Apple Stock Prediction: Will AAPL Reach $254? Buy Or Sell At $200?

Table of Contents

Analyzing Apple's Current Financial Performance and Future Prospects

Apple's recent performance provides a strong foundation for predicting its future trajectory. Analyzing key financial indicators is crucial for assessing the viability of the $254 price target.

Revenue Growth and Profitability

Apple's recent financial reports paint a picture of continued growth, although at a potentially slowing pace. Their quarterly and annual earnings consistently demonstrate the strength of their diversified revenue streams.

- iPhone Sales: While iPhone sales remain a significant contributor, their growth rate has shown some moderation in recent quarters. This is partly due to global economic conditions and increased competition.

- Services Revenue: Apple's services segment, encompassing subscriptions like Apple Music, iCloud, and the App Store, continues to show robust growth, proving to be a key driver of profitability.

- Wearables, Home, and Accessories: This sector showcases impressive growth, highlighting the success of products like Apple Watch and AirPods.

- Mac and iPad Sales: These sectors experience fluctuations but contribute steadily to the overall revenue.

Analyzing Apple's revenue, Apple profit, and Apple financial report data reveals strong profitability and healthy margins, showcasing the company's pricing power and efficiency. The key is understanding the relative growth rates of these different sectors and their contribution to overall Apple revenue.

Innovation and Product Pipeline

Apple's continued success hinges on its ability to innovate and introduce groundbreaking products. The upcoming product pipeline suggests a positive outlook for Apple's future.

- New iPhone Releases: Each new generation of iPhones typically fuels a surge in sales, impacting Apple's market share and overall revenue. The anticipated features and technological advancements in the next iPhone cycle will be crucial factors.

- Mac and iPad Updates: Renewed interest in the Mac lineup, with the introduction of new chips and designs, could boost sales. Similarly, improvements to the iPad ecosystem can maintain market competitiveness.

- Services Expansion: Expanding the Apple Services ecosystem with new offerings and improved user experiences will be critical for maintaining growth.

- AR/VR initiatives: Apple's rumored entry into the augmented and virtual reality market represents a significant potential growth area, though its impact remains uncertain at this stage.

Assessing Apple innovation, Apple new products, Apple product launches, and their potential impact on Apple market share is critical for understanding future growth potential.

Macroeconomic Factors and Market Conditions

Global macroeconomic conditions significantly influence Apple's stock price. Factors such as inflation, recession risks, and geopolitical instability all play a role.

- Inflation and Interest Rates: Higher inflation and interest rates can impact consumer spending, potentially affecting demand for Apple products.

- Recessionary Fears: A global recession could significantly impact consumer electronics sales, negatively impacting Apple's revenue.

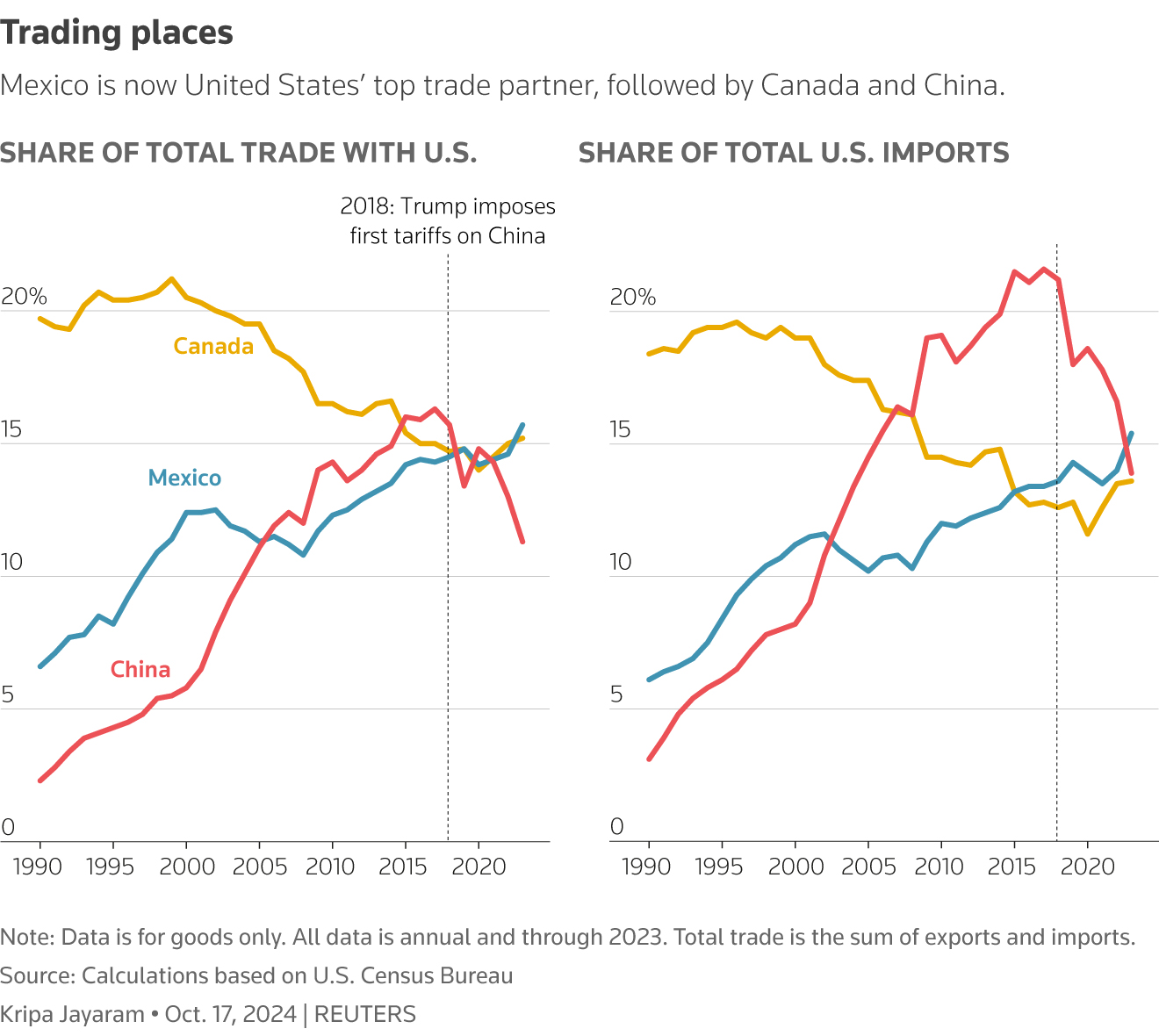

- Geopolitical Risks: Supply chain disruptions and trade tensions could negatively impact Apple's manufacturing and distribution capabilities.

- Tech Sector Performance: The overall performance of the tech sector will inevitably influence the performance of Apple stock.

Understanding these factors and their influence on the Apple stock market and the tech stock market is crucial.

Technical Analysis of AAPL Stock: Chart Patterns and Indicators

Technical analysis provides insights into potential price movements by examining historical price data and market trends.

Chart Patterns

Analyzing the Apple stock chart reveals key support and resistance levels. The $200 level may act as a significant support level, while the $254 target represents a strong resistance level. Identifying these levels is crucial in predicting potential price movements.

Technical Indicators

Using technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages can help gauge the momentum and potential direction of AAPL's price. The interpretation of these Apple stock chart indicators requires expertise and should be considered alongside fundamental analysis. (Include charts and graphs here to visually represent the technical analysis).

Valuation of Apple Stock: Is AAPL Overvalued or Undervalued?

Determining whether AAPL is currently overvalued or undervalued requires a thorough valuation analysis.

Discounted Cash Flow Analysis (DCF)

A DCF analysis estimates the intrinsic value of Apple stock by discounting its future cash flows back to their present value. This method provides a framework for evaluating whether the current market price reflects the company's true worth.

Comparable Company Analysis

Comparing AAPL's valuation metrics (such as Price-to-Earnings ratio (PE ratio)) to those of its competitors in the tech sector allows us to assess whether it is trading at a premium or discount compared to similar companies.

Risk Assessment: Potential Upside and Downside of Investing in AAPL

Investing in any stock involves inherent risks. It's crucial to carefully assess both the potential upside and downside before making an investment decision.

Upside Potential

The potential for AAPL to reach $254 or even higher hinges on continued strong financial performance, successful product launches, and favorable macroeconomic conditions.

Downside Risk

Several factors could negatively impact AAPL's stock price, including:

- Increased competition

- Economic slowdown or recession

- Geopolitical instability

- Negative regulatory changes

- Supply chain disruptions

Conclusion: Apple Stock Prediction – $254 Target and Your $200 Decision

Our analysis of Apple's financial performance, technical indicators, and valuation suggests [Insert Recommendation: Buy, Sell, or Hold]. While the potential for AAPL to reach $254 exists, the $200 entry point presents both opportunities and risks. The decision to buy, sell, or hold AAPL at $200 depends on your individual risk tolerance, investment horizon, and overall investment strategy. Remember, this analysis is for informational purposes only and should not be considered financial advice. Before making any investment decisions regarding Apple stock (AAPL), conduct your own thorough research and consider consulting with a qualified financial advisor. Always remember the inherent risks associated with stock market investments. Therefore, carefully consider your own Apple stock prediction and make informed decisions about buying, selling, or holding AAPL.

Featured Posts

-

Strengthening North American Trade Canada And Mexicos Response To Us Tariffs

May 25, 2025

Strengthening North American Trade Canada And Mexicos Response To Us Tariffs

May 25, 2025 -

Se Faire Des Amis Parmi Les Gens D Ici Strategies Et Conseils

May 25, 2025

Se Faire Des Amis Parmi Les Gens D Ici Strategies Et Conseils

May 25, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 25, 2025

Escape To The Country Financing Your Rural Dream Home

May 25, 2025 -

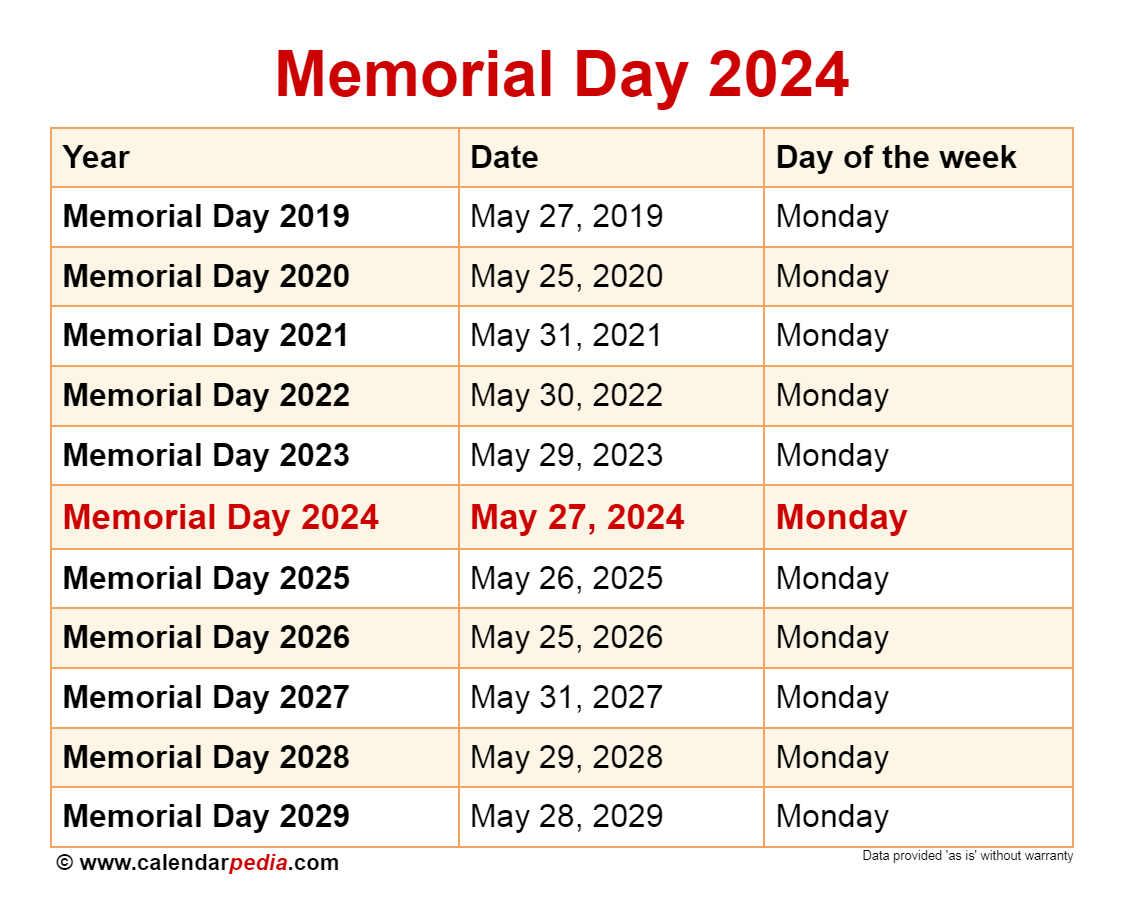

2025 Memorial Day Travel Busiest Flight Days And How To Avoid Them

May 25, 2025

2025 Memorial Day Travel Busiest Flight Days And How To Avoid Them

May 25, 2025 -

Exploring Jenson And The Fw 22 Extended Line

May 25, 2025

Exploring Jenson And The Fw 22 Extended Line

May 25, 2025