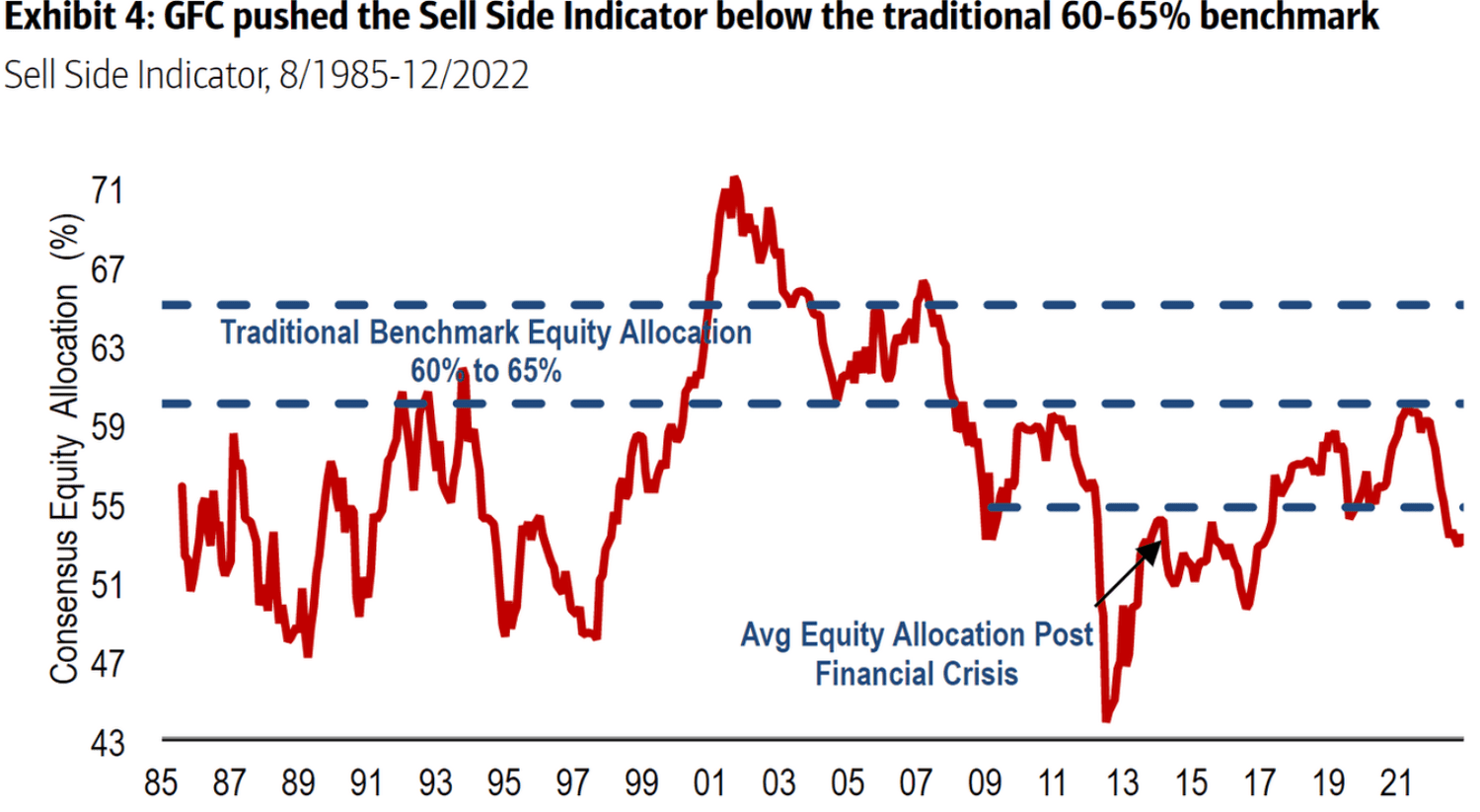

Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's valuation analysis centers on several key factors that, in their view, justify currently high stock market valuations. Their argument rests on a confluence of economic and market forces.

-

Low Interest Rates Justify Higher Valuations: BofA argues that historically low interest rates support higher price-to-earnings (P/E) ratios. Lower borrowing costs make equities more attractive relative to bonds, leading investors to pay a premium for future earnings growth. This is a crucial element of their overall assessment of the equity market.

-

Continued Earnings Growth Despite High Valuations: BofA forecasts continued earnings growth for many companies, even with elevated valuations. This positive outlook for corporate profits mitigates some of the risks associated with high stock market valuations. Their analysis considers various sectors and their individual growth potential.

-

Economic Outlook and its Impact on Stock Prices: BofA's positive economic outlook supports their view on stock valuations. They point to factors such as continued consumer spending and ongoing government stimulus as contributing to sustained economic growth, which, in turn, fuels corporate profitability. Understanding their economic outlook is key to grasping their position on market valuation.

-

Specific Valuation Metrics Used: While BofA considers a range of valuation metrics, they likely focus on a combination of P/E ratios, Price-to-Sales ratios, and other relevant multiples to arrive at their conclusion. Analyzing these metrics across different sectors provides a more nuanced view. They may also adjust for factors like growth rates to arrive at a more comprehensive picture.

-

Caveats and Qualifications: It's crucial to acknowledge that BofA likely includes caveats in their analysis. No forecast is perfect, and unforeseen economic shocks or geopolitical events could significantly impact their projections and the overall valuation of the equity market. They likely emphasize the importance of monitoring the situation closely.

Counterarguments and Potential Risks

While BofA presents a bullish case, counterarguments and potential risks associated with high stock market valuations must be acknowledged.

-

Market Correction or Significant Downturn: High valuations historically precede market corrections or even more significant downturns. The potential for a substantial drop in stock prices is a significant risk that investors should consider. This risk is exacerbated by the fact that many investors are currently holding large amounts of cash.

-

Valuation Bubble: Some analysts warn of a potential valuation bubble, suggesting that current prices are not justified by underlying fundamentals. A bubble bursting could lead to a sharp and potentially prolonged market decline. The potential for a bubble emphasizes the need for thorough due diligence.

-

Importance of Portfolio Diversification: Diversifying investments across asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Over-reliance on equities, especially during periods of high valuations, can amplify potential losses. Understanding your own risk profile and the level of risk you are comfortable with is crucial.

-

Alternative Investment Strategies: Considering alternative investment strategies less sensitive to stock market fluctuations, such as bonds or real estate, can provide a buffer during periods of market uncertainty. These strategies can smooth out returns over the long term, even if they yield smaller gains in the short term.

-

Historical Examples: History provides ample examples of market corrections following periods of elevated valuations. Studying past market cycles can offer valuable insights into potential future scenarios and the timing of market corrections.

Assessing Valuation Metrics

Understanding key valuation metrics is crucial for evaluating the stock market's current state.

-

P/E Ratio (Price-to-Earnings): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for future growth. It's important to analyze this metric across different sectors, since different sectors will have differing growth prospects.

-

PEG Ratio (Price/Earnings to Growth): This adjusts the P/E ratio by considering the company's earnings growth rate. A lower PEG ratio suggests a potentially more attractive valuation. This gives a more nuanced view and is useful for comparing companies across different sectors and growth stages.

-

Price-to-Sales Ratio: This compares a company's stock price to its revenue per share. It's useful for evaluating companies with negative earnings or those in early growth stages. Analyzing this alongside the P/E ratio provides a clearer picture of the valuation.

-

Market Capitalization: The total market value of a company's outstanding shares. While not a direct valuation metric, it provides context for understanding the scale of investment in a particular company or sector.

-

Comparison with Historical Averages: Comparing current valuation multiples (like P/E ratios) to historical averages can provide insights into whether valuations are unusually high or low relative to the past. Understanding the historical context is crucial to interpreting current data.

Developing an Informed Investment Strategy

Navigating high stock market valuations requires a well-informed investment strategy tailored to your individual circumstances.

-

Risk Tolerance and Investment Horizon: Understanding your risk tolerance (your comfort level with potential losses) and investment horizon (how long you plan to invest) is paramount. Longer investment horizons generally allow for greater risk-taking.

-

Integrating BofA's Perspective: While BofA's optimism is valuable, it shouldn't dictate your investment decisions solely. Integrate their analysis with your own research and risk assessment. Consider their findings alongside independent analyses.

-

Active vs. Passive Investing: Both active (actively managing your portfolio) and passive (index fund investing) strategies have merits. High valuations may make active management more appealing to some investors seeking to identify undervalued opportunities.

-

Role of Asset Allocation: A well-diversified portfolio across asset classes is key to managing risk. Adjusting your asset allocation based on your risk tolerance and market conditions is essential. Rebalancing your portfolio is necessary in the face of changing market conditions.

-

Seeking Professional Financial Advice: Don't hesitate to seek advice from a qualified financial advisor if needed. A financial advisor can help you develop a personalized investment strategy that aligns with your goals and risk tolerance.

Conclusion

High stock market valuations present a complex situation. While Bank of America offers a surprisingly optimistic outlook, citing factors like low interest rates and projected earnings growth, counterarguments regarding potential market corrections and valuation bubbles remain. The key takeaway is that investors should proceed with caution, remaining vigilant and thoroughly researching their investment options.

While BofA suggests high stock market valuations aren't necessarily a cause for immediate panic, investors should remain vigilant and develop a well-informed strategy considering the potential risks. Conduct thorough research, understand your own risk tolerance, and consider consulting a financial advisor before making any investment decisions related to high stock market valuations. Remember, understanding your own risk profile is paramount in navigating these uncertain times.

Featured Posts

-

Barstools Portnoy Attacks California Governor Newsom

Apr 26, 2025

Barstools Portnoy Attacks California Governor Newsom

Apr 26, 2025 -

Sindicalistul Naval Din Mangalia Solicita Interventia Ambasadei Olandei

Apr 26, 2025

Sindicalistul Naval Din Mangalia Solicita Interventia Ambasadei Olandei

Apr 26, 2025 -

Analysis 70 Million Impact Of Us Port Fees On Auto Carrier

Apr 26, 2025

Analysis 70 Million Impact Of Us Port Fees On Auto Carrier

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Big Game Spot Breakdown

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Big Game Spot Breakdown

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025

Latest Posts

-

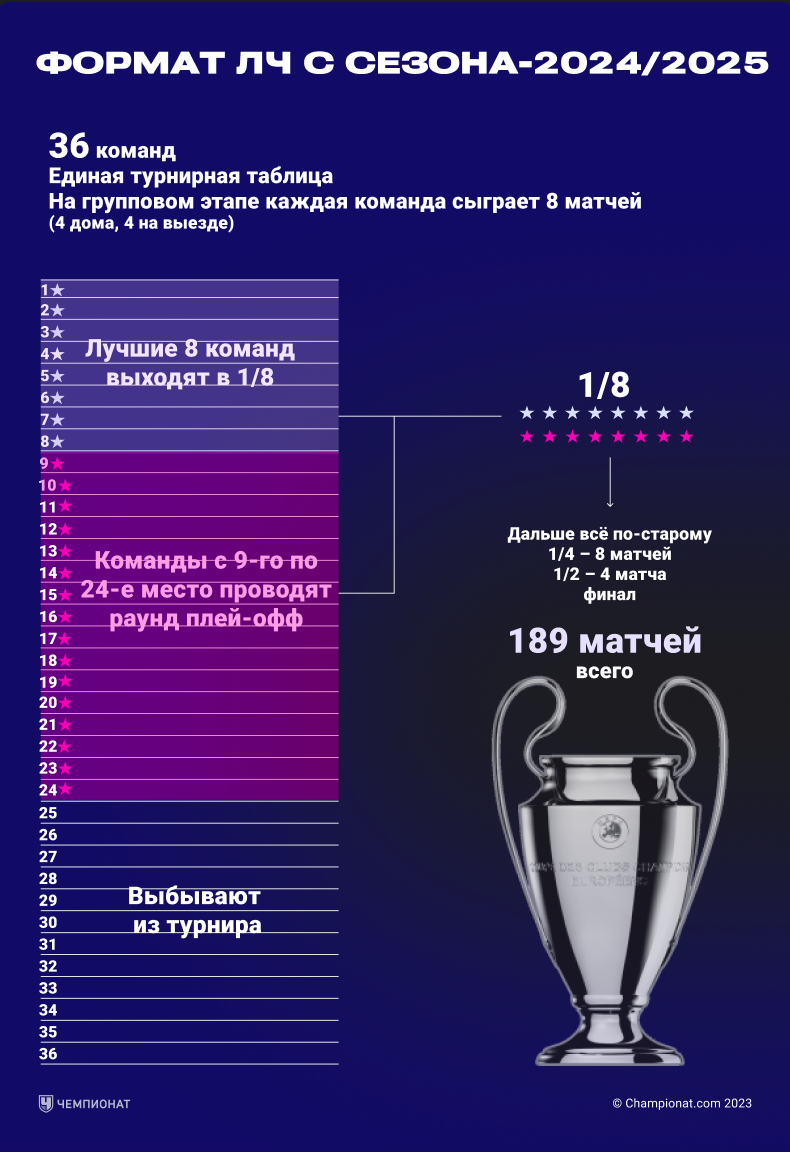

Liga Chempionov 2024 2025 Prognoz Raspisanie I Translyatsii Polufinalov I Finala

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Raspisanie I Translyatsii Polufinalov I Finala

May 09, 2025 -

Statistika I Prognozy Na Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025

Statistika I Prognozy Na Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025 -

Polufinal I Final Ligi Chempionov 2024 2025 Data Vremya Prognozy I Translyatsii

May 09, 2025

Polufinal I Final Ligi Chempionov 2024 2025 Data Vremya Prognozy I Translyatsii

May 09, 2025 -

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025 -

Psg Dominon Formacionet E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025

Psg Dominon Formacionet E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025