Apple Stock: A $254 Prediction – Investment Strategy And Risks

Table of Contents

Factors Contributing to the $254 Apple Stock Prediction

Several factors contribute to the optimistic $254 Apple stock price prediction. Understanding these is crucial for assessing the investment's viability.

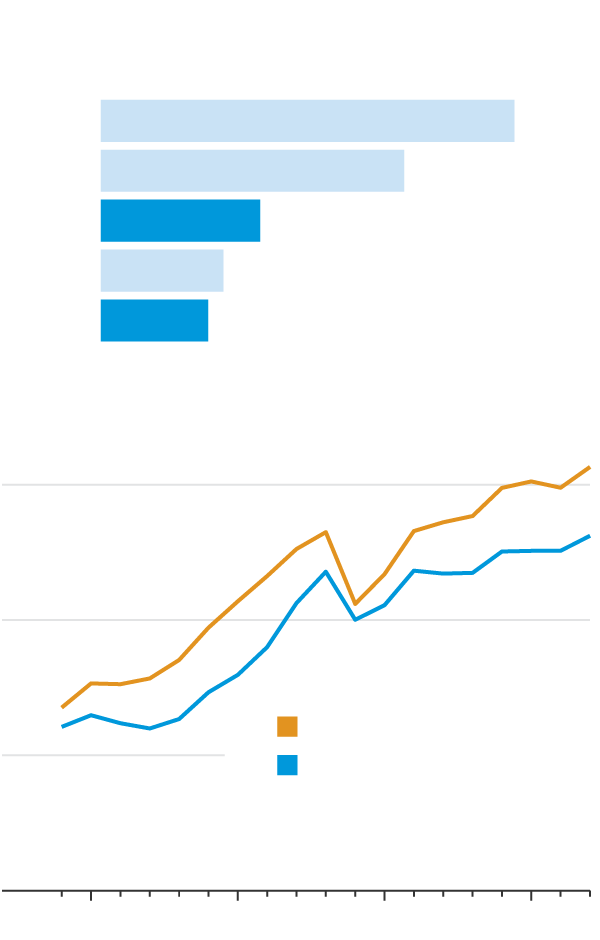

Strong Financial Performance & Growth

Apple's consistent revenue growth is a cornerstone of this prediction. This growth is fueled by several key drivers:

- Robust iPhone Sales: Despite market saturation concerns, iPhone sales continue to generate significant revenue, demonstrating the enduring appeal of the brand and its ecosystem.

- Booming Services Revenue: Apple's services segment, including Apple Music, iCloud, and the App Store, showcases impressive growth and high profit margins, diversifying its revenue streams.

- Wearables Success: The Apple Watch and AirPods have become incredibly popular, contributing substantially to overall revenue and demonstrating Apple's success in expanding into new product categories.

- Expansion into New Markets: Apple continues to penetrate emerging markets globally, unlocking significant growth potential. Furthermore, exploring new product categories like augmented reality (AR) and electric vehicles (EVs) promises long-term growth. The potential Apple car, for example, is a significant factor driving investor enthusiasm.

These factors contribute to Apple's high profit margins and robust cash flow, providing a strong foundation for future growth and stock price appreciation. Analyzing Apple revenue, profit, and growth figures is essential for any potential investor.

Innovation and Product Pipeline

Apple's reputation for innovation is a major driver of its stock price. The company consistently releases new products and features that keep consumers engaged and excited:

- iPhone Updates: Annual iPhone releases with significant improvements in technology and features maintain strong consumer demand.

- Apple Watch Advancements: The Apple Watch's continuous evolution, with improvements in health monitoring and fitness tracking, broadens its appeal.

- Disruptive Technologies: The potential for Apple to become a major player in AR/VR and the autonomous vehicle market presents significant long-term growth opportunities. The ongoing development of Apple's AR/VR headset and its rumored electric vehicle initiatives signal its commitment to innovation and future market dominance.

This continuous innovation and strong brand loyalty contribute significantly to the bullish Apple stock price prediction.

Market Sentiment and Investor Confidence

Positive market sentiment and strong investor confidence in Apple are crucial elements in the $254 prediction:

- Leading Tech Company Status: Apple's position as a leading technology company inspires confidence among investors.

- Strong Institutional Ownership: Large institutional investors hold substantial shares of Apple stock, indicating strong belief in its long-term prospects.

- High Analyst Ratings: Many financial analysts rate Apple stock highly, further reinforcing positive investor sentiment.

- Economic Resilience: Apple has demonstrated a remarkable ability to weather economic downturns, offering investors a degree of stability.

The combination of positive investor sentiment and strong institutional backing contributes significantly to the sustained demand for Apple stock. Analyzing Apple investor sentiment and Apple stock ratings from various sources is key to understanding the market's perception.

Investment Strategy for Apple Stock

Investing in Apple stock requires a well-defined strategy to mitigate risk and maximize potential returns.

Determining Your Risk Tolerance

Before investing, carefully assess your risk tolerance:

- Investment Goals: Define your financial goals and the timeframe you have to achieve them (short-term, mid-term, or long-term).

- Portfolio Diversification: Consider your overall investment portfolio and whether Apple stock aligns with your diversification strategy. Avoid putting all your eggs in one basket.

- Tech Stock Volatility: Understand that tech stocks, including Apple, can experience significant price fluctuations.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy that mitigates risk:

- Regular Investments: Invest a fixed amount of money at regular intervals (e.g., monthly or quarterly), regardless of the stock price.

- Risk Reduction: This approach reduces the risk of investing a lump sum at a market peak.

Long-Term Holding Strategy

A long-term holding strategy leverages Apple's growth potential:

- Long-Term Perspective: Invest with a long-term perspective, aiming to benefit from Apple's sustained growth over many years.

- Weathering Volatility: Be prepared to withstand short-term market fluctuations and maintain your investment through periods of volatility.

Risks Associated with Investing in Apple Stock

Despite the optimistic outlook, several risks are associated with investing in Apple stock:

Market Volatility and Economic Downturns

Tech stocks are particularly vulnerable to economic downturns:

- Economic Sensitivity: Apple's stock price can be significantly impacted by broader economic conditions and global uncertainty.

- Geopolitical Factors: Geopolitical events and international tensions can influence investor sentiment and stock prices.

Competition and Technological Disruption

Apple faces intense competition:

- Competitive Landscape: Companies like Samsung and Google pose significant competition in various technology sectors.

- Technological Disruption: The risk exists that new technologies could render Apple's current products obsolete.

Overvaluation Concerns

The $254 prediction might reflect overvaluation:

- Valuation Analysis: Carefully analyze Apple's valuation metrics (e.g., Price-to-Earnings ratio) to determine if the predicted price is justified.

- Future Growth: Assess whether Apple's future growth potential supports the predicted price target.

Conclusion

The $254 Apple stock price prediction represents both exciting opportunities and considerable risks. Apple's strong financial performance, innovative product pipeline, and positive investor sentiment are attractive features. However, investors must carefully consider market volatility, intense competition, and the potential for overvaluation. A well-defined investment strategy, including a thorough risk assessment and a suitable time horizon, is crucial before investing in Apple stock. Remember to conduct thorough research and, if necessary, consult a financial advisor before making any investment decisions. Start your Apple stock investment journey today with informed decision-making.

Featured Posts

-

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025

90 Let Sergeyu Yurskomu Pamyat O Genii Paradoksov

May 24, 2025 -

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025 -

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025

Relx Sterke Financiele Resultaten Ondanks Economische Uitdagingen Dankzij Ai

May 24, 2025

Latest Posts

-

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025 -

Sam Altmans Exclusive Project With Jony Ive An Inside Look

May 24, 2025

Sam Altmans Exclusive Project With Jony Ive An Inside Look

May 24, 2025 -

Universals 7 Billion Theme Park A Detailed Look At The Disney Competition

May 24, 2025

Universals 7 Billion Theme Park A Detailed Look At The Disney Competition

May 24, 2025 -

Exclusive Look Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025

Exclusive Look Sam Altman And Jony Ives Top Secret Device Development

May 24, 2025 -

Open Ais Future Sam Altmans Exclusive Collaboration With Jony Ive On A New Device

May 24, 2025

Open Ais Future Sam Altmans Exclusive Collaboration With Jony Ive On A New Device

May 24, 2025