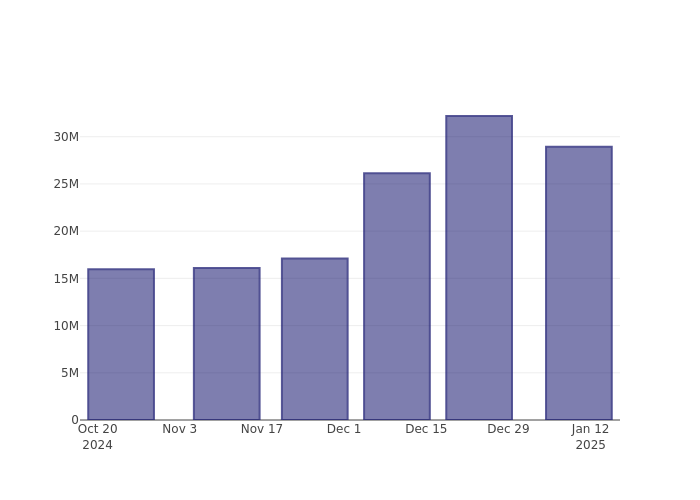

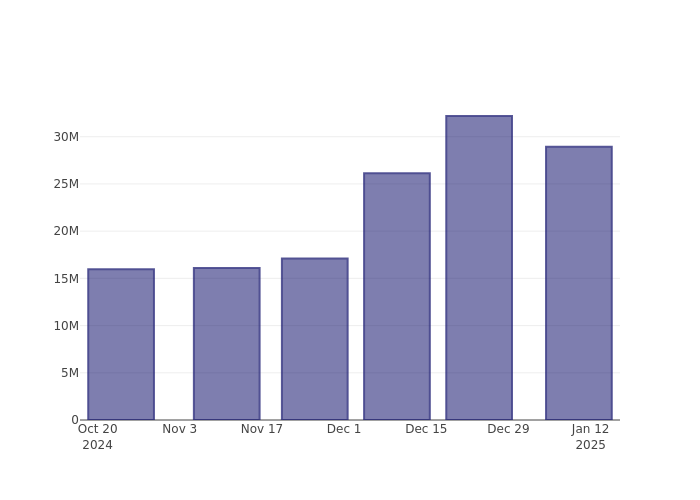

Analyzing The Sharp Drop In D-Wave Quantum Inc. (QBTS) Stock: 2025

Table of Contents

Market Sentiment and Investor Confidence

The sharp downturn in QBTS stock price reflects a significant shift in market sentiment and investor confidence. Several factors contributed to this negative perception.

Impact of Negative News and Analyst Reports

Negative press releases and downgraded ratings from financial analysts significantly impacted investor sentiment.

- Negative Q3 earnings report citing slower-than-expected adoption of quantum annealing technology: The release highlighted a substantial gap between projected growth and actual performance, raising concerns about the company's market penetration.

- Several prominent analysts downgraded QBTS to 'sell' or 'underperform': These actions amplified the negative narrative and triggered a wave of selling pressure among institutional investors.

- Concerns regarding the long-term viability of quantum annealing: Reports questioning the ultimate applicability and scalability of D-Wave's quantum annealing technology compared to other approaches further eroded investor confidence.

Competition in the Quantum Computing Market

The quantum computing market is rapidly evolving, with several competitors emerging with potentially superior technologies. This increased competition presents a major challenge for D-Wave.

- Increased competition from companies developing gate-based quantum computers: Gate-based quantum computing is considered by many to be a more versatile and scalable approach, posing a significant threat to D-Wave's quantum annealing technology.

- IBM's and Google's advancements in qubit technology overshadowing D-Wave's annealing approach: The significant progress made by these tech giants in qubit development and related technologies has shifted investor focus towards alternative quantum computing platforms.

- Aggressive marketing and strategic partnerships of competitors: The successful marketing and strategic partnerships formed by rival quantum computing companies have also contributed to the shifting market sentiment against D-Wave.

Overall Market Downturn and Tech Stock Corrections

The broader market conditions also played a role in the QBTS stock drop. A general downturn in the tech sector impacted even promising companies.

- Overall market correction leading to widespread selling pressure in the tech sector: The broader market sell-off affected high-growth tech stocks like QBTS, regardless of their individual performance.

- Rise in interest rates impacting investor appetite for high-growth tech stocks: Increased interest rates reduce the appeal of high-growth, yet less profitable, companies, impacting investor willingness to hold QBTS shares.

- Flight to safety among investors: During periods of economic uncertainty, investors tend to shift towards more stable investments, leading to a decline in speculative assets such as QBTS stock.

D-Wave's Business Performance and Financial Health

D-Wave's business performance and financial health directly impact investor confidence. A closer examination reveals several areas of concern.

Revenue Growth and Profitability

D-Wave's revenue growth and profitability have fallen short of expectations.

- Slower-than-anticipated growth in sales of quantum computing systems: The company's failure to meet projected sales targets indicates challenges in effectively commercializing its technology.

- Persistent operating losses impacting investor confidence: Continued operational losses raise concerns about the company's long-term financial sustainability and ability to achieve profitability.

- Dependence on government grants and research funding: Over-reliance on external funding sources rather than consistent commercial revenue contributes to investor uncertainty.

Research and Development Spending

Significant investment in research and development is crucial, but the return on investment remains a question mark.

- High R&D expenditure without commensurate revenue growth: While R&D is essential, the lack of substantial revenue growth raises questions about the efficiency and effectiveness of D-Wave's investment strategy.

- Concerns about the long-term return on R&D investments: Investors are demanding demonstrable progress and a clear path to profitability resulting from ongoing R&D efforts.

- Uncertainty regarding future funding for R&D: Securing continued funding for crucial research initiatives is a persistent challenge for D-Wave and impacts investor confidence.

Customer Acquisition and Adoption Rates

Slow customer acquisition and adoption rates hinder D-Wave's growth trajectory.

- Challenges in securing new customers and expanding the customer base: The company's struggle to attract new clients reflects difficulties in demonstrating the practical value and competitive advantage of its technology.

- Slow adoption of quantum annealing technology in various sectors: The limited adoption of quantum annealing across diverse industries highlights the need for wider technological validation and practical applications.

- Lack of demonstrable ROI for early adopters: A failure to effectively showcase a clear return on investment for early adopters inhibits wider market adoption and growth.

Technological Challenges and Limitations

D-Wave's reliance on quantum annealing presents technological challenges and limitations.

Limitations of Quantum Annealing Technology

Quantum annealing, while groundbreaking, has inherent limitations compared to gate-based quantum computing.

- Quantum annealing's limitations in solving certain types of problems: The technology is not universally applicable and struggles with certain classes of computational problems, limiting its potential use cases.

- Comparison with the potential of gate-based quantum computing for broader applications: Gate-based quantum computing offers greater flexibility and scalability, potentially eclipsing the capabilities of quantum annealing in the long term.

- Difficulty in integrating with existing classical computing infrastructure: The complexities of integrating quantum annealing systems with current computing architectures present a significant barrier to widespread adoption.

Scalability and Error Correction Issues

Scaling up the number of qubits and addressing errors remains a significant hurdle for D-Wave.

- Difficulty in scaling up the number of qubits while maintaining stability: Increasing the number of qubits while maintaining the system's stability and accuracy is a major technological challenge.

- Challenges in developing effective error correction techniques: Quantum computers are inherently susceptible to errors; developing robust error correction methods is crucial for reliable computation.

- Limitations in qubit coherence times: The short coherence times of D-Wave's qubits limit the duration and complexity of computations that can be performed reliably.

Conclusion

The sharp drop in D-Wave Quantum Inc. (QBTS) stock in 2025 is a multifaceted issue stemming from a confluence of market sentiment, competitive pressures, financial performance, and technological limitations. Understanding these interconnected factors is essential for investors to assess the long-term potential of QBTS and make informed decisions. Further research into D-Wave's strategic initiatives and technological advancements is recommended to better gauge the future trajectory of the QBTS stock price. Stay informed on the latest developments in the quantum computing industry and continue to analyze the D-Wave Quantum Inc. (QBTS) stock to make the best investment choices. Careful monitoring of QBTS stock performance and news related to quantum annealing technology is crucial for any investor considering this sector.

Featured Posts

-

I Dynami Toy Tampoy Erotas Fygi Kai Syllipsi Se Istorika Kai Sygxrona Keimena

May 20, 2025

I Dynami Toy Tampoy Erotas Fygi Kai Syllipsi Se Istorika Kai Sygxrona Keimena

May 20, 2025 -

Robert P Burke A Four Star Admirals Fall From Grace Due To Bribery

May 20, 2025

Robert P Burke A Four Star Admirals Fall From Grace Due To Bribery

May 20, 2025 -

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025 -

Chivas Regals Strategic Alliance With Charles Leclerc Brand Ambassadorship

May 20, 2025

Chivas Regals Strategic Alliance With Charles Leclerc Brand Ambassadorship

May 20, 2025 -

La Chanson De Louane Pour L Eurovision 2024

May 20, 2025

La Chanson De Louane Pour L Eurovision 2024

May 20, 2025