Analyzing The Factors Behind D-Wave Quantum (QBTS) Stock's Monday Plunge

Table of Contents

Market Sentiment and Investor Reactions to Recent News

The D-Wave Quantum (QBTS) stock plunge can be largely attributed to a confluence of negative market sentiment and reactions to recent company news. Several key factors contributed to this downturn.

Impact of Recent Earnings Reports

D-Wave's recent earnings report significantly impacted investor confidence. Specific financial metrics revealed deviations from analyst expectations, fueling the sell-off.

- Revenue: A substantial shortfall in revenue compared to projected figures raised concerns about the company's growth trajectory.

- Earnings per Share (EPS): A negative EPS, or a wider-than-expected loss, further dampened investor enthusiasm.

- Future Guidance: Negative revisions to future revenue projections signaled a potential slowdown in growth, prompting investors to take profits or exit their positions.

- Analyst Comments: Several financial analysts issued downgrades, citing concerns about competition and market saturation, further exacerbating the negative sentiment. For example, Analyst X stated, "[Quote expressing concern about D-Wave's future]."

Competitive Landscape and Technological Advancements

The quantum computing sector is intensely competitive, with several players vying for market dominance. This competitive pressure played a significant role in the D-Wave Quantum (QBTS) stock plunge.

- Key Competitors: Companies like IBM, Google, and Rigetti Computing are making significant strides in quantum computing technology, creating intense pressure on D-Wave.

- Technological Breakthroughs: Recent breakthroughs by competitors in areas like qubit coherence and error correction have potentially eroded D-Wave's perceived technological advantage.

- Market Saturation Concerns: Growing concerns about market saturation in the near term, as multiple players enter the market with potentially superior technology, may have influenced investor apprehension.

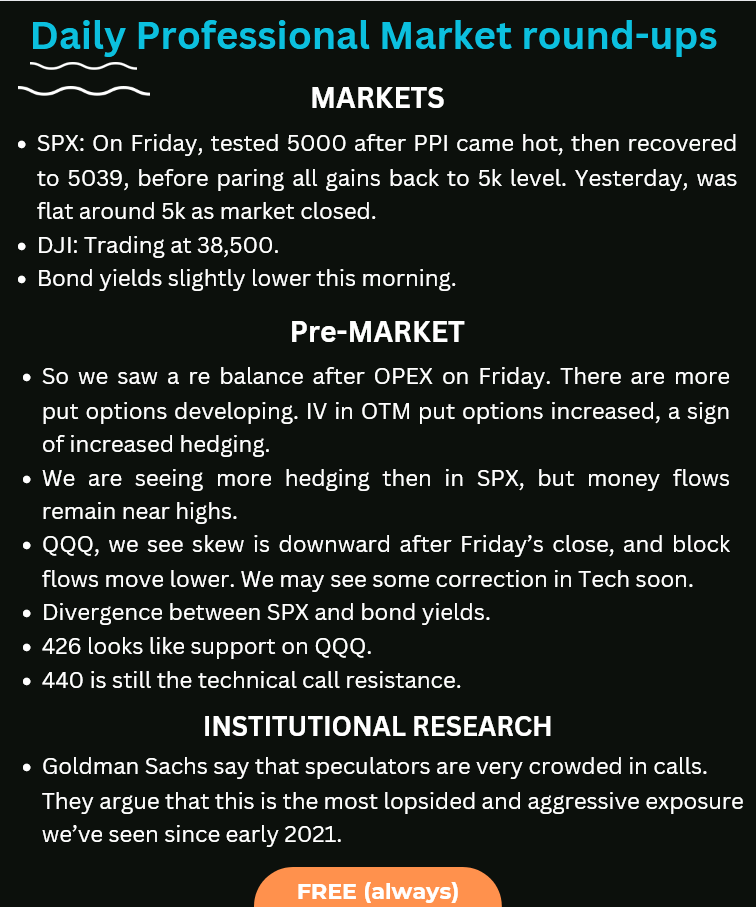

Overall Market Volatility

Broader market trends also contributed to the D-Wave Quantum (QBTS) stock decline. The overall volatile market environment exacerbated the negative impact of company-specific news.

- Economic Uncertainty: Prevailing economic uncertainty might have made investors more risk-averse, leading to a sell-off in high-growth tech stocks like D-Wave.

- Sector-Wide Sell-off: A broader sell-off in the technology sector, driven by factors such as rising interest rates or geopolitical instability, likely amplified the D-Wave Quantum (QBTS) stock plunge.

Technical Analysis of QBTS Stock Performance

A technical analysis of QBTS stock charts reveals several factors contributing to the Monday plunge.

Chart Patterns and Trading Volume

The stock's chart exhibited several bearish patterns leading up to the decline.

- Bearish Engulfing Candles: The appearance of bearish engulfing candlestick patterns signaled a potential reversal in the upward trend.

- High Trading Volume: The significantly increased trading volume during the downturn indicates a strong selling pressure driving the price lower.

Support and Resistance Levels

The stock breached crucial support levels, exacerbating the decline.

- Breaching Support: The failure to hold key support levels indicated a weakening of investor confidence.

- Psychological Impact: The break below these support levels triggered further selling pressure, as investors reacted to the perceived negative signal.

Speculative Factors and Market Rumors

Speculative factors and market rumors likely added to the downward pressure on D-Wave Quantum (QBTS) stock.

Impact of Negative News or Rumors

While unsubstantiated, negative news or rumors circulating on social media or among investors could have contributed to the sell-off.

- Unverified Reports: Rumors, even if unfounded, can impact investor sentiment and trigger selling.

- Social Media Sentiment: Negative sentiment expressed on social media platforms can influence trading decisions.

Potential for Short-Selling

Increased short-selling activity might have amplified the price drop.

- Short-Selling Mechanics: Short-sellers borrow and sell shares, hoping to buy them back later at a lower price, profiting from the price decline.

- Short Interest Data: Monitoring short interest data for QBTS could offer insights into the extent of short-selling activity.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Plunge and Future Outlook

The D-Wave Quantum (QBTS) stock plunge resulted from a combination of factors, including disappointing earnings, intense competition in the quantum computing market, broader market volatility, and potentially, speculative trading activities. Understanding these interwoven dynamics is crucial for investors. The future outlook remains uncertain, with both potential risks and opportunities. While the recent decline is concerning, the long-term prospects for quantum computing remain promising. However, before making any investment decisions related to D-Wave Quantum (QBTS) stock, thorough research and careful monitoring of market performance are essential. Continue your research by exploring further analysis of D-Wave Quantum (QBTS) stock trends and the competitive landscape of the quantum computing industry.

Featured Posts

-

Australian Trans Influencers Record Breaking Success Why The Doubt

May 21, 2025

Australian Trans Influencers Record Breaking Success Why The Doubt

May 21, 2025 -

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta

May 21, 2025

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta

May 21, 2025 -

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 21, 2025

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 21, 2025 -

Experience Vybz Kartel Live Historic New York City Performance

May 21, 2025

Experience Vybz Kartel Live Historic New York City Performance

May 21, 2025 -

Predicting Rain Latest Updates On On And Off Shower Chances

May 21, 2025

Predicting Rain Latest Updates On On And Off Shower Chances

May 21, 2025