Analyzing The Economic Consequences Of The Student Loan Crisis

Table of Contents

Impact on Individual Borrowers and Household Finances

The weight of student loan debt significantly impacts the financial well-being of individual borrowers and their households. This burden extends beyond the immediate monthly payments, creating a ripple effect with long-term consequences.

Difficulty in Achieving Financial Stability

The crushing weight of student loans delays major life milestones for many young adults. This debt significantly restricts financial flexibility and opportunities.

- Delayed Homeownership: High monthly payments make saving for a down payment and securing a mortgage incredibly challenging, pushing back the dream of homeownership for years, if not indefinitely.

- Delayed Family Formation: Starting a family requires significant financial resources, and substantial student loan payments often make it impossible for young couples to afford childcare, healthcare, and other necessities associated with raising a family.

- Retirement Planning Challenges: With limited disposable income diverted towards student loan repayments, many borrowers struggle to save adequately for retirement, potentially facing financial insecurity in their later years.

- Reduced Consumer Spending: The significant portion of income allocated to student loan repayment directly reduces consumer spending, contributing to a slowdown in economic growth. This impacts various sectors, from retail to hospitality.

- Increased Bankruptcy and Financial Distress: Overwhelmed by debt, many borrowers face bankruptcy or other forms of severe financial distress, creating a vicious cycle of hardship. This often leads to credit score damage, further limiting future financial opportunities. Examples include individuals forced to default on loans, leading to wage garnishment and damage to credit scores.

Mental Health and Well-being

The stress associated with managing substantial student loan debt extends far beyond financial difficulties. The psychological toll is significant and impacts borrowers' overall health and well-being.

- Increased Anxiety and Depression: The constant pressure of looming debt contributes to higher rates of anxiety, depression, and other mental health issues among young adults.

- Reduced Productivity: The mental strain associated with debt can significantly impair productivity at work and in other aspects of life.

- Impact on Relationships: Financial stress stemming from student loans can strain relationships with family and friends.

- Available Support Systems: While resources like financial counseling and mental health services exist, awareness and accessibility remain crucial factors in providing effective support to struggling borrowers.

Macroeconomic Impacts of the Student Loan Crisis

The student loan crisis isn't just a personal problem; it has significant macroeconomic consequences impacting the entire US economy.

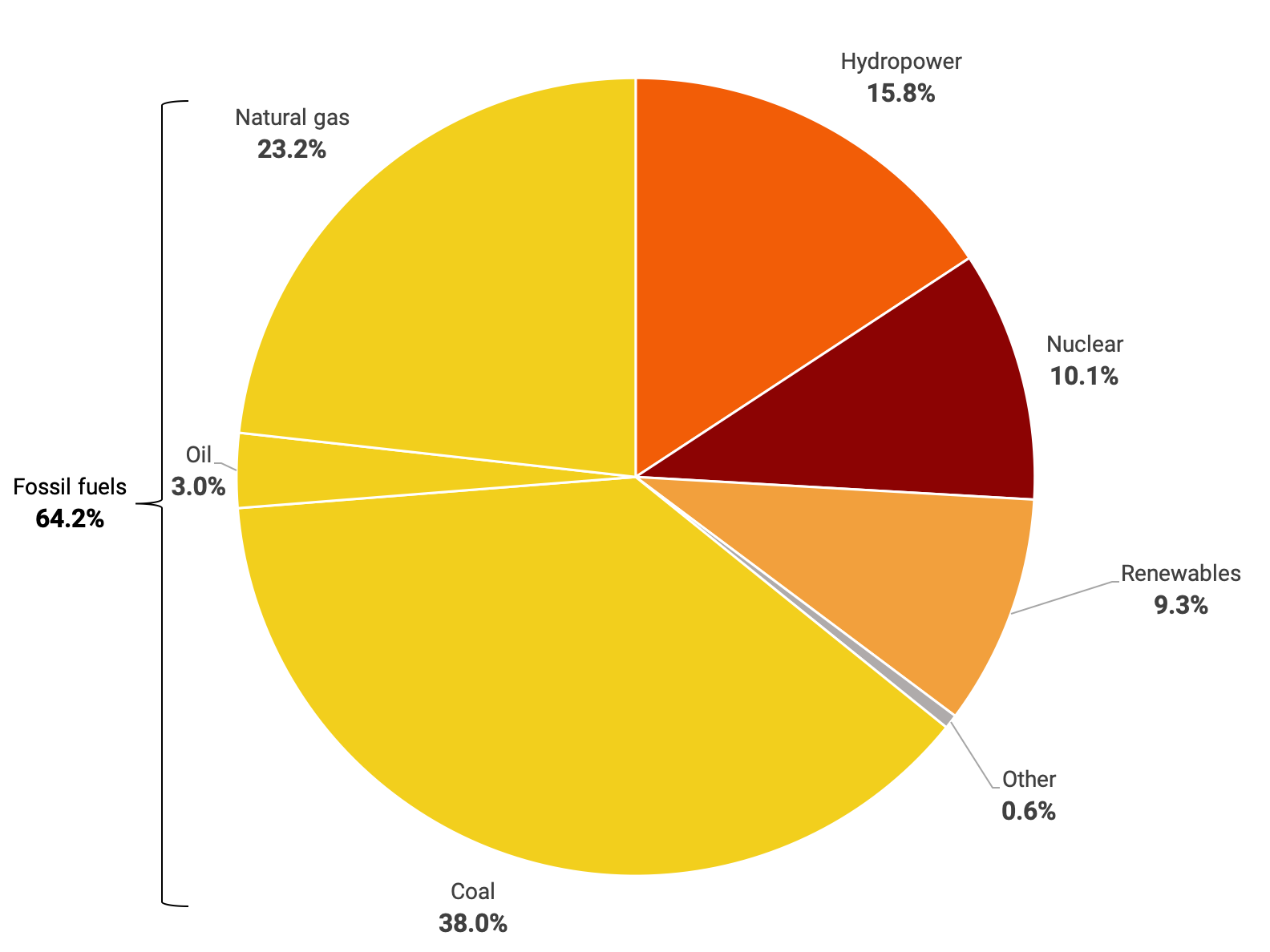

Reduced Economic Growth

The collective burden of student loan debt significantly dampens economic growth.

- Lower Consumer Spending: As discussed earlier, high student loan payments reduce disposable income, leading to decreased consumer spending and hindering economic activity.

- Decreased Investment: The financial strain limits the ability of individuals to invest in other areas of the economy, such as starting businesses or purchasing assets.

- Negative Impact on GDP Growth: Studies consistently demonstrate a strong correlation between high student loan debt and slower GDP growth. The reduced consumer spending and investment directly contribute to this negative impact.

- Impact on Future Earnings: The burden of debt can constrain career choices, limiting individuals to jobs that offer stability and consistent income over more ambitious, potentially higher-paying, but riskier career paths.

Impact on the Housing Market

Student loan debt significantly impacts the housing market, affecting homeownership rates and overall demand.

- Delayed Homeownership (reiterated): The inability to save for a down payment due to student loan payments reduces the number of potential homebuyers.

- Reduced Demand: This decreased demand impacts the real estate market, potentially lowering property values in some areas.

- Impact on Rental Market: The increased reliance on renting due to delayed homeownership creates a ripple effect within the rental market, increasing competition and potentially inflating rental costs.

Impact on Entrepreneurship and Innovation

The high level of student loan debt discourages entrepreneurship and innovation among young adults.

- Reduced Startup Activity: The financial burden makes starting a business – a risky endeavor by its nature – an even less appealing prospect for many graduates.

- Less Investment in New Ventures: The limited financial resources prevent investment in innovative ventures, potentially hindering technological advancements and economic diversification.

- Stifled Economic Dynamism: This reduction in entrepreneurial activity and innovation ultimately stifles economic dynamism and long-term growth.

Policy Implications and Potential Solutions

Addressing the student loan crisis requires a multifaceted approach involving government intervention and a fundamental re-evaluation of higher education financing.

Government Intervention and Loan Forgiveness Programs

Government intervention, including loan forgiveness programs, has been widely debated.

- Loan Forgiveness Pros and Cons: While loan forgiveness can provide immediate relief to borrowers, it also has potential drawbacks, such as the cost to taxpayers and the potential for moral hazard.

- Economic Impact of Policy Interventions: Careful analysis is required to assess the economic impact of different policy interventions, considering both short-term and long-term effects.

- International Examples: Examining successful (or unsuccessful) government interventions in other countries can offer valuable insights and lessons learned.

Addressing the Root Causes of the Crisis

Focusing solely on debt relief is insufficient; addressing the root causes is equally crucial.

- Rising Tuition Costs: The escalating cost of tuition is a primary driver of the crisis, demanding immediate attention and reform.

- Alternative Funding Models: Exploring alternative funding models for higher education, such as income-share agreements or greater reliance on grants, could reduce reliance on loans.

- Transparency in Student Loan Programs: Greater transparency in student loan programs will help students make informed borrowing decisions.

- Responsible Borrowing Practices: Encouraging responsible borrowing practices through improved financial literacy education is essential.

Conclusion

The student loan crisis presents a significant challenge to individual borrowers and the overall US economy. The consequences, ranging from hindered financial stability and reduced economic growth to decreased entrepreneurial activity, necessitate immediate and comprehensive action. Addressing this crisis requires a multi-pronged approach involving government intervention, responsible borrowing practices, and a fundamental reform of higher education financing. We must find innovative solutions to alleviate the burden of student loan debt and prevent further exacerbation of the student loan crisis. Understanding the multifaceted economic consequences is the first step towards building a more sustainable and equitable future for higher education and the national economy. Let's work together to find effective solutions to this critical issue and mitigate the long-term economic repercussions of the student loan crisis.

Featured Posts

-

Blake Lively Vs Justin Baldoni Lawyers Fierce Response To Dismissal Motion

May 28, 2025

Blake Lively Vs Justin Baldoni Lawyers Fierce Response To Dismissal Motion

May 28, 2025 -

Romes Champion Hard Work Fuels Future Success

May 28, 2025

Romes Champion Hard Work Fuels Future Success

May 28, 2025 -

Legal Rebuttal Baldonis Lawyer Vs Ryan Reynolds

May 28, 2025

Legal Rebuttal Baldonis Lawyer Vs Ryan Reynolds

May 28, 2025 -

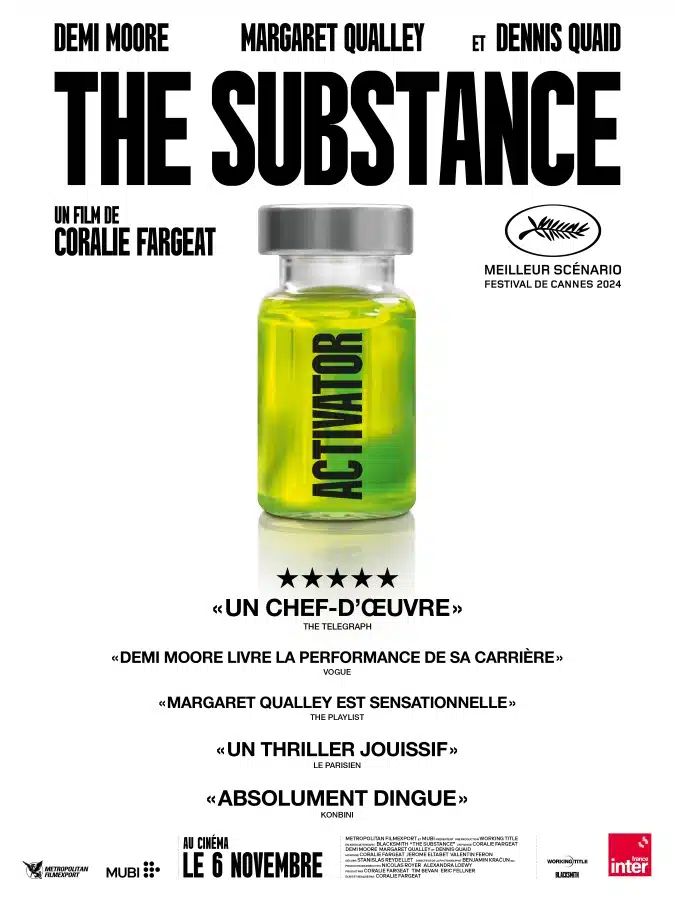

Wes Andersons Latest Film A Critique Of Style Over Substance

May 28, 2025

Wes Andersons Latest Film A Critique Of Style Over Substance

May 28, 2025 -

Miami Marlins Defeat Nationals Reach 500 Mark

May 28, 2025

Miami Marlins Defeat Nationals Reach 500 Mark

May 28, 2025