Apple's Stock Price: A $254 Target – Is It Time To Buy At $200?

Table of Contents

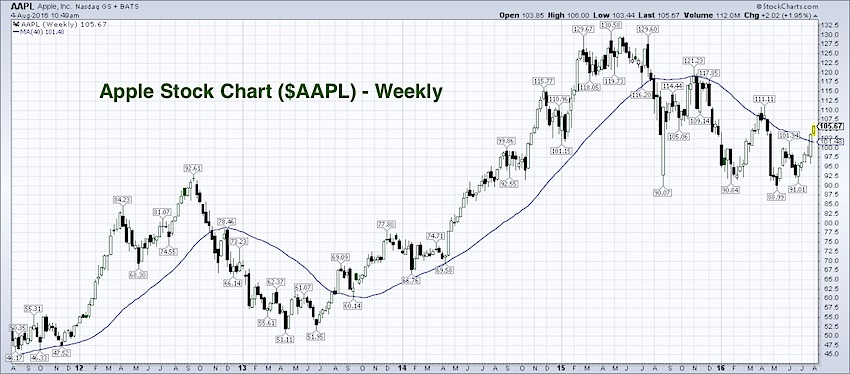

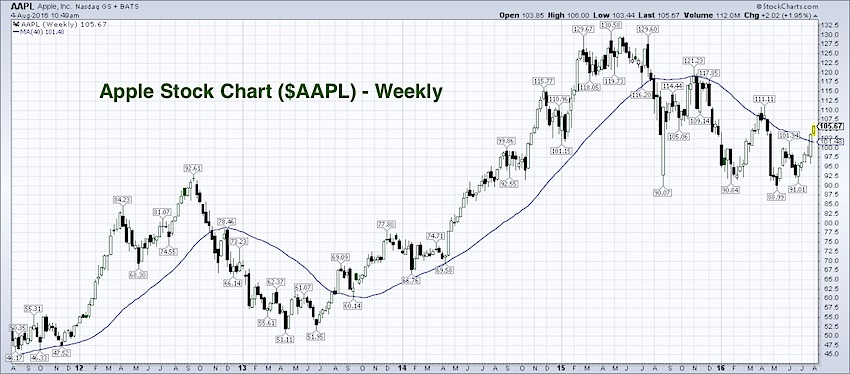

Current Market Conditions and Apple's Performance

The current market sentiment is a crucial factor influencing Apple's stock performance. While overall market conditions can be described as somewhat volatile, the tech sector, to which Apple belongs, often exhibits resilience during economic uncertainty. Analyzing Apple's recent financial performance provides a clearer picture. The company's consistent revenue growth and strong earnings reports signal robust financial health.

- Recent quarterly earnings and their impact on the stock price: Apple's recent earnings reports have generally exceeded analyst expectations, leading to positive short-term stock price movements. However, it's important to note that these results are often followed by periods of consolidation or even slight dips as investors assess the long-term implications.

- Key performance indicators (KPIs) demonstrating Apple's financial health: KPIs like revenue growth, profit margins, and return on equity consistently paint a picture of financial strength for Apple. These metrics indicate a company that is well-positioned to weather economic downturns and continue its growth trajectory.

- Comparison to competitor performance (e.g., Microsoft, Samsung): While competitors like Microsoft and Samsung also perform well, Apple maintains a leading position in several key markets, particularly smartphones and wearables. This market leadership contributes significantly to its strong stock performance relative to competitors. Analyzing these comparisons within the context of the overall tech stock market provides further insight into Apple’s performance.

Analyst Predictions and Price Targets

Various analysts have set price targets for Apple's stock, ranging from conservative estimates to more optimistic projections. The much-discussed $254 target is based on several factors.

- Summary of different analyst opinions and their price targets: The range of price targets reflects the inherent uncertainty in the stock market. While some analysts remain cautious, many believe that Apple’s strong fundamentals and future product launches justify a higher valuation.

- Factors contributing to the $254 price target predictions: Analysts cite several key factors driving this prediction, including anticipated growth in services revenue, the launch of new innovative products (like the potential for augmented reality headsets), and continued market share growth in key sectors.

- Potential risks and downsides associated with these predictions: It's crucial to acknowledge that price targets are not guarantees. Unforeseen events, increased competition, or a shift in consumer demand could negatively impact Apple's stock price, making the $254 target unattainable.

Factors Influencing Apple's Stock Price

Several interconnected factors influence Apple's stock price, creating a complex interplay of internal and external forces.

- The influence of upcoming product launches on investor expectations: New product releases, like the iPhone and Apple Watch, significantly impact investor expectations. Successful launches typically boost the stock price, while underperforming products can lead to temporary declines. The upcoming product pipeline is a crucial factor influencing Apple stock forecast.

- The impact of global economic uncertainty on Apple's stock price: Global economic uncertainty, such as inflation or recessionary fears, can significantly impact consumer spending and, consequently, Apple's stock price. The tech sector is often viewed as a cyclical industry; therefore, Apple's stock is vulnerable to broader economic trends.

- The effect of supply chain disruptions on Apple's profitability: Supply chain disruptions, as experienced in recent years, can limit production and impact profitability, potentially influencing the Apple stock price negatively. Resilience in navigating these challenges is a key aspect to watch.

- How investor confidence affects the stock price: Investor sentiment plays a vital role in shaping Apple's stock price. Positive news and strong financial results boost confidence, driving the price upward; conversely, negative news can trigger selling pressure. Investor sentiment is thus a crucial factor influencing the Apple stock forecast.

Risks and Potential Downsides of Investing in Apple at $200

While the potential upside is significant, investing in Apple at $200 carries inherent risks.

- Potential risks associated with investing in the tech sector: The tech sector is known for its volatility. Market corrections or sector-specific downturns can significantly impact Apple's stock price.

- Risks specific to Apple, such as increased competition or regulatory challenges: Increased competition from other tech giants, particularly in the smartphone and services markets, could negatively affect Apple's market share and profitability. Regulatory challenges could also impact the company's operations and financial performance.

- The possibility of the stock price falling below $200: Despite the optimistic outlook, there's always a risk that the stock price could fall below the current level, resulting in financial losses for investors.

Conclusion

The prospect of Apple's stock price reaching $254 is appealing, driven by strong financial performance, upcoming product releases, and positive analyst predictions. However, the decision to buy at $200 necessitates careful consideration of various factors, including market volatility, potential supply chain issues, and the ever-present risk of unforeseen events. While the potential rewards are significant, remember that investing in Apple's stock price involves risk. Conduct thorough due diligence, align your investment strategy with your risk tolerance, and consult with a financial advisor before making any investment decisions. Careful analysis of Apple's stock price and the factors influencing it is crucial for informed investment choices.

Featured Posts

-

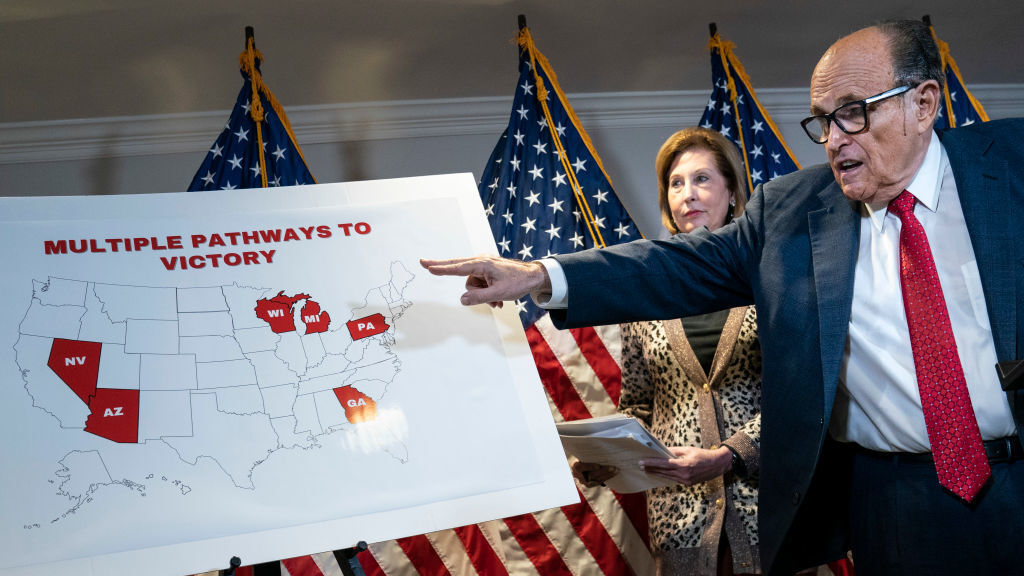

Court Rejects Trumps Claims Against Elite Law Firms

May 25, 2025

Court Rejects Trumps Claims Against Elite Law Firms

May 25, 2025 -

Examining The Factors Behind Trumps Criticism Of European Trade Practices

May 25, 2025

Examining The Factors Behind Trumps Criticism Of European Trade Practices

May 25, 2025 -

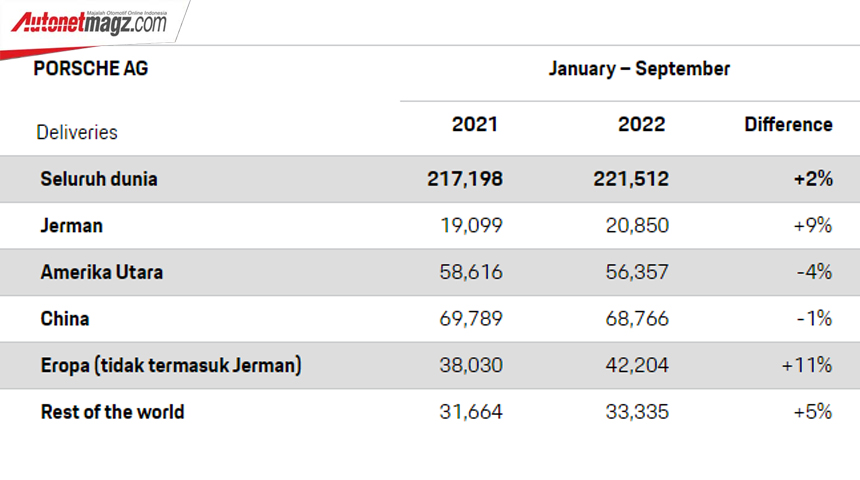

Porsche 356 Dan Zuffenhausen Jejak Sejarah Manufaktur Jerman

May 25, 2025

Porsche 356 Dan Zuffenhausen Jejak Sejarah Manufaktur Jerman

May 25, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 25, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 25, 2025 -

Monaco Vs Nice Le Groupe Convoque

May 25, 2025

Monaco Vs Nice Le Groupe Convoque

May 25, 2025