debt, or return cash to shareholders.

- Debt Levels: High debt levels can increase financial risk. Analyzing Palantir's debt-to-equity ratio and its ability to service its debt is critical for understanding its financial stability. Understanding Palantir's cash flow and debt management is crucial to assessing its long-term financial health and stability.

2.2 Factors Influencing Palantir's Stock Performance

H3: Government Contracts and Geopolitical Events

Palantir's significant reliance on government contracts exposes it to geopolitical risks and shifts in government priorities.

- Dependence on Government Contracts: A high proportion of revenue from government sources creates vulnerability to budget cuts, contract delays, or changes in government policy. Analyzing the mix of government and commercial contracts is key to understanding this risk.

- Contract Renewals: The uncertainty surrounding contract renewals adds volatility to Palantir's revenue stream and stock price. Successful renewals signal stability, while failures can significantly impact the company's performance.

- Geopolitical Instability: International relations and political instability in regions where Palantir operates can significantly affect its contract opportunities and overall performance.

H3: Competition and Market Dynamics

Palantir competes with other big data analytics companies and faces challenges from emerging technologies.

- Key Competitors: Identifying and analyzing the strategies of competitors like AWS, Microsoft Azure, and Google Cloud is vital in understanding Palantir's competitive positioning. Palantir's market share relative to these competitors provides insight into its market success.

- Market Size and Growth: Understanding the growth trajectory of the big data analytics market helps in assessing Palantir's long-term growth potential. Market forecasts offer insights into future opportunities and competitive intensity.

- Market Share: Analyzing Palantir's market share and its ability to gain or maintain share relative to competitors is crucial for assessing its competitive strength.

H3: Technological Advancements and Innovation

Palantir's success hinges on its technological capabilities and ability to innovate.

- Technological Capabilities: Evaluating Palantir's core technologies, such as its Foundry platform and Gotham software, and their applicability to different industries is crucial.

- R&D Investments: The company's investment in research and development indicates its commitment to technological advancements and future innovation.

- New Product Releases: The introduction of new products and features can significantly impact Palantir's growth trajectory and investor sentiment. Analyzing the impact of new product releases on Palantir's stock performance is crucial. The ability of Palantir's technology to adapt to changing market demands significantly influences its stock performance.

2.3 Investor Sentiment and Market Analysis of Palantir's Stock

H3: Analyst Ratings and Price Targets

Analyst ratings and price targets provide insights into investor sentiment and future expectations.

- Consensus View: The overall consensus among analysts regarding Palantir's stock provides a valuable summary of market sentiment. Disagreements among analysts indicate uncertainty and potential risks.

- Price Targets: Analyst price targets offer predictions of Palantir's future stock price, which are useful for gauging investor expectations.

H3: News and Media Coverage

News and media coverage can significantly influence investor sentiment and stock price movements.

- Significant Events: Analyzing the impact of company announcements, partnerships, or regulatory changes on Palantir's stock price reveals market sensitivity to these events.

- Public Perception: Positive or negative media coverage can sway public opinion, impacting investor confidence and stock price.

Conclusion: Assessing the Future of Palantir's Stock Performance

Analyzing Palantir's stock performance reveals a complex picture of high growth potential interwoven with substantial risks. The company's dependence on government contracts, the competitive landscape, and technological advancements all play significant roles in shaping its future. While Palantir's innovative data analytics platforms offer substantial value, investors must carefully weigh the potential rewards against inherent risks before making investment decisions. Remember, conducting thorough research and understanding the complexities of Palantir's business model are paramount before investing. To continue your research on Palantir's stock performance, explore resources such as financial news websites (e.g., Yahoo Finance, Bloomberg), SEC filings, and analyst reports. Further analysis of Palantir's long-term growth prospects or its competitive positioning in specific markets will provide a more nuanced understanding of Palantir's stock performance and investment potential.

Featured Posts

-

Edmonton School Construction 14 Projects To Proceed Rapidly

May 09, 2025

Edmonton School Construction 14 Projects To Proceed Rapidly

May 09, 2025 -

Expert Claims Against Daycare A Critical Analysis For Parents

May 09, 2025

Expert Claims Against Daycare A Critical Analysis For Parents

May 09, 2025 -

Psg Dominon Formacionet E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025

Psg Dominon Formacionet E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025 -

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025 -

Madeleine Mc Cann Parents Police Investigating Fresh Safety Threats

May 09, 2025

Madeleine Mc Cann Parents Police Investigating Fresh Safety Threats

May 09, 2025