Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale Behind Their Optimistic Stance

BofA's relatively bullish outlook on current high stock market valuations rests on several key pillars. They argue that several significant factors mitigate the risks typically associated with elevated valuations.

Low Interest Rates as a Supporting Factor

Low interest rates play a crucial role in BofA's assessment. There's an inverse relationship between interest rates and stock prices; lower rates make borrowing cheaper for companies, boosting investment and earnings, and simultaneously make bonds less attractive, driving investors towards stocks.

- Inverse Relationship: When interest rates are low, the return on bonds decreases, making stocks a more appealing investment option for higher returns.

- Quantitative Easing (QE): The impact of past quantitative easing programs has injected significant liquidity into the market, further supporting stock prices. BofA points to this increased liquidity as a factor that offsets valuation concerns.

- BofA's Argument: BofA specifically argues that the current low-interest-rate environment justifies, to some extent, the higher stock market valuations, as the opportunity cost of holding stocks remains relatively low.

Strong Corporate Earnings and Future Growth Projections

BofA's optimistic stance is also underpinned by their assessment of strong corporate earnings and robust future growth projections. They cite several key sectors exhibiting impressive growth and profitability.

- Key Growth Sectors: Technology, healthcare, and consumer staples are highlighted as sectors driving significant growth, contributing to overall market strength.

- Data and Examples: While specific data from BofA's reports would require referencing their publications directly, their analyses generally point to positive earnings revisions and upward revisions in future growth estimates.

- Projected Growth Rates: BofA's projections (which again, should be checked in their official reports) indicate continued, albeit possibly slower, growth in the coming years, which they believe supports current valuations.

Long-Term Investment Horizon

BofA emphasizes the importance of a long-term investment horizon when considering high stock market valuations. They advocate against making short-term decisions based solely on valuation metrics.

- Long-Term Strategy: A long-term strategy allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of the market.

- Risks of Short-Term Trading: BofA cautions against reacting to short-term valuation spikes or dips, as this can lead to poor investment decisions and missed opportunities.

- Focus on Fundamentals: Instead of solely focusing on valuation metrics, BofA suggests investors concentrate on the underlying fundamentals of individual companies and the overall economic outlook.

Counterarguments and Addressing Investor Concerns

While BofA presents a positive outlook, it's crucial to acknowledge the valid concerns surrounding high stock market valuations.

Acknowledging the Valuation Debate

Many investors express concerns about potentially inflated valuations.

- Price-to-Earnings Ratios (P/E): High P/E ratios across many sectors raise concerns about potential overvaluation.

- Shiller P/E (CAPE): The cyclically adjusted price-to-earnings ratio (CAPE) also shows elevated levels, suggesting potential overvaluation compared to historical averages.

- Potential Market Bubbles: Some analysts warn about the possibility of market bubbles forming in certain sectors, driven by speculative investment.

BofA's Rebuttal to Counterarguments

BofA addresses these concerns by pointing to the factors discussed earlier – low interest rates, robust corporate earnings, and the long-term outlook.

- Low Interest Rate Justification: They reiterate that low interest rates justify higher valuations to some degree, by comparing returns on stocks to bonds.

- Earnings Growth Outpacing Valuation Concerns: BofA's analysis indicates that projected earnings growth could potentially justify current valuations, even if they appear high based on historical metrics.

- Managing Risks: They highlight that while risks exist, these risks are manageable through a diversified investment approach and a long-term perspective.

Alternative Perspectives and Considerations

Even with BofA's optimistic assessment, investors should consider additional perspectives.

Diversification as a Risk Mitigation Strategy

Diversification is a key risk management tool in any market environment, particularly when valuations are high.

- Asset Class Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Sector Diversification: Investing across various sectors mitigates the impact of underperformance in a single sector.

- Geographic Diversification: Investing globally helps to diversify risks further, reducing dependence on any single economy.

The Importance of Due Diligence

Before making any investment decisions, thorough due diligence is essential.

- Independent Research: Investors should conduct their own independent research to validate BofA's claims and assess the risk-reward profile of specific investments.

- Analyst Reports: Reviewing reports from various financial institutions can provide a balanced perspective.

- Financial News: Staying up-to-date with financial news and market trends is critical for informed decision-making.

Conclusion

BofA's analysis suggests that while high stock market valuations are a concern for many, several factors, particularly low interest rates and robust corporate earnings, mitigate the immediate risks. However, counterarguments, including high P/E ratios and potential market bubbles, remain valid concerns. The bank emphasizes the importance of a long-term investment horizon. While BofA offers a compelling perspective, understanding the nuances of high stock market valuations is crucial for informed investment decisions. Conduct your own thorough research and determine if your portfolio aligns with your risk tolerance in this environment. Remember, carefully evaluating high stock market valuations is key to successful long-term investing.

Featured Posts

-

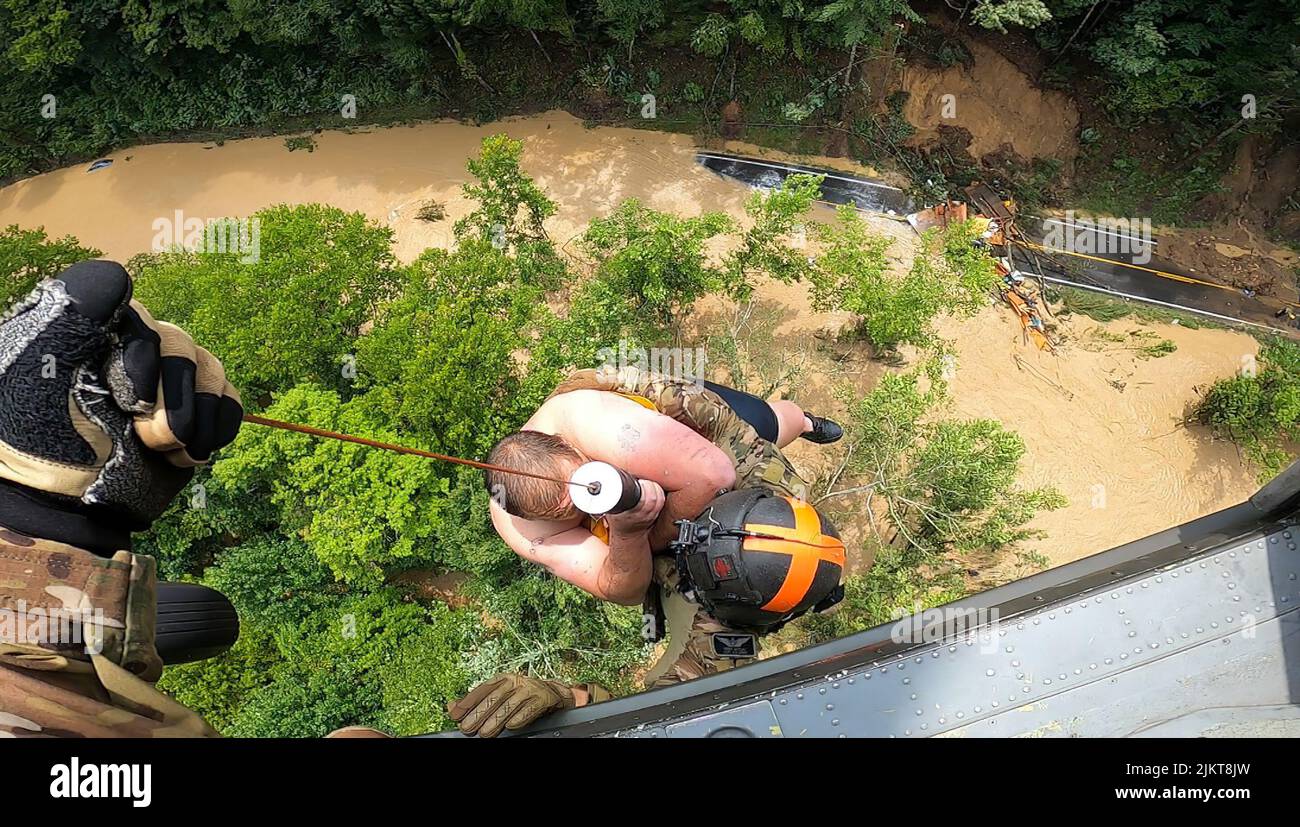

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025 -

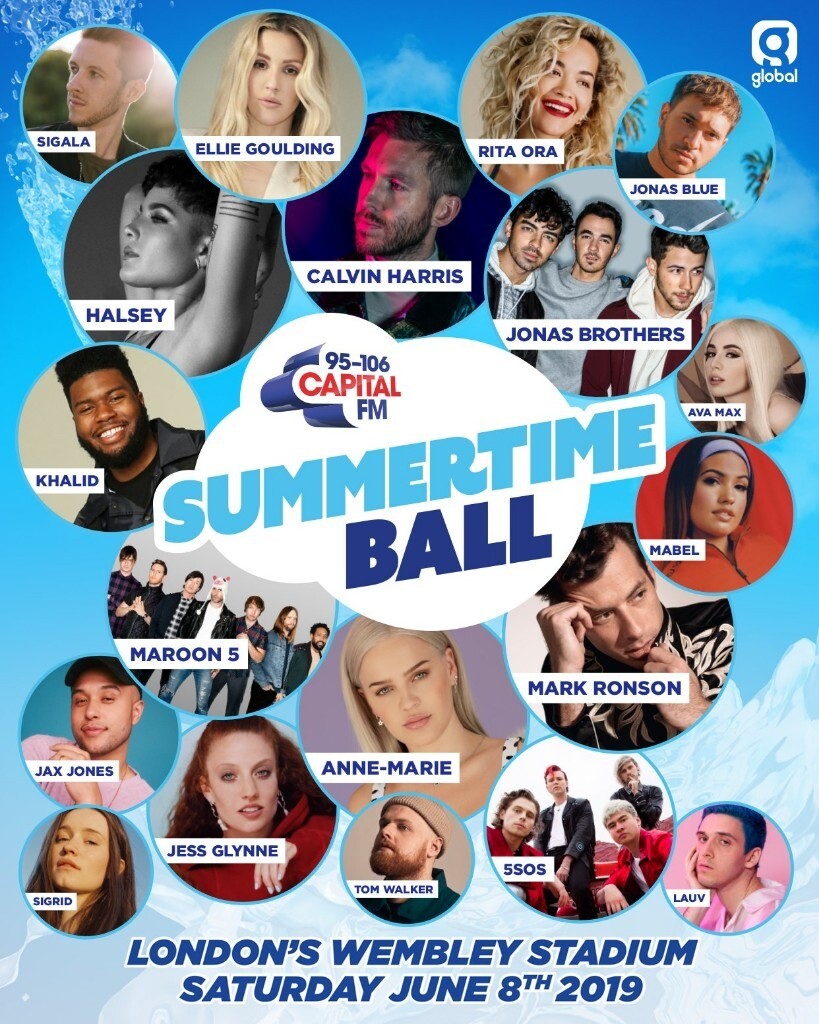

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025 -

Ambanis Reliance Strong Earnings Signal For Indian Market

Apr 29, 2025

Ambanis Reliance Strong Earnings Signal For Indian Market

Apr 29, 2025 -

Kentucky Flood Emergency State Of Emergency Declared

Apr 29, 2025

Kentucky Flood Emergency State Of Emergency Declared

Apr 29, 2025 -

Middle Management A Vital Link In Organizational Effectiveness And Employee Development

Apr 29, 2025

Middle Management A Vital Link In Organizational Effectiveness And Employee Development

Apr 29, 2025