Analyzing The Low Uptake Of 10-Year Mortgages Among Canadian Homebuyers

Table of Contents

Only a small percentage of Canadian homebuyers opt for 10-year mortgages. While the majority choose shorter-term options like 5-year mortgages, the question remains: why are 10-Year Mortgages Canada so unpopular? This article delves into the reasons behind this trend, exploring financial uncertainties, the preference for flexibility, a lack of awareness surrounding the benefits, and the role played by mortgage professionals. We will analyze why this longer-term commitment remains a niche choice in the Canadian mortgage market.

H2: Financial Uncertainty and the 10-Year Commitment

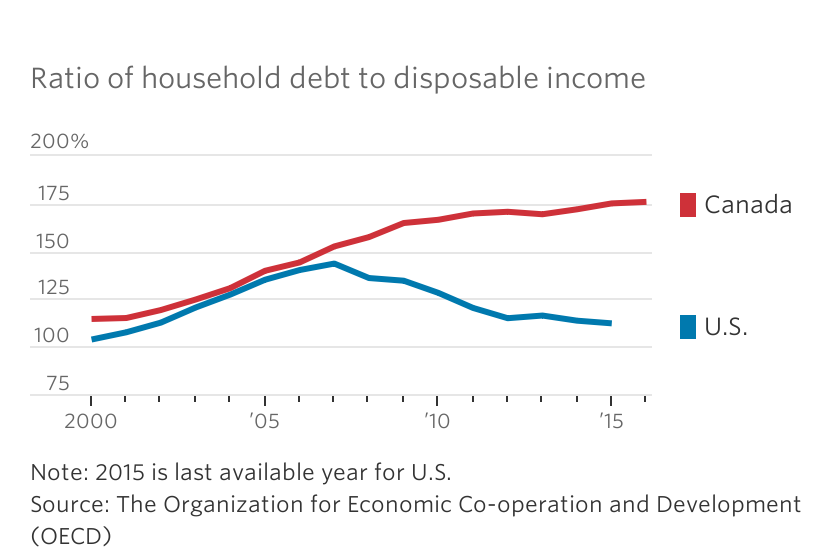

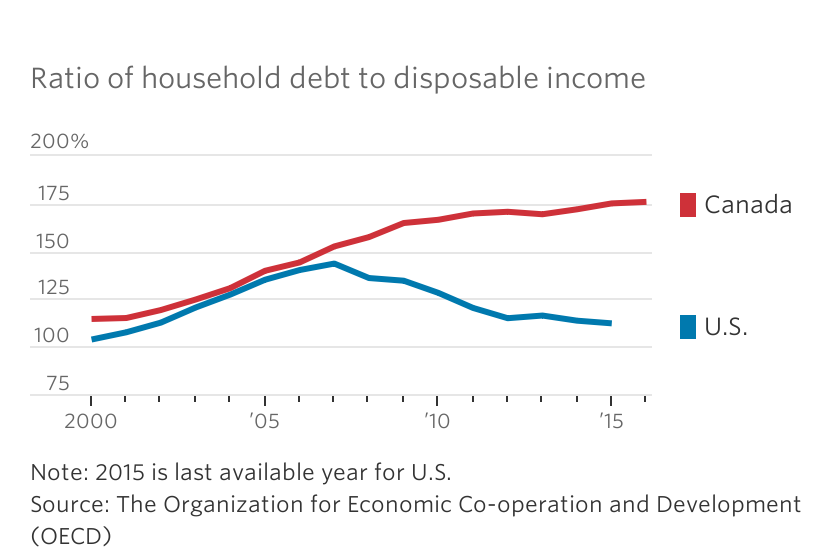

A 10-year mortgage represents a significant financial commitment. Choosing a fixed interest rate for a decade locks you into a specific payment amount, regardless of potential future interest rate fluctuations. The Canadian economy is dynamic; interest rates can rise or fall significantly over such a period. This creates a considerable risk for homebuyers.

- Risk of higher interest rates later in the term: Locking in a rate early could mean paying more than those who refinance into lower rates later.

- Difficulty predicting future financial stability: Unexpected job loss, illness, or other life changes can severely impact affordability during a 10-year mortgage term.

- Limited flexibility in refinancing options: Breaking a 10-year mortgage early often involves hefty penalties, making refinancing challenging.

- Potential penalties for early repayment: These penalties can significantly outweigh the benefits of refinancing if rates drop.

H2: Preference for Flexibility and Shorter-Term Options

The popularity of 5-year mortgages in Canada stems from the flexibility they offer. Homeowners can renegotiate their interest rates every five years, taking advantage of potential rate drops in the market. This flexibility is highly valued, particularly in a fluctuating economic climate.

- Rate adjustments every 5 years: This allows homeowners to adapt their mortgage payments to their changing financial situations.

- Ability to switch lenders or mortgage products: The 5-year renewal point offers an opportunity to explore better rates or different mortgage products.

- Better alignment with financial planning cycles: Shorter-term mortgages often better align with typical financial planning horizons.

- Greater adaptability to life changes: Job loss, marriage, children – life changes are easier to navigate with the flexibility of a shorter-term mortgage.

H2: Lack of Awareness and Understanding of 10-Year Mortgage Benefits

While the risks of 10-year mortgages are often emphasized, the potential benefits are frequently overlooked. A longer-term mortgage can offer lower interest rates than shorter-term options and provide the predictability of consistent monthly payments for a longer period.

- Potential for lower overall interest costs: Despite the potential for higher rates during the term, 10-year mortgages may offer lower overall interest payments compared to renewing multiple shorter-term mortgages.

- Predictability of long-term budgeting: Fixed payments for a decade offer greater financial stability and simplify budgeting.

- Financial stability and peace of mind: For borrowers with stable finances and a long-term outlook, a 10-year mortgage can provide significant peace of mind.

- Need for greater consumer education and outreach: More education is needed to highlight the advantages of 10-year mortgages for those who can manage the financial risk.

H2: The Role of Mortgage Brokers and Financial Advisors

Mortgage brokers and financial advisors play a pivotal role in shaping consumer choices. Their recommendations significantly influence whether a homeowner chooses a 5-year or a 10-year mortgage.

- Importance of unbiased financial advice: Brokers should present all options objectively, weighing the pros and cons for each client’s specific financial situation.

- Need for more education for brokers on promoting 10-year mortgages: Brokers need a deeper understanding of the potential benefits of longer-term mortgages.

- Impact of commission structures on mortgage recommendations: Commission structures shouldn't incentivize pushing specific mortgage products over others.

- The role of client education and risk tolerance assessment: Thorough client consultations and risk assessments are crucial to ensure the right mortgage choice.

Conclusion: Rethinking the 10-Year Mortgage Landscape in Canada

The low uptake of 10-year mortgages in Canada is primarily driven by financial uncertainty, a preference for flexibility, and a lack of awareness regarding their potential benefits. While the risk of higher interest rates and reduced flexibility is real, the potential for long-term savings and financial stability shouldn't be overlooked. Explore the potential savings and stability of 10-Year Mortgages Canada; speak to a financial advisor today to determine if it's the right choice for you. Understanding the intricacies of different mortgage terms, including the potential advantages of a 10-year mortgage for suitable borrowers, is key to making informed decisions.

Featured Posts

-

Watch Gypsy Rose Life After Lockup Season 2 Episode 4 Free Streaming Options

May 06, 2025

Watch Gypsy Rose Life After Lockup Season 2 Episode 4 Free Streaming Options

May 06, 2025 -

Timnas U20 Indonesia Vs Yaman Laga Tanpa Gol Posisi 3 Terjamin

May 06, 2025

Timnas U20 Indonesia Vs Yaman Laga Tanpa Gol Posisi 3 Terjamin

May 06, 2025 -

Ayo Edebiri Celebrates Ayo Edebiri Day At Her Alma Mater

May 06, 2025

Ayo Edebiri Celebrates Ayo Edebiri Day At Her Alma Mater

May 06, 2025 -

Miley Cyrus On Her Fathers Narcissism A Difficult Family Dynamic

May 06, 2025

Miley Cyrus On Her Fathers Narcissism A Difficult Family Dynamic

May 06, 2025 -

Canadian Mortgage Preferences Why 10 Year Terms Fall Short

May 06, 2025

Canadian Mortgage Preferences Why 10 Year Terms Fall Short

May 06, 2025