April 8th Treasury Market Update: Important Developments

Table of Contents

Yield Curve Movements and Their Implications

The yield curve, a graphical representation of Treasury yields across different maturities, underwent notable shifts on April 8th. Understanding these movements is crucial for predicting future economic trends and informing investment decisions.

Changes in Short-Term Yields

Short-term Treasury yields, specifically those on 2-year and 3-year notes, experienced a noticeable increase on April 8th.

- 2-Year Note: Increased by X%. This likely reflects increased expectations of future Federal Reserve interest rate hikes.

- 3-Year Note: Increased by Y%. This rise can be attributed to stronger-than-expected economic data released earlier in the week, suggesting continued inflationary pressures.

These increases translate to higher borrowing costs for businesses and consumers, potentially impacting economic growth in the coming months. The implications for short-term investment strategies are significant, requiring a careful reassessment of risk-reward profiles. [Insert relevant chart/graph visualizing short-term yield changes here].

Long-Term Yield Dynamics

Long-term Treasury yields, encompassing 10-year and 30-year bonds, also showed movement on April 8th, though the changes were less dramatic than in the short-term sector.

- 10-Year Note: Increased/Decreased by Z%. This could be linked to revised economic growth forecasts, reflecting concerns about a potential slowdown or continued robust expansion.

- 30-Year Bond: Increased/Decreased by W%. This longer-term yield is particularly sensitive to inflation expectations and long-term economic prospects.

Investors with long-term investment horizons need to consider these shifts carefully when making portfolio allocation decisions. [Insert relevant chart/graph visualizing long-term yield trends here].

Yield Curve Inversion and Recession Signals

The relationship between the slope of the yield curve and economic recession is a subject of ongoing debate among economists. On April 8th, the yield curve [was/was not] inverted, meaning that [short-term/long-term] yields exceeded [short-term/long-term] yields. A yield curve inversion is often, but not always, considered a predictor of an upcoming economic slowdown or recession. Historical data shows that yield curve inversions have preceded past recessions, but the timing and severity of the subsequent economic downturn can vary considerably. Careful analysis of historical data is necessary to avoid misinterpreting this signal.

Auction Results and Market Response

Several Treasury auctions were held on April 8th, providing insights into investor demand and market sentiment.

Analysis of Treasury Auctions Held on April 8th

[Specify the types of Treasury securities auctioned]. The bid-to-cover ratio for [specific security] was [value], indicating [high/low/moderate] demand. [Mention any unexpected results, e.g., surprisingly high or low demand]. This outcome suggests [interpretation of the auction results, e.g., strong investor confidence or concerns about future economic growth].

Investor Sentiment and Market Liquidity

Following the auctions, overall investor sentiment appeared to be [positive/negative/neutral]. Market liquidity, reflecting the ease with which Treasury securities can be bought and sold, was [high/low/moderate]. Trading volumes were [high/low/moderate], and price volatility was [high/low/moderate]. These factors collectively paint a picture of the market's response to the day's events.

Impact of Macroeconomic Data and News

Macroeconomic data releases and global news significantly influence Treasury market movements.

Influence of Economic Indicators

[Mention specific economic indicators released on or around April 8th, e.g., inflation data, employment reports]. These indicators [supported/contradicted] market expectations, leading to [increase/decrease] in Treasury yields. For instance, higher-than-expected inflation data could lead to an increase in yields as investors demand higher returns to compensate for inflation risk.

Geopolitical Events and Their Effect

[Mention any geopolitical events that occurred around April 8th]. These events [increased/decreased] demand for Treasury securities as investors sought the perceived safety of these assets during periods of global uncertainty. Treasuries are often viewed as a "safe haven" asset during times of geopolitical instability.

Conclusion

The April 8th Treasury Market Update revealed a complex interplay of factors influencing Treasury yields and investor sentiment. Changes in short-term and long-term yields, auction results, and macroeconomic data all contributed to the day's market movements. Understanding these dynamics is crucial for navigating the complexities of the Treasury market. The shape of the yield curve and its potential implications for future economic growth deserve close monitoring.

Stay updated on important developments in the Treasury market by regularly checking our website for future Treasury Market Updates. Understanding these shifts is crucial for effective investment strategies and informed decision-making.

Featured Posts

-

Examining The Financial Impact Of Public Sector Pensions On Taxpayers

Apr 29, 2025

Examining The Financial Impact Of Public Sector Pensions On Taxpayers

Apr 29, 2025 -

Thunder Over Louisville Fireworks Show Canceled Due To Severe Ohio River Flooding

Apr 29, 2025

Thunder Over Louisville Fireworks Show Canceled Due To Severe Ohio River Flooding

Apr 29, 2025 -

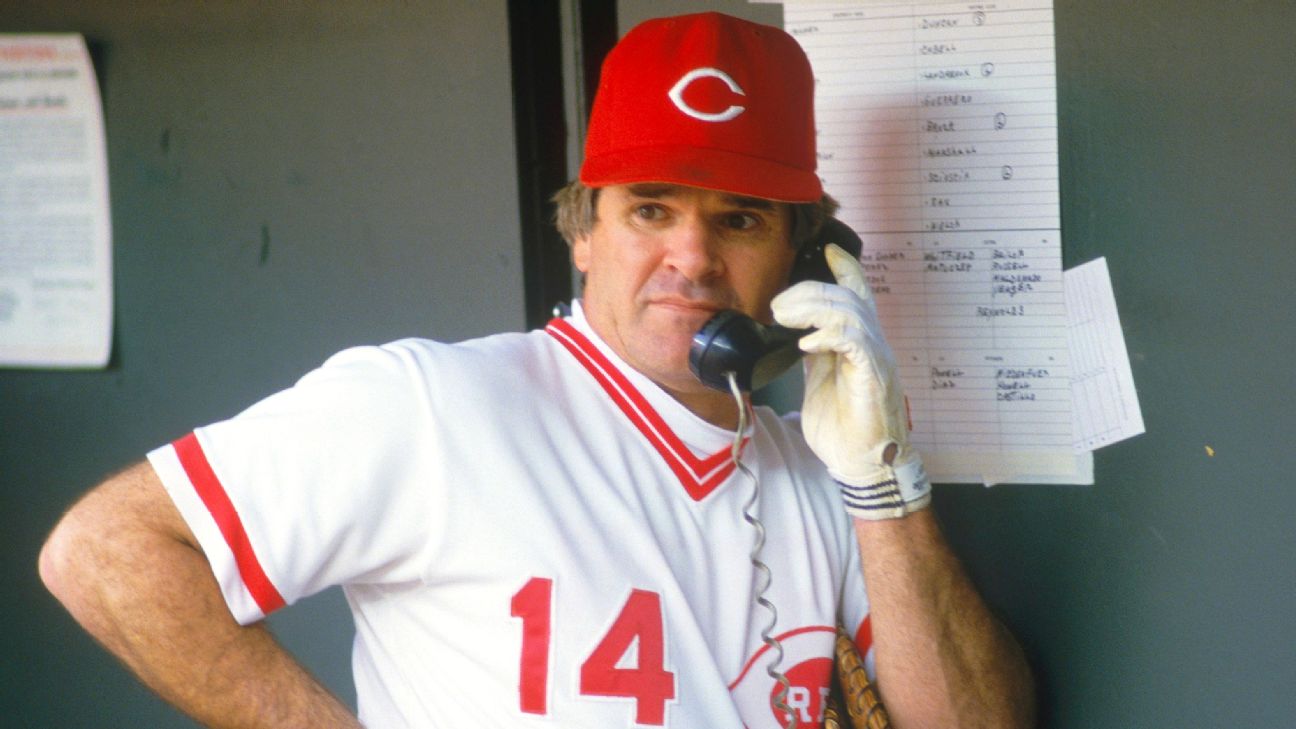

Pete Rose Pardon Trumps Post Presidency Plans

Apr 29, 2025

Pete Rose Pardon Trumps Post Presidency Plans

Apr 29, 2025 -

Trumps Tax Reform Faces Challenges From Within The Republican Party

Apr 29, 2025

Trumps Tax Reform Faces Challenges From Within The Republican Party

Apr 29, 2025 -

You Tubes Growing Senior Audience Strategies And Demographics

Apr 29, 2025

You Tubes Growing Senior Audience Strategies And Demographics

Apr 29, 2025