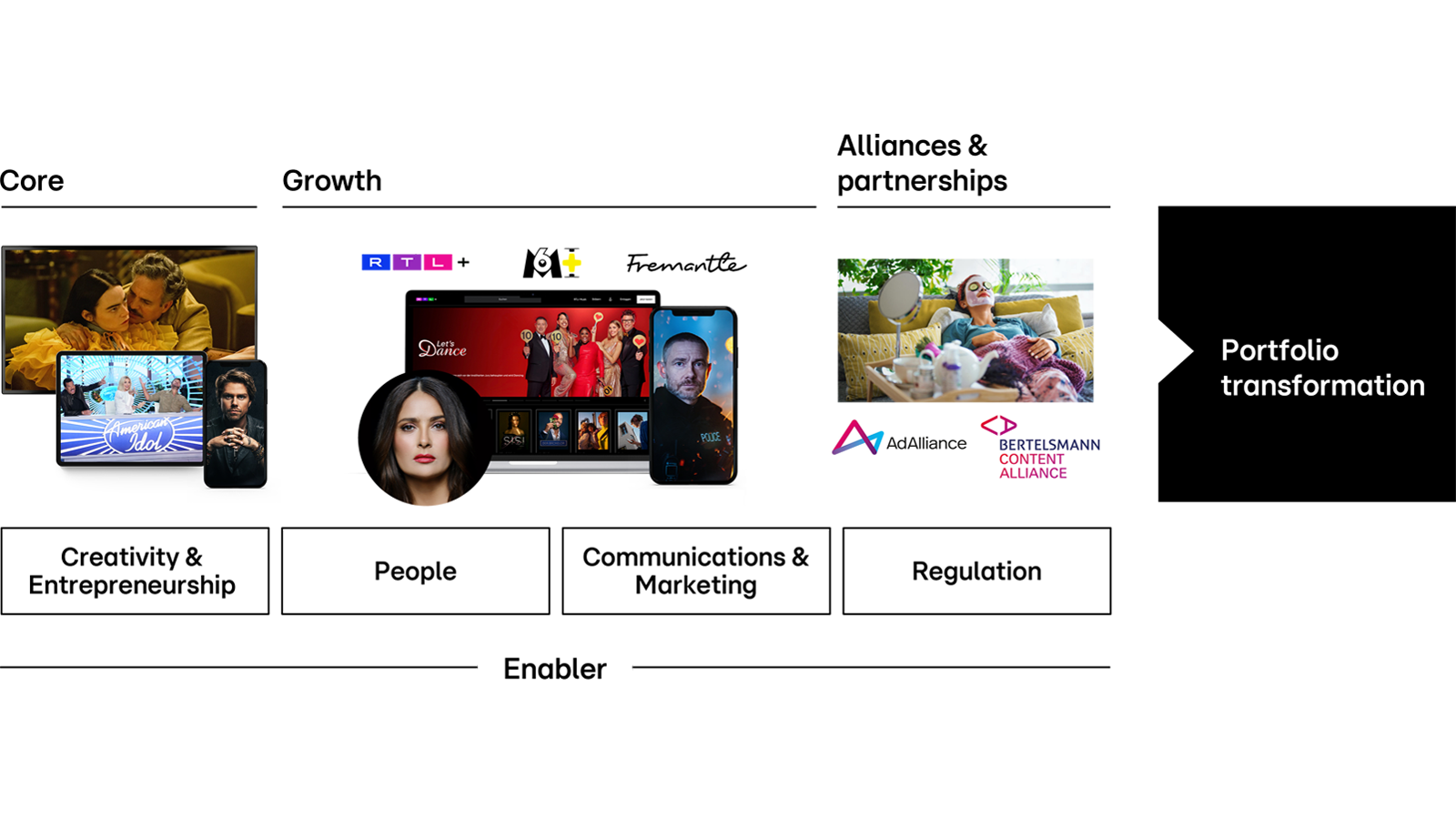

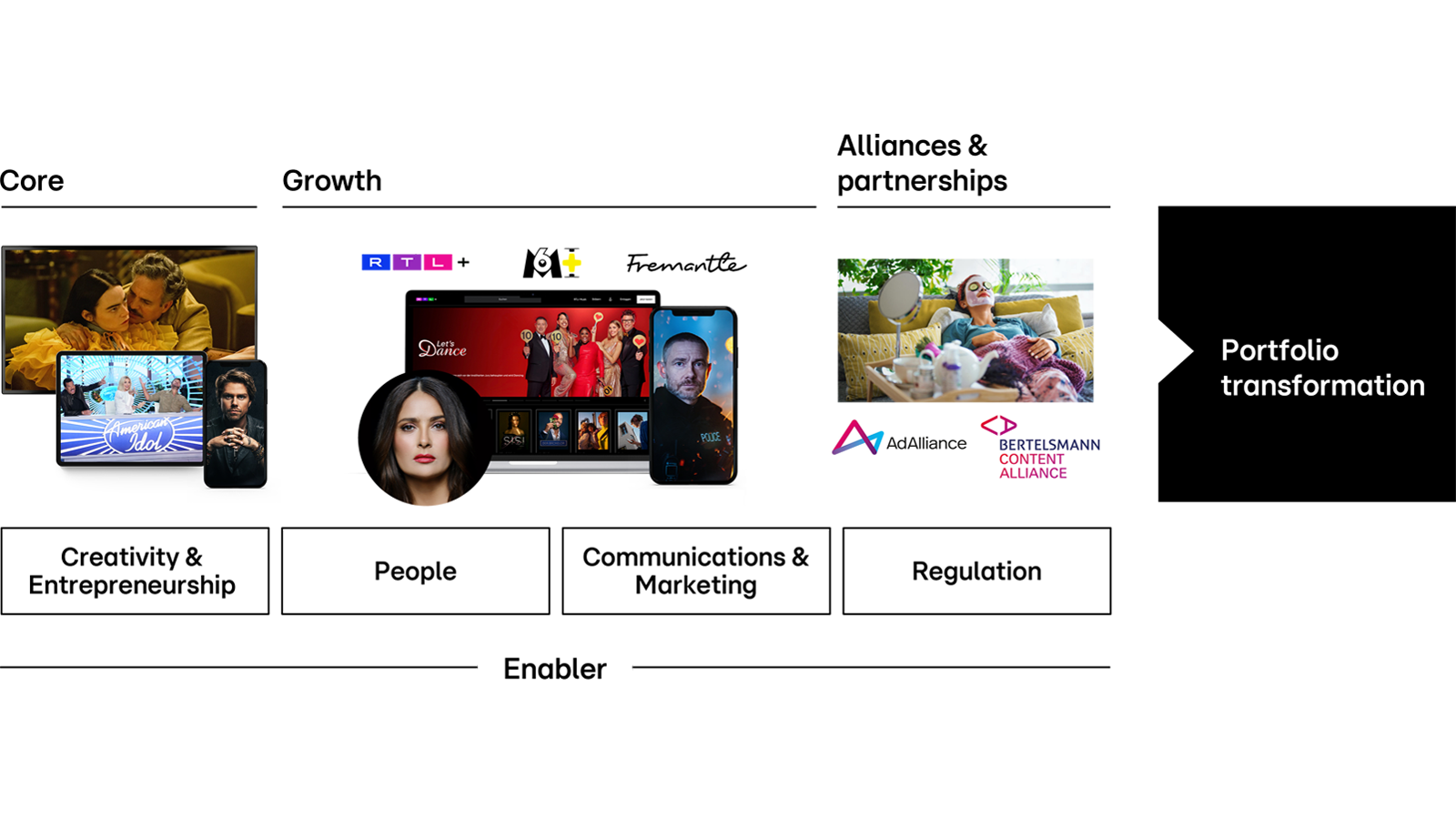

Analyzing RTL Group's Path To Streaming Profitability

Table of Contents

RTL Group, a European media giant, is aggressively pursuing profitability in the increasingly competitive streaming market. This analysis dissects RTL Group's strategies, challenges, and overall trajectory towards achieving sustainable streaming revenue. We'll explore their content strategies, monetization approaches, and the broader context of the European media landscape. The quest for streaming profitability is a complex one, and understanding RTL Group's approach offers valuable insights into the future of European media.

RTL Group's Streaming Services: A Comparative Overview

RTL Group's journey into streaming began with TVNow, a platform that, while functional, lacked the scale and strategic vision needed to compete effectively in the burgeoning SVOD market. The rebranding to RTL+ marked a significant shift, signifying a commitment to a more ambitious and comprehensive streaming strategy.

-

TVNow's limitations and the reasons for its rebranding to RTL+: TVNow suffered from a limited content library, a less-than-intuitive user interface, and a lack of original programming. The rebranding to RTL+ aimed to address these shortcomings directly.

-

RTL+'s content library expansion and its impact on subscriber growth: RTL+ boasts a significantly expanded content library compared to its predecessor, featuring a mix of acquired and original programming. This expansion has been key to driving subscriber growth, although precise figures remain commercially sensitive.

-

Comparison of RTL+'s functionality and user experience with competitors: While RTL+ offers a user-friendly interface and a decent selection of content, it still faces challenges in competing with the established functionality and user experience of giants like Netflix and Disney+. Improvements in recommendation algorithms and personalized content suggestions are crucial for enhanced user engagement.

-

Geographical reach and expansion plans for RTL+: Currently, RTL+ primarily focuses on the German-speaking market. However, RTL Group has signaled intentions to expand its reach across Europe, leveraging its existing network of channels and production companies. This expansion will require significant investment and adaptation to local market preferences.

Content Strategy and Original Programming for Streaming Success

RTL Group's content strategy for RTL+ is multifaceted. It involves a blend of licensed content and original productions, recognizing the importance of both in attracting and retaining subscribers. The emphasis on local programming is particularly noteworthy.

-

Investment in original series and films for RTL+: RTL+ has committed significant resources to commissioning original series and films, aiming to create exclusive content that differentiates it from competitors. The success of these original productions will be crucial in driving subscriber acquisition and long-term engagement.

-

Licensing agreements and content partnerships: While original programming is vital, RTL+ also relies on licensing agreements with major studios and content providers to bolster its library. Strategic partnerships enhance content diversity and appeal to a wider audience.

-

Focus on local programming to cater to regional audiences: RTL Group's strength lies in its deep understanding of local markets across Europe. Producing locally relevant shows and films is a smart strategy for building brand loyalty and resonating with specific audience preferences.

-

Successes and failures of specific original productions: While some RTL+ originals have achieved significant viewership, others have received less positive reception. Analyzing both successes and failures is crucial for refining future content strategies.

-

How content strategy impacts subscriber acquisition and retention: A strong content library, rich with original and licensed content tailored to audience tastes, directly impacts subscriber acquisition and retention. This is a key driver of RTL+'s streaming profitability.

Monetization Strategies: Balancing SVOD and AVOD

RTL+ employs a hybrid monetization strategy, combining subscription video on demand (SVOD) with advertising-based video on demand (AVOD). This approach presents both opportunities and challenges.

-

Pricing strategies for RTL+ subscriptions: RTL+ needs to strike a balance between competitive pricing and profitability. Subscription prices must reflect the value of the content offered while remaining attractive to potential subscribers.

-

Effectiveness of the AVOD model in generating revenue: Advertising revenue can contribute significantly to profitability, but excessive advertising can negatively impact the user experience and subscriber satisfaction.

-

Balancing subscriber satisfaction with advertising revenue: This is a delicate balancing act. RTL+ needs to optimize its advertising strategy to maximize revenue without compromising user experience. Targeted advertising, personalized ads, and limited ad-breaks are crucial aspects of this strategy.

-

Exploration of hybrid models combining SVOD and AVOD: The hybrid model offers flexibility. RTL+ can potentially offer different tiers of subscription, with ad-supported options catering to price-sensitive consumers.

-

The role of advertising technology and targeted advertising: Leveraging advanced advertising technologies, including data analytics and AI-powered targeting, is vital for maximizing the effectiveness of the AVOD model and driving revenue.

Competitive Landscape and Market Challenges

The European streaming market is fiercely competitive, with established global players like Netflix and Disney+ vying for market share. RTL+ faces several significant challenges.

-

Key competitors in the European streaming market (Netflix, Disney+, etc.): These established players offer vast libraries of content and have significantly more resources for content acquisition and marketing.

-

Challenges posed by the increasing saturation of the streaming market: The market is becoming increasingly crowded, making it harder for new entrants and smaller players to gain traction.

-

Strategies for differentiation and competitive advantage: RTL+ needs to focus on offering unique content, such as high-quality local productions, that sets it apart from the competition.

-

Regulatory hurdles and market-specific limitations: Navigating varying regulations and market conditions across Europe poses significant complexities.

-

Impact of piracy on revenue generation: Piracy is a persistent threat that impacts revenue generation for all streaming services.

Key Performance Indicators (KPIs) and Future Outlook

Several key performance indicators (KPIs) are crucial for evaluating RTL Group's streaming success.

-

Analysis of current subscriber numbers and growth trends: Consistent subscriber growth is essential for demonstrating the platform's appeal and long-term viability.

-

Churn rate and strategies to improve subscriber retention: A high churn rate indicates dissatisfaction with the service. Improving content and user experience is vital for retention.

-

ARPU (Average Revenue Per User) and its implications for profitability: Increasing ARPU, through higher subscription prices or additional revenue streams, is crucial for profitability.

-

CAC (Customer Acquisition Cost) and the efficiency of marketing and acquisition strategies: Reducing CAC while maintaining subscriber growth is essential for long-term financial sustainability.

-

Projected financial performance and long-term sustainability: RTL Group must demonstrate a clear path to profitability and long-term sustainability in the competitive streaming landscape.

Conclusion

RTL Group's pursuit of streaming profitability is an ongoing strategic endeavor. The transition from TVNow to RTL+, coupled with investments in original programming and a hybrid monetization model, demonstrates a proactive approach. However, navigating the intensely competitive European streaming market, managing subscriber acquisition costs, and overcoming the challenges of piracy remain crucial aspects of their future success. Further analysis of RTL+'s key performance indicators will be vital in assessing the long-term viability of their streaming strategy. To stay informed about RTL Group's progress and the dynamics of the European streaming market, continue following analyses on RTL Group's path to streaming profitability.

Featured Posts

-

El Hijo De Michael Schumacher Mick Se Separa Y Aparece En Una App De Citas

May 20, 2025

El Hijo De Michael Schumacher Mick Se Separa Y Aparece En Una App De Citas

May 20, 2025 -

The Kite Runner In Nigeria A Study Of Pragmatism And Moral Compromise

May 20, 2025

The Kite Runner In Nigeria A Study Of Pragmatism And Moral Compromise

May 20, 2025 -

Benjamin Kaellman Maalivire Huuhkajien Avuksi

May 20, 2025

Benjamin Kaellman Maalivire Huuhkajien Avuksi

May 20, 2025 -

The Ftv Live Hell Of A Run Controversy Criticism And Change

May 20, 2025

The Ftv Live Hell Of A Run Controversy Criticism And Change

May 20, 2025 -

Wwe Raw May 19 2025 Full Results And Match Grades

May 20, 2025

Wwe Raw May 19 2025 Full Results And Match Grades

May 20, 2025