Apple Stock (AAPL) Price Targets: Key Levels And Technical Analysis

Table of Contents

Understanding Current Market Sentiment for AAPL

Current market sentiment toward AAPL is a crucial factor in predicting its future price movement. Several recent events significantly impact investor confidence and the overall Apple stock price prediction.

-

Recent earnings reports and their impact on AAPL stock: Apple's recent earnings reports have generally been positive, showing consistent revenue growth and strong performance across various product segments. However, any deviation from expected earnings can significantly influence the stock price, creating short-term volatility. Analyzing these reports for trends in revenue, profits, and future guidance is key to assessing the overall outlook.

-

Analysis of recent analyst ratings and price target adjustments: Leading financial analysts regularly issue ratings and price targets for AAPL, providing valuable insights into market sentiment. A consensus of bullish ratings often points to a positive outlook, while a mix of bullish and bearish ratings suggests uncertainty. Tracking these adjustments helps investors gauge the collective wisdom of the market.

-

Influence of macroeconomic factors (e.g., inflation, interest rates) on AAPL: Broader economic conditions heavily influence AAPL's performance. High inflation and rising interest rates can negatively impact consumer spending and affect Apple's sales, potentially leading to downward pressure on the stock price. Conversely, a stable economic environment can bolster investor confidence and support higher valuations.

-

Mention of any significant competitor activity: Competition within the tech industry is fierce. The actions of competitors, such as the release of new products or aggressive marketing campaigns, can affect Apple's market share and, consequently, its stock price. Staying informed about the competitive landscape is crucial for accurate AAPL stock price predictions.

Key Support and Resistance Levels for Apple Stock

Technical analysis relies heavily on identifying support and resistance levels. These are price points where the stock's price has historically struggled to break through, either on the upside (resistance) or the downside (support). Identifying these levels can help predict potential price reversals.

-

Explanation of support and resistance levels and their significance in technical analysis: Support levels represent prices where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are the opposite, where selling pressure typically dominates, halting price increases.

-

Identification of major support levels (e.g., $150, $140) and the potential for a bounce: If the AAPL price drops to a key support level like $150 or $140, it might signal a buying opportunity, as investors may view this as a good entry point. A bounce from these levels suggests strong underlying support.

-

Identification of major resistance levels (e.g., $180, $200) and the potential for a pullback: Conversely, if AAPL reaches a resistance level like $180 or $200, it might indicate a potential pullback as sellers become more active. Breaking through these levels signifies a significant bullish move.

-

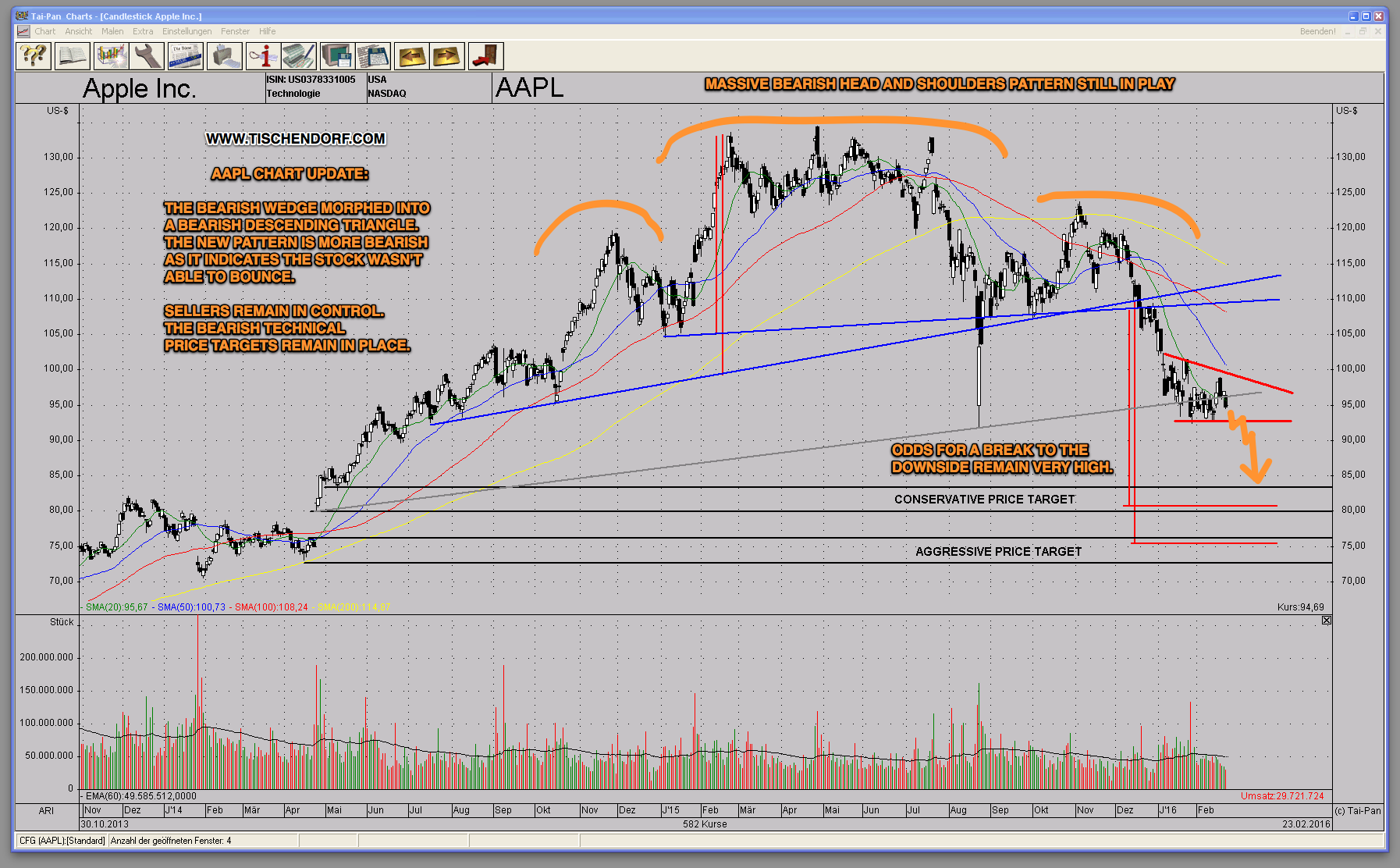

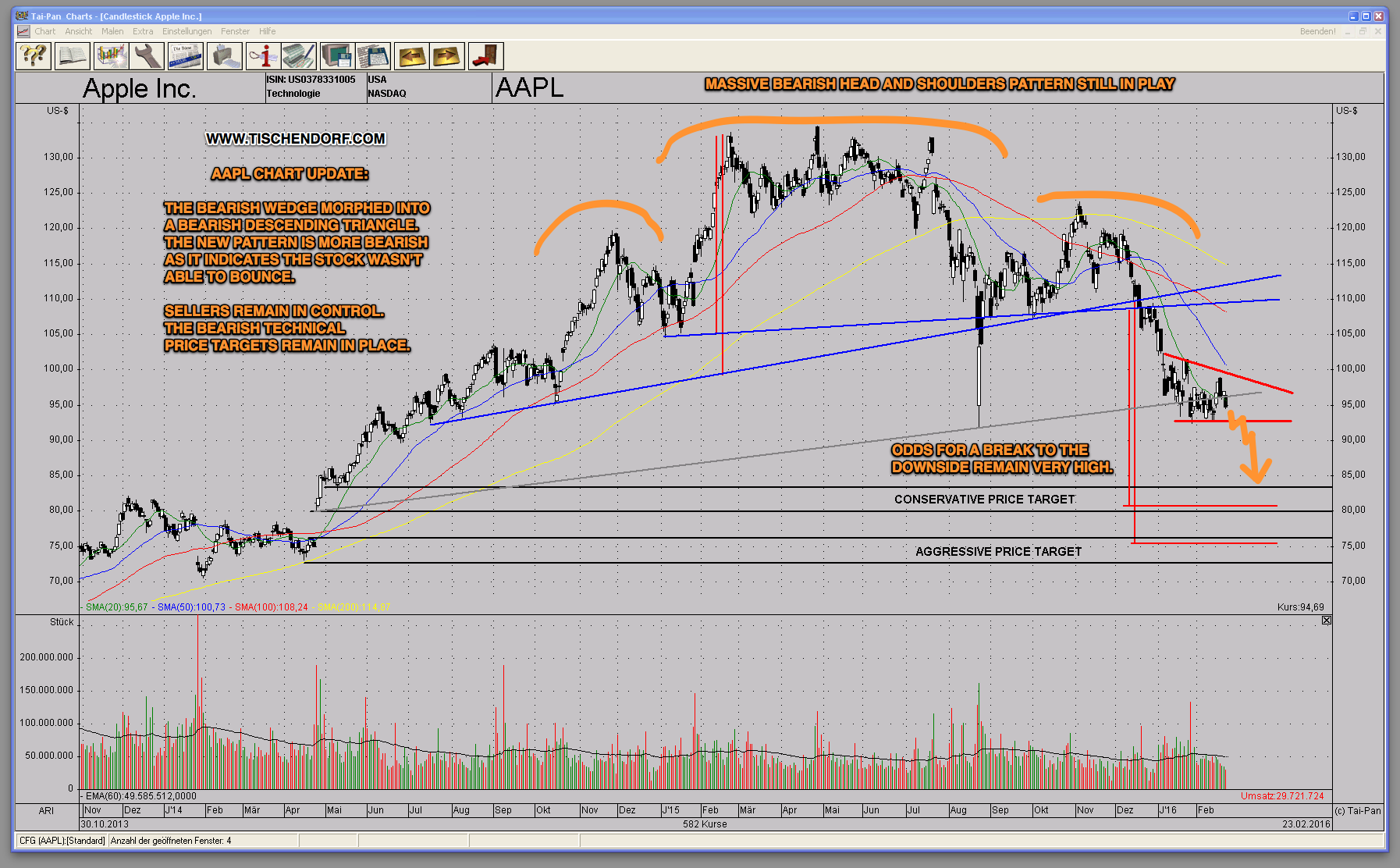

Use of chart patterns (e.g., head and shoulders, triangles) to identify potential future price movements: Chart patterns can provide visual clues about potential future price direction. Identifying patterns like head and shoulders (often bearish) or triangles (can be bullish or bearish depending on the type) adds another layer to technical analysis.

Technical Indicators and Their Implications for AAPL

Technical indicators provide additional signals to confirm potential price movements. Several indicators can be used to analyze AAPL's price trajectory.

-

Explanation of chosen technical indicators and their interpretation: Moving averages, RSI, and MACD are common tools. Moving averages smooth out price fluctuations to identify trends, while RSI measures momentum and overbought/oversold conditions, and MACD helps identify buy/sell signals.

-

Analysis of moving averages (e.g., 50-day, 200-day) to determine short-term and long-term trends: The 50-day moving average reflects shorter-term trends, while the 200-day moving average represents longer-term trends. A bullish crossover (50-day crossing above 200-day) is often seen as a positive signal.

-

Use of RSI (Relative Strength Index) to assess the stock's momentum and potential for overbought or oversold conditions: RSI values above 70 typically indicate an overbought condition (potential for a pullback), while values below 30 suggest an oversold condition (potential for a rebound).

-

Analysis of MACD (Moving Average Convergence Divergence) to identify potential buy or sell signals: MACD crossover signals (when the MACD line crosses above or below the signal line) are often used to identify potential buy or sell opportunities.

Analyzing Apple's Price Target Predictions from Leading Analysts

Many reputable financial analysts provide price targets for AAPL, offering diverse perspectives. Analyzing these predictions helps understand the range of potential outcomes.

-

List of analysts and their respective price targets for AAPL: While a specific list cannot be provided here, many financial news websites and analyst platforms offer this data.

-

Comparison of the different predictions and identification of any significant discrepancies: Discrepancies highlight the uncertainty inherent in price prediction. A wide range of targets suggests considerable debate about AAPL's future.

-

Discussion of the factors driving analysts' predictions: Understanding the underlying rationale behind each analyst's prediction is crucial. Consider factors like projected earnings growth, market share changes, and macroeconomic conditions.

Conclusion

Analyzing Apple Stock (AAPL) price targets requires a holistic approach, considering current market sentiment, key support and resistance levels, technical indicators, and expert predictions. While no prediction is foolproof, combining these analyses offers a more informed perspective. Remember that support and resistance levels at $150, $140, $180, and $200 are significant markers, and analyst predictions provide a range of potential future prices. However, it's crucial to conduct thorough due diligence before making any investment decisions. The information presented here should not be considered financial advice.

Call to Action: Stay informed on the latest developments impacting Apple Stock (AAPL) price targets. Continue your research, regularly reviewing technical analysis and market sentiment to effectively manage your AAPL investments. Understanding AAPL price target predictions is an ongoing process requiring consistent monitoring and analysis.

Featured Posts

-

Will A Wall Street Rebound Undermine The Daxs Recent Success

May 25, 2025

Will A Wall Street Rebound Undermine The Daxs Recent Success

May 25, 2025 -

Gambling On Tragedy Analyzing Bets On The Los Angeles Wildfires

May 25, 2025

Gambling On Tragedy Analyzing Bets On The Los Angeles Wildfires

May 25, 2025 -

Ealas Paris Grand Slam A Nation Watches

May 25, 2025

Ealas Paris Grand Slam A Nation Watches

May 25, 2025 -

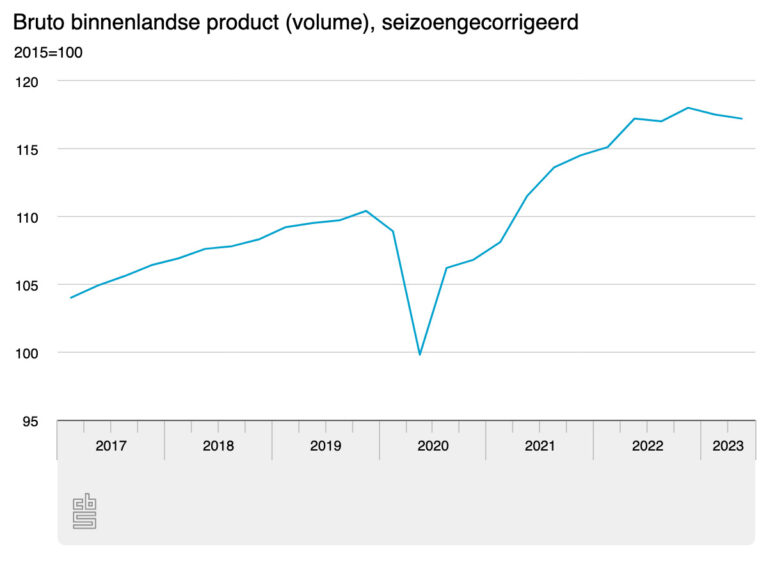

Dutch Economy Suffers As Us Trade Tensions Rise

May 25, 2025

Dutch Economy Suffers As Us Trade Tensions Rise

May 25, 2025 -

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 25, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 25, 2025