Are We In A Recession? Stock Investor Sentiment Remains Positive

Table of Contents

The Case for a Recession

While stock investor sentiment might be positive, several economic indicators suggest a potential recession is on the horizon.

Economic Indicators Pointing Towards a Recession

Several key economic indicators paint a concerning picture:

- Inflation Rates: Persistently high inflation rates erode purchasing power and stifle economic growth. The current inflation rate, while showing signs of cooling, remains significantly above target levels in many developed economies. [Link to reputable source on inflation data].

- Rising Interest Rates: Central banks worldwide are aggressively raising interest rates to combat inflation. Higher interest rates increase borrowing costs for businesses and consumers, potentially leading to reduced investment and spending, further slowing economic activity. [Link to reputable source on interest rate data].

- Inverted Yield Curve: An inverted yield curve, where short-term interest rates exceed long-term rates, is a historically reliable predictor of recessions. This inversion suggests that investors anticipate lower future economic growth and are demanding higher yields on shorter-term investments. [Link to reputable source on yield curve data].

- Consumer Confidence Index: The consumer confidence index, a measure of consumer sentiment regarding the economy, has shown a recent decline, reflecting growing uncertainty and apprehension about the future. [Link to reputable source on consumer confidence data].

Concerns Fueling Recessionary Fears

Beyond these indicators, several factors fuel recessionary fears:

- Geopolitical Instability: The ongoing war in Ukraine, along with other geopolitical tensions, disrupts global supply chains and contributes to uncertainty in the market.

- Supply Chain Disruptions: Lingering supply chain bottlenecks continue to impact production and contribute to inflationary pressures.

- High Energy Prices: Soaring energy costs increase input prices for businesses and reduce disposable income for consumers, dampening economic activity.

[Insert chart or graph illustrating the combined impact of these factors on economic growth].

Why Stock Investor Sentiment Remains Positive

Despite the considerable evidence pointing towards a recession, stock investor sentiment remains surprisingly buoyant. Several factors contribute to this apparent disconnect.

Resilient Corporate Earnings

Many large corporations have reported strong earnings, exceeding expectations. This resilience, particularly in certain sectors like technology and healthcare, is bolstering investor confidence. Technological advancements and innovation are driving productivity and profitability in these sectors.

The Influence of Monetary Policy

While interest rate hikes aim to curb inflation, they also influence investor sentiment. Some investors interpret these actions as a sign that central banks are actively managing the economy and preventing a severe downturn. The anticipation of future policy shifts – potentially including rate cuts if economic conditions worsen – also contributes to a degree of optimism.

Long-Term Investment Strategies

Many investors are adopting a long-term perspective, viewing the current economic uncertainty as a temporary setback. They believe that focusing on fundamental value and long-term growth prospects can mitigate the risks associated with short-term economic fluctuations. They see potential opportunities for discounted entry into strong companies.

Analyzing the Disconnect: Recession Fears vs. Positive Stock Investor Sentiment

The disparity between recessionary fears and positive stock investor sentiment highlights the complexities of market psychology and investor behavior.

Market Psychology and Investor Behavior

Investor decisions are often driven by a combination of rational analysis and emotional factors like fear, greed, and herd mentality. The market can overreact or underreact to economic data, leading to temporary deviations from fundamental values.

The Role of Speculation and Market Volatility

Speculation and market volatility play a significant role in shaping investor sentiment. Unpredictable events, whether geopolitical or economic, can trigger sudden shifts in market sentiment, irrespective of underlying economic fundamentals.

Conclusion

In summary, while several key economic indicators suggest a potential recession, stock investor sentiment remains surprisingly positive. This disconnect is attributable to resilient corporate earnings, interpretations of monetary policy, and long-term investment strategies. However, the influence of market psychology, speculation, and volatile events should not be underestimated.

Key Takeaways:

- Economic indicators point towards potential recessionary risks.

- Strong corporate earnings and certain interpretations of monetary policy are supporting positive stock investor sentiment.

- Long-term investment strategies are helping to mitigate short-term economic anxieties.

- Market psychology and volatility significantly influence investor behavior.

Understanding the nuances of stock investor sentiment in the face of potential recession is crucial. Stay informed and make well-considered decisions based on the latest market trends and a comprehensive analysis of both economic indicators and investor sentiment. Continuously monitoring stock investor sentiment and economic indicators will allow for more informed investment strategies.

Featured Posts

-

Exploring The Nike And Hyperice Collaboration

May 06, 2025

Exploring The Nike And Hyperice Collaboration

May 06, 2025 -

Life After Lock Up Season 2 Featuring Gypsy Rose Blanchard Release Date And Cast

May 06, 2025

Life After Lock Up Season 2 Featuring Gypsy Rose Blanchard Release Date And Cast

May 06, 2025 -

Will Cusma Survive Carneys Meeting With Trump Holds The Key

May 06, 2025

Will Cusma Survive Carneys Meeting With Trump Holds The Key

May 06, 2025 -

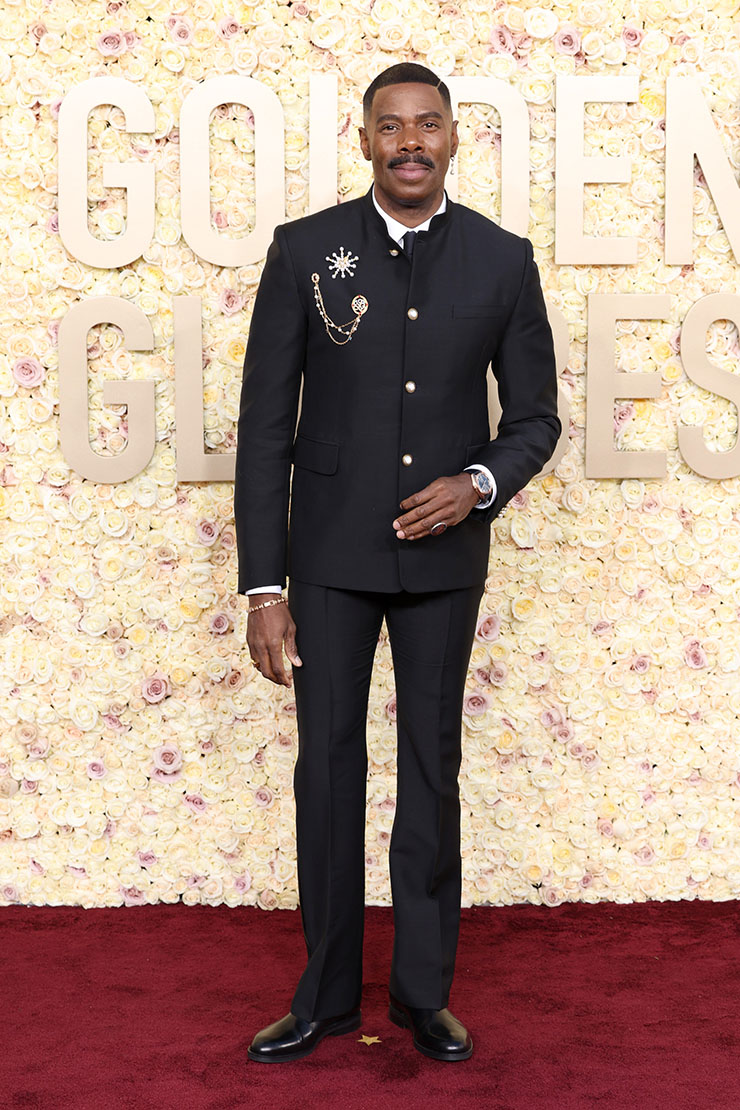

Colman Domingo A Style Icon Redefining Mens Fashion

May 06, 2025

Colman Domingo A Style Icon Redefining Mens Fashion

May 06, 2025 -

Watch Celtics Vs Heat Game Details For February 10th

May 06, 2025

Watch Celtics Vs Heat Game Details For February 10th

May 06, 2025