Apple Q2 Earnings Preview: Stock Price Under Pressure

Table of Contents

Weakening iPhone Sales and Supply Chain Concerns

The performance of iPhone sales is paramount to Apple's overall financial health. Keywords like "iPhone sales," "supply chain disruption," "component shortages," and "production costs" are all key factors to consider when predicting Apple Q2 earnings.

-

Potential Slowdown in iPhone Sales: Compared to previous quarters, analysts predict a potential slowdown in iPhone sales. This could be attributed to several factors, including saturated markets in some regions and increased competition. The sales figures for the iPhone 14 series, particularly the base models, will be closely scrutinized.

-

Supply Chain Disruptions: Ongoing supply chain disruptions and potential component shortages remain a concern. Geopolitical instability and manufacturing challenges in key regions could impact production and the availability of iPhones, leading to lower-than-expected sales figures. This could directly affect Apple's Q2 earnings and its stock price.

-

Rising Component Costs: The increasing cost of crucial components for iPhone manufacturing is squeezing profit margins. This is a significant challenge for Apple, as higher production costs can impact the pricing strategy and overall profitability of its devices. Balancing production costs with consumer pricing remains a delicate act.

-

Recent News and Analyst Predictions: Several reputable financial analysts have voiced concerns regarding a potential decline in iPhone demand, citing a combination of economic uncertainty and a longer-than-expected product lifecycle for existing models. These predictions will undoubtedly influence investor sentiment surrounding Apple Q2 earnings.

Services Revenue Growth and its Importance

While iPhone sales remain a critical revenue driver, the growth of Apple's Services segment is increasingly important for long-term stability. Keywords like "Apple Services," "App Store revenue," "iCloud," "Apple Music," "subscription revenue," and "recurring revenue" highlight this increasingly important segment.

-

Growth Trajectory of Apple Services: Apple's Services segment, encompassing the App Store, iCloud, Apple Music, Apple TV+, and other subscription services, is expected to continue its growth trajectory. However, the rate of growth will be closely monitored, as any slowdown could signal wider market issues.

-

Recurring Revenue Streams: The significance of recurring revenue streams for long-term stability cannot be overstated. The predictability of subscription income provides a buffer against fluctuations in product sales, making Apple's business model more resilient.

-

Individual Service Performance: The performance of individual services within the Apple Services ecosystem will be analyzed. The App Store's revenue, for example, is closely tied to the overall health of the mobile app market. Similarly, iCloud's subscriber base and Apple Music's user growth will be key indicators.

-

New Services and Initiatives: Any new services launched or significant initiatives undertaken within the Apple Services segment will be evaluated for their potential impact on revenue and future growth.

Overall Market Sentiment and Macroeconomic Factors

The broader macroeconomic environment significantly influences Apple's performance and investor sentiment. Keywords like "macroeconomic conditions," "inflation," "interest rates," "consumer spending," "tech stock market," and "investor confidence" are highly relevant here.

-

Impact of Macroeconomic Conditions: The current macroeconomic climate, marked by inflation and potentially rising interest rates, could dampen consumer spending on discretionary items like iPhones and other Apple products. This is a key factor in assessing the potential for Apple Q2 earnings to meet or exceed expectations.

-

Influence of Interest Rates and Inflation: Rising interest rates directly impact investor sentiment, potentially leading to a reassessment of valuations for tech stocks like Apple. Inflation also influences consumer behavior and purchasing power, which affects demand for Apple products.

-

Tech Stock Market Performance: The overall performance of the tech stock market is inextricably linked to Apple's stock price. If the broader tech sector experiences a downturn, Apple is likely to be affected, regardless of its individual performance.

-

Geopolitical Factors: Geopolitical factors, such as trade tensions or international conflicts, could impact Apple's supply chains, manufacturing processes, and overall market access, potentially affecting Apple Q2 earnings.

Analyst Predictions and Stock Price Targets

Analyst predictions and stock price targets provide valuable insights into market expectations regarding Apple's Q2 earnings. Keywords such as "Apple stock forecast," "price target," "analyst ratings," "buy sell hold rating," and "stock market prediction" are crucial in this section.

-

Consensus Among Analysts: A summary of the consensus among financial analysts regarding Apple's Q2 earnings is essential. This includes their projections for revenue, earnings per share (EPS), and overall financial performance.

-

Specific Price Targets: Major financial institutions often set price targets for Apple stock, reflecting their individual assessments of the company's future performance and valuation.

-

Buy, Sell, and Hold Ratings: Analyst ratings, which categorize stock recommendations as buy, sell, or hold, provide a snapshot of market sentiment and can influence investor decisions. A table summarizing these ratings and associated price targets from different analysts would be beneficial. (A table would be inserted here in the actual article).

Conclusion

Several key factors will influence Apple's Q2 earnings and subsequent impact on its stock price. Weakening iPhone sales, supply chain issues, and macroeconomic conditions all present challenges. However, the continued growth of Apple Services revenue provides a degree of resilience. Monitoring these elements, along with analyst predictions, is crucial for understanding the complete picture.

Call to Action: Stay tuned for our post-earnings analysis of Apple's Q2 results to gain a complete understanding of the financial performance and what it means for the future of Apple stock. Keep up-to-date on the latest developments regarding Apple Q2 earnings and its stock price fluctuations. Understanding Apple Q2 earnings is vital for informed investment decisions.

Featured Posts

-

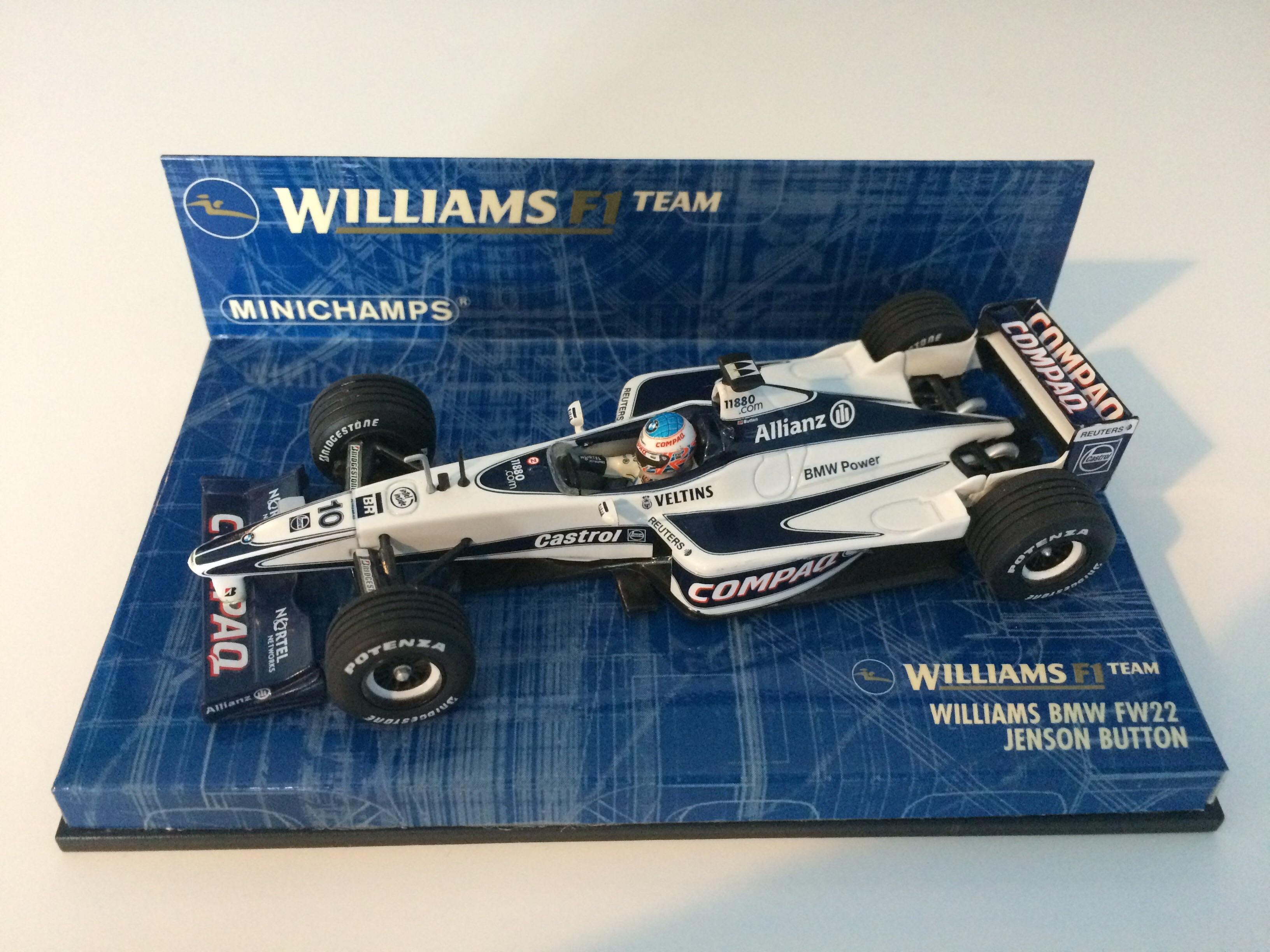

Jenson Fw 22 Extended A Deep Dive

May 25, 2025

Jenson Fw 22 Extended A Deep Dive

May 25, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6th Witness Tells All This Fall

May 25, 2025

Cassidy Hutchinsons Memoir Key Jan 6th Witness Tells All This Fall

May 25, 2025 -

Bakhreinska Gran Pri Mertsedes So Kazni Za Tekhnichki Prekrshotsi

May 25, 2025

Bakhreinska Gran Pri Mertsedes So Kazni Za Tekhnichki Prekrshotsi

May 25, 2025 -

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 25, 2025

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 25, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Story

May 25, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Story

May 25, 2025