Are Strong Corporate Earnings Sustainable? A Look At Future Projections

Table of Contents

Analyzing Current Economic Indicators

Macroeconomic Factors

Several macroeconomic factors significantly influence corporate earnings. Understanding these is crucial for predicting future performance.

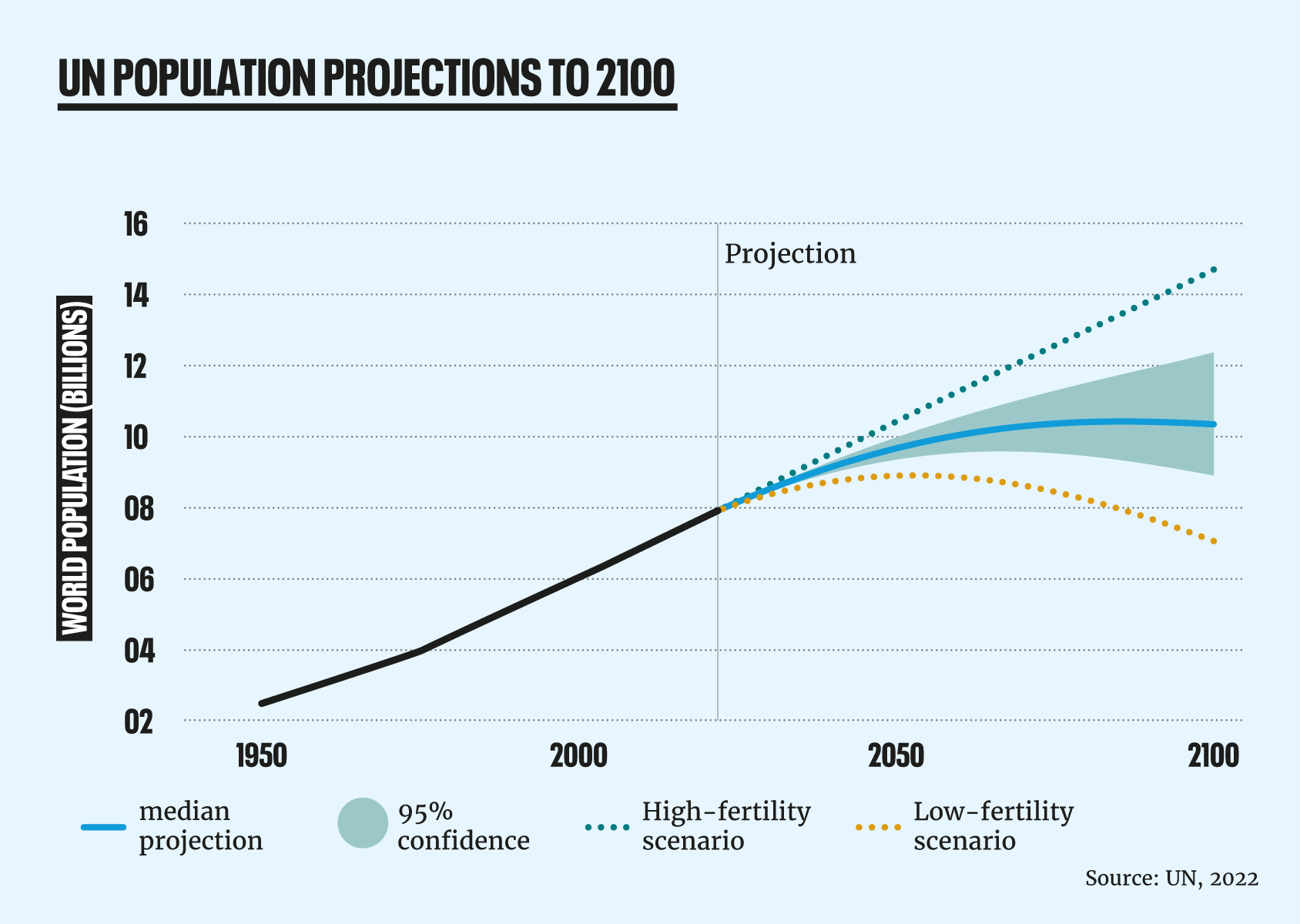

- Economic Growth: Strong GDP growth typically translates to higher corporate revenues and profits. Conversely, a recession can severely impact earnings. Current GDP projections are vital for assessing future corporate performance.

- Inflationary Pressures: Sustained high inflation erodes profit margins if companies cannot pass increased costs to consumers. Managing inflationary pressures effectively is a key determinant of earnings sustainability.

- Interest Rate Hikes: Increased interest rates raise borrowing costs for companies, potentially slowing investment and reducing profitability. The Federal Reserve's monetary policy directly influences corporate access to capital.

- Unemployment Rates: High unemployment can dampen consumer spending, negatively impacting sales and profits for many businesses. Conversely, low unemployment can fuel economic growth and boost corporate earnings.

Geopolitical Risks

Geopolitical instability and global events create significant uncertainty for businesses.

- Geopolitical Uncertainty: Wars, political instability, and trade tensions disrupt supply chains and impact market access, creating volatility in corporate earnings. The Russia-Ukraine conflict serves as a prime example of significant geopolitical risk.

- Supply Chain Resilience: The ability to navigate disruptions to global supply chains is crucial for maintaining profitability. Companies with diversified supply chains are better positioned to withstand shocks.

- Global Trade Tensions: Protectionist policies and trade wars can restrict market access and increase costs, negatively affecting corporate earnings. Navigating these complex global dynamics is critical for sustainable growth.

Examining Industry-Specific Trends

Sectoral Performance

Different sectors exhibit varying degrees of resilience and growth potential.

- Sectoral Growth: Technology, healthcare, and renewable energy sectors often demonstrate strong growth potential, while others, such as retail or manufacturing, might face more significant headwinds.

- Industry Performance: Analyzing the performance of individual industries provides valuable insights into the overall health of the economy and future earnings potential. Some sectors might benefit from specific technological advancements or shifts in consumer demand.

- Market Share: Companies with a strong market share generally enjoy greater pricing power and profitability. Competition within each sector plays a significant role in determining individual company performance.

Technological Disruption

Technological advancements reshape industries, creating both opportunities and challenges.

- Digital Transformation: Companies successfully embracing digital technologies often experience increased efficiency and improved profitability. Those lagging behind risk obsolescence.

- Technological Innovation: Breakthrough innovations can disrupt existing markets, creating new winners and losers. Adapting to these changes is crucial for long-term success.

- Automation: Automation and AI are transforming numerous industries, leading to cost savings and increased productivity, but also to potential job displacement and ethical considerations.

Assessing Corporate Strategies and Financial Health

Profitability and Margins

Profitability metrics are crucial indicators of a company's financial health.

- Profit Margin Analysis: Analyzing net income margins and operating margins reveals the efficiency of a company's operations and its ability to generate profits. Strong margins usually point to sustainable earnings.

- Return on Investment (ROI): ROI indicates the effectiveness of a company's investments in generating profits. High ROI suggests efficient capital allocation and a strong financial position.

- Cost Optimization: Companies that successfully optimize their costs are better positioned to withstand economic downturns and maintain healthy profit margins, leading to more sustainable earnings.

Debt Levels and Financial Risk

High debt levels can create significant financial risk for companies.

- Debt-to-Equity Ratio: This ratio reveals the proportion of a company's financing that comes from debt. A high ratio indicates greater financial risk.

- Financial Leverage: Using debt to amplify returns can be risky, especially during economic downturns. Excessive leverage can lead to financial distress.

- Credit Rating: Credit rating agencies assess the creditworthiness of companies, providing insights into their ability to meet their financial obligations. A strong credit rating is typically associated with lower risk and more sustainable earnings.

Conclusion

The sustainability of strong corporate earnings depends on a complex interplay of macroeconomic factors, industry-specific trends, and individual corporate strategies. While current earnings may be robust, several potential headwinds exist, including inflation, geopolitical uncertainty, and rising interest rates. Analyzing specific industries and companies, their debt levels, and their adaptability to technological change is crucial for accurately assessing future prospects. By carefully analyzing these factors and monitoring key economic indicators, you can develop a more informed perspective on the sustainability of strong corporate earnings. Continue your research by focusing on specific sectors and examining the financial health of individual corporations to further refine your understanding of sustainable corporate earnings. Consider consulting with a financial advisor to gain personalized insights into analyzing corporate earnings and making informed investment decisions.

Featured Posts

-

Bad Bunny Conciertos Madrid Y Barcelona Compra Tus Entradas Ahora

May 30, 2025

Bad Bunny Conciertos Madrid Y Barcelona Compra Tus Entradas Ahora

May 30, 2025 -

311 Deaths In England Underscore The Dangers Of Extreme Heat

May 30, 2025

311 Deaths In England Underscore The Dangers Of Extreme Heat

May 30, 2025 -

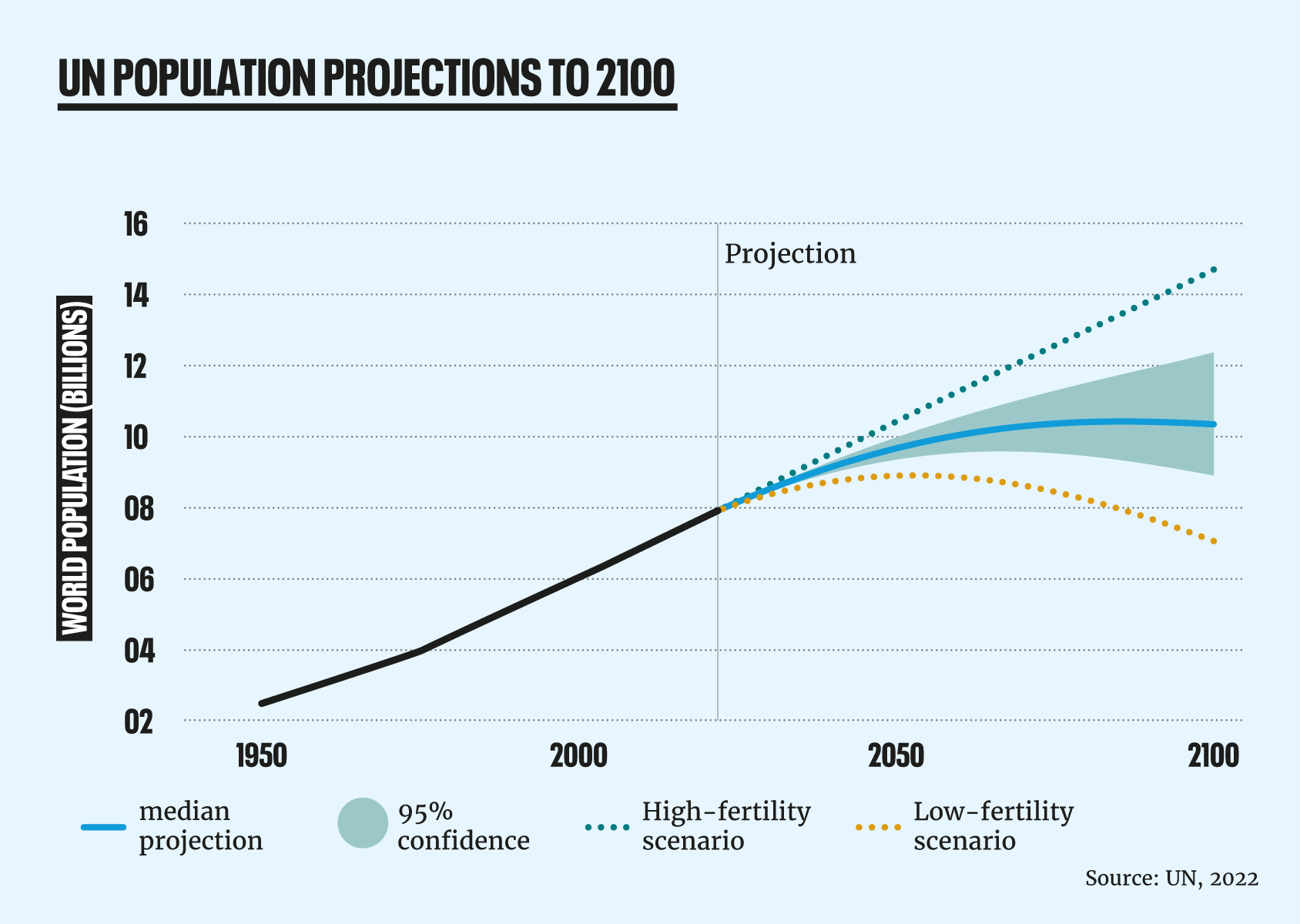

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025 -

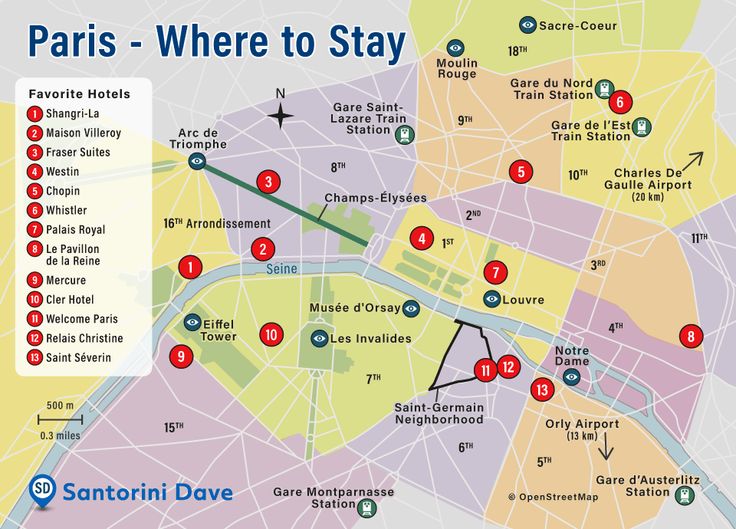

Reporte De Caidas Ticketmaster El 8 De Abril Grupo Milenio

May 30, 2025

Reporte De Caidas Ticketmaster El 8 De Abril Grupo Milenio

May 30, 2025 -

Analysis Trump Administrations Decision To Deny Sunnova Energys Loan Request

May 30, 2025

Analysis Trump Administrations Decision To Deny Sunnova Energys Loan Request

May 30, 2025