Analyzing The Scholar Rock Stock Decline: Monday's Market Reaction

Table of Contents

Market Sentiment and Overall Market Conditions

Monday's market performance played a significant role in the Scholar Rock stock decline. The overall market sentiment was negatively impacted by several factors. Concerns over rising interest rates and persistent inflation dampened investor enthusiasm across various sectors, including biotechnology. This broader market weakness created a headwind for many stocks, including Scholar Rock. The negative sentiment was further exacerbated by anxieties surrounding potential economic slowdowns.

- Specific market index movements: The NASDAQ Biotechnology Index, a key benchmark for biotech companies, experienced a notable decline on Monday, reflecting the negative sentiment within the sector. This general downturn provided a negative backdrop for Scholar Rock's individual performance.

- Investor confidence levels: Data suggests a decrease in investor confidence across the board, particularly in growth stocks like those in the biotechnology sector. This reduced risk appetite likely contributed to the selling pressure on Scholar Rock's stock.

- News related to general market trends affecting biotech: Reports highlighting continued uncertainty in the economic forecast and the potential impact on healthcare spending likely contributed to the negative market sentiment impacting biotech stocks like Scholar Rock.

Scholar Rock Specific News and Announcements

While the broader market contributed to the Scholar Rock stock decline, company-specific news may have also played a role. It's crucial to examine whether any announcements or events surrounding Scholar Rock itself triggered the drop. Although no major negative press releases were issued on Monday, a careful review of the preceding days is necessary to identify potential contributing factors.

- Specific press releases or news articles: A thorough review of all press releases and news articles concerning Scholar Rock in the days leading up to Monday's decline is needed to identify any potential triggers. Any negative press, even seemingly minor, could contribute to investor concerns.

- Details of any clinical trial updates or regulatory decisions: Any updates concerning clinical trials, whether positive or negative, can significantly influence a biotech company's stock price. Setbacks or delays in trials could easily trigger a sell-off. Similarly, any regulatory hurdles or delays could further exacerbate the situation.

- Analysis of the company’s financial performance: Review of Scholar Rock's recent financial performance, including any unexpected changes or announcements, is crucial. Concerns about revenue growth, profitability, or unexpected expenses could also influence investor decisions.

Industry Trends and Competitive Landscape

The broader biotechnology industry landscape also influences individual company performance. Analyzing industry trends and the competitive landscape can provide further insight into the Scholar Rock stock decline. Increased competition, shifts in regulatory environments, or emerging technological advancements all play a role.

- Specific examples of competitor activity: The successes or failures of competitors within the same therapeutic area can directly impact investor perception and allocation of capital. A competitor's positive clinical trial results, for instance, might lead investors to shift their focus.

- Impact of regulatory changes on the biotech sector: New regulations or policy changes impacting the approval process for new drugs can create uncertainty within the industry, leading to volatility in stock prices.

- Analysis of emerging industry trends: Emerging trends like personalized medicine, gene editing, or immunotherapy can reshape the competitive landscape. Scholar Rock's position within these evolving trends needs to be carefully examined.

Analyst Ratings and Predictions

Analyst ratings and price targets often influence investor sentiment and trading activity. A review of post-decline analyst commentary helps gauge expert opinion on the Scholar Rock stock decline. Any significant downgrades or lowered price targets could intensify the sell-off.

- Specific analyst ratings and price targets: Identifying the specific ratings and price targets from key financial analysts provides a quantitative perspective on the market's view of Scholar Rock.

- Summary of analyst comments and rationale: Understanding the reasoning behind analyst ratings helps determine if the decline is justified by fundamental factors or driven primarily by market sentiment.

- Overall consensus view among analysts: The overall consensus view from analysts provides a comprehensive picture of expert sentiment towards Scholar Rock's future performance.

Conclusion: Understanding and Monitoring the Scholar Rock Stock Decline

The Scholar Rock stock decline on Monday was likely a confluence of factors. Broader market conditions, including concerns about inflation and interest rates, created a negative backdrop. Company-specific news, industry trends, and analyst sentiment all played a role. Understanding these interwoven factors is critical for informed investment decisions.

While short-term volatility is common in the stock market, the decline presents an opportunity to reassess the company's long-term prospects. Continue analyzing the Scholar Rock stock, monitor the Scholar Rock stock decline closely, and stay updated on the Scholar Rock stock performance for a comprehensive understanding of future developments. By carefully tracking news, financial reports, and analyst opinions, investors can make informed decisions about their investment in Scholar Rock.

Featured Posts

-

Ghas Stance On Jhl Privatisation A Detailed Analysis

May 08, 2025

Ghas Stance On Jhl Privatisation A Detailed Analysis

May 08, 2025 -

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025 -

A Look At Krypto In The Latest Superman Movie Footage

May 08, 2025

A Look At Krypto In The Latest Superman Movie Footage

May 08, 2025 -

Taca Guanabara Victoria Aplastante Del Flamengo Con Espectacular Gol De Arrascaeta

May 08, 2025

Taca Guanabara Victoria Aplastante Del Flamengo Con Espectacular Gol De Arrascaeta

May 08, 2025 -

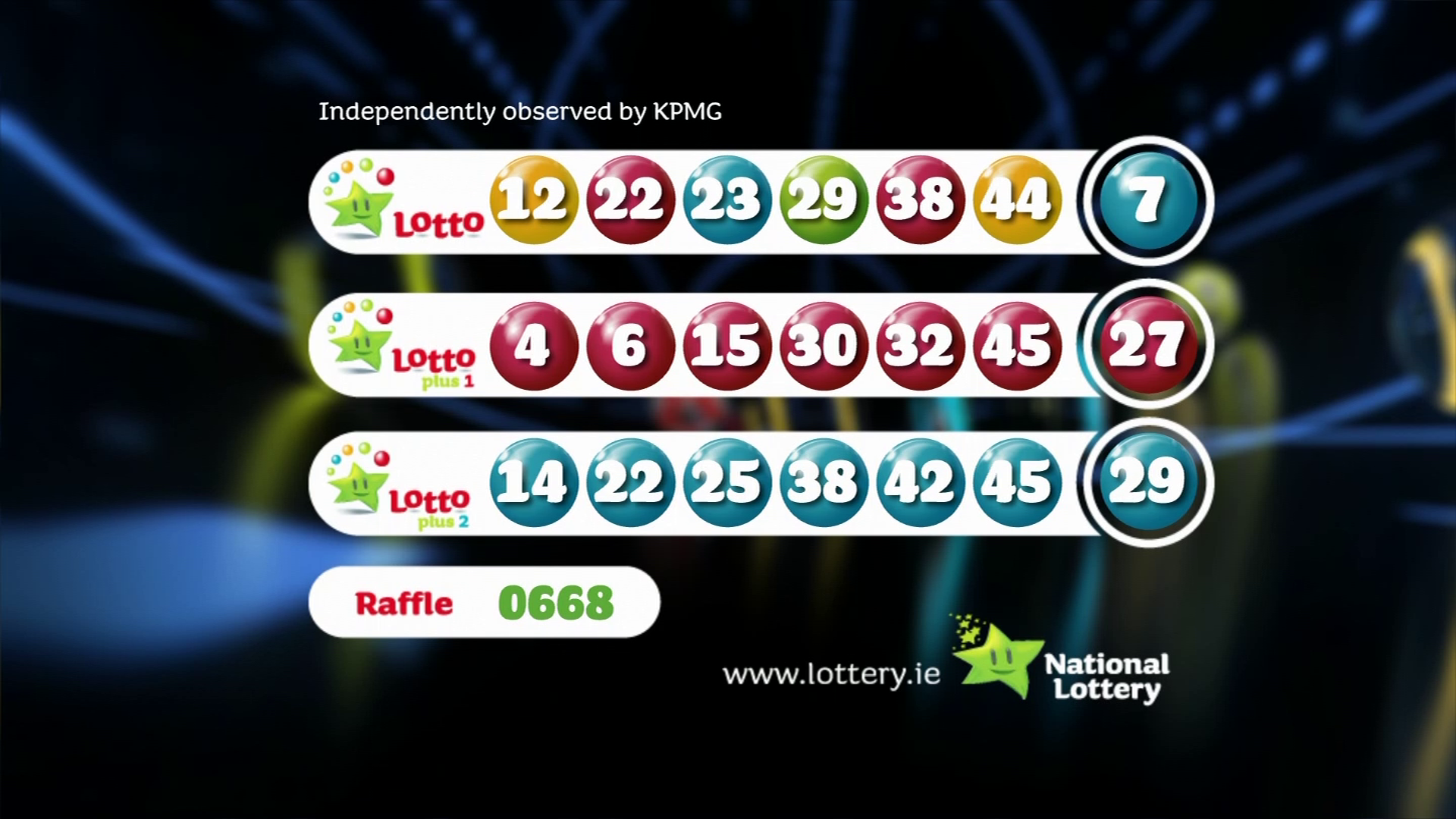

Lotto Results Saturday April 12th Check The Winning Numbers Now

May 08, 2025

Lotto Results Saturday April 12th Check The Winning Numbers Now

May 08, 2025