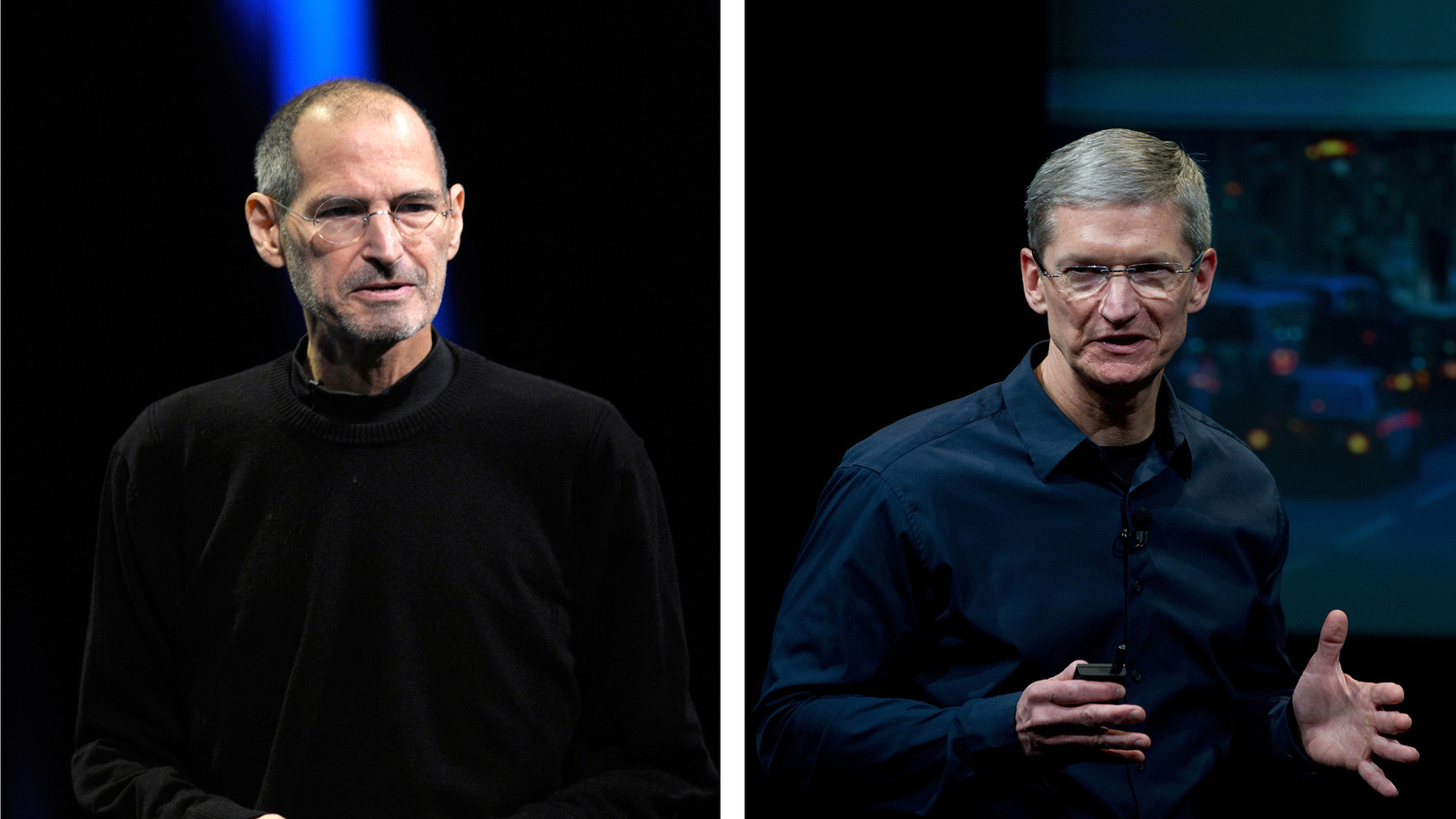

Apple's Stock Dip And Tim Cook's Leadership Under Scrutiny

Table of Contents

Declining iPhone Sales and Market Saturation

The recent downturn in Apple's stock price is significantly linked to declining iPhone sales and the increasingly saturated smartphone market. This challenges Apple's historical dominance and necessitates a deeper look at its strategies.

Saturated Smartphone Market

The global smartphone market is undeniably mature. Growth has slowed considerably, and Apple faces stiff competition from numerous Android manufacturers.

- Competition from Android manufacturers: Companies like Samsung, Xiaomi, and Oppo offer comparable features at often lower price points, directly impacting iPhone sales.

- Price points of competing devices: The premium smartphone segment, where Apple traditionally dominates, is becoming increasingly crowded with high-quality alternatives at more competitive prices.

- Feature parity: Many Android devices now boast features similar to those in iPhones, reducing the perceived technological advantage Apple once held. Keywords: iPhone sales, smartphone market, Android competition, market saturation, premium smartphones.

Lack of Significant iPhone Innovation

Another contributing factor is the perception that recent iPhone releases have offered incremental upgrades rather than groundbreaking innovations. While each generation introduces improvements, these are often viewed as evolutionary rather than revolutionary.

- Incremental updates vs. groundbreaking innovations: Consumers expect more significant leaps in technology, and Apple might be falling short of these increasingly high expectations.

- Consumer expectations: The rapid pace of technological advancement fuels high expectations among consumers, requiring continuous and impactful innovation to justify upgrades.

- Comparison to previous generations of iPhones: The differences between successive iPhone generations are arguably less pronounced than in previous years, leading some consumers to postpone upgrades. Keywords: iPhone innovation, new features, product lifecycle, consumer demand, technological advancements.

Concerns Regarding Apple's Future Innovation and Diversification

Apple's heavy reliance on iPhone revenue presents a significant risk, especially given the challenges outlined above. Diversification is crucial for long-term stability.

Dependence on iPhone Revenue

The iPhone remains the backbone of Apple's revenue stream, generating a substantial percentage of its overall income. This dependence creates vulnerability to market fluctuations and declining sales.

- Percentage of revenue from iPhone sales: A significant portion of Apple's annual revenue is still generated by iPhone sales, leaving the company exposed if sales continue to decline.

- Diversification strategies: Apple is actively pursuing diversification through its services segment (like Apple Music and iCloud) and its wearables business (Apple Watch and AirPods). However, these segments still need to significantly expand to offset potential iPhone sales declines.

- Impact of declining iPhone sales on overall revenue: Any drop in iPhone sales directly and significantly impacts Apple's overall financial performance. Keywords: Apple revenue, iPhone dependency, diversification strategy, services revenue, wearables market.

Competition in Emerging Technologies

Apple's performance in emerging technologies like augmented reality (AR)/virtual reality (VR) and electric vehicles (EVs) will be critical to its future success. The level of competition in these areas is fierce.

- Apple's AR/VR strategy: Apple is reportedly developing its own AR/VR headset, but its entry into this market is facing strong competition from established players.

- The electric vehicle market: Apple's rumored foray into electric vehicles faces intense competition from companies like Tesla and traditional automakers that have a head start.

- Competition from established players: The competitive landscape in these emerging tech sectors is incredibly crowded, requiring substantial investments and innovation to gain meaningful market share. Keywords: AR/VR, electric vehicles, emerging technologies, market competition, future of tech.

Investor Sentiment and the Impact on Stock Price

The combination of declining iPhone sales and concerns about future innovation has undeniably impacted investor sentiment, contributing to the stock price decline.

Analyst Ratings and Predictions

Analyst ratings and predictions reflect a cautious outlook on Apple's near-term prospects, contributing to the decreased investor confidence.

- Recent analyst reports: Many analyst reports have downgraded Apple's stock price target, reflecting concerns about slowing iPhone sales and the company's overall growth trajectory.

- Stock price predictions: The predictions for Apple's future stock performance vary widely, reflecting the uncertainty surrounding the company's future prospects.

- Investor confidence: The stock price decline signals a decrease in investor confidence, further impacting the overall market value of Apple. Keywords: Apple stock price, analyst ratings, investor confidence, stock market analysis, stock predictions.

Economic Factors and Market Volatility

External macroeconomic factors also play a role in Apple's stock performance. Global economic uncertainty can impact consumer spending and investment.

- Global economic slowdown: A global economic slowdown can dampen consumer spending on discretionary items like premium smartphones, directly impacting Apple's sales.

- Inflation: Rising inflation can reduce consumer purchasing power, impacting demand for Apple products.

- Interest rates: Increased interest rates can affect investment decisions and lead to a reassessment of riskier assets like technology stocks.

- Supply chain disruptions: Global supply chain disruptions can impact the availability of Apple products and potentially hinder sales. Keywords: macroeconomic factors, inflation, interest rates, global economy, supply chain.

Conclusion

Apple's recent stock dip is a multifaceted issue stemming from declining iPhone sales, concerns regarding future innovation, and external macroeconomic factors. While Tim Cook's leadership has overseen periods of significant growth for Apple, the current challenges require a strategic reassessment and a renewed focus on innovation and diversification. The company’s ability to navigate these hurdles will significantly impact its future performance. What are your thoughts on Apple's stock dip and Tim Cook's leadership? Discuss the future of Apple and its innovation. Share your predictions for Apple's stock price. Keywords: Apple stock, Tim Cook, leadership, innovation.

Featured Posts

-

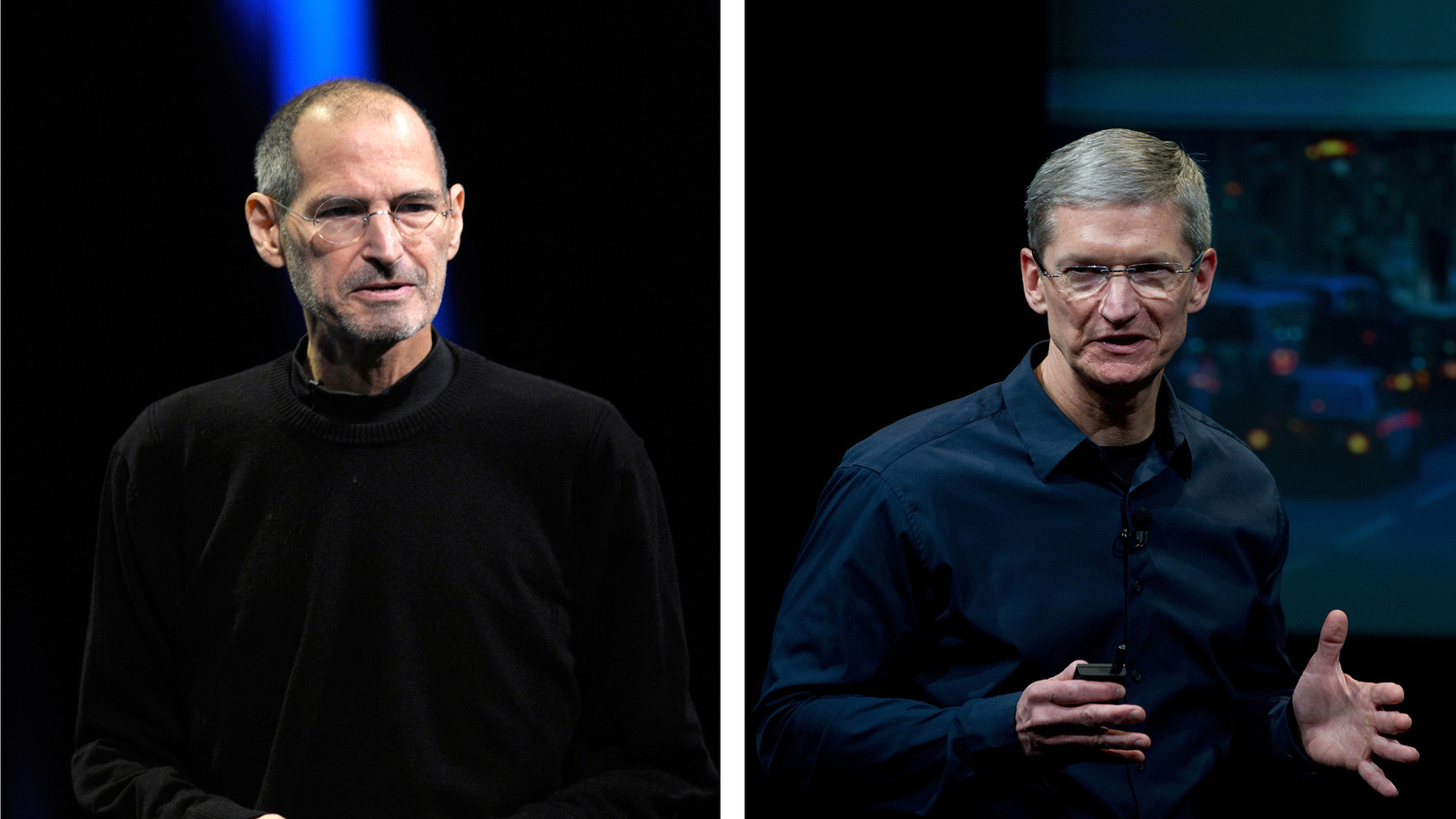

Pogacars Solo Breakaway Secures Tour Of Flanders Win

May 26, 2025

Pogacars Solo Breakaway Secures Tour Of Flanders Win

May 26, 2025 -

Otono Con Estilo Charlene De Monaco Y La Tendencia Del Lino

May 26, 2025

Otono Con Estilo Charlene De Monaco Y La Tendencia Del Lino

May 26, 2025 -

Met Gala 2025 Will Naomi Campbell Attend Amidst Wintour Feud Rumors

May 26, 2025

Met Gala 2025 Will Naomi Campbell Attend Amidst Wintour Feud Rumors

May 26, 2025 -

Scrutinizing Opulence Presidential Seals 100 000 Watches And The Ethics Of Lavish Spending

May 26, 2025

Scrutinizing Opulence Presidential Seals 100 000 Watches And The Ethics Of Lavish Spending

May 26, 2025 -

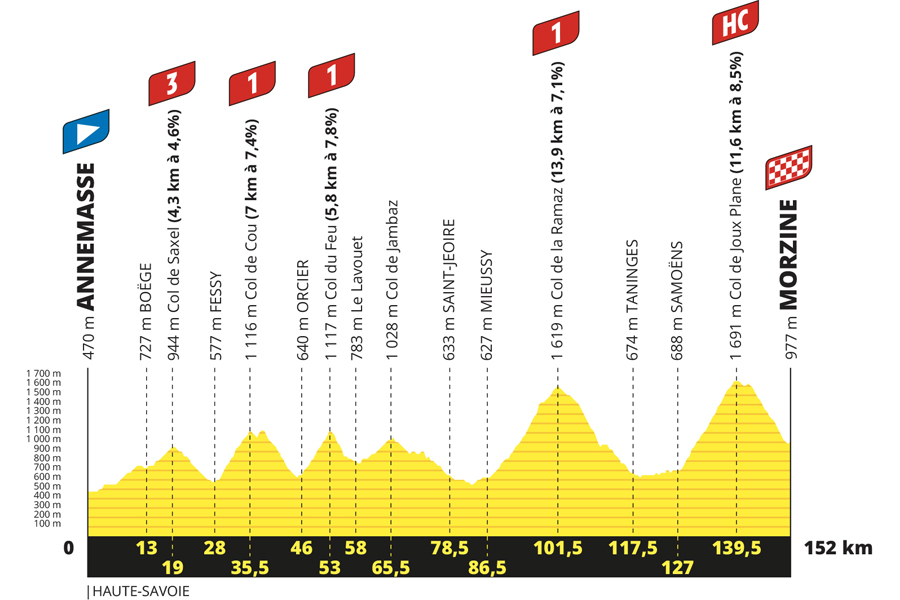

Rtbf Votre Jeu Officiel De Management Cycliste Pour Le Tour De France

May 26, 2025

Rtbf Votre Jeu Officiel De Management Cycliste Pour Le Tour De France

May 26, 2025