April Employment Situation: 177,000 New Jobs, Unemployment At 4.2%

Table of Contents

Job Growth Analysis: A Deeper Dive into the 177,000 New Jobs

The creation of 177,000 new jobs in April represents a slowdown compared to the robust job growth seen in previous months. Analyzing sectoral job growth reveals a more complex story. While some sectors experienced significant gains, others showed more modest growth or even decline.

- Sectoral Job Growth: The leisure and hospitality sector continued its strong performance, adding a substantial number of jobs. Professional and business services also contributed to overall job growth. However, the manufacturing sector experienced a slight decline, highlighting the ongoing challenges faced by some industries. Understanding this sectoral job growth is crucial for a complete picture of the labor market's health.

- Month-over-Month and Year-over-Year Job Growth: Compared to March's job growth figures, April's numbers represent a decrease in momentum. Looking at year-over-year job growth, the overall trend still indicates positive growth, though the rate of increase has moderated. This suggests a potential cooling of the labor market.

- Job Quality: While the number of new jobs is significant, the quality of those jobs requires scrutiny. The report needs to detail the breakdown between full-time employment and part-time employment, as well as the proportion of temporary versus permanent positions. This information is vital for assessing the overall health and stability of the job market.

- Key Sectors:

- Significant Growth: Leisure and hospitality, professional and business services, healthcare.

- Modest Growth/Decline: Manufacturing, retail, information.

Unemployment Rate Remains Steady at 4.2% - What Does it Mean?

The unemployment rate remaining steady at 4.2% is generally considered positive, indicating a relatively healthy labor market. However, it's crucial to consider this figure within the broader context of labor market dynamics.

- Significance of 4.2%: A 4.2% unemployment rate is near historical lows, suggesting that many individuals seeking employment are finding opportunities. However, it doesn’t capture the nuances of underemployment or those who have left the workforce altogether.

- Types of Unemployment: The 4.2% figure doesn't differentiate between frictional unemployment (temporary unemployment between jobs), structural unemployment (mismatch between skills and available jobs), and cyclical unemployment (due to economic downturns). Understanding the composition of unemployment is critical for policymakers.

- Labor Force Participation: Analyzing the labor force participation rate provides further insights. A rising participation rate suggests increased confidence in the job market, with more people actively seeking employment. A declining rate might signal discouragement among potential workers. Tracking the employment-to-population ratio offers another perspective.

- Key Unemployment Data Summary:

- Unemployment rate remains low, close to historical lows.

- Further analysis needed to determine the types of unemployment.

- Labor force participation rate needs careful monitoring.

Wage Growth and Inflation: A Balancing Act

Average hourly earnings are a critical indicator of the labor market’s health. Analyzing wage growth in relation to inflation helps us understand the purchasing power of workers and its impact on the overall economy.

- Average Hourly Earnings and Inflation: The report should detail average hourly earnings and compare this growth rate to the current inflation rate. If wage growth outpaces inflation, workers’ purchasing power increases. If inflation outpaces wage growth, purchasing power decreases. This directly impacts consumer spending.

- Impact on Consumer Spending and Economic Growth: Strong wage growth generally leads to increased consumer spending, boosting economic growth. Conversely, stagnant or slow wage growth can dampen consumer spending and hinder economic expansion.

- Wage-Price Spiral Potential: Rapid wage growth combined with high inflation can potentially create a wage-price spiral, a vicious cycle where rising wages fuel further inflation, leading to even higher wage demands. Monitoring this dynamic is crucial for policymakers.

- Wage Growth vs. Inflation: Bullet points comparing the percentage change in average hourly earnings against the inflation rate offer a clear visualization of the relationship.

Long-Term Implications and Future Outlook of the April Employment Situation

The April employment situation report has significant implications for the future, impacting both monetary policy decisions and market sentiment.

- Monetary Policy Implications: The Federal Reserve closely monitors employment data to inform its monetary policy decisions. The report's findings might influence the Fed's approach to interest rate adjustments. Low unemployment and rising wages might prompt the Fed to continue raising interest rates to combat inflation.

- Stock Market and Investor Sentiment: The report's details influence investor sentiment and market performance. Positive job growth and stable unemployment often boost investor confidence, while weaker-than-expected numbers can lead to market volatility.

- Future Job Growth and Unemployment Predictions: Based on the current trends, economists will offer predictions regarding future job growth and unemployment rates. These predictions will likely factor in various economic indicators and potential risks.

- Potential Scenarios:

- Scenario 1: Continued moderate job growth, unemployment remains low, inflation gradually decreases.

- Scenario 2: Job growth slows significantly, unemployment ticks up, inflation remains stubbornly high.

- Scenario 3: Robust job growth continues, wages rise significantly, leading to inflationary pressures.

Conclusion: Understanding the April Employment Situation Report and its Impact

The April employment situation report reveals a complex picture of the US labor market. While the creation of 177,000 jobs and a steady unemployment rate of 4.2% are generally positive indicators, a detailed analysis of sectoral job growth, wage growth relative to inflation, and the overall economic outlook is crucial. The implications for the Federal Reserve’s monetary policy and investor sentiment are significant. Understanding the nuances of this report is vital for businesses, investors, and policymakers alike. Stay tuned for the next employment situation report to get further insights into the evolving labor market and its impact on the US economy.

Featured Posts

-

Sarajevo Book Fair Gibonni Promovira Novo Izdanje

May 04, 2025

Sarajevo Book Fair Gibonni Promovira Novo Izdanje

May 04, 2025 -

Corinthians Analise Tatica Do Empate Com O America De Cali Na Colombia

May 04, 2025

Corinthians Analise Tatica Do Empate Com O America De Cali Na Colombia

May 04, 2025 -

Prince Harry King Charles Silence Following Security Case

May 04, 2025

Prince Harry King Charles Silence Following Security Case

May 04, 2025 -

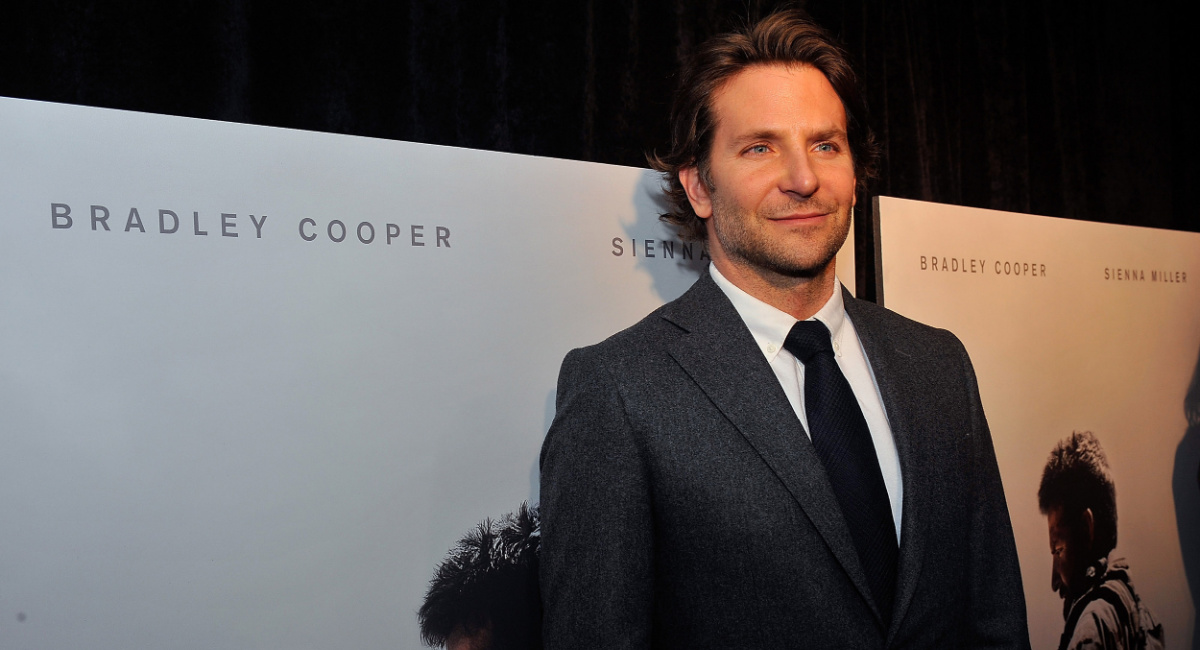

Bradley Cooper And Will Arnett Behind The Scenes Of Is This Thing On In Nyc

May 04, 2025

Bradley Cooper And Will Arnett Behind The Scenes Of Is This Thing On In Nyc

May 04, 2025 -

Anna Kendricks Body Language Fans React To Blake Lively Interview

May 04, 2025

Anna Kendricks Body Language Fans React To Blake Lively Interview

May 04, 2025