Apple Stock: Key Levels Breached Ahead Of Q2 Results

Table of Contents

Technical Analysis: Key Support and Resistance Levels Broken

The recent price action in Apple stock (AAPL) has been dramatic, with key support and resistance levels being decisively broken. Understanding the significance of these breaches is crucial for predicting future price movements. For example, the recent break below the $160 support level, a level that had held for several weeks, signals a potential shift in momentum, potentially indicating further downside. Conversely, a strong rebound above this level could suggest renewed buying interest.

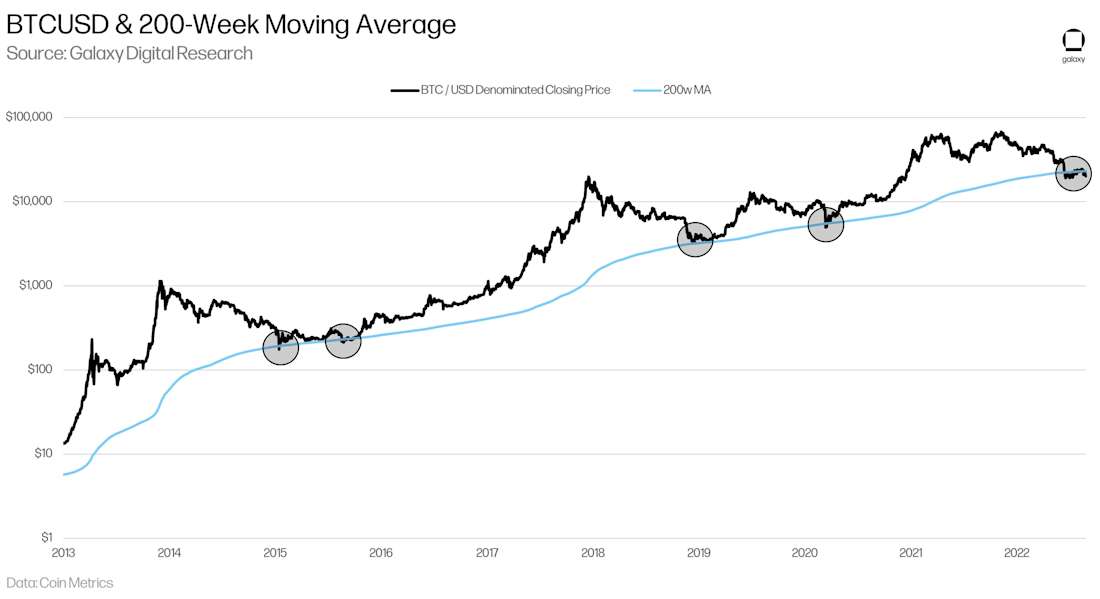

- Technical Indicators: Moving averages, such as the 50-day and 200-day moving averages, have crossed, indicating a bearish trend. The Relative Strength Index (RSI) is currently below 30, suggesting the stock is oversold, but this doesn't guarantee an immediate rebound.

- Chart Patterns: While not definitively confirmed, some analysts see potential bearish chart patterns forming, such as a head and shoulders pattern, which often precedes further price declines. However, a successful retest of the broken support level could invalidate this pattern.

- Volume Analysis: High volume accompanying the break below the $160 support level confirms the significance of this move. This suggests that the selling pressure was strong and sustained, increasing the likelihood of further price decreases in the short term.

Fundamental Analysis: Factors Influencing Apple Stock Performance

Beyond the technical indicators, understanding the underlying fundamentals of Apple's business is essential for evaluating its stock price. The overall macroeconomic environment plays a significant role, with factors like inflation and interest rates impacting consumer spending and investor sentiment.

Apple's recent performance has been a mixed bag. While sales figures for some products remain strong, others show signs of slowing growth. Supply chain disruptions continue to pose a challenge, impacting production and potentially affecting future earnings.

- Supply Chain Disruptions: Ongoing supply chain issues, particularly concerning component shortages, could continue to impact Apple's production capacity and profitability.

- New Product Launches: The success of new products like the iPhone 14 and Apple Watch Series 8 will be crucial for future growth. Initial sales figures have been promising, but sustained demand remains to be seen.

- Competitive Pressures: Intense competition from other tech giants, particularly in the smartphone and wearable markets, puts downward pressure on Apple's market share and pricing power.

Q2 Earnings Expectations and Potential Scenarios

Analysts' predictions for Apple's Q2 earnings are varied, with estimates ranging from slightly below to slightly above expectations. The actual results will significantly impact the stock price.

- Positive Catalysts: Exceeding expectations, driven by strong iPhone sales, robust growth in the services segment (Apple Music, iCloud, etc.), and successful new product adoption, could trigger a significant rally in Apple stock.

- Negative Catalysts: Falling short of expectations, perhaps due to weaker-than-expected demand, increased competition, or lingering supply chain issues, could lead to a further decline in the stock price.

- Price Targets: Based on various earnings scenarios, price targets for Apple stock post-earnings vary considerably. A strong beat could send the price towards $180 or higher, while a significant miss could push it below $150.

Risk Assessment and Investment Strategies

Investing in Apple stock, like any investment, carries inherent risks. The recent price volatility highlights the potential for significant losses. Investors should carefully consider their risk tolerance before making any investment decisions.

- Diversification: Diversifying your investment portfolio across different asset classes can help mitigate the risk associated with investing in a single stock like Apple.

- Stop-Loss Orders: Employing stop-loss orders can limit potential losses by automatically selling your shares if the price falls below a predetermined level.

- Financial Advisor: Consult a qualified financial advisor before making any significant investment decisions. They can provide personalized advice tailored to your financial situation and risk tolerance.

Conclusion

Apple stock's recent breach of key support/resistance levels creates uncertainty ahead of Q2 earnings. However, a thorough analysis of technical and fundamental factors provides a clearer picture of potential outcomes. Understanding the key risks and rewards allows investors to make more informed decisions.

Call to Action: Stay informed about upcoming Apple Q2 results and monitor these key levels for further insights into Apple stock's price movement. Conduct thorough research and consult financial professionals before investing in Apple stock or any other security. Regularly review your Apple stock holdings and adapt your strategy based on market changes. Understanding the nuances of Apple stock price movements will enable you to make smarter investment decisions regarding your Apple stock portfolio.

Featured Posts

-

Apple Stock Forecast 254 Potential Investment Advice At Current Prices

May 25, 2025

Apple Stock Forecast 254 Potential Investment Advice At Current Prices

May 25, 2025 -

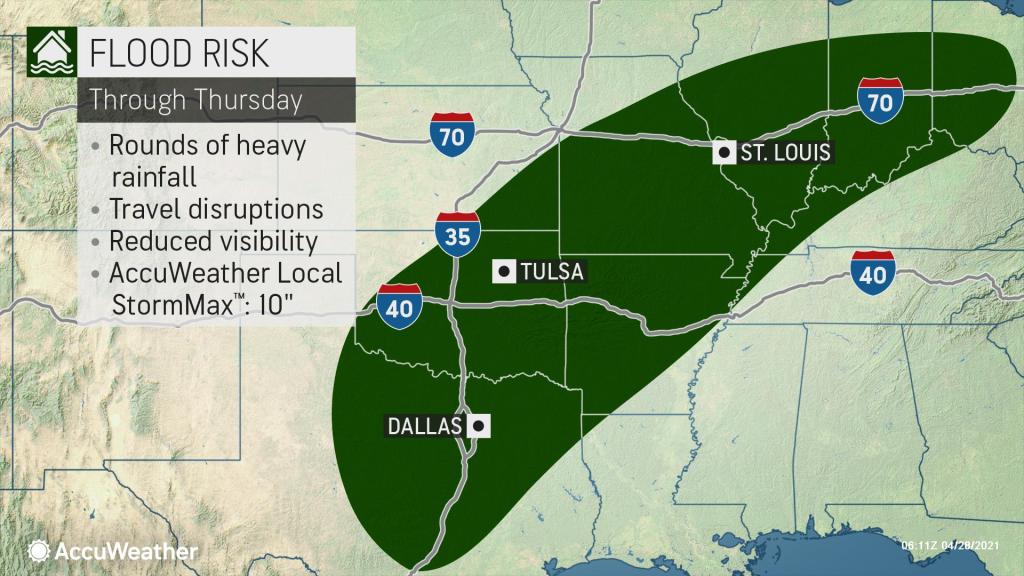

Flood Advisory In Effect Miami Valley Faces Severe Weather Threat

May 25, 2025

Flood Advisory In Effect Miami Valley Faces Severe Weather Threat

May 25, 2025 -

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025 -

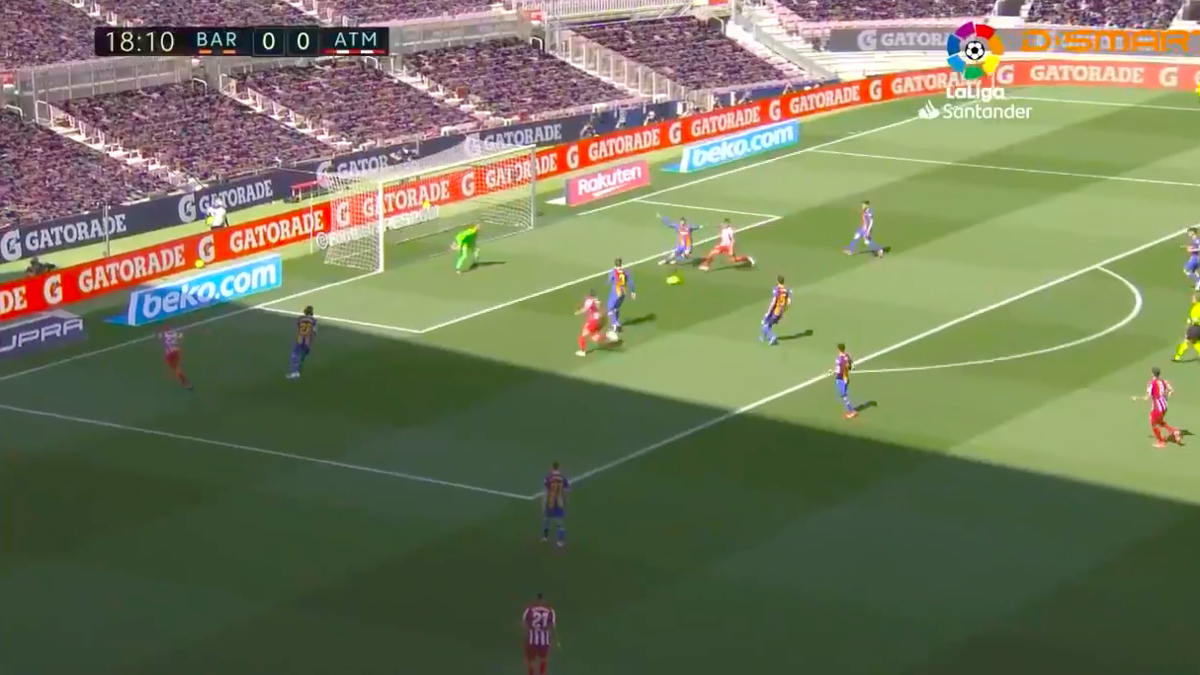

Barcelona Atletico Madrid Canli Mac Yayini Fanatik Gazetesi Nden Son Dakika Guencellemeler

May 25, 2025

Barcelona Atletico Madrid Canli Mac Yayini Fanatik Gazetesi Nden Son Dakika Guencellemeler

May 25, 2025 -

Your Country Escape Awaits A Step By Step Relocation Plan

May 25, 2025

Your Country Escape Awaits A Step By Step Relocation Plan

May 25, 2025