Are High Stock Valuations A Concern? BofA Weighs In.

Table of Contents

BofA's Assessment of Current High Stock Valuations

BofA's recent report on high stock valuations presented a nuanced perspective, acknowledging both the potential for continued growth and the inherent risks. The analysis incorporated various key metrics, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other valuation multiples across different sectors.

-

BofA's Overall Stance: While not explicitly bearish, BofA expressed caution, suggesting a more neutral-to-slightly cautious outlook on the current market. They acknowledged the strong corporate earnings driving current valuations but emphasized the need for careful consideration of potential risks.

-

Factors Contributing to High Valuations (According to BofA): BofA highlighted several factors contributing to the current high stock valuations, including persistently low interest rates, robust corporate earnings, and continued investor optimism fueled by government stimulus measures. They specifically noted the technology sector as a driver of high valuations, citing strong growth and innovation.

-

Specific Sectors and Stocks: BofA's report didn't single out specific companies for criticism, but they did suggest that certain sectors, particularly those with high growth expectations but limited current profitability, might be more vulnerable to valuation corrections. They encouraged investors to conduct thorough due diligence before investing in these sectors.

-

Warnings and Cautions: BofA emphasized the importance of carefully considering the potential for a market correction in light of these high valuations. They cautioned against chasing high-growth stocks solely based on past performance and stressed the need for a well-diversified investment portfolio.

Factors Contributing to High Stock Valuations

Beyond BofA's analysis, several broader economic factors contribute to the current environment of high stock valuations:

-

Low Interest Rate Environment: Exceptionally low interest rates globally make bonds less attractive compared to stocks, pushing investors towards equities and inflating valuations. This has a significant impact on the overall market capitalization.

-

Strong Corporate Earnings and Profit Growth: Many companies have reported strong earnings, further boosting investor confidence and driving up stock prices. This strong performance, however, doesn't always directly correlate with justifiable high valuations.

-

Increased Investor Optimism and Risk Appetite: A general sense of optimism, fueled by economic recovery hopes, has led to increased risk-taking among investors, contributing to higher valuations for even riskier assets.

-

Quantitative Easing and Government Stimulus: Government intervention through quantitative easing and substantial stimulus packages injected massive liquidity into the market, supporting higher asset prices, including stocks.

-

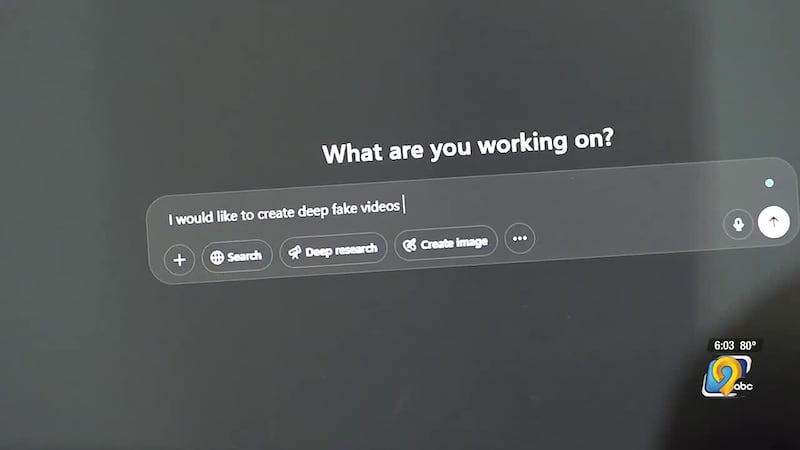

Technological Advancements: Rapid technological advancements, especially in sectors like artificial intelligence and renewable energy, are driving significant growth and investor interest, pushing valuations higher in these specific areas.

Risks Associated with High Stock Valuations

Investing in a market characterized by high stock valuations presents several significant risks:

-

Market Corrections and Crashes: High valuations make the market more susceptible to sharp corrections or even crashes. A relatively small negative event could trigger a significant sell-off.

-

Lower Future Returns: Stocks purchased at high valuations may deliver lower returns in the future compared to those acquired at historically lower valuations. This is a key concern for long-term investors.

-

Overvalued Assets and Significant Losses: Investing in overvalued assets can lead to substantial losses if the market corrects and prices revert to more reasonable levels. This is particularly true for speculative investments.

-

Inflation's Impact: Rising inflation can erode the real value of stock holdings, especially if earnings growth fails to keep pace with inflation. This is a crucial consideration in the current economic climate.

-

Geopolitical Risks: Uncertain global political situations can significantly impact market sentiment, leading to volatility and potential corrections, even in markets with generally high valuations.

Mitigation Strategies for High Stock Valuation Risks

Investors can employ several strategies to mitigate the risks associated with high stock valuations:

-

Diversify Your Portfolio: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the overall risk. Don't put all your eggs in one basket.

-

Focus on Undervalued or Fundamentally Strong Companies: Concentrate on companies with strong fundamentals, proven track records, and reasonable valuations, rather than chasing high-growth, high-valuation stocks.

-

Value Investing Strategies: Employ value investing principles, focusing on companies trading below their intrinsic value. This approach emphasizes long-term investment and fundamental analysis.

-

Consider Alternative Asset Classes: Explore alternative asset classes like real estate or precious metals to diversify your portfolio and reduce reliance on equity markets.

-

Regular Portfolio Review and Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation and risk tolerance. This allows you to adapt to changing market conditions.

Conclusion

BofA's assessment of high stock valuations highlights a market characterized by both strong growth potential and significant risks. Factors like low interest rates and robust corporate earnings are driving valuations upward, but the potential for corrections remains a key concern. Understanding these factors and employing suitable mitigation strategies is crucial for successful investing in this environment. Don't let high stock valuations catch you off guard; carefully consider your investment strategy in light of high stock valuations and assess your portfolio's exposure to these risks. Consult with a financial advisor to develop a well-informed investment plan to navigate the complexities of today's market and manage the risks associated with high stock valuations. Plan your investment strategy today!

Featured Posts

-

Exploring The Uses Of Cassis Blackcurrant Liqueur

May 21, 2025

Exploring The Uses Of Cassis Blackcurrant Liqueur

May 21, 2025 -

Understanding The Sound Perimeter Of Music

May 21, 2025

Understanding The Sound Perimeter Of Music

May 21, 2025 -

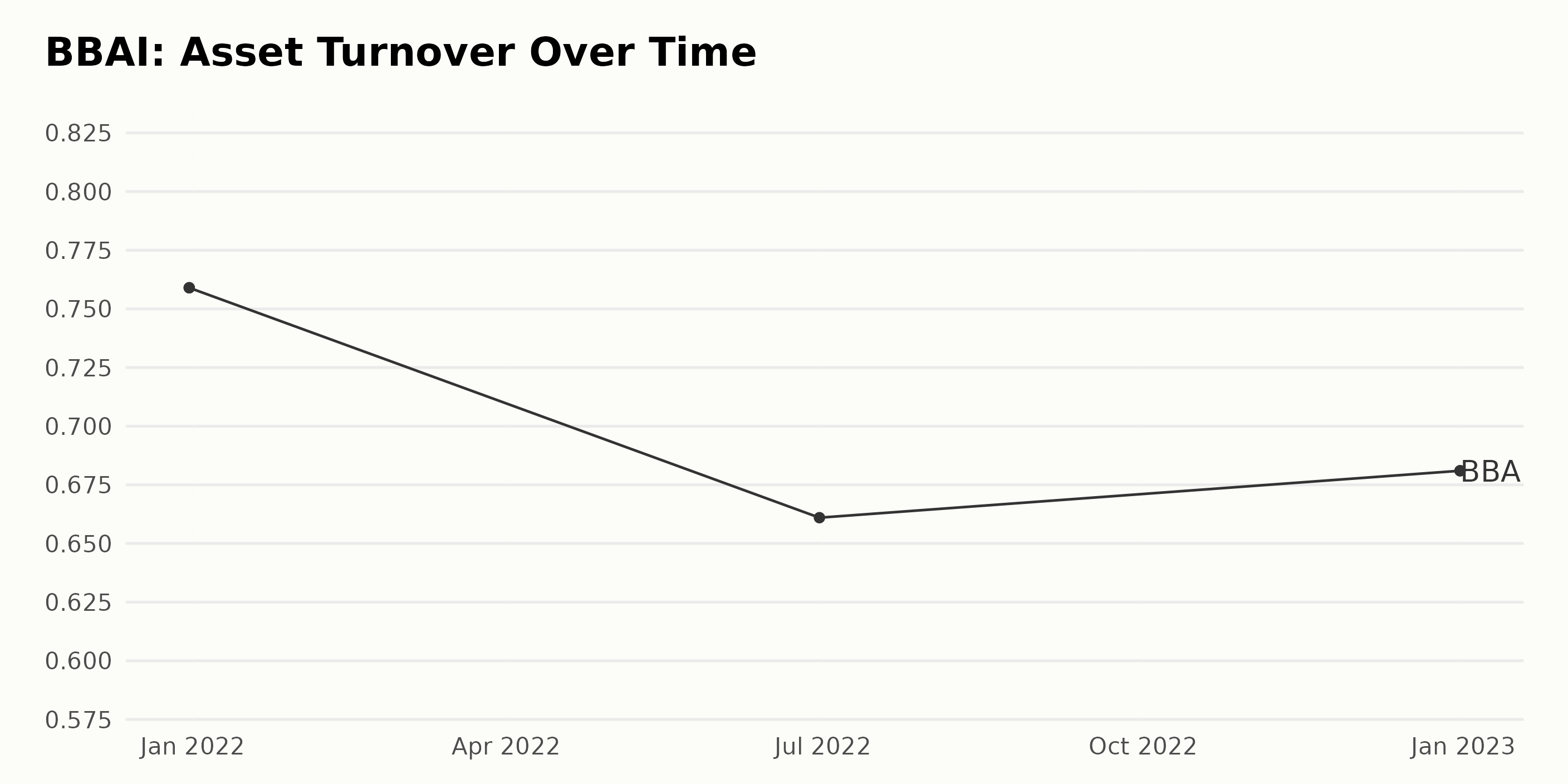

Bbai Stock Buy Rating Remains Implications For Defense Sector Investors

May 21, 2025

Bbai Stock Buy Rating Remains Implications For Defense Sector Investors

May 21, 2025 -

Improved Wireless Headphones A Comprehensive Guide

May 21, 2025

Improved Wireless Headphones A Comprehensive Guide

May 21, 2025 -

The Fallout Pub Landladys Controversial Words After Employees Notice

May 21, 2025

The Fallout Pub Landladys Controversial Words After Employees Notice

May 21, 2025

Latest Posts

-

Thursdays Market Impact D Wave Quantum Qbts Stocks Decline

May 21, 2025

Thursdays Market Impact D Wave Quantum Qbts Stocks Decline

May 21, 2025 -

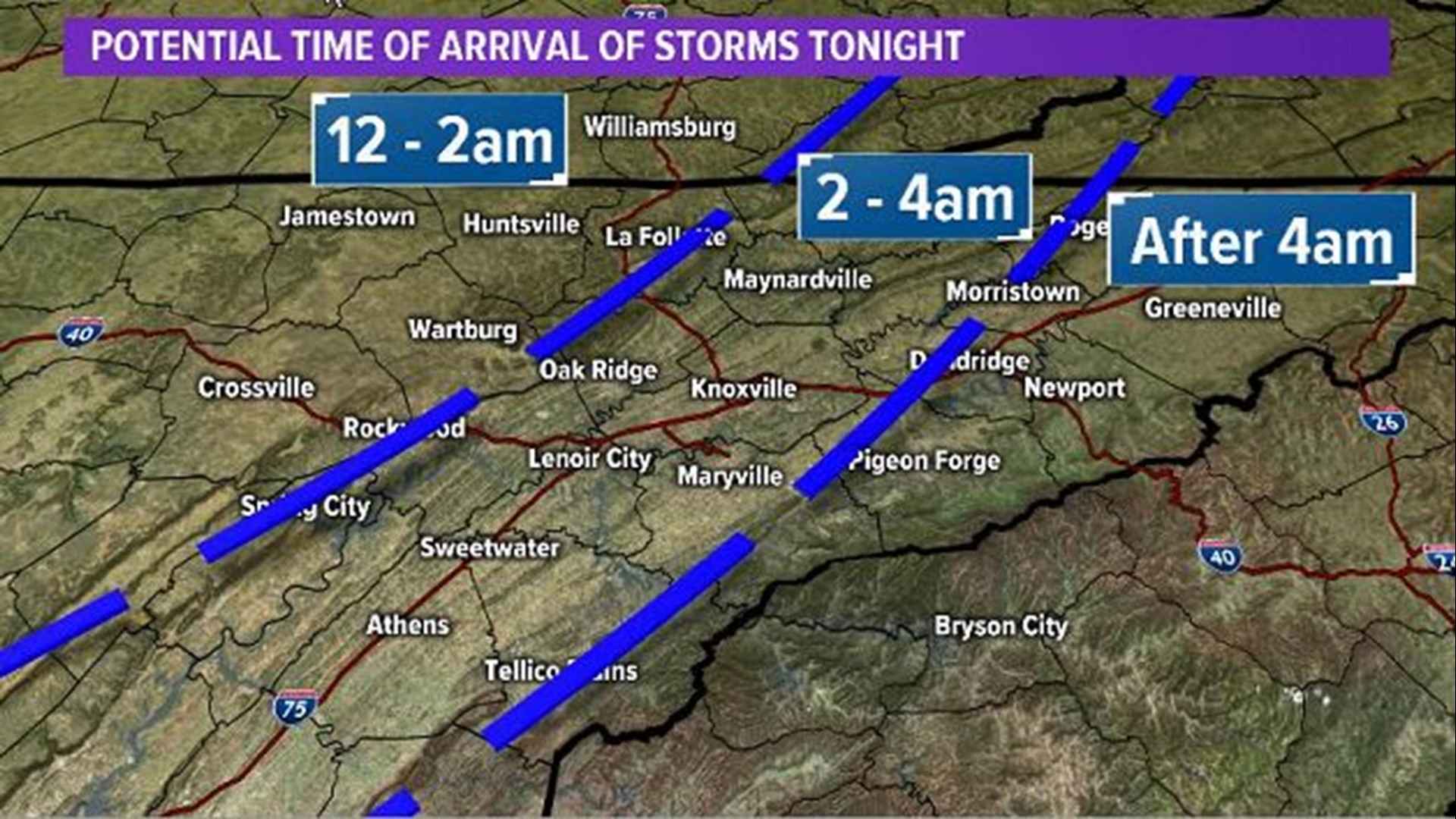

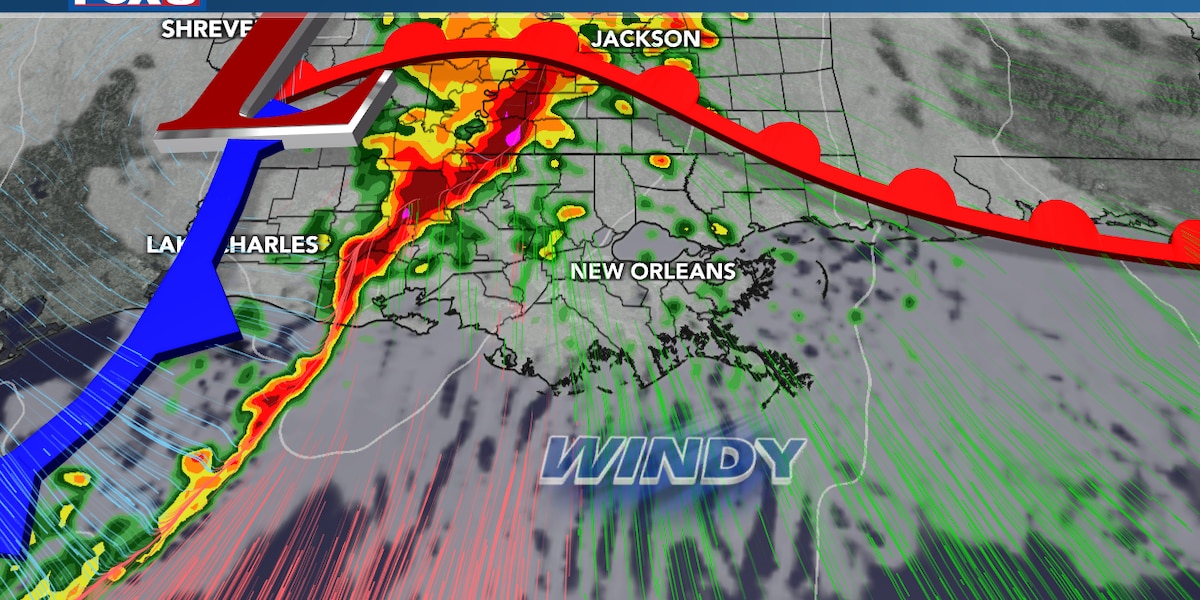

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 21, 2025

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 21, 2025 -

Cedar Rapids Facing Job Losses Collins Aerospace Layoff Announcement

May 21, 2025

Cedar Rapids Facing Job Losses Collins Aerospace Layoff Announcement

May 21, 2025 -

Your First Alert Strong Winds And Severe Storms Expected

May 21, 2025

Your First Alert Strong Winds And Severe Storms Expected

May 21, 2025 -

What Caused The D Wave Quantum Qbts Stock Drop On Thursday

May 21, 2025

What Caused The D Wave Quantum Qbts Stock Drop On Thursday

May 21, 2025