Apple Stock: Q2 Earnings Top Forecasts, IPhone Sales Lead The Way

Table of Contents

Q2 Earnings: A Detailed Look at the Numbers

Apple's Q2 2024 earnings report painted a picture of robust financial health. The company significantly outperformed analyst expectations across several key metrics, solidifying its position as a tech giant. Let's delve into the specifics:

-

Revenue Growth: Apple reported a total revenue of [Insert Actual Revenue Figure Here], exceeding the anticipated [Insert Analyst Prediction Figure Here] and representing a [Insert Percentage] year-over-year increase. This substantial growth demonstrates Apple's ability to maintain strong sales even in a challenging economic climate.

-

Revenue Breakdown by Product Category: A closer look at the revenue breakdown reveals the continued dominance of the iPhone. [Insert Percentage]% of total revenue came from iPhone sales, followed by [Insert Percentages and Product Categories - Mac, iPad, Wearables, Services]. This diversification across product lines mitigates risk and contributes to overall financial stability.

-

Net Income and Earnings Per Share (EPS): Apple reported a net income of [Insert Net Income Figure Here], translating to an EPS of [Insert EPS Figure Here]. This compares favorably to the previous year's [Insert Previous Year's Net Income and EPS figures] and surpasses analyst expectations of [Insert Analyst EPS Prediction].

-

Gross Margins: Apple maintained healthy gross margins of [Insert Gross Margin Percentage Here], indicating efficient management of production costs and pricing strategies. This is a crucial indicator of profitability and reflects Apple's strong brand positioning and pricing power.

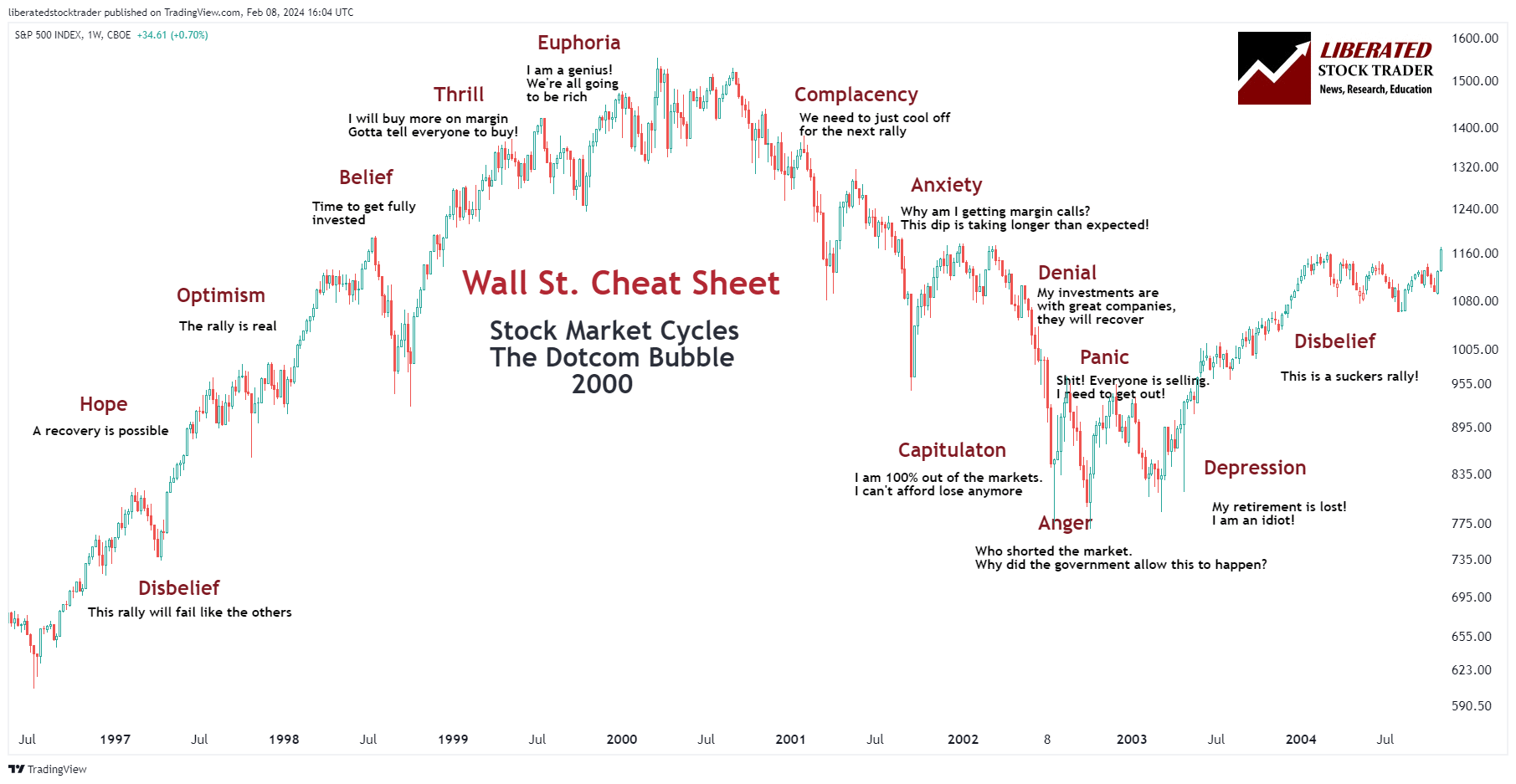

[Insert Chart/Graph Visualizing Key Financial Data Here]

iPhone Sales Drive Growth: Understanding the Demand

The phenomenal success of Apple's Q2 was undeniably fueled by robust iPhone sales. [Insert Actual iPhone Sales Figure Here] units were sold, exceeding predictions and demonstrating persistent consumer demand. Several factors contributed to this success:

-

New Product Launches: The release of new iPhone models, particularly the [Mention Specific Models if Applicable], stimulated significant sales. These new models often incorporate innovative features and design improvements that attract consumers.

-

Improved Features: Enhanced features like improved camera technology, faster processors, and enhanced software capabilities continue to attract customers seeking the latest in mobile technology. Apple's focus on user experience is a major driver of loyalty and repeat purchases.

-

Marketing Campaigns: Apple's marketing prowess played a vital role. Targeted campaigns effectively highlighted the iPhone's capabilities, reaching consumers worldwide and fueling desire for the latest devices.

-

Global Smartphone Market Impact: While the global smartphone market faces challenges, Apple's premium positioning and brand loyalty have shielded it from the worst effects. This demonstrates the strength of its ecosystem and the resilience of its customer base.

-

Supply Chain: Apple’s proactive management of its supply chain has mitigated potential disruptions, ensuring that products are readily available to meet consumer demand.

Services Revenue Continues its Upward Trajectory

Apple's Services segment continues its impressive growth trajectory, proving a crucial source of recurring revenue. The segment, which includes the App Store, iCloud, Apple Music, Apple TV+, and other services, saw a [Insert Percentage] increase in revenue, reaching [Insert Revenue Figure Here].

-

App Store Performance: The App Store remains a significant revenue driver, benefitting from a large and active user base.

-

iCloud Growth: Increasing reliance on cloud storage and services fuels steady growth in iCloud subscriptions.

-

Apple Music and Apple TV+ Subscriptions: The increasing popularity of Apple's streaming services contributes significantly to the segment's revenue.

-

New Initiatives: Apple continues to invest in and expand its services portfolio, introducing new offerings and partnerships to further drive growth. The potential for expansion into new service areas also presents future opportunities for revenue growth.

Looking Ahead: Future Outlook for Apple Stock

The strong Q2 results position Apple favorably for future growth, but challenges remain.

-

Future Earnings Predictions: Based on the Q2 performance, analysts predict continued growth in the coming quarters. [Insert Analyst Predictions or Range].

-

Potential Risks and Challenges: Increased competition, global economic uncertainty, and potential supply chain disruptions are key risks that could impact Apple's future performance.

-

Future Growth Areas: Apple's investment in areas like augmented reality (AR), virtual reality (VR), and potentially electric vehicles presents exciting opportunities for future revenue streams.

-

Analyst Ratings and Predictions: Many analysts maintain a positive outlook on Apple stock, citing the company's strong financial position, innovative product pipeline, and loyal customer base. [Insert Relevant Analyst Ratings and Predictions if Available]

Conclusion

Apple's strong Q2 earnings, driven primarily by robust iPhone sales and continued growth in its Services segment, demonstrate the company's enduring appeal and financial strength. The results exceeded expectations, showcasing Apple's ability to navigate a challenging global market. The company's diversified revenue streams, strong brand loyalty, and ongoing innovation position it well for continued success.

Call to Action: Are you considering investing in Apple stock? Learn more about the current market trends and potential future growth of Apple stock to make an informed investment decision. Thorough research and understanding of Apple's financials are key factors in any investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Bangladesh Europe Trade Collaborative Efforts For Economic Development

May 24, 2025

Bangladesh Europe Trade Collaborative Efforts For Economic Development

May 24, 2025 -

Cheapest And Least Crowded Flights Memorial Day Travel 2025

May 24, 2025

Cheapest And Least Crowded Flights Memorial Day Travel 2025

May 24, 2025 -

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025 -

Onrust Op Wall Street Positief Sentiment Voor De Aex

May 24, 2025

Onrust Op Wall Street Positief Sentiment Voor De Aex

May 24, 2025 -

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Latest Posts

-

Preserving History The Fight To Save Museum Programs From Budget Cuts

May 24, 2025

Preserving History The Fight To Save Museum Programs From Budget Cuts

May 24, 2025 -

Museum Funding Crisis The Aftermath Of Trumps Budget Decisions

May 24, 2025

Museum Funding Crisis The Aftermath Of Trumps Budget Decisions

May 24, 2025 -

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025 -

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025 -

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025