Analyzing The Investment Viability Of Uber Technologies (UBER)

Table of Contents

Uber's Financial Performance and Key Metrics

Understanding Uber's financial performance is crucial for assessing its investment viability. Let's examine key metrics to gauge its financial health.

Revenue Analysis

Uber boasts diversified revenue streams, primarily from its ride-sharing services, Uber Eats (food delivery), and Uber Freight (logistics). Analyzing revenue growth trends reveals significant insights. Recent years have shown a steady increase in overall revenue, although the contribution of each segment fluctuates.

- Uber Rides: While still a significant revenue generator, this segment faces challenges from increased competition and fluctuating fuel prices.

- Uber Eats: This segment has demonstrated strong growth potential, benefiting from the increasing popularity of food delivery services.

- Uber Freight: This segment offers a promising avenue for long-term growth, tapping into the expanding logistics and transportation sector.

(Insert chart/graph visualizing revenue growth and breakdown by segment here)

Keywords: Uber revenue, Uber Eats revenue, Uber freight revenue, revenue growth, financial performance

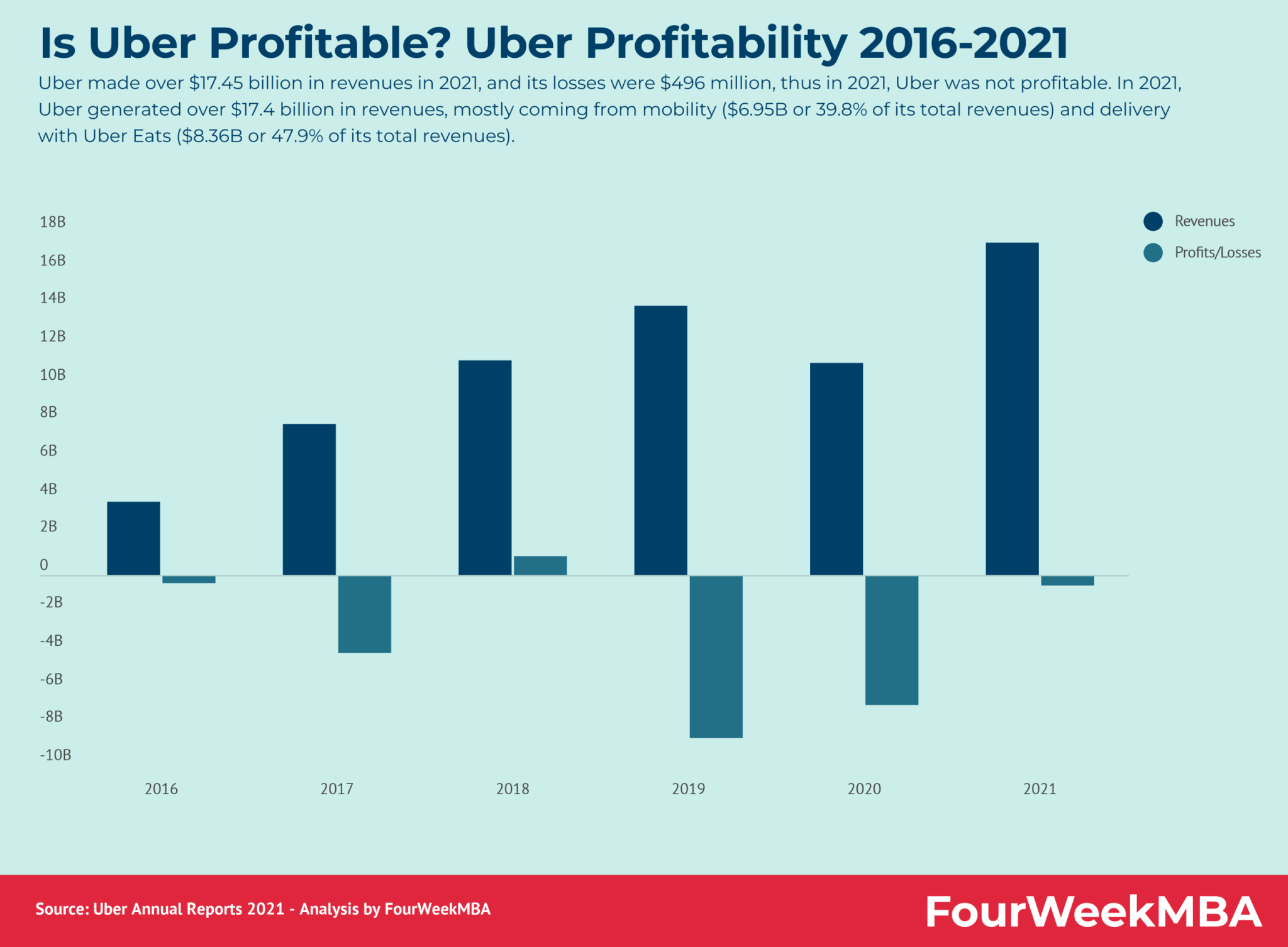

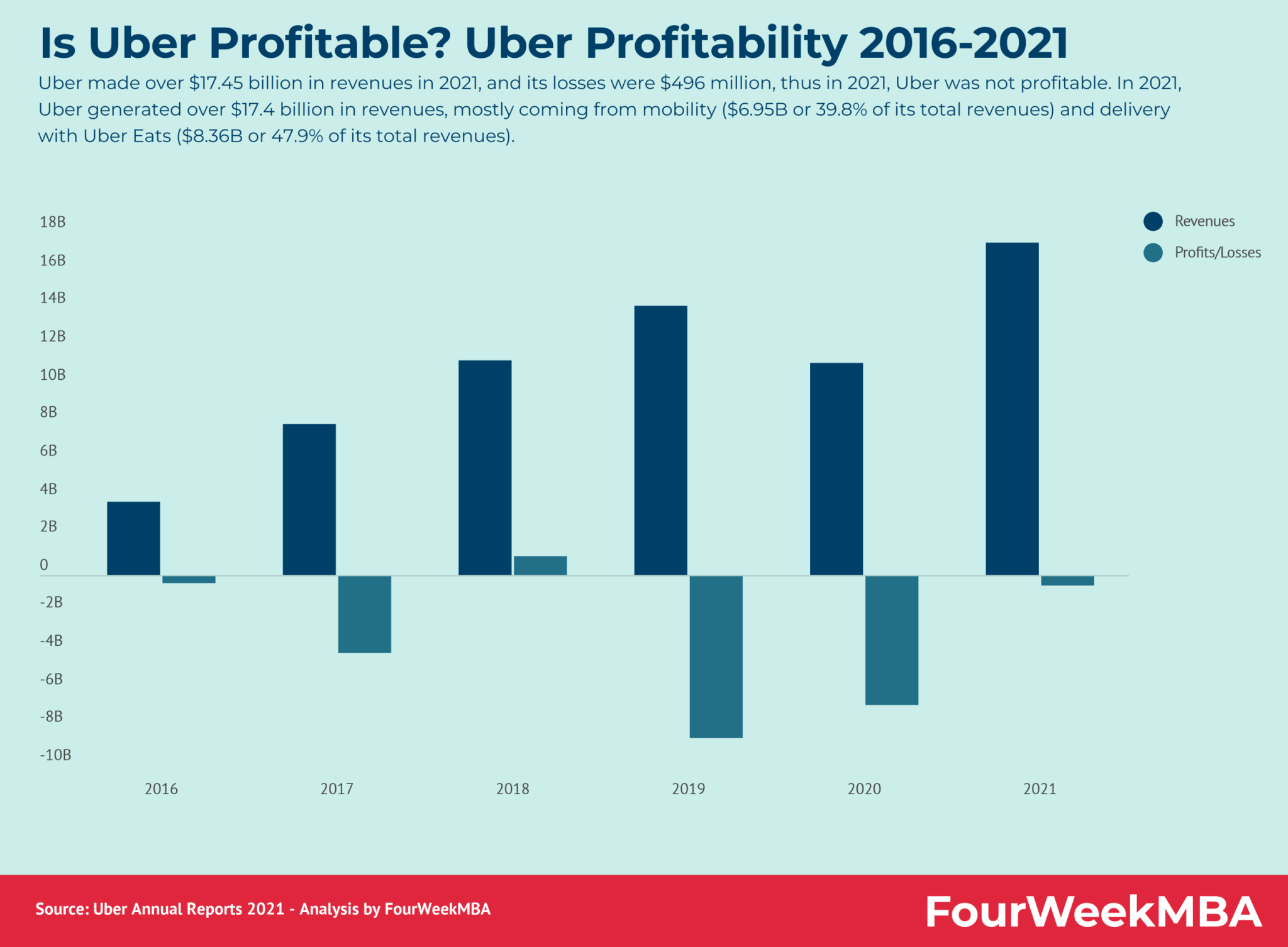

Profitability and Margins

Uber's profitability is a critical factor in determining investment viability. While the company has shown progress in reducing losses, achieving consistent profitability remains a key challenge.

- Net Income: Uber's net income has historically been negative, but improving profitability is a strategic goal.

- Operating Income: Analyzing operating income helps understand the profitability of core operations.

- EBITDA Margin: Tracking EBITDA margin provides a useful indicator of operational efficiency and profitability.

(Insert chart/graph visualizing profitability and margin trends here)

Keywords: Uber profitability, EBITDA margin, operating margin, net income, profitability analysis

Debt and Cash Flow

Uber's debt levels and cash flow are important indicators of its financial health and sustainability.

- Debt Levels: A high level of debt can increase financial risk and limit the company's flexibility.

- Cash Flow from Operations: Strong operating cash flow indicates the company's ability to generate cash from its core business activities.

- Free Cash Flow: Free cash flow is a measure of the cash available for reinvestment, debt repayment, or distribution to shareholders.

Analyzing the relationship between debt and cash flow helps assess Uber's ability to manage its finances and invest in future growth.

Keywords: Uber debt, cash flow, free cash flow, debt-to-equity ratio, financial health

Competitive Landscape and Market Position

Uber operates in a highly competitive market. Understanding its competitive position is crucial.

Major Competitors

Uber faces intense competition from various players:

- Lyft: A direct competitor in the US ride-sharing market.

- Didi Chuxing: A dominant player in the Chinese ride-hailing market.

- Local ride-sharing services: Numerous smaller, regional players compete in various markets.

Analyzing the market share and competitive strategies of these players is essential for evaluating Uber's market position and long-term prospects.

Keywords: Uber competitors, Lyft, Didi Chuxing, competitive analysis, market share

Market Growth and Future Potential

The ride-sharing and food delivery markets are experiencing significant growth, driven by factors like urbanization, technological advancements, and changing consumer preferences.

- Ride-sharing market: Growth is expected to continue, although regulatory changes and competition will influence its trajectory.

- Food delivery market: This segment is experiencing rapid expansion, presenting significant opportunities for Uber Eats.

Uber's ability to adapt to market changes and capitalize on growth opportunities will be key to its future success.

Keywords: market growth, ride-sharing market, food delivery market, market potential, future growth

Risks and Challenges Facing Uber

Several risks and challenges could impact Uber's future performance.

Regulatory Risks

The ride-sharing and delivery industries face significant regulatory scrutiny globally.

- Ride-sharing regulations: Varying regulations across different jurisdictions pose operational challenges and compliance costs.

- Labor regulations: Classifying drivers as independent contractors or employees has significant legal and financial implications.

Keywords: Uber regulation, regulatory risks, ride-sharing regulations, legal challenges

Operational Risks

Uber's operations are subject to several risks:

- Driver availability: Maintaining a sufficient supply of drivers is crucial for service reliability.

- Safety concerns: Ensuring passenger and driver safety is paramount and requires continuous investment in safety measures.

- Operational efficiency: Optimizing operations to reduce costs and improve efficiency is essential for profitability.

Keywords: driver availability, safety concerns, operational efficiency, operational risks

Economic and Geopolitical Risks

Macroeconomic and geopolitical factors can significantly influence Uber's business.

- Economic downturns: Recessions can lead to reduced consumer spending and impact demand for ride-sharing and delivery services.

- Geopolitical instability: Political instability or conflict in specific regions can disrupt operations and affect profitability.

Keywords: economic risks, geopolitical risks, inflation, recession, macroeconomic factors

Conclusion: Is Investing in Uber Right for You?

Analyzing the investment viability of Uber Technologies (UBER) requires a careful consideration of its financial performance, competitive landscape, and inherent risks. While Uber demonstrates strong revenue growth and expansion across several key sectors, achieving sustainable profitability and navigating a complex regulatory environment remain significant challenges. The intense competition and exposure to macroeconomic fluctuations also present substantial risks. Whether UBER is a "buy," "hold," or "sell" ultimately depends on individual risk tolerance and investment goals. Therefore, thorough due diligence and consultation with a qualified financial advisor are highly recommended before making any investment decisions regarding Uber Technologies (UBER). Conduct further research to make an informed choice about the investment viability of Uber stock.

Featured Posts

-

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giriyor Son Durum

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giriyor Son Durum

May 19, 2025 -

10km Wrong Way Drive British Drivers French Motorway Incident

May 19, 2025

10km Wrong Way Drive British Drivers French Motorway Incident

May 19, 2025 -

5 0 Win Haaland Powers Norways World Cup Qualifying Opener

May 19, 2025

5 0 Win Haaland Powers Norways World Cup Qualifying Opener

May 19, 2025 -

Increased Costs For Royal Mails First Class Three Day Delivery Service

May 19, 2025

Increased Costs For Royal Mails First Class Three Day Delivery Service

May 19, 2025 -

Fsu Shooting Victims Family Background A Cia Operatives Legacy

May 19, 2025

Fsu Shooting Victims Family Background A Cia Operatives Legacy

May 19, 2025