Analyzing Warren Buffett's Investment Portfolio: Hits And Misses

Table of Contents

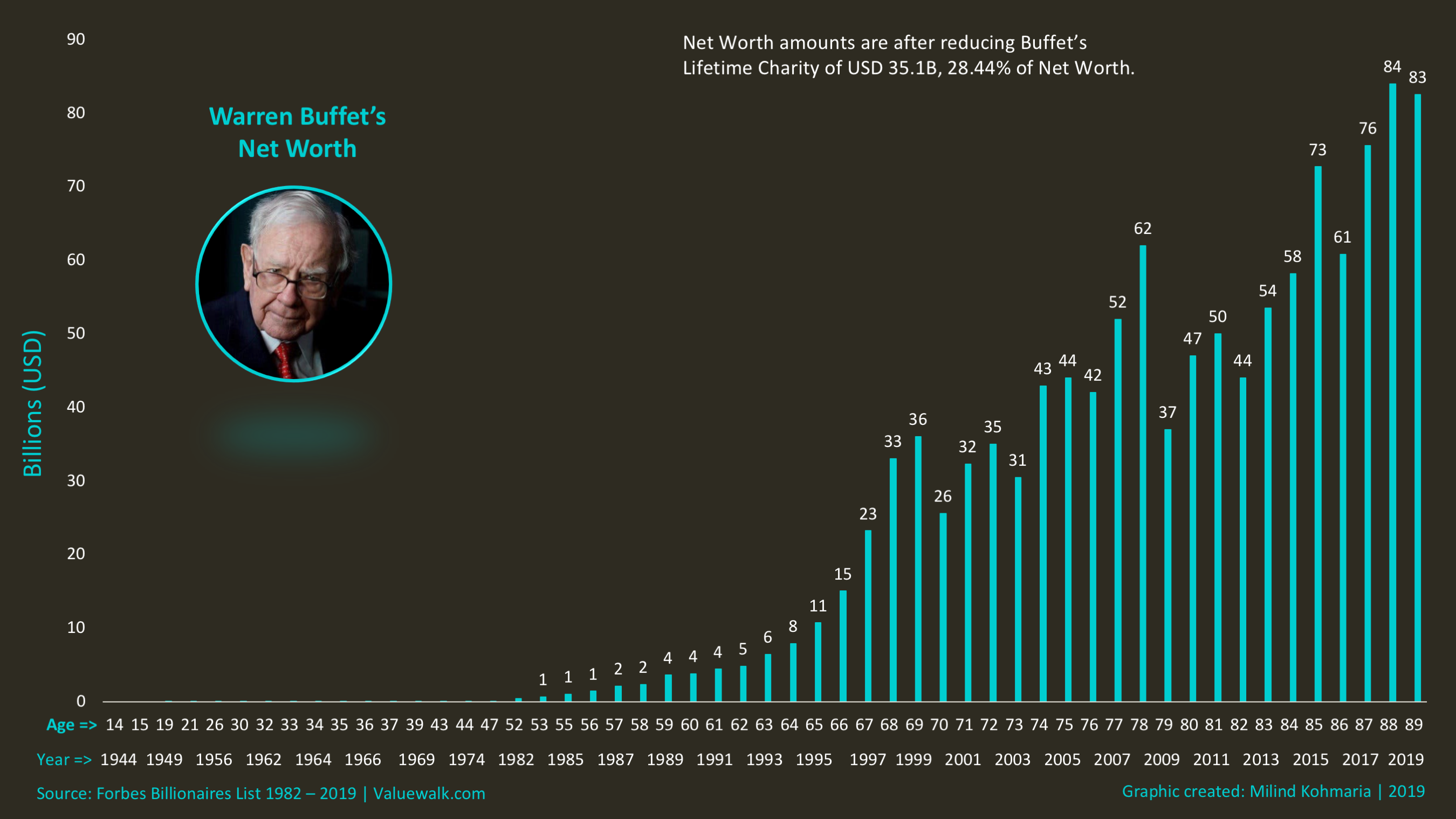

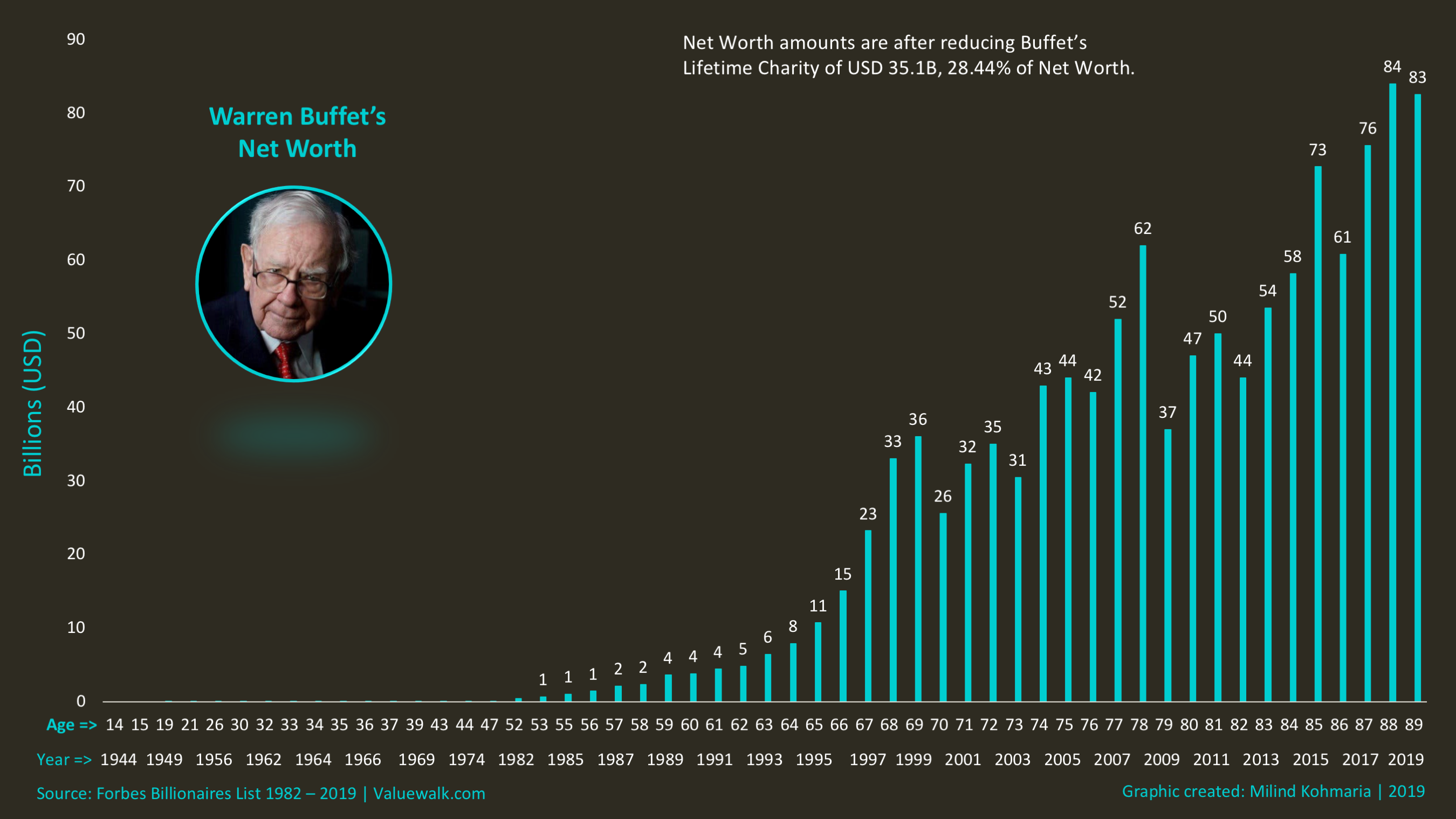

Warren Buffett, the Oracle of Omaha, is renowned for his exceptional investment prowess and long-term success. His investment portfolio, primarily managed through Berkshire Hathaway, serves as a gold standard case study for aspiring investors worldwide. This analysis delves into both the remarkable successes and the less-publicized misses within Buffett's portfolio, offering insights into his investment philosophy and decision-making process. We'll explore key holdings, strategic decisions, and lessons learned from both triumphs and failures, providing a comprehensive understanding of his investment strategy.

Warren Buffett's Winning Investments: A Look at Berkshire Hathaway's Biggest Successes

Buffett's success is built on a foundation of meticulous research, long-term vision, and a deep understanding of value investing. Let's examine some of his most successful investments:

The Coca-Cola Investment: A Masterclass in Long-Term Value Investing

- Initial Investment: In 1988, Berkshire Hathaway began acquiring Coca-Cola stock, eventually accumulating a significant stake.

- Long-Term Returns: This investment has generated enormous returns for Berkshire Hathaway over the decades, demonstrating the power of compounding and the rewards of holding exceptional businesses for the long haul.

- Dividend Reinvestment: Buffett has consistently reinvested Coca-Cola's dividends, further accelerating the growth of Berkshire's holdings.

- Strategic Fit: Coca-Cola's global brand recognition and consistent profitability align perfectly with Berkshire Hathaway's overall portfolio strategy of investing in high-quality, enduring businesses.

- The Power of Compounding: The Coca-Cola investment exemplifies the magic of compounding returns, showcasing how consistent growth over time can lead to extraordinary wealth creation.

The Coca-Cola investment stands as a testament to Buffett's patience and long-term perspective. He recognized the inherent value in a strong brand and a consistent business model, holding onto the investment despite market fluctuations and reaping substantial rewards over decades.

American Express: A Value Investing Triumph

- Investment Timing: Buffett invested heavily in American Express after the Salad Oil scandal in the 1960s, when the company’s stock price plummeted due to negative market sentiment.

- Recovery from Crisis: He recognized the underlying strength of the American Express business and its ability to recover from the crisis, capitalizing on the temporary undervaluation.

- Long-Term Value Creation: The investment proved remarkably successful as American Express rebounded and experienced significant long-term growth.

- Return on Investment: The returns on this investment were substantial, further solidifying Buffett's reputation as a masterful value investor.

- Buffett's Assessment of Management Quality: A key factor in his decision was his assessment of the quality of American Express' management team.

This investment highlights Buffett's ability to identify undervalued assets and capitalize on market mispricing, a hallmark of his value investing approach.

Apple Inc.: A Diversification into Technology

- Rationale Behind the Investment: Buffett's investment in Apple marked a significant diversification into the technology sector, showing his adaptability to evolving market dynamics.

- Growth Potential: He recognized Apple's strong brand, loyal customer base, and substantial growth potential within the technology landscape.

- Apple's Brand and Customer Loyalty: The strength and loyalty of Apple’s customer base contributed to a high degree of predictability in future revenues.

- Synergies with Berkshire's Other Holdings: While not explicitly synergistic with other holdings, Apple’s financial strength provided a stable and high-return asset in Berkshire’s portfolio.

This investment showcased Buffett's willingness to adapt his investment strategy to capitalize on new opportunities while maintaining his core value investing principles.

Analyzing Warren Buffett's Investment Misses: Lessons Learned from Setbacks

Even the Oracle of Omaha isn't immune to investment setbacks. Analyzing these failures offers valuable lessons for all investors.

The Dexter Shoe Company Acquisition: A Case of Misjudgment

- Reasons for the Acquisition: Berkshire Hathaway acquired Dexter Shoe Company, believing it possessed the potential for significant growth.

- Factors Leading to Underperformance: Several factors, including increased competition and changing market dynamics, contributed to Dexter's underperformance.

- Impact on Berkshire Hathaway's Portfolio: The acquisition ultimately resulted in a loss for Berkshire Hathaway, demonstrating that even well-researched investments can fail.

- Lessons Learned: This experience underscores the importance of thorough due diligence, recognizing market shifts, and accepting losses as part of the investment process.

The Dexter Shoe acquisition serves as a reminder that even the most experienced investors make mistakes and that rigorous analysis is crucial.

Other Notable Investment Challenges

- Some energy sector investments and specific stock picks have underperformed, highlighting the importance of diversification and the inherent risks in any investment.

Acknowledging these setbacks is crucial. They highlight the importance of continuous learning and adaptation within the dynamic world of investing.

The Importance of Long-Term Perspective and Patience

- Even investments that initially appear to be failures can eventually turn profitable over a longer timeframe, emphasizing patience in the investment process.

This is a fundamental principle of value investing, and a key takeaway from analyzing Warren Buffett’s investment portfolio.

Key Takeaways and Investment Strategies from Buffett's Portfolio

Analyzing Warren Buffett's investment portfolio reveals several key strategies:

Value Investing Principles:

Buffett’s success is deeply rooted in value investing, focusing on identifying companies trading below their intrinsic value.

The Importance of Due Diligence:

Thorough research, understanding a company's financials, and assessing its management team are crucial before making any investment.

Long-Term Vision:

Maintaining a long-term perspective and resisting the urge to react to short-term market volatility is essential for long-term success.

Understanding Risk Management:

Diversification across various sectors and understanding your own risk tolerance are key components of successful investing.

Conclusion

Analyzing Warren Buffett's investment portfolio reveals a compelling blend of remarkable successes and insightful lessons learned from setbacks. His enduring success stems not only from astute stock picking but also from a deep understanding of value investing principles, a long-term perspective, and the ability to learn from both triumphs and failures. By studying both his winning investments and his misses, aspiring investors can gain valuable insights into effective portfolio management and long-term wealth creation. Continue to learn from analyzing Warren Buffett's investment portfolio and refining your own investment strategy accordingly.

Featured Posts

-

Almlk Tsharlz W Eshqh Llmwsyqa Aktshafat Mthyrt

May 06, 2025

Almlk Tsharlz W Eshqh Llmwsyqa Aktshafat Mthyrt

May 06, 2025 -

Betting On The Los Angeles Wildfires A Societal Commentary

May 06, 2025

Betting On The Los Angeles Wildfires A Societal Commentary

May 06, 2025 -

Compstons Latest Thriller Highs And Lows Of A Promising Premise

May 06, 2025

Compstons Latest Thriller Highs And Lows Of A Promising Premise

May 06, 2025 -

Met Gala Guest List Leak Whos In And Whos Out

May 06, 2025

Met Gala Guest List Leak Whos In And Whos Out

May 06, 2025 -

Priyanka Chopras Mother Shares Her Daughters Struggles In Bollywood

May 06, 2025

Priyanka Chopras Mother Shares Her Daughters Struggles In Bollywood

May 06, 2025