Apple Stock (AAPL) Price Prediction: Key Levels And Support/Resistance

Table of Contents

Understanding Support and Resistance Levels in AAPL Stock

Support and resistance levels are crucial concepts in technical analysis used to predict potential price movements. Understanding these levels is key to forecasting the future price of Apple stock (AAPL). They represent price areas where buying or selling pressure is expected to be strong, leading to price reversals or consolidations.

-

Definition of support level (price floor): A support level is a price point where buying pressure is anticipated to be strong enough to prevent a further price decline. Think of it as a price floor. When the price reaches this level, buyers often step in, pushing the price back up.

-

Definition of resistance level (price ceiling): A resistance level is a price point where selling pressure is expected to be strong enough to prevent a further price increase. This acts as a price ceiling. When the price reaches this level, sellers often emerge, pushing the price back down.

-

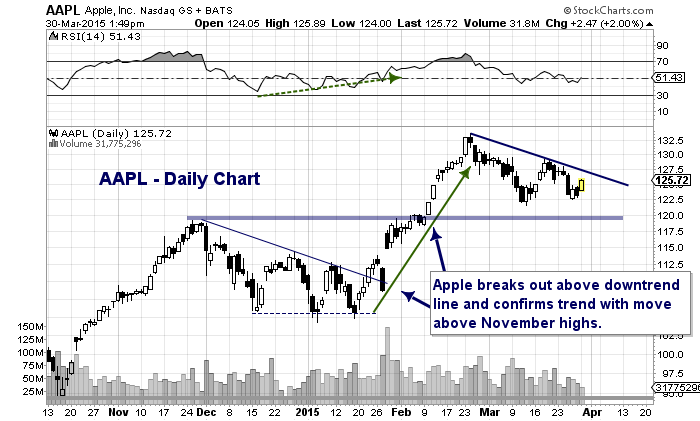

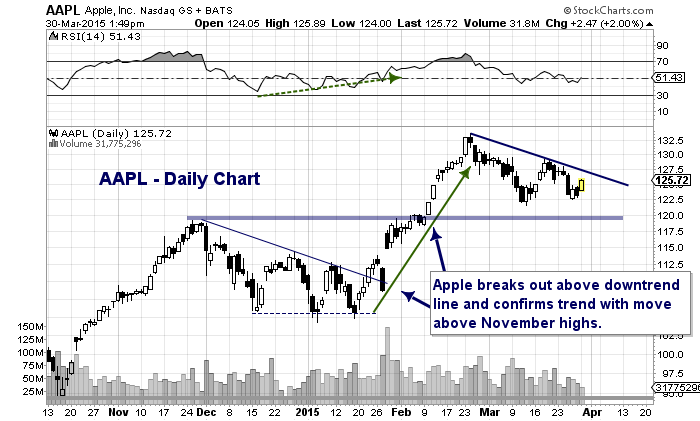

How these levels are identified on price charts: Support and resistance levels can be identified on price charts using various techniques, including moving averages, trendlines, and chart patterns like head and shoulders or double tops/bottoms. The AAPL stock price chart reveals these patterns over time.

-

Importance of volume confirmation at support and resistance levels: The volume of trading at support and resistance levels is crucial. High volume confirms the strength of these levels, while low volume suggests weaker support or resistance. Analyzing volume alongside price action provides a more comprehensive understanding of AAPL support levels and AAPL resistance levels. This technical analysis is key to identifying reliable support and resistance areas.

Current Market Analysis and Apple's Financial Performance

Analyzing Apple's financial performance and the broader market context is crucial for predicting AAPL's future price. Current market conditions, including overall market sentiment, interest rates, and inflation, significantly impact investor behavior and stock valuations.

-

Recent earnings reports and their impact on stock price: Apple's recent earnings reports have generally been positive, boosting investor confidence and driving up the stock price. However, any unexpected downturn in earnings could significantly impact the AAPL stock price.

-

Key financial metrics (e.g., EPS, revenue growth): Analyzing key financial metrics like Earnings Per Share (EPS) and revenue growth provides insight into Apple's financial health and future growth prospects. Consistent strong performance in these metrics usually supports a bullish outlook for AAPL.

-

Analysis of product launches and their market reception: New product launches, such as the iPhone and Apple Watch, are key drivers of Apple's revenue. The market reception of these products significantly influences investor sentiment and AAPL's stock price.

-

Discussion of competitive landscape and potential threats: The competitive landscape, including competition from Android devices and other tech companies, presents potential threats to Apple's market share and future growth. Analyzing competitive pressures is crucial when assessing AAPL financials.

Identifying Key Support and Resistance Levels for AAPL

Identifying key support and resistance levels for AAPL requires careful analysis of the Apple stock price chart. Several price points can be identified as potential support and resistance zones based on past price action and technical indicators. (Note: This section would ideally include charts illustrating these levels)

-

Short-term support and resistance levels (e.g., based on recent price action): Based on recent price action, short-term support might be found around [insert specific price level], while resistance could be seen around [insert specific price level]. These levels are subject to change based on market volatility.

-

Mid-term support and resistance levels (e.g., based on longer-term trends): Looking at longer-term trends, mid-term support may be located around [insert specific price level], and resistance around [insert specific price level]. These levels provide a more stable benchmark for AAPL price targets.

-

Potential breakout levels and their implications for the stock price: Breakouts above resistance levels suggest a bullish trend, while breakouts below support levels could indicate a bearish trend. Careful observation of volume during these breakouts is crucial. Technical indicators, like moving averages and Fibonacci retracement, can help identify potential breakout levels.

AAPL Price Prediction Scenarios

Based on the analysis above, we can outline several price prediction scenarios for AAPL stock:

-

Bullish scenario and conditions needed for it to materialize: A bullish scenario assumes sustained strong financial performance, positive market sentiment, and successful new product launches. This could lead to AAPL surpassing resistance levels and reaching price targets of [insert specific price level].

-

Bearish scenario and potential catalysts: A bearish scenario might arise from disappointing earnings, negative market sentiment, or increased competition. This could push the AAPL price below support levels, reaching price targets of [insert specific price level].

-

Neutral scenario and factors maintaining the status quo: A neutral scenario anticipates sideways price movement within a defined range, bounded by identified support and resistance levels. This scenario could prevail if market conditions remain relatively stable. This AAPL price prediction 2024 (or longer-term) scenario assumes no significant catalysts, either positive or negative.

Conclusion

Predicting the Apple stock (AAPL) price accurately is challenging, but analyzing support and resistance levels, combined with a thorough understanding of Apple's financial performance and the overall market context, significantly improves the chances of making an informed investment decision. Remember, investing in the stock market involves risk. This analysis provides insights into potential price movements of Apple Stock (AAPL), but it's not a guarantee. We've outlined short-term AAPL forecasts and a longer-term Apple stock outlook, but remember that these are just potential scenarios. Conduct your own thorough research and consider consulting a financial advisor before making any investment decisions related to Apple Stock (AAPL) or any other security. Stay informed about Apple Stock (AAPL) price movements and key levels to make well-informed investment choices.

Featured Posts

-

Hsv Aufstieg Zurueck In Der Bundesliga Die Party Beginnt

May 25, 2025

Hsv Aufstieg Zurueck In Der Bundesliga Die Party Beginnt

May 25, 2025 -

Wta Italian Open Chinese Player Through To Quarterfinals

May 25, 2025

Wta Italian Open Chinese Player Through To Quarterfinals

May 25, 2025 -

Laurent Baffie Thierry Ardisson Defend Ses Blagues Controversees

May 25, 2025

Laurent Baffie Thierry Ardisson Defend Ses Blagues Controversees

May 25, 2025 -

Porsche Cayenne 2025 A Comprehensive Look At Its Interior And Exterior Design

May 25, 2025

Porsche Cayenne 2025 A Comprehensive Look At Its Interior And Exterior Design

May 25, 2025 -

Mia Farrow And Sadie Sink A Broadway Encounter

May 25, 2025

Mia Farrow And Sadie Sink A Broadway Encounter

May 25, 2025