Analyzing The Impact Of Tax Credits On Minnesota Film Production

Table of Contents

Economic Benefits of Minnesota Film Tax Credits

The Minnesota film tax credit program has demonstrably positive effects on the state's economy. These benefits extend beyond direct financial injections, creating a ripple effect that boosts various sectors and strengthens the local film industry's infrastructure.

Job Creation and Employment

Film productions utilizing Minnesota film tax credits generate substantial employment opportunities. These jobs are not limited to on-screen talent; they extend to a wide range of roles, encompassing crew members, support staff, caterers, and local businesses providing goods and services. For example, the recent filming of [insert example of a film production that used Minnesota tax credits and its employment numbers] created [insert number] jobs directly and indirectly stimulated the Minnesota film jobs market. This demonstrates the significant potential of film industry jobs Minnesota offers.

- Increased employment in various sectors (e.g., camera operators, editors, gaffers, grips, sound technicians, catering services, transportation, security).

- Opportunities for local talent, fostering career development and reducing the need for out-of-state hires.

- Potential for long-term career development within the Minnesota film industry, creating a sustainable and skilled workforce.

Revenue Generation and Local Spending

Film productions significantly contribute to the state's economic impact Minnesota film. Productions bring substantial revenue through spending on various goods and services within the state. This revenue generation isn't confined to large studios; it extends to local businesses, creating a multiplier effect that strengthens communities.

- Increased spending in local hotels, restaurants, and transportation services.

- Support for local suppliers and vendors, strengthening local businesses and economies.

- Significant contributions to state and local tax revenue, often exceeding the amount provided in tax credits. This helps offset the initial cost of film tax credits.

Infrastructure Development

The growth of the Minnesota film industry, fueled by tax credits, stimulates investment in essential film-related infrastructure. This includes the development of studios, soundstages, and post-production facilities. These improvements enhance the state's competitiveness in attracting larger-scale productions.

- Attraction of private investment for the development of state-of-the-art film infrastructure Minnesota.

- Improved infrastructure strengthens the state's capacity to handle more significant film projects, increasing revenue generation.

- Creation of a more sustainable and robust film industry jobs Minnesota ecosystem.

Potential Drawbacks and Challenges of Minnesota Film Tax Credits

While the benefits of Minnesota film tax credits are undeniable, it is crucial to acknowledge potential drawbacks and challenges associated with the program. A balanced assessment requires considering both the positive and negative aspects.

Cost to Taxpayers

The cost of film tax credits is a significant factor. It's essential to analyze whether the economic benefits generated by the program outweigh the expenditure from taxpayer burden. A thorough analysis needs to be conducted to determine the true return on investment (ROI). This should include comparisons with other states' tax credit programs to assess the effectiveness and efficiency of Minnesota's approach.

- Assessment of the total financial impact on the state budget.

- Comparative analysis of Minnesota’s film tax credit program against similar programs in other states.

- Detailed evaluation of the ROI of the tax credit program, including both direct and indirect economic benefits.

Accountability and Transparency

Maintaining tax credit transparency and accountability in film incentives is crucial for public trust. Robust mechanisms are needed to ensure that the program is administered fairly and effectively, preventing any potential misuse.

- Regular review of the application and approval process for tax credits.

- Implementation of strict monitoring and evaluation procedures to assess the program's effectiveness.

- Establishment of clear guidelines and oversight mechanisms to minimize the potential for fraud or abuse.

Impact on Other Industries

It's important to consider the opportunity cost associated with focusing resources on film production. Investing heavily in one sector, even a high-growth one, might divert funds from other potentially beneficial sectors of the Minnesota economy.

- Analysis of potential trade-offs between supporting the film industry and other crucial sectors of the Minnesota economy.

- Exploration of strategies to balance support for the film industry with investment in other vital economic sectors.

Conclusion: The Future of Minnesota Film Production and Tax Credits

The Minnesota film tax credit program has demonstrably boosted the state's film industry, creating jobs, generating revenue, and stimulating infrastructure development. However, a careful evaluation of the cost of film tax credits and ensuring tax credit transparency is vital for its long-term sustainability. Ongoing monitoring, rigorous analysis of the ROI, and a focus on accountability in film incentives are essential. Improvements could include more targeted incentives, greater transparency in the application process, and a comprehensive assessment of the program's impact on other sectors. Let's continue the conversation about maximizing the benefits of film tax credits in Minnesota, ensuring a thriving film industry that contributes significantly to the state's economic prosperity.

Featured Posts

-

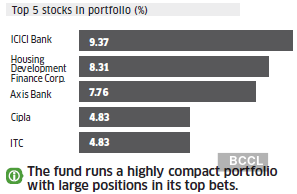

Dsps Top India Fund Shifts To Cautious Stance Raises Cash Levels

Apr 29, 2025

Dsps Top India Fund Shifts To Cautious Stance Raises Cash Levels

Apr 29, 2025 -

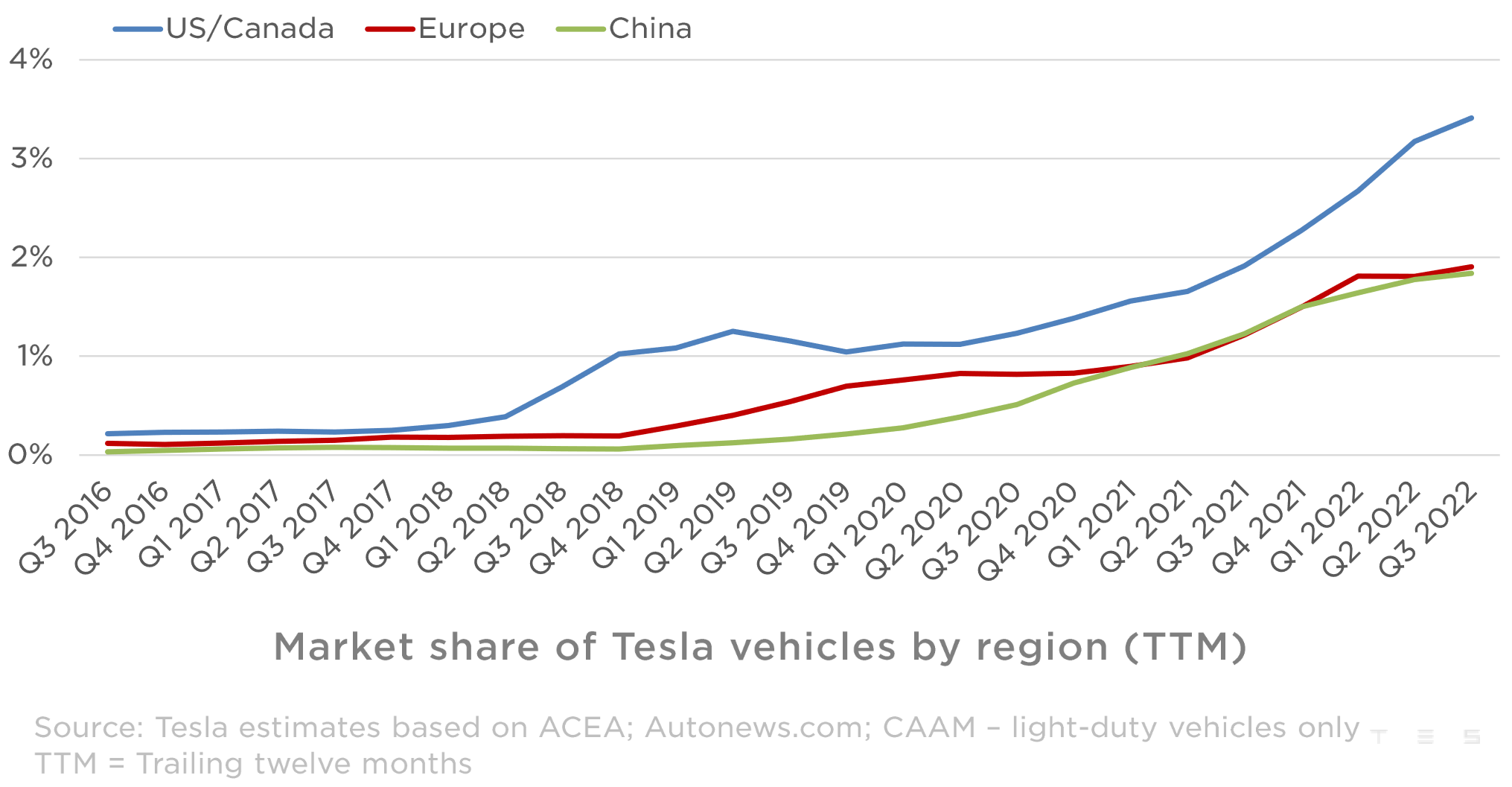

Chinas Impact On Bmw And Porsche Sales Market Share And Future Outlook

Apr 29, 2025

Chinas Impact On Bmw And Porsche Sales Market Share And Future Outlook

Apr 29, 2025 -

What To Do If You Think You Might Have Adult Adhd

Apr 29, 2025

What To Do If You Think You Might Have Adult Adhd

Apr 29, 2025 -

You Tube A New Home For Older Viewers Favorite Television Programs

Apr 29, 2025

You Tube A New Home For Older Viewers Favorite Television Programs

Apr 29, 2025 -

The Pete Rose Pardon Donald Trumps Presidential Power Play

Apr 29, 2025

The Pete Rose Pardon Donald Trumps Presidential Power Play

Apr 29, 2025