Apple Stock: A $254 Target – Time To Invest At $200?

Table of Contents

Analyzing Apple's Current Market Position

Strong Fundamentals

Apple boasts consistently strong financials, making it an attractive investment for many. Its profitability and revenue growth remain impressive, driven by several key factors:

- Robust iPhone Sales: Despite market saturation concerns, iPhone sales continue to be a significant revenue driver for Apple. Recent models have incorporated innovative features, maintaining consumer demand.

- Booming Services Sector: Apple's services segment, including Apple Music, iCloud, Apple TV+, and Apple Arcade, is experiencing exponential growth, providing a recurring revenue stream and diversifying its income sources. This segment's performance is increasingly vital to Apple's overall financial health.

- Wearables Market Dominance: The Apple Watch and AirPods have established Apple as a leader in the wearables market. This segment continues to expand, adding a substantial contribution to Apple's overall revenue and profitability.

The following data points highlight Apple's financial strength:

- [Insert Q[Number] Earnings Data: e.g., Q4 2023 Revenue, Net Income, Earnings Per Share]. These figures demonstrate Apple's continued ability to generate significant profits.

- [Insert Market Share Data for iPhones and Wearables: e.g., Global smartphone market share, smartwatch market share]. This data underscores Apple's dominance in key product categories.

These strong fundamentals, reflected in robust Apple financials and strong market share in key product categories, form a solid base for future growth and increased Apple stock price.

Competitive Landscape

While Apple enjoys a dominant position, it faces competition from tech giants like Samsung and Google.

- Samsung: A major competitor in the smartphone and consumer electronics markets, Samsung often offers comparable technology at competitive prices.

- Google: Google's Android operating system powers a vast majority of smartphones globally, creating a strong competitive ecosystem.

However, Apple maintains several key competitive advantages:

- Brand Loyalty: Apple enjoys unparalleled brand loyalty, fostering customer retention and repeat purchases.

- Integrated Ecosystem: The seamless integration of Apple devices and services creates a powerful ecosystem that encourages customer lock-in.

- Innovation: Apple's history of innovation consistently delivers cutting-edge products and services, maintaining its competitive edge.

Despite these advantages, potential threats remain, including increasing competition in emerging markets and the potential for disruptive technologies to emerge. Maintaining its innovative edge and adapting to changing consumer preferences will be crucial for Apple to retain its market dominance.

Factors Influencing the $254 Price Target

Analyst Predictions and Rationale

Several reputable analysts predict an Apple stock price increase to $254. Their rationale often centers on:

- New Product Launches: Anticipated product launches, such as new iPhones, Macs, and other devices, are expected to drive sales growth.

- Market Expansion: Expanding into new markets and further penetrating existing ones are key growth drivers cited by analysts.

- Technological Advancements: Apple's continued investment in research and development points to technological breakthroughs that could significantly enhance product appeal and drive revenue growth.

However, it’s important to note that these predictions carry inherent risks:

- Unforeseen Events: Geopolitical instability, supply chain disruptions, or unexpected economic downturns could impact Apple's performance.

- Competitive Pressures: Increased competition and the emergence of disruptive technologies could negatively affect Apple's market share.

Macroeconomic Conditions and Market Sentiment

Broader economic factors significantly influence Apple's stock price:

- Interest Rates: Rising interest rates can impact investor sentiment and potentially reduce investment in growth stocks like Apple.

- Inflation: High inflation can reduce consumer spending, potentially affecting demand for Apple products.

- Recession Risks: The risk of a recession can negatively impact investor confidence and decrease Apple's stock valuation.

The overall market sentiment towards tech stocks also plays a crucial role. Positive sentiment can boost Apple's stock price, while negative sentiment can have the opposite effect. Monitoring these factors is critical for evaluating Apple stock's potential.

Risk Assessment and Investment Strategy

Potential Risks

Investing in Apple stock, even at $200, carries inherent risks:

- Market Volatility: Stock markets are inherently volatile, and Apple's stock price can fluctuate significantly.

- Target Price Uncertainty: The $254 target may not be reached, and the stock price could remain stagnant or even decline.

- Overvaluation: Apple's stock could be overvalued at the current price, leading to potential losses.

Understanding these risks is crucial for making informed investment decisions.

Diversification and Investment Timeline

Diversification is paramount in any investment strategy. Don't put all your eggs in one basket. Investing in Apple should be part of a broader, diversified portfolio to mitigate risk.

A long-term investment strategy is generally recommended for Apple stock. Apple has a proven track record of long-term growth, and a longer time horizon allows for weathering short-term market fluctuations.

Finally, your personal risk tolerance must be considered. Only invest an amount you are comfortable potentially losing.

Conclusion

Apple stock, currently trading around $200, presents a potentially attractive investment opportunity given the $254 price target predicted by some analysts. However, before investing in Apple stock, it's crucial to thoroughly analyze its current market position, understand the factors driving the price target, and carefully assess the inherent risks. Remember to diversify your portfolio and consider your personal investment timeline and risk tolerance. Is $200 the right entry point for you? Only careful research and consideration of your individual financial situation will help you decide whether to invest in Apple stock now. Do your due diligence and make an informed decision about your Apple stock investment.

Featured Posts

-

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 25, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 25, 2025 -

Investigating The Hells Angels A Look At Their Operations

May 25, 2025

Investigating The Hells Angels A Look At Their Operations

May 25, 2025 -

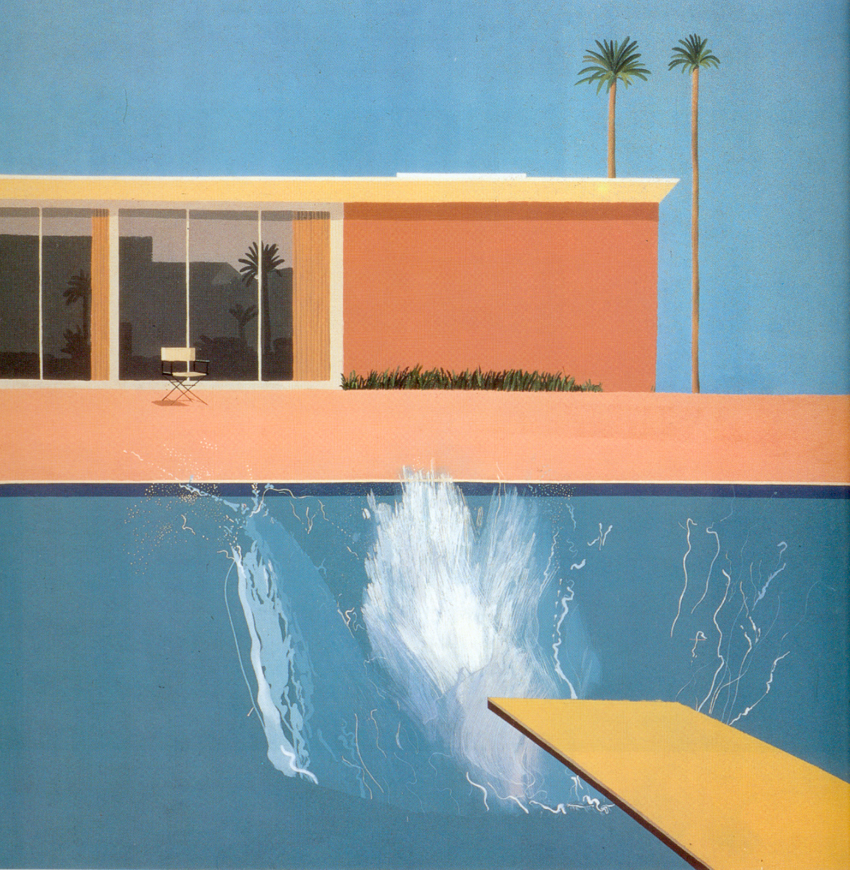

David Hockney A Bigger Picture Analyzing The Artists Techniques And Themes

May 25, 2025

David Hockney A Bigger Picture Analyzing The Artists Techniques And Themes

May 25, 2025 -

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025 -

Analysis European Stock Market Performance Amidst Tariff Uncertainty And Lvmh Slump

May 25, 2025

Analysis European Stock Market Performance Amidst Tariff Uncertainty And Lvmh Slump

May 25, 2025